Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist with the following question Suppose it's January 2021 and you would like to estimate the unlovered cost of capital (r) for Cowbel Corp.

Please assist with the following question

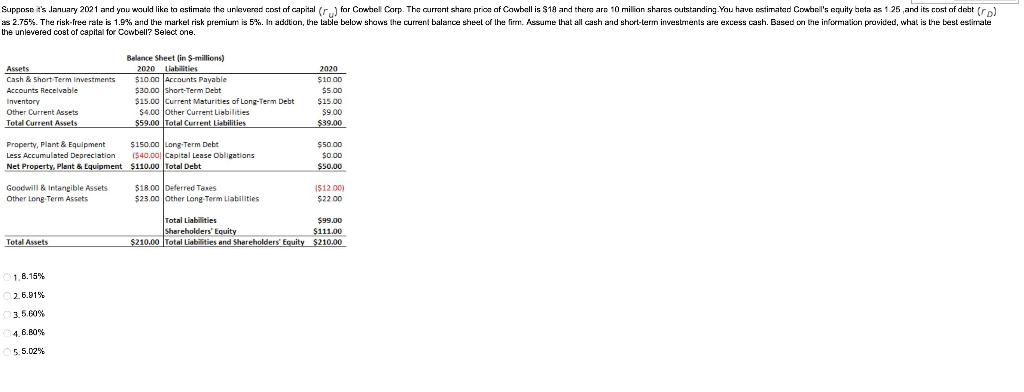

Suppose it's January 2021 and you would like to estimate the unlovered cost of capital (r) for Cowbel Corp. The current share price of Cowbell is $18 and there are 10 million shares outstanding. You have estimated Cobel's equity bata as 125 and its cost of doht) as 2.75%. The risk-free rale is 1.9% and the market risk premiurn is 5%. In addition, the table below shows the current balance sheet of the firen. Assume that all cash and short-term investments are excess cash. Based on the information provided, what is the best estirale the unlevered cost of capital for Cowbell? Select one. Assets Cash & Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet in S-millions) 2020 Liabilities $10.00 Accounts Payable $30.00 Short-Term Debt $15.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $59.00 Total Current Liabilities 2020 $10.00 $5.00 $15.00 $9.00 $39.00 Property, Plant & Equipment $150.00 Long-Term Debt Less Accumulated Depreciation ($40.00 Capital Lease Obligations Net Property, Plant & Equipment $110.00 Total Debt $50.00 $0.00 $50.00 Goodwill & Intaneible Assets Other Long Term Assets $18.00 Deferred Taxes $23.00 other Long Term Liabilities $12.00) $22.00 Total Liabilities $99.00 Shareholders' Equity $111.00 $210.00 Total Liabilities and Shareholders' Equity $210.00 Total Assets 1. B.15% 26.01% 3.5.60% 48.80% 5.5.02% Suppose it's January 2021 and you would like to estimate the unlovered cost of capital (r) for Cowbel Corp. The current share price of Cowbell is $18 and there are 10 million shares outstanding. You have estimated Cobel's equity bata as 125 and its cost of doht) as 2.75%. The risk-free rale is 1.9% and the market risk premiurn is 5%. In addition, the table below shows the current balance sheet of the firen. Assume that all cash and short-term investments are excess cash. Based on the information provided, what is the best estirale the unlevered cost of capital for Cowbell? Select one. Assets Cash & Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet in S-millions) 2020 Liabilities $10.00 Accounts Payable $30.00 Short-Term Debt $15.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $59.00 Total Current Liabilities 2020 $10.00 $5.00 $15.00 $9.00 $39.00 Property, Plant & Equipment $150.00 Long-Term Debt Less Accumulated Depreciation ($40.00 Capital Lease Obligations Net Property, Plant & Equipment $110.00 Total Debt $50.00 $0.00 $50.00 Goodwill & Intaneible Assets Other Long Term Assets $18.00 Deferred Taxes $23.00 other Long Term Liabilities $12.00) $22.00 Total Liabilities $99.00 Shareholders' Equity $111.00 $210.00 Total Liabilities and Shareholders' Equity $210.00 Total Assets 1. B.15% 26.01% 3.5.60% 48.80% 5.5.02%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started