Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist with the questions attached. QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow: Harry is 20 years old.

please assist with the questions attached.

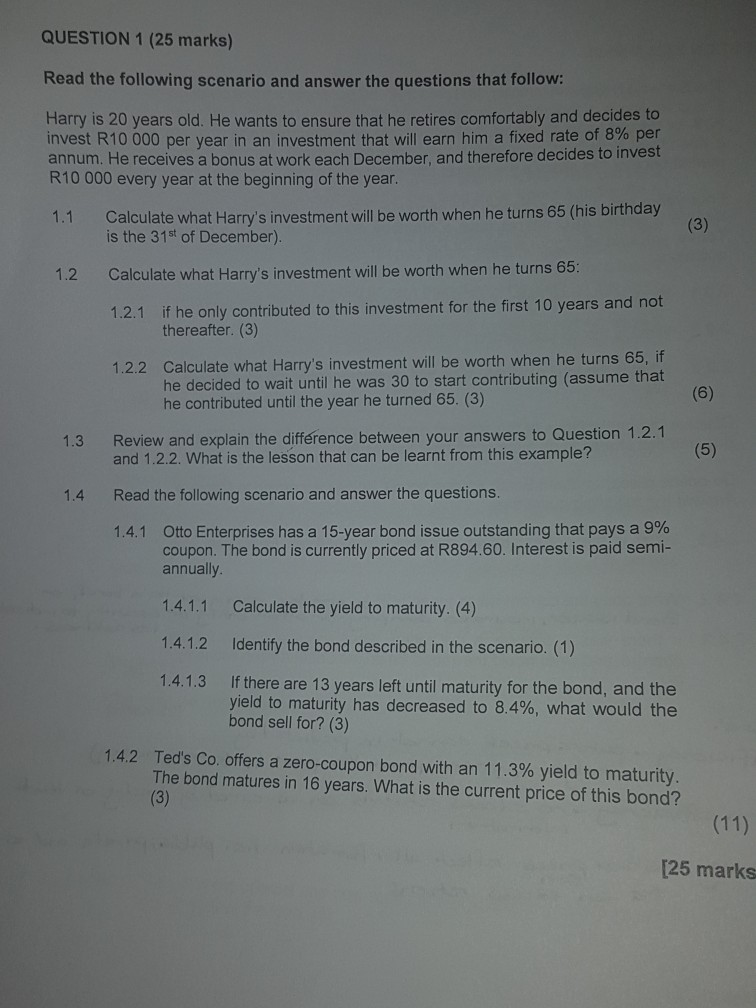

QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow: Harry is 20 years old. He wants to ensure that he retires comfortably and decides to invest R10 000 per year in an investment that will earn him a fixed rate of 8% per annum. He receives a bonus at work each December, and therefore decides to invest R10 000 every year at the beginning of the year. 1.1 Calculate what Harry's investment will be worth when he turns 65 (his birthday is the 31st of December) Calculate what Harry's investment will be worth when he turns 65: 1.2.1 1.2 if he only contributed to this investment for the first 10 years and not thereafter. (3) Calculate what Harry's investment will be worth when he turns 65, if he decided to wait until he was 30 to start contributing (assume that he contributed until the year he turned 65. (3) 1.2.2 1.3 Review and explain the difference between your answers to Question 1.2.1 and 1.2.2. What is the lesson that can be learnt from this example? Read the following scenario and answer the questions. 1.4.1 1.4 Otto Enterprises has a 15-year bond issue outstanding that pays a 9% coupon. The bond is currently priced at R894.60. Interest is paid semi- annually 1.4.1.1 1.4.1.2 1.4.1.3 Calculate the yield to maturity. (4) Identify the bond described in the scenario. (1) If there are 13 years left until maturity for the bond, and the yield to maturity has decreased to 8.4%, what would the bond sell for? (3) 1.4.2 Ted's Co. offers a zero-coupon bond with an 11.3% yield to maturity The bond matures in 16 years. What is the current price of this bond? [25 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started