Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist with the following multiple choice Question 8 (1 point) Which of the following statements is false? 1) Bond traders typically quote bond prices

Please assist with the following multiple choice

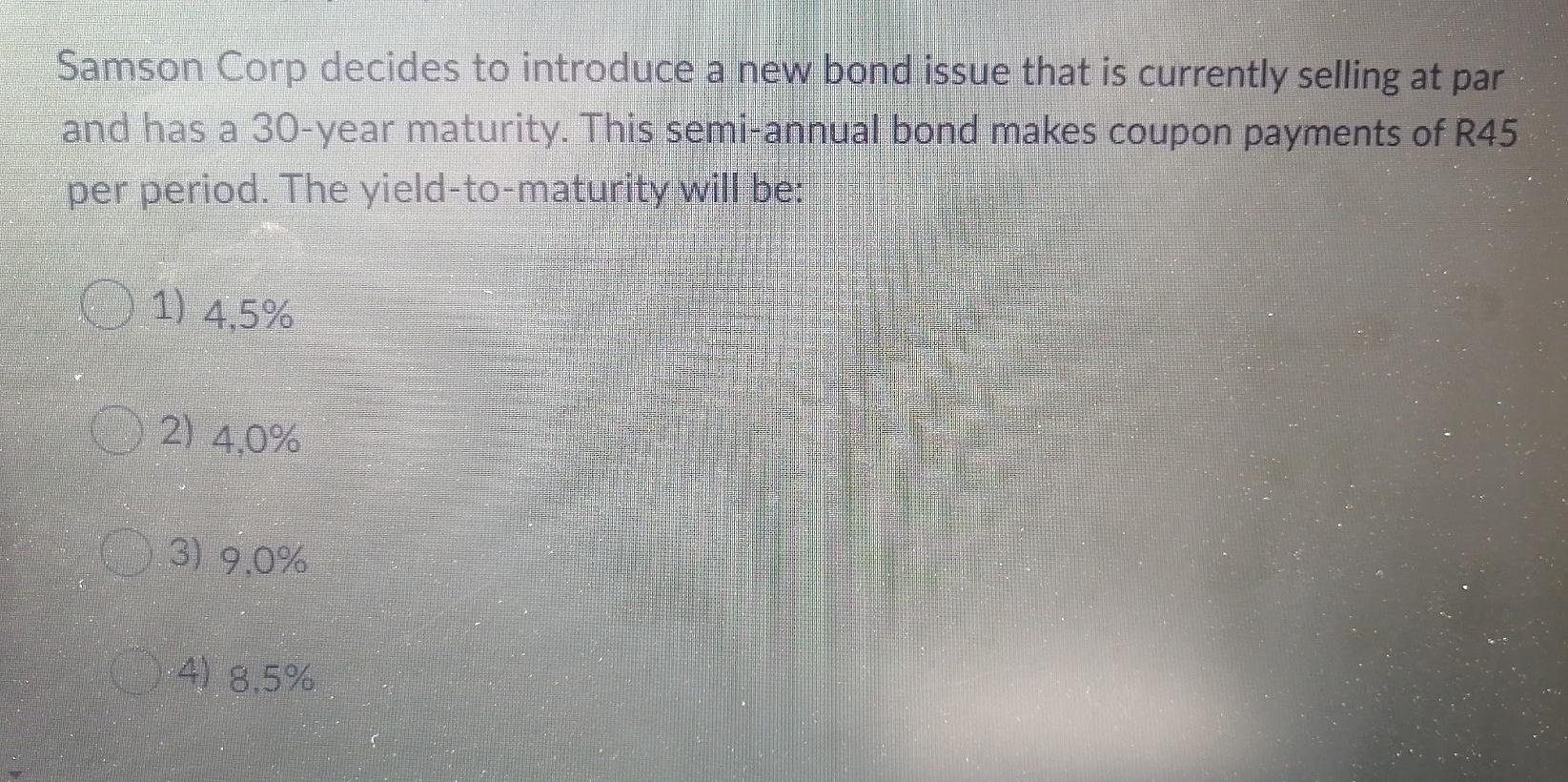

Question 8 (1 point) Which of the following statements is false? 1) Bond traders typically quote bond prices rather than bond yields. 2) Treasury bills are zero-coupon bonds. 3) Zero-coupon bonds always trade at a discount. 4) The yield to maturity is typically stated as an annual rate by multiplying the calculated YTM by the number of coupon payment per year, thereby converting it to an APR. Which of the following statements is false? 1) The amount of each coupon payment is determined by the coupon rate of the bond. 2) Prior to its maturity date, the price of a zero-coupon bond is always greater than its face value. 3) The simplest type of bond is a zero-coupon bond. 4) Treasury bilis are U.S. government bonds with a maturity of up to one year. Which of the following statements is false? O Prices of bonds with lower durations are more sensitive to interest rate 1) changes. When a bond is trading at a discount, the price increase between coupons 2) will exceed the drop when a coupon is paid, so the bond's price will rise and its discount will decline as time passes. Coupon bonds may trade at a discount: at a premium. or at par. 3) D) The sensitivity of a bond's price changes in interest rates is the bond's duration, A bond that makes no coupon payments during the life of the bond, but is sold at a considerable discount, is known as: 1) an inflation-linked bond 2) a zero-coupon bond 3 a discount bond 4) a premium bond Samson Corp decides to introduce a new bond issue that is currently selling at par and has a 30-year maturity. This semi-annual bond makes coupon payments of R45 per period. The yield-to-maturity will be: 1) 4,5% 2) 4,0% 3) 9.0% 4) 8.5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started