Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4

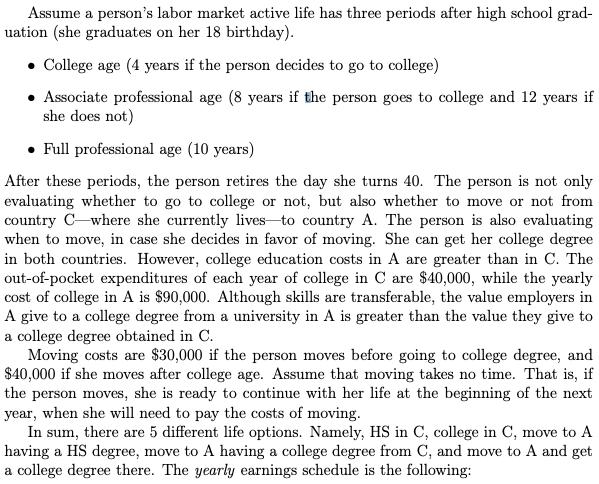

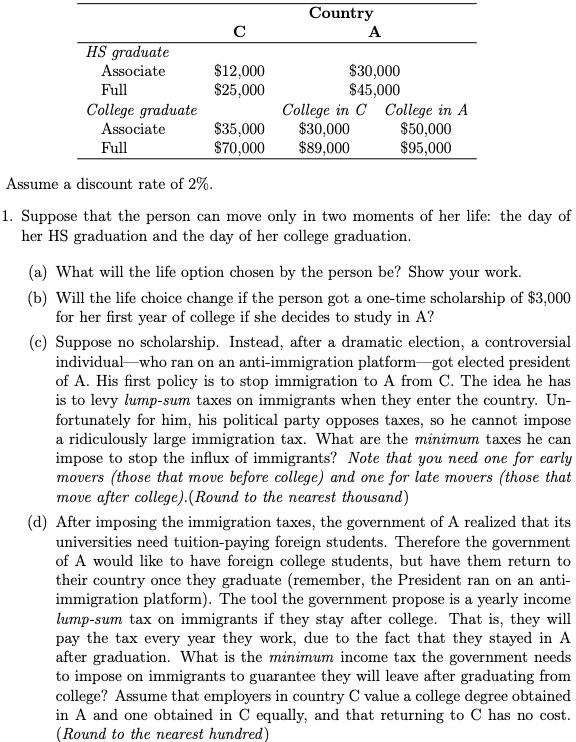

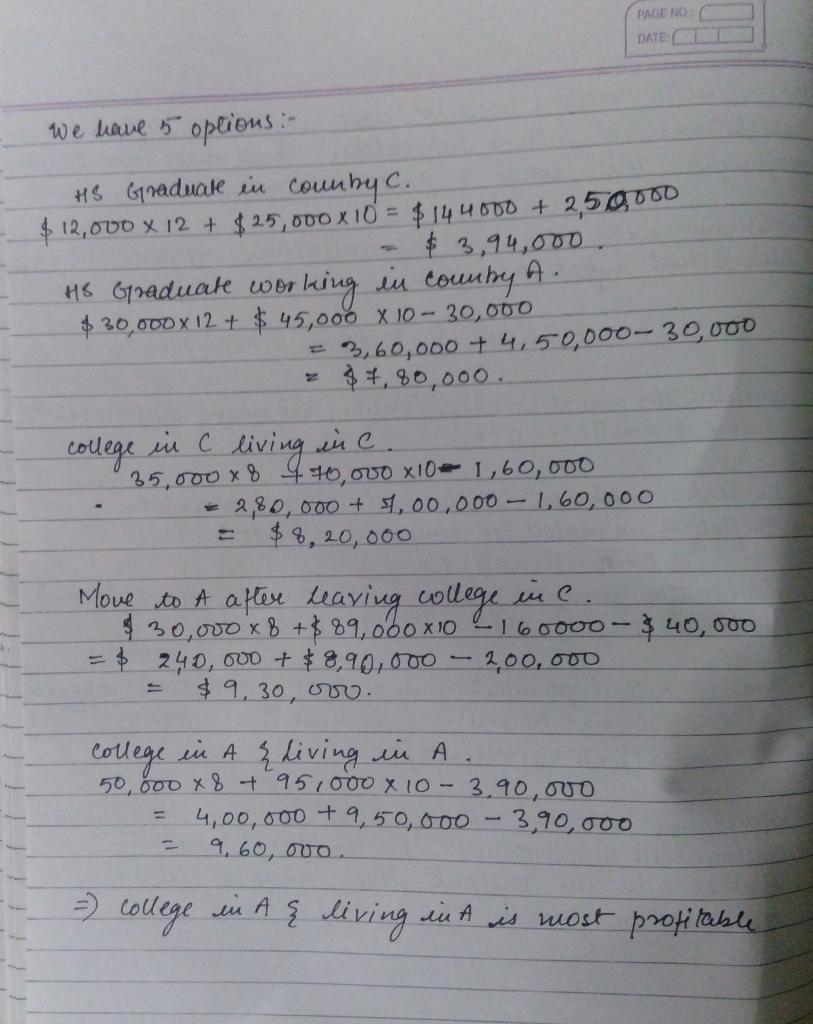

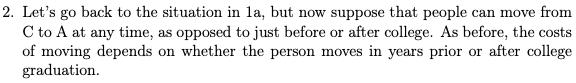

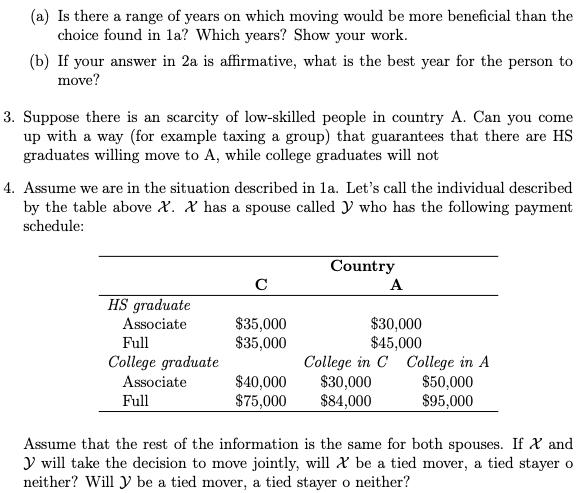

Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither? Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither? Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither? Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither? Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither? Assume a person's labor market active life has three periods after high school grad- uation (she graduates on her 18 birthday). College age (4 years if the person decides to go to college) Associate professional age (8 years if the person goes to college and 12 years if she does not) Full professional age (10 years) After these periods, the person retires the day she turns 40. The person is not only evaluating whether to go to college or not, but also whether to move or not from country C-where she currently lives to country A. The person is also evaluating when to move, in case she decides in favor of moving. She can get her college degree in both countries. However, college education costs in A are greater than in C. The out-of-pocket expenditures of each year of college in C are $40,000, while the yearly cost of college in A is $90,000. Although skills are transferable, the value employers in A give to a college degree from a university in A is greater than the value they give to a college degree obtained in C. Moving costs are $30,000 if the person moves before going to college degree, and $40,000 if she moves after college age. Assume that moving takes no time. That is, if the person moves, she is ready to continue with her life at the beginning of the next year, when she will need to pay the costs of moving. In sum, there are 5 different life options. Namely, HS in C, college in C, move to A having a HS degree, move to A having a college degree from C, and move to A and get a college degree there. The yearly earnings schedule is the following: Country C A HS graduate $12,000 $25,000 $30,000 $45,000 College in C College in A Associate Full College graduate $35,000 $70,000 $30,000 $89,000 Associate $50,000 Full $95,000 Assume a discount rate of 2%. 1. Suppose that the person can move only in two moments of her life: the day of her HS graduation and the day of her college graduation. (a) What will the life option chosen by the person be? Show your work. (b) Will the life choice change if the person got a one-time scholarship of $3,000 for her first year of college if she decides to study in A? (c) Suppose no scholarship. Instead, after a dramatic election, a controversial individual-who ran on an anti-immigration platform-got elected president of A. His first policy is to stop immigration to A from C. The idea he has is to levy lump-sum taxes on immigrants when they enter the country. Un- fortunately for him, his political party opposes taxes, so he cannot impose a ridiculously large immigration tax. What are the minimum taxes he can impose to stop the influx of immigrants? Note that you need one for early movers (those that move before college) and one for late movers (those that move after college).(Round to the nearest thousand) (d) After imposing the immigration taxes, the government of A realized that its universities need tuition-paying foreign students. Therefore the government of A would like to have foreign college students, but have them return to their country once they graduate (remember, the President ran on an anti- immigration platform). The tool the government propose is a yearly income lump-sum tax on immigrants if they stay after college. That is, they will pay the tax every year they work, due to the fact that they stayed in A after graduation. What is the minimum income tax the government needs to impose on immigrants to guarantee they will leave after graduating from college? Assume that employers in country C value a college degree obtained in A and one obtained in C equally, and that returning to C has no cost. (Round to the nearest hundred) PAGE NO. DATE we lave 5 opeions:- HS Gnaduale in counby C. $ 12,000 X 12 + $25,000X 10 = $14 4000 + 2,50,000 $ 3,94,000 A. HS G/raduak wor kiug iu tounby $ 30,000 X 12 t $ 45,000 X 10-30,000 3,60,000 + 4,50,000-30,000 * 4 4, 80,000. in e. in C college 35,000x8 4 40,000 x10 1,60, 000 living 2,80,000 + 1,00,000- 1,60,000 $8,20,000 Moue to A aftere Leaving college $ 30,000 x 8 +$89,060X 10 2160000- =D$ 240,000 + $8,90,000 2,00, 000 $9,30,00v. ine. $ 40, 000 %3D sin A q living ii A. college 50, 600 x8 t 951000X 10-3,90,000 4,00,000 +9,50,000- 3,90,000 9,60,000. %3D 1 2 lollege u A { living iu A is most profitable PAGE NO. DATE B. No, tu optiou went chauge the best optiou is to study in college in A. allowing eis C. He need to oe inpose minimum $1,41,000 tax for those who eutere before college 1,11,00 for those who entr aftex eoluege. thee is no nalue f graduation in lollege rom A. Ator impositiou taz ou As in snieme counry A. NO oue will moue to graduate in countny A, Howev er, mi ni mum yearrly tase needs to be $ 25,000. 2. Let's go back to the situation in la, but now suppose that people can move from C to A at any time, as opposed to just before or after college. As before, the costs of moving depends on whether the person moves in years prior or after college graduation. (a) Is there a range of years on which moving would be more beneficial than the choice found in 1a? Which years? Show your work. (b) If your answer in 2a is affirmative, what is the best year for the person to move? 3. Suppose there is an scarcity of low-skilled people in country A. Can you come up with a way (for example taxing a group) that guarantees that there are HS graduates willing move to A, while college graduates will not 4. Assume we are in the situation described in la. Let's call the individual described by the table above X. X has a spouse called y who has the following payment schedule: Country C A HS graduate $35,000 $35,000 $30,000 $45,000 College in C College in A Associate Full College graduate $40,000 $75,000 $30,000 $84,000 $50,000 $95,000 Associate Full Assume that the rest of the information is the same for both spouses. If X and y will take the decision to move jointly, will X be a tied mover, a tied stayer o neither? Will y be a tied mover, a tied stayer o neither?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To determine the best life option we need to compare the present value of earnings in discounted terms of each option Lets start with the fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started