Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please awnser all Use the following table for the next several questions on absorption and variable costing. Caliber Corp manufactures and sells GPS watches for

please awnser all

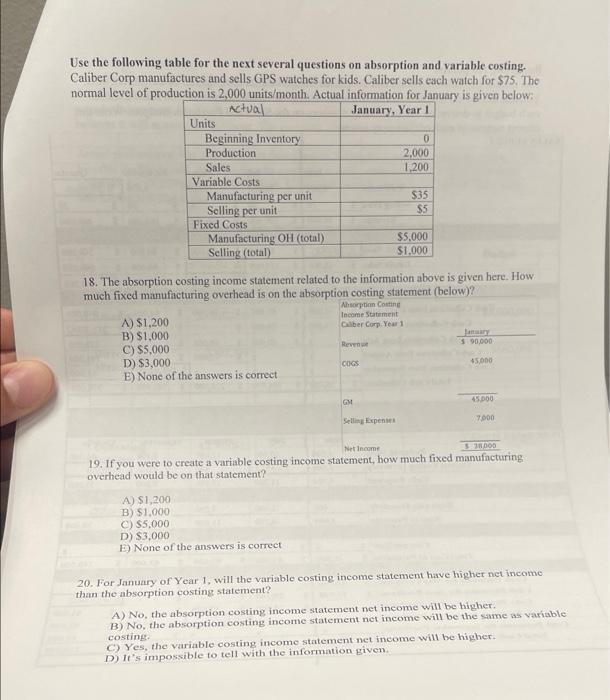

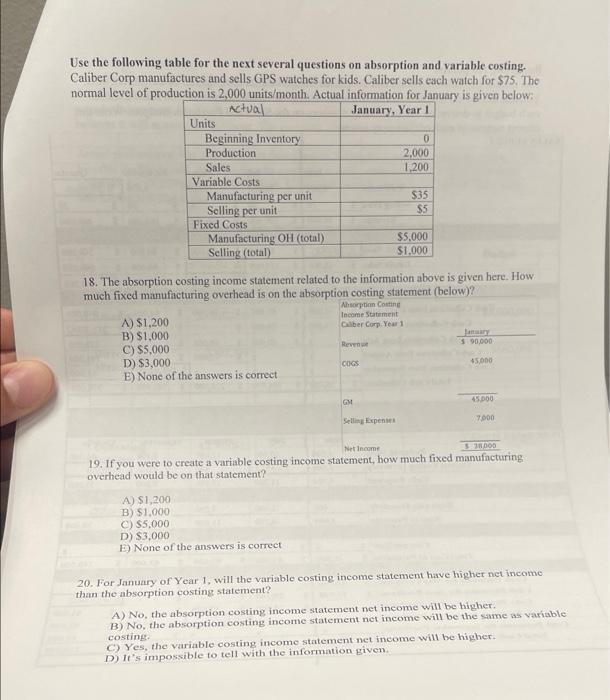

Use the following table for the next several questions on absorption and variable costing. Caliber Corp manufactures and sells GPS watches for kids. Caliber sells each watch for $75. The normal level of production is 2,000 units/month. Actual information for January is given below: actual January, Year 1 Units Beginning Inventory 0 Production 2,000 Sales 1,200 Variable Costs Manufacturing per unit $35 Selling per unit $5 Fixed Costs Manufacturing OH (total) $5,000 Selling (total) $1.000 18. The absorption costing income statement related to the information above is given here. How much fixed manufacturing overhead is on the absorption costing statement (below)? Absorption Costing Income Statement A) $1.200 Gilber Corp. Year B) $1.000 C) $5,000 590.000 D) $3.000 COGS E) None of the answers is correct Reven 45.00 GM 45.000 Selling Expenses 7.000 DOD Net Income 19. If you were to create a variable costing income statement, how much fixed manufncturing overhead would be on that statement? A) $1,200 B) $1.000 C) $5,000 D) $3.000 E) None of the answers is correct 20. For January of Year 1, will the variable costing income statement have higher net income than the absorption costing statement? A) No, the absorption costing income statement net income will be higher B) No, the absorption costing income statement net income will be the same as variable costing C) Yes, the variable costing income statement net income will be higher D) It's impossible to tell with the information given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started