Please assist with this nineteen part managerial accounting problem

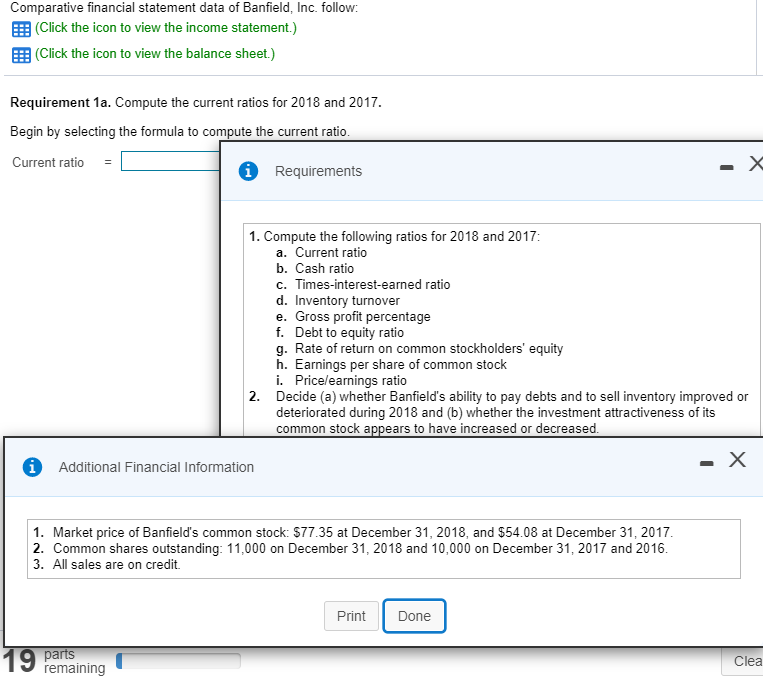

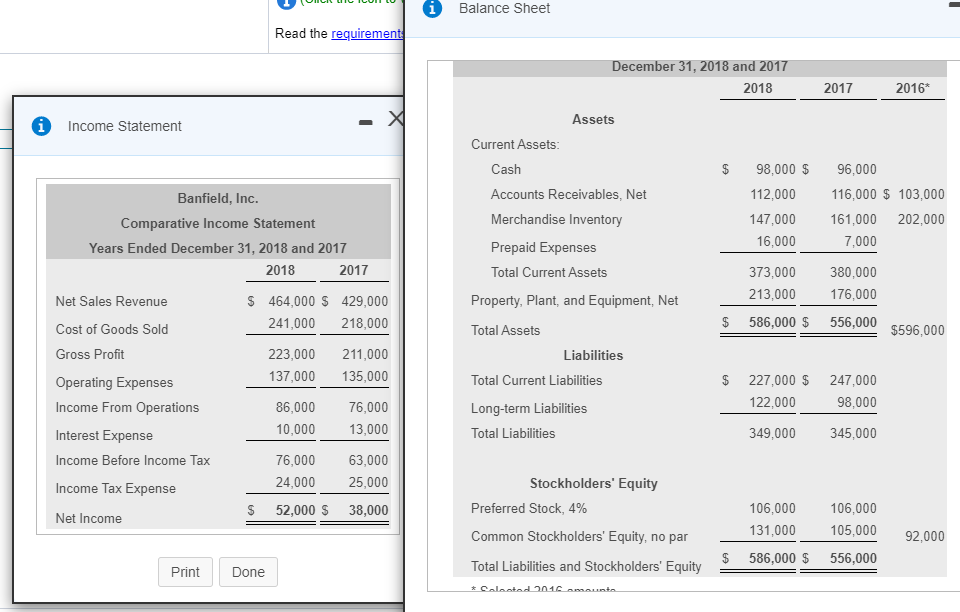

Comparative financial statement data of Banfield, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) Requirement 1a. Compute the current ratios for 2018 and 2017. Begin by selecting the formula to compute the current ratio. Current ratio = Requirements 1. Compute the following ratios for 2018 and 2017: a. Current ratio b. Cash ratio c. Times-interest-earned ratio d. Inventory turnover e. Gross profit percentage f. Debt to equity ratio g. Rate of return on common stockholders' equity h. Earnings per share of common stock i. Price/earnings ratio 2. Decide (a) whether Banfield's ability to pay debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. 1. Market price of Banfield's common stock: $77.35 at December 31, 2018, and $54.08 at December 31, 2017. 2. Common shares outstanding: 11,000 on December 31, 2018 and 10,000 on December 31, 2017 and 2016. 3. All sales are on credit. Print Done 19 parts 1 remaining Clea Balance Sheet Read the requirement December 31, 2018 and 2017 2018 2017 2016* A Income Statement Assets Current Assets Cash Accounts Receivables, Net Merchandise Inventory $ 98,000 $ 112,000 147,000 16,000 96,000 116,000 $ 103,000 161,000 202,000 7,000 Prepaid Expenses Total Current Assets Property, Plant, and Equipment, Net 373,000 213,000 586,000 $ 380,000 176,000 556,000 $ $596,000 Banfield, Inc. Comparative Income Statement Years Ended December 31, 2018 and 2017 2018 2017 Net Sales Revenue $ 464,000 $ 429,000 Cost of Goods Sold 241,000 218,000 Gross Profit 223,000 211,000 Operating Expenses 137,000 135,000 Income From Operations 86,000 76,000 10,000 13,000 Interest Expense Income Before Income Tax 76,000 63,000 Income Tax Expense 24,000 25,000 $ 52,000 $ 38,000 Net Income Total Assets Liabilities Total Current Liabilities $ 227,000 $ 122,000 247,000 98,000 Long-term Liabilities Total Liabilities 349,000 345,000 Stockholders' Equity Preferred Stock, 4% Common Stockholders' Equity, no par Total Liabilities and Stockholders' Equity * Calatod 2010. Aut 106,000 131,000 106,000 105.000 556,000 92.000 $ 586,000 $ Print Done