please , be fast It's an emergancy

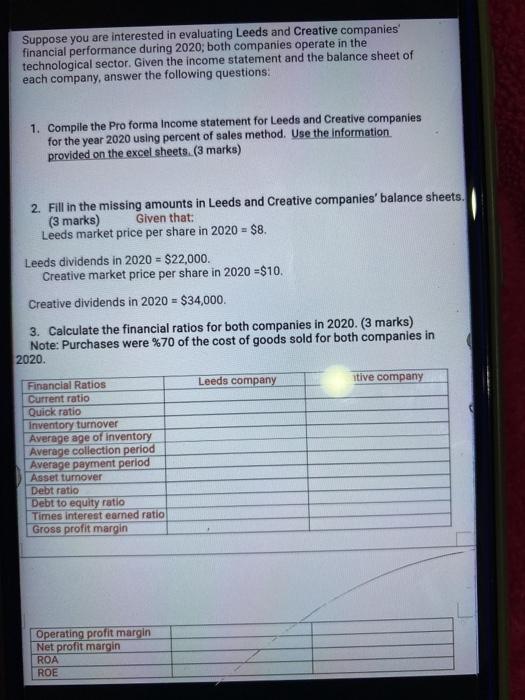

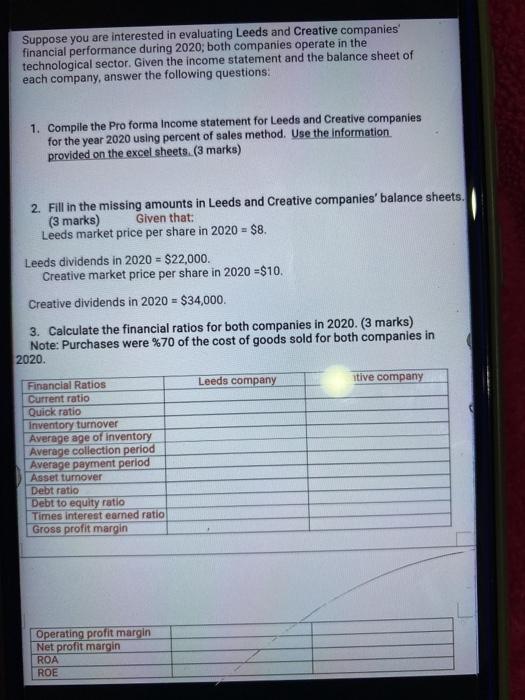

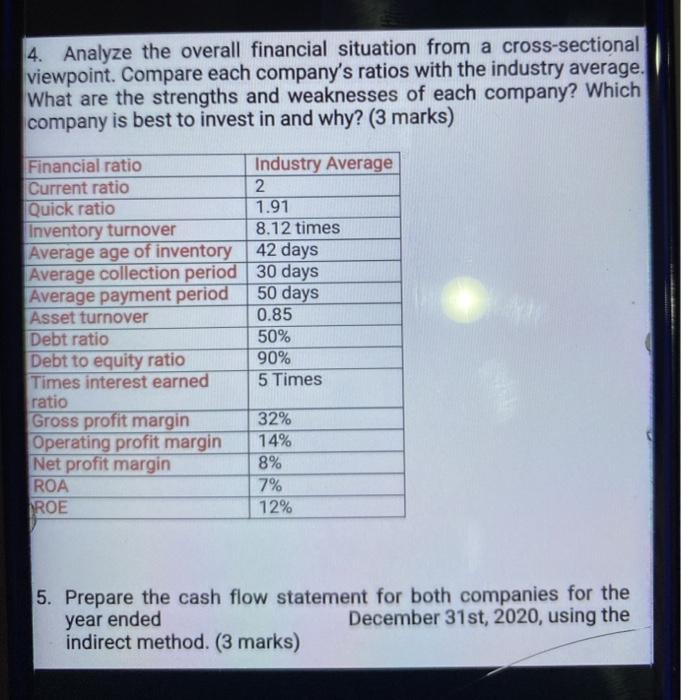

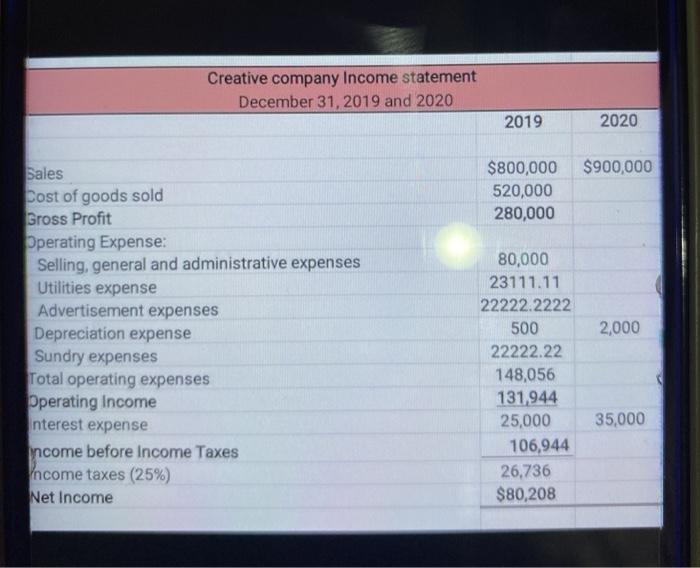

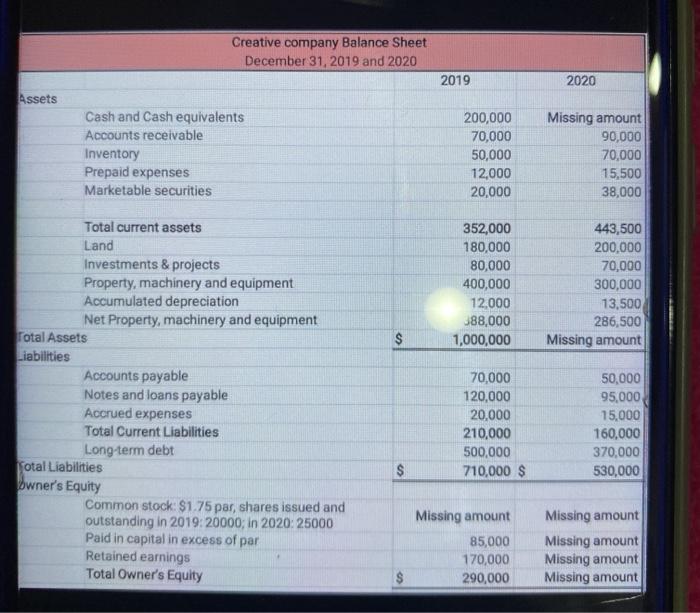

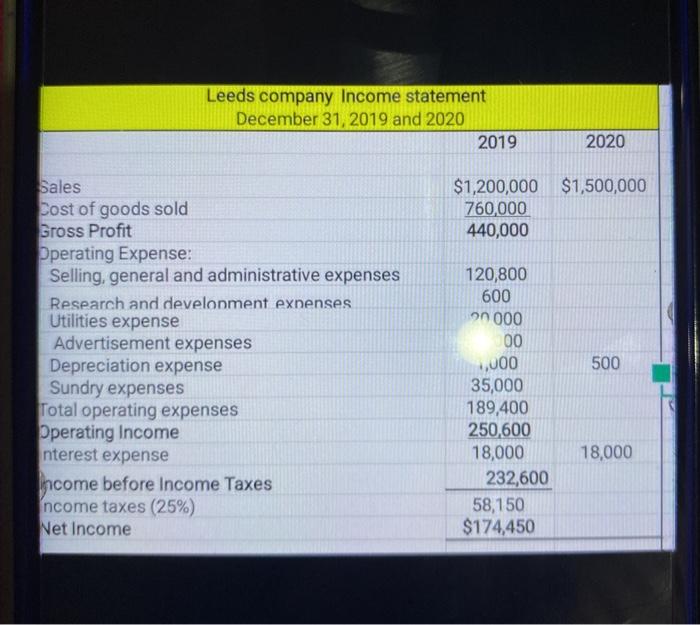

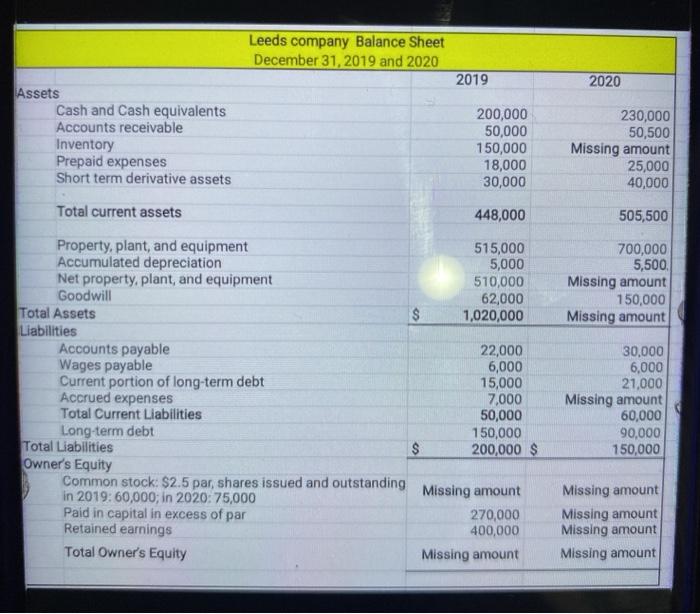

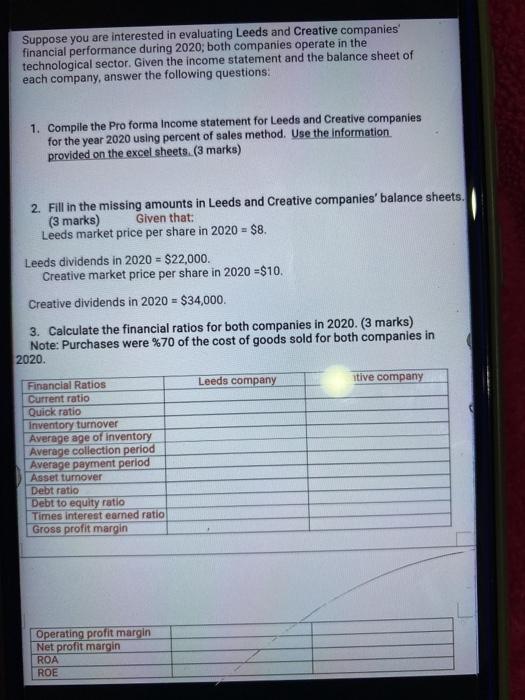

Suppose you are interested in evaluating Leeds and Creative companies financial performance during 2020, both companies operate in the technological sector. Given the income statement and the balance sheet of each company, answer the following questions: 1. Compile the Proforma Income statement for Leeds and Creative companies for the year 2020 using percent of sales method. Use the information provided on the excel sheets. (3 marks) 2. Fill in the missing amounts in Leeds and Creative companies' balance sheets. (3 marks) Given that: Leeds market price per share in 2020 - $8. Leeds dividends in 2020 - $22,000. Creative market price per share in 2020 =$10. Creative dividends in 2020 = $34,000. 3. Calculate the financial ratios for both companies in 2020. (3 marks) Note: Purchases were %70 of the cost of goods sold for both companies in 2020. Leeds company itive company Financial Ratios Current ratio Quick ratio Inventory turnover Average age of inventory Average collection period Average payment period Asset turnover Debt ratio Debt to equity ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin ROA ROE 4. Analyze the overall financial situation from a cross-sectional viewpoint. Compare each company's ratios with the industry average. What are the strengths and weaknesses of each company? Which company is best to invest in and why? (3 marks) Financial ratio Industry Average Current ratio 2 Quick ratio 1.91 Inventory turnover 8.12 times Average age of inventory 42 days Average collection period 30 days Average payment period 50 days Asset turnover 0.85 Debt ratio 50% Debt to equity ratio 90% Times interest earned 5 Times ratio Gross profit margin 32% Operating profit margin 14% Net profit margin 8% ROA 7% SROE 12% 5. Prepare the cash flow statement for both companies for the year ended December 31st, 2020, using the indirect method. (3 marks) Creative company Income statement December 31, 2019 and 2020 2019 2020 $900,000 $800,000 520,000 280,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income nterest expense income before Income Taxes Income taxes (25%) Net Income 2,000 80,000 23111.11 22222.2222 500 22222.22 148,056 131,944 25,000 106,944 26,736 $80,208 35,000 Creative company Balance Sheet December 31, 2019 and 2020 2019 2020 Assets Cash and Cash equivalents Accounts receivable Inventory Prepaid expenses Marketable securities 200,000 70,000 50,000 12,000 20,000 Missing amount 90,000 70,000 15,500 38,000 352,000 180,000 80,000 400,000 12,000 588,000 1,000,000 443,500 200.000 70,000 300,000 13,500 286,500 Missing amount $ $ Total current assets Land Investments & projects Property, machinery and equipment Accumulated depreciation Net Property, machinery and equipment Total Assets Liabilities Accounts payable Notes and loans payable Accrued expenses Total Current Liabilities Long-term debt Total Liabilities owner's Equity Common stock: $1.75 par, shares issued and outstanding in 2019: 20000; in 2020:25000 Paid in capital in excess of par Retained earnings Total Owner's Equity 70,000 120,000 20.000 210,000 500,000 710,000 S 50,000 95,000 15,000 160,000 370,000 530,000 $ Missing amount 85,000 170,000 290,000 Missing amount Missing amount Missing amount Missing amount $ Leeds company Income statement December 31, 2019 and 2020 2019 2020 $1,200,000 $1,500,000 760,000 440,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Research and development expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income nterest expense Income before Income Taxes ncome taxes (25%) Net Income 500 120,800 600 on 000 00 1,000 35,000 189,400 250,600 18,000 232,600 58,150 $174,450 18,000 Leeds company Balance Sheet December 31, 2019 and 2020 2019 2020 Assets Cash and Cash equivalents Accounts receivable Inventory Prepaid expenses Short term derivative assets 200,000 50,000 150,000 18,000 30,000 230,000 50,500 Missing amount 25,000 40,000 Total current assets 448,000 505,500 700,000 5,500 Missing amount 150,000 Missing amount Property, plant, and equipment 515,000 Accumulated depreciation 5,000 Net property, plant, and equipment 510,000 Goodwill 62,000 Total Assets $ 1,020,000 Liabilities Accounts payable 22,000 Wages payable 6,000 Current portion of long-term debt 15,000 Accrued expenses 7,000 Total Current Liabilities 50,000 Long-term debt 150,000 Total Liabilities $ 200,000 $ Owner's Equity Common stock: $2.5 par, shares issued and outstanding Missing amount in 2019: 60,000; in 2020: 75,000 Paid in capital in excess of par 270,000 Retained earnings 400,000 Total Owner's Equity Missing amount 30.000 6,000 21,000 Missing amount 60,000 90,000 150,000 Missing amount Missing amount Missing amount Missing amount Suppose you are interested in evaluating Leeds and Creative companies financial performance during 2020, both companies operate in the technological sector. Given the income statement and the balance sheet of each company, answer the following questions: 1. Compile the Proforma Income statement for Leeds and Creative companies for the year 2020 using percent of sales method. Use the information provided on the excel sheets. (3 marks) 2. Fill in the missing amounts in Leeds and Creative companies' balance sheets. (3 marks) Given that: Leeds market price per share in 2020 - $8. Leeds dividends in 2020 - $22,000. Creative market price per share in 2020 =$10. Creative dividends in 2020 = $34,000. 3. Calculate the financial ratios for both companies in 2020. (3 marks) Note: Purchases were %70 of the cost of goods sold for both companies in 2020. Leeds company itive company Financial Ratios Current ratio Quick ratio Inventory turnover Average age of inventory Average collection period Average payment period Asset turnover Debt ratio Debt to equity ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin ROA ROE 4. Analyze the overall financial situation from a cross-sectional viewpoint. Compare each company's ratios with the industry average. What are the strengths and weaknesses of each company? Which company is best to invest in and why? (3 marks) Financial ratio Industry Average Current ratio 2 Quick ratio 1.91 Inventory turnover 8.12 times Average age of inventory 42 days Average collection period 30 days Average payment period 50 days Asset turnover 0.85 Debt ratio 50% Debt to equity ratio 90% Times interest earned 5 Times ratio Gross profit margin 32% Operating profit margin 14% Net profit margin 8% ROA 7% SROE 12% 5. Prepare the cash flow statement for both companies for the year ended December 31st, 2020, using the indirect method. (3 marks) Creative company Income statement December 31, 2019 and 2020 2019 2020 $900,000 $800,000 520,000 280,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income nterest expense income before Income Taxes Income taxes (25%) Net Income 2,000 80,000 23111.11 22222.2222 500 22222.22 148,056 131,944 25,000 106,944 26,736 $80,208 35,000 Creative company Balance Sheet December 31, 2019 and 2020 2019 2020 Assets Cash and Cash equivalents Accounts receivable Inventory Prepaid expenses Marketable securities 200,000 70,000 50,000 12,000 20,000 Missing amount 90,000 70,000 15,500 38,000 352,000 180,000 80,000 400,000 12,000 588,000 1,000,000 443,500 200.000 70,000 300,000 13,500 286,500 Missing amount $ $ Total current assets Land Investments & projects Property, machinery and equipment Accumulated depreciation Net Property, machinery and equipment Total Assets Liabilities Accounts payable Notes and loans payable Accrued expenses Total Current Liabilities Long-term debt Total Liabilities owner's Equity Common stock: $1.75 par, shares issued and outstanding in 2019: 20000; in 2020:25000 Paid in capital in excess of par Retained earnings Total Owner's Equity 70,000 120,000 20.000 210,000 500,000 710,000 S 50,000 95,000 15,000 160,000 370,000 530,000 $ Missing amount 85,000 170,000 290,000 Missing amount Missing amount Missing amount Missing amount $ Leeds company Income statement December 31, 2019 and 2020 2019 2020 $1,200,000 $1,500,000 760,000 440,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Research and development expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income nterest expense Income before Income Taxes ncome taxes (25%) Net Income 500 120,800 600 on 000 00 1,000 35,000 189,400 250,600 18,000 232,600 58,150 $174,450 18,000 Leeds company Balance Sheet December 31, 2019 and 2020 2019 2020 Assets Cash and Cash equivalents Accounts receivable Inventory Prepaid expenses Short term derivative assets 200,000 50,000 150,000 18,000 30,000 230,000 50,500 Missing amount 25,000 40,000 Total current assets 448,000 505,500 700,000 5,500 Missing amount 150,000 Missing amount Property, plant, and equipment 515,000 Accumulated depreciation 5,000 Net property, plant, and equipment 510,000 Goodwill 62,000 Total Assets $ 1,020,000 Liabilities Accounts payable 22,000 Wages payable 6,000 Current portion of long-term debt 15,000 Accrued expenses 7,000 Total Current Liabilities 50,000 Long-term debt 150,000 Total Liabilities $ 200,000 $ Owner's Equity Common stock: $2.5 par, shares issued and outstanding Missing amount in 2019: 60,000; in 2020: 75,000 Paid in capital in excess of par 270,000 Retained earnings 400,000 Total Owner's Equity Missing amount 30.000 6,000 21,000 Missing amount 60,000 90,000 150,000 Missing amount Missing amount Missing amount Missing amount