Please assist with this question and explain in steps so i can understand

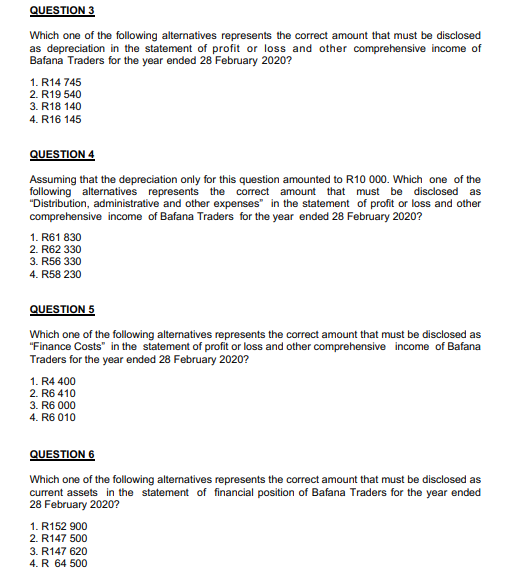

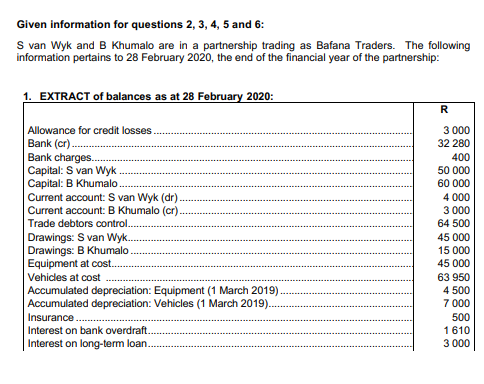

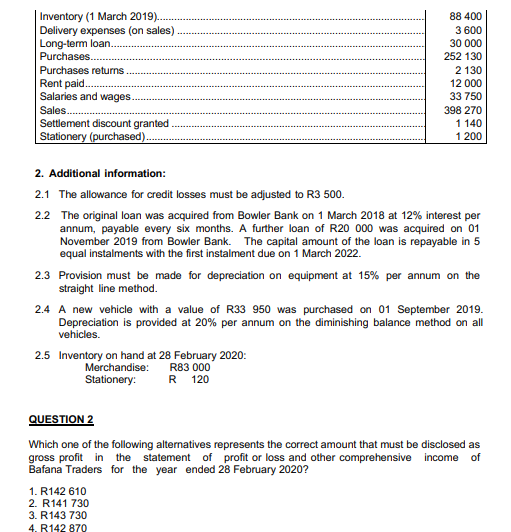

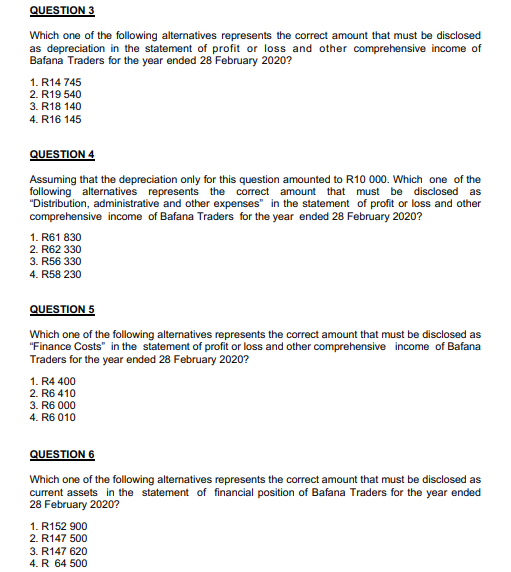

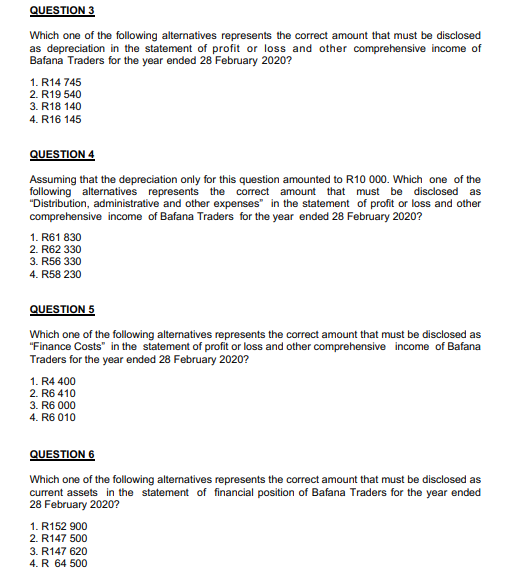

Given information for questions 2, 3, 4, 5 and 6: S van Wyk and B Khumalo are in a partnership trading as Bafana Traders. The following information pertains to 28 February 2020, the end of the financial year of the partnership: EXTRACT of balances as at 28 February 2020: R Allowance for credit losses 3 000 Bank (cr) . 32 280 Bank charges.. 400 Capital: S van Wyk 50 000 Capital: B Khumalo . 60 000 Current account: S van Wyk (dr) 4 000 Current account: B Khumalo (cr) 3 000 Trade debtors control.. 64 500 Drawings: S van Wyk. 45 000 Drawings: B Khumalo 15 000 Equipment at cost. 45 000 Vehicles at cost 63 950 Accumulated depreciation: Equipment (1 March 2019) 4 500 Accumulated depreciation: Vehicles (1 March 2019).. 7 000 Insurance ... 500 Interest on bank overdraft. 1 610 Interest on long-term loan. 3 000Inventory (1 March 2019).. 88 400 Delivery expenses (on sales) 3 600 Long-term loan... 30 000 Purchases. 252 130 Purchases returns .. 2 130 Rent paid... 12 000 Salaries and wages. 33 750 Sales..... 398 270 Settlement discount granted 1 140 Stationery (purchased). 1 200 2. Additional information: 2.1 The allowance for credit losses must be adjusted to R3 500. 2.2 The original loan was acquired from Bowler Bank on 1 March 2018 at 12% interest per annum, payable every six months. A further loan of R20 000 was acquired on 01 November 2019 from Bowler Bank. The capital amount of the loan is repayable in 5 equal instalments with the first instalment due on 1 March 2022. 2.3 Provision must be made for depreciation on equipment at 15% per annum on the straight line method. 2.4 A new vehicle with a value of R33 950 was purchased on 01 September 2019. Depreciation is provided at 20% per annum on the diminishing balance method on all vehicles. 2.5 Inventory on hand at 28 February 2020: Merchandise: R83 000 Stationery: 120 QUESTION 2 Which one of the following alternatives represents the correct amount that must be disclosed as gross profit in the statement of profit or loss and other comprehensive income of Bafana Traders for the year ended 28 February 2020? 1. R142 610 2. R141 730 3. R143 730 R142 870QUESTION 3 Which one of the following alternatives represents the correct amount that must be disclosed as depreciation in the statement of profit or loss and other comprehensive income of Bafana Traders for the year ended 28 February 2020? 1. R14 745 2. R19 540 3. R18 140 4. R16 145 QUESTION 4 Assuming that the depreciation only for this question amounted to R10 000. Which one of the following alternatives represents the correct amount that must be disclosed as "Distribution, administrative and other expenses" in the statement of profit or loss and other comprehensive income of Bafana Traders for the year ended 28 February 2020? 1. R61 830 2. R62 330 3. R56 330 4. R58 230 QUESTION 5 Which one of the following alternatives represents the correct amount that must be disclosed as "Finance Costs" in the statement of profit or loss and other comprehensive income of Bafana Traders for the year ended 28 February 2020? 1. R4 400 2. R6 410 3. R6 000 4. R6 010 QUESTION 6 Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of Bafana Traders for the year ended 28 February 2020? 1. R152 900 2. R147 500 3. R147 620 4. R 64 500