Please assist with my professor's feedback. I've already responded to some of them and would like to correct any mistakes. Thank you

The feedback can be found under the task 13

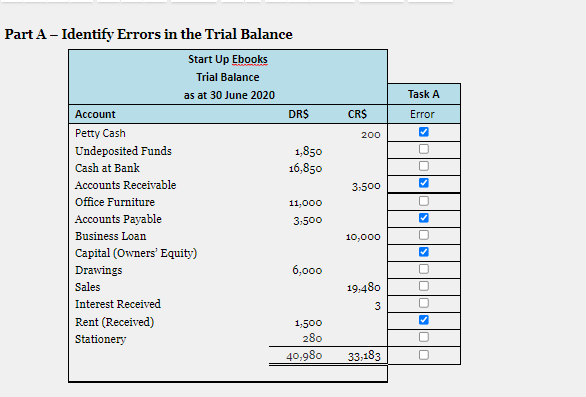

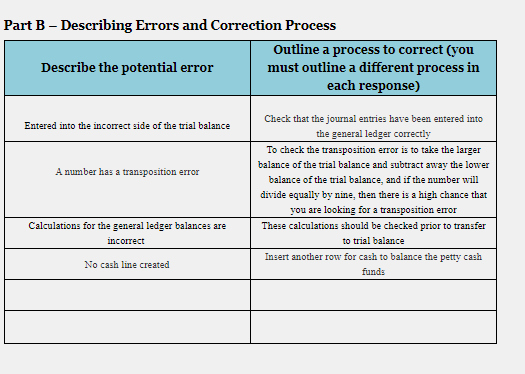

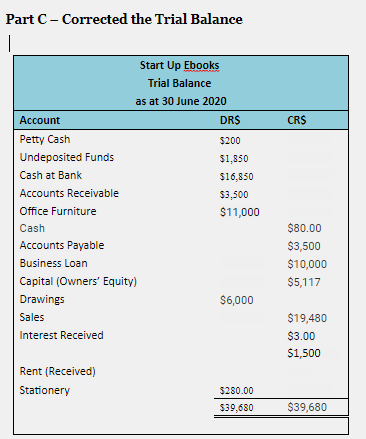

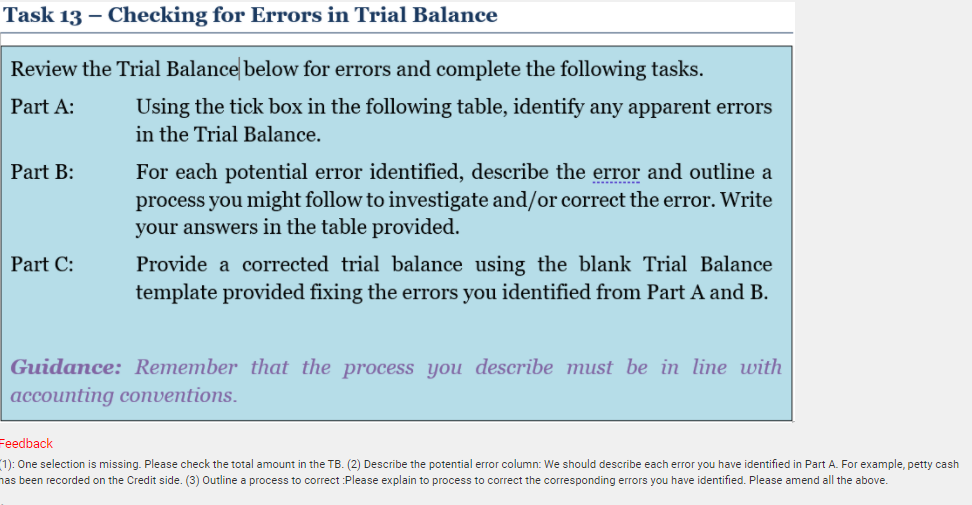

Part A - Identify Errors in the Trial Balance Start Up Ebooks Trial Balance as at 30 June 2020 Task A Account DRS CRS Error Petty Cash 200 Undeposited Funds 1,850 Cash at Bank 16,850 Accounts Receivable 3.500 Office Furniture 11,000 Accounts Payable 3,500 Business Loan 10,000 Capital (Owners' Equity) Drawings 6,000 Sales 19,480 Interest Received 3 Rent (Received) 1,500 Stationery 280 40,980 33,183Part B - Describing Errors and Correction Process Outline a process to correct (you Describe the potential error must outline a different process in each response) Check that the journal entries have been entered into Entered into the incorrect side of the trial balance the general ledger correctly To check the transposition error is to take the larger balance of the trial balance and subtract away the lower A number has a transposition error balance of the trial balance, and if the number will divide equally by nine, then there is a high chance that you are looking for a transposition error Calculations for the general ledger balances are These calculations should be checked prior to transfer incorrect to trial balance Insert another row for cash to balance the petty cash No cash line created fundsPart C- Corrected the Trial Balance Start Up Ebooks Trial Balance as at 30 June 2020 Account DRS CRS Petty Cash $200 Undeposited Funds $1.850 Cash at Bank $16.850 Accounts Receivable $3,500 Office Furniture $11,000 Cash $80.00 Accounts Payable $3,500 Business Loan $10,000 Capital (Owners' Equity) $5,117 Drawings $6,000 Sales $19,480 Interest Received $3.00 51,500 Rent (Received) Stationery $280.00 539.680 $39,680Task 13 - Checking for Errors in Trial Balance Review the Trial Balance below for errors and complete the following tasks. Part A: Using the tick box in the following table, identify any apparent errors in the Trial Balance. Part B: For each potential error identified, describe the error and outline a process you might follow to investigate and/ or correct the error. Write your answers in the table provided. Part C: Provide a corrected trial balance using the blank Trial Balance template provided fixing the errors you identified from Part A and B. Guidance: Remember that the process you describe must be in line with accounting conventions. Feedback (1): One selection is missing. Please check the total amount in the TB. (2) Describe the potential error column: We should describe each error you have identified in Part A. For example, petty cash has been recorded on the Credit side. (3) Outline a process to correct :Please explain to process to correct the corresponding errors you have identified. Please amend all the above