Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you

please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you in advance.

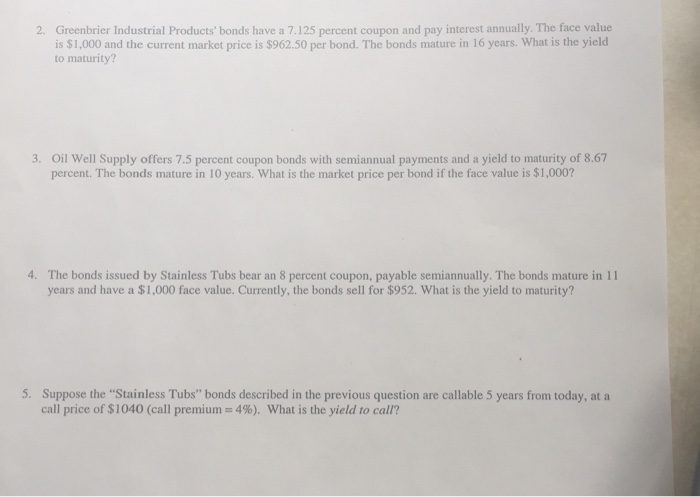

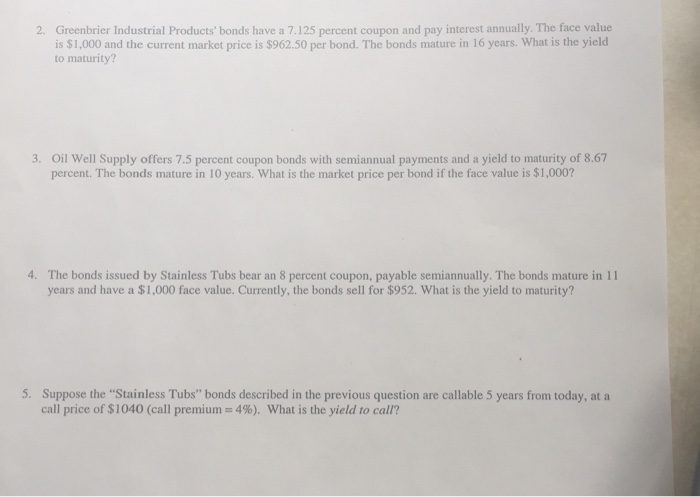

2. Greenbrier Industrial Products' bonds have a 7.125 percent coupon and pay interest annually. The face value is $1,000 and the current market price is $962.50 per bond. The bonds mature in 16 years. What is the yield to maturity? 3. Oil Well Supply offers 7.5 percent coupon bonds with semiannual payments and a yield to maturity of 8.67 percent. The bonds mature in 10 years. What is the market price per bond if the face value is $1,000? 4. The bonds issued by Stainless Tubs bear an 8 percent coupon, payable semiannually. The bonds mature in 11 years and have a $1,000 face value. Currently, the bonds sell for $952. What is the yield to maturity? 5. Suppose the "Stainless Tubs" bonds described in the previous question are callable 5 years from today, at a call price of $1040 (call premium = 4%). What is the yield to call

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started