Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist with question 2 and question 3 Accounting assignment The following information relates to ABC Pty Ltd, a business that manufactures electric products operating

Please assist with question 2 and question 3 Accounting assignment

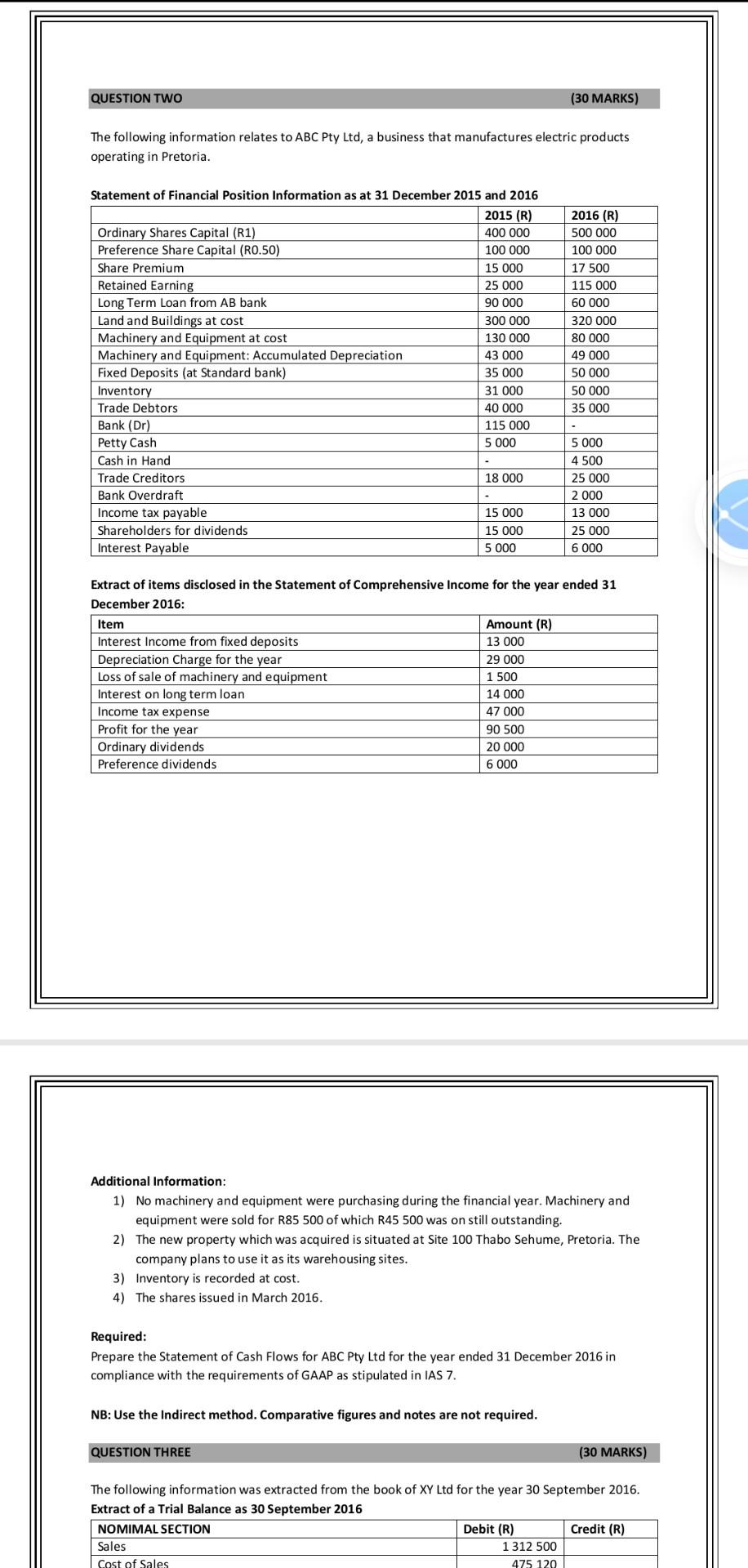

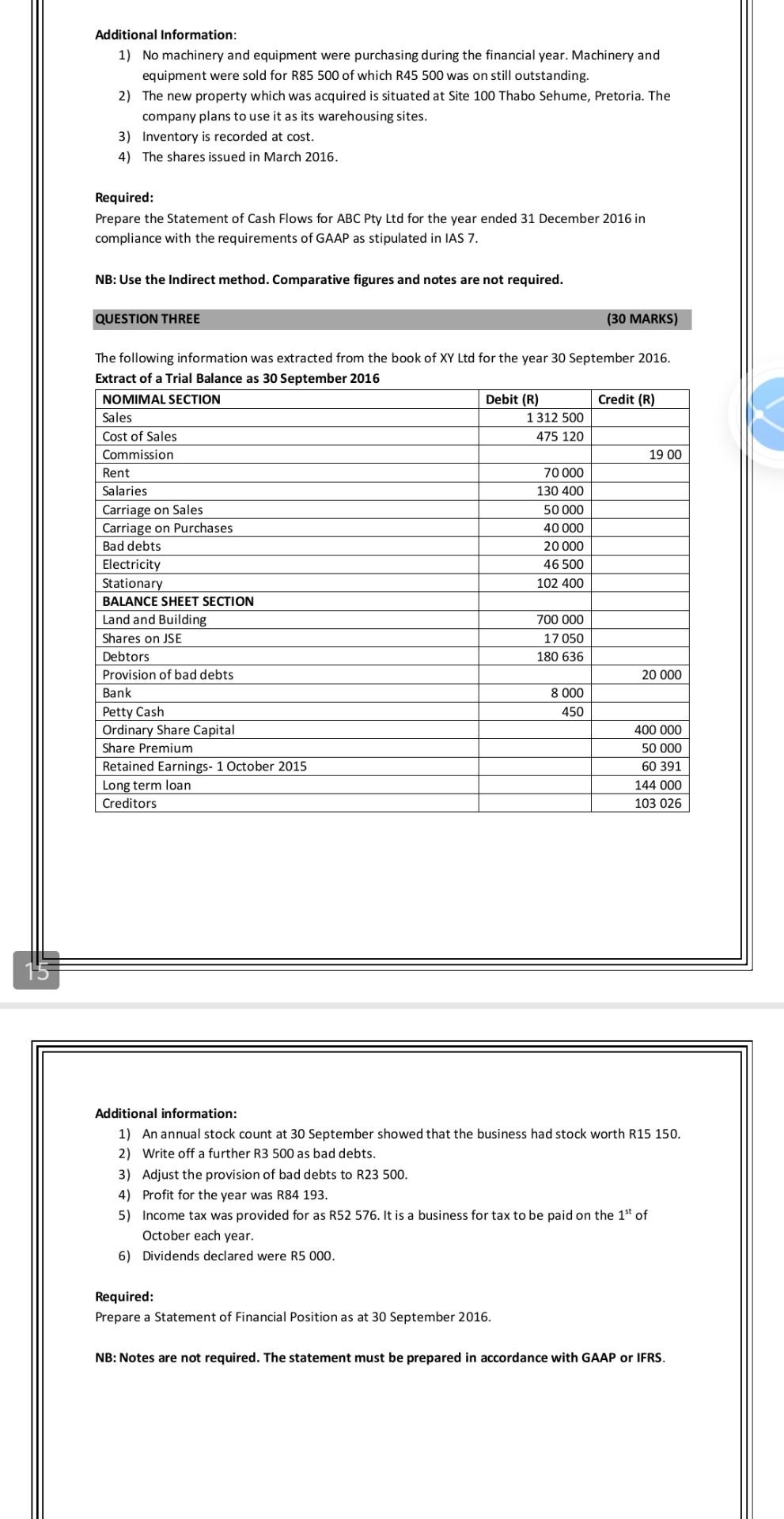

The following information relates to ABC Pty Ltd, a business that manufactures electric products operating in Pretoria. Extract of items disclosed in the Statement of Comprehensive Income for the year ended 31 December 2016: Additional Information: 1) No machinery and equipment were purchasing during the financial year. Machinery and equipment were sold for R85 500 of which R45 500 was on still outstanding. 2) The new property which was acquired is situated at Site 100 Thabo Sehume, Pretoria. The company plans to use it as its warehousing sites. 3) Inventory is recorded at cost. 4) The shares issued in March 2016. Required: Prepare the Statement of Cash Flows for ABC Pty Ltd for the year ended 31 December 2016 in compliance with the requirements of GAAP as stipulated in IAS 7. NB: Use the Indirect method. Comparative figures and notes are not required. QUESTION THREE (30 MARKS) The following information was extracted from the book of XY Ltd for the year 30 September 2016. Additional Information: 1) No machinery and equipment were purchasing during the financial year. Machinery and equipment were sold for R85 500 of which R45 500 was on still outstanding. 2) The new property which was acquired is situated at Site 100 Thabo Sehume, Pretoria. The company plans to use it as its warehousing sites. 3) Inventory is recorded at cost. 4) The shares issued in March 2016. Required: Prepare the Statement of Cash Flows for ABC Pty Ltd for the year ended 31 December 2016 in compliance with the requirements of GAAP as stipulated in IAS 7. NB: Use the Indirect method. Comparative figures and notes are not required. QUESTION THREE (30 MARKS) The following information was extracted from the book of XY Ltd for the year 30 September 2016. Extract of a Trial Balance as 30 Sentember 2016 Additional information: 1) An annual stock count at 30 September showed that the business had stock worth R15 150. 2) Write off a further R3 500 as bad debts. 3) Adjust the provision of bad debts to R23 500. 4) Profit for the year was R84 193. 5) Income tax was provided for as R52 576. It is a business for tax to be paid on the 1st of October each year. 6) Dividends declared were R5 000 . Required: Prepare a Statement of Financial Position as at 30 September 2016. NB: Notes are not required. The statement must be prepared in accordance with GAAP or IFRS. Additional information: 1) An annual stock count at 30 September showed that the business had stock worth R15 150. 2) Write off a further R3 500 as bad debts. 3) Adjust the provision of bad debts to R23 500. 4) Profit for the year was R84 193. 5) Income tax was provided for as R52 576. It is a business for tax to be paid on the 1st of October each year. 6) Dividends declared were R5 000. Required: Prepare a Statement of Financial Position as at 30 September 2016. NB: Notes are not required. The statement must be prepared in accordance with GAAP or IFRSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started