Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE BE HURYY I ONLY HAVE 2 HOURS TO ANSWER IT THANKS. QUESTION 3 (20 MARKS: 36 MINUTES) Farhana, a graduate from UUM, was appointed

PLEASE BE HURYY I ONLY HAVE 2 HOURS TO ANSWER IT

THANKS.

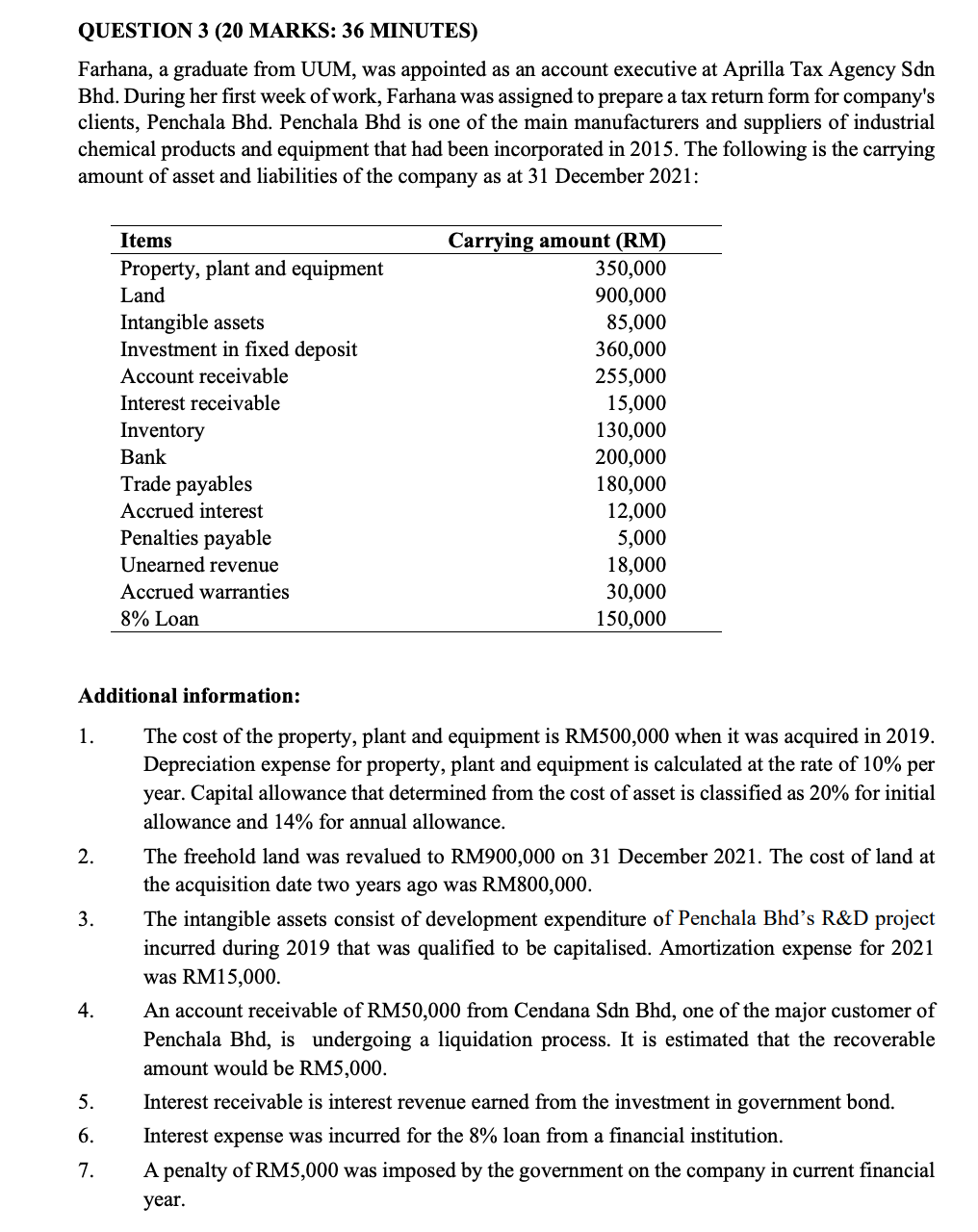

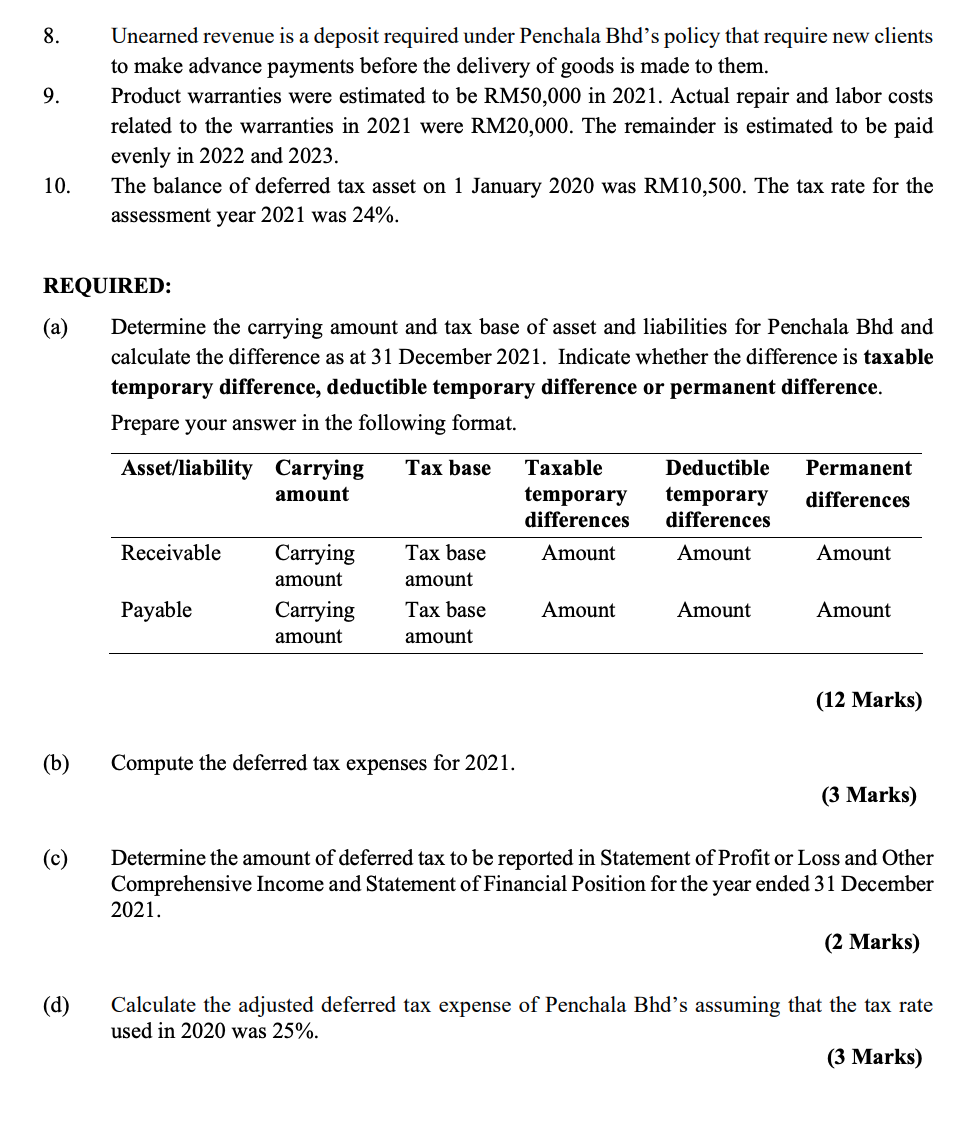

QUESTION 3 (20 MARKS: 36 MINUTES) Farhana, a graduate from UUM, was appointed as an account executive at Aprilla Tax Agency Sdn Bhd. During her first week of work, Farhana was assigned to prepare a tax return form for company's clients, Penchala Bhd. Penchala Bhd is one of the main manufacturers and suppliers of industrial chemical products and equipment that had been incorporated in 2015. The following is the carrying amount of asset and liabilities of the company as at 31 December 2021: Items Property, plant and equipment Land Intangible assets Investment in fixed deposit Account receivable Interest receivable Inventory Bank Trade payables Accrued interest Penalties payable Unearned revenue Accrued warranties 8% Loan Carrying amount (RM) 350,000 900,000 85,000 360,000 255,000 15,000 130,000 200,000 180,000 12,000 5,000 18,000 30,000 150,000 Additional information: 1. 2. 3. The cost of the property, plant and equipment is RM500,000 when it was acquired in 2019. Depreciation expense for property, plant and equipment is calculated at the rate of 10% per year. Capital allowance that determined from the cost of asset is classified as 20% for initial allowance and 14% for annual allowance. The freehold land was revalued to RM900,000 on 31 December 2021. The cost of land at the acquisition date two years ago was RM800,000. The intangible assets consist of development expenditure of Penchala Bhd's R&D project incurred during 2019 that was qualified to be capitalised. Amortization expense for 2021 was RM15,000. An account receivable of RM50,000 from Cendana Sdn Bhd, one of the major customer of Penchala Bhd, is undergoing a liquidation process. It is estimated that the recoverable amount would be RM5,000. Interest receivable is interest revenue earned from the investment in government bond. Interest expense was incurred for the 8% loan from a financial institution. A penalty of RM5,000 was imposed by the government on the company in current financial year. 4. 5. 6. 7. 8. 9. Unearned revenue is a deposit required under Penchala Bhd's policy that require new clients to make advance payments before the delivery of goods is made to them. Product warranties were estimated to be RM50,000 in 2021. Actual repair and labor costs related to the warranties in 2021 were RM20,000. The remainder is estimated to be paid evenly in 2022 and 2023. The balance of deferred tax asset on 1 January 2020 was RM10,500. The tax rate for the assessment year 2021 was 24%. 10. REQUIRED: (a) Determine the carrying amount and tax base of asset and liabilities for Penchala Bhd and calculate the difference as at 31 December 2021. Indicate whether the difference is taxable temporary difference, deductible temporary difference or permanent difference. Prepare your answer in the following format. Asset/liability Carrying Tax base Taxable Deductible Permanent amount temporary temporary differences differences differences Receivable Carrying Tax base Amount Amount Amount amount amount Payable Carrying Tax base Amount Amount Amount amount amount (12 Marks) (b) Compute the deferred tax expenses for 2021. (3 Marks) (c) Determine the amount of deferred tax to be reported in Statement of Profit or Loss and Other Comprehensive Income and Statement of Financial Position for the year ended 31 December 2021. (2 Marks) (d) Calculate the adjusted deferred tax expense of Penchala Bhd's assuming that the tax rate used in 2020 was 25%. (3 Marks) QUESTION 3 (20 MARKS: 36 MINUTES) Farhana, a graduate from UUM, was appointed as an account executive at Aprilla Tax Agency Sdn Bhd. During her first week of work, Farhana was assigned to prepare a tax return form for company's clients, Penchala Bhd. Penchala Bhd is one of the main manufacturers and suppliers of industrial chemical products and equipment that had been incorporated in 2015. The following is the carrying amount of asset and liabilities of the company as at 31 December 2021: Items Property, plant and equipment Land Intangible assets Investment in fixed deposit Account receivable Interest receivable Inventory Bank Trade payables Accrued interest Penalties payable Unearned revenue Accrued warranties 8% Loan Carrying amount (RM) 350,000 900,000 85,000 360,000 255,000 15,000 130,000 200,000 180,000 12,000 5,000 18,000 30,000 150,000 Additional information: 1. 2. 3. The cost of the property, plant and equipment is RM500,000 when it was acquired in 2019. Depreciation expense for property, plant and equipment is calculated at the rate of 10% per year. Capital allowance that determined from the cost of asset is classified as 20% for initial allowance and 14% for annual allowance. The freehold land was revalued to RM900,000 on 31 December 2021. The cost of land at the acquisition date two years ago was RM800,000. The intangible assets consist of development expenditure of Penchala Bhd's R&D project incurred during 2019 that was qualified to be capitalised. Amortization expense for 2021 was RM15,000. An account receivable of RM50,000 from Cendana Sdn Bhd, one of the major customer of Penchala Bhd, is undergoing a liquidation process. It is estimated that the recoverable amount would be RM5,000. Interest receivable is interest revenue earned from the investment in government bond. Interest expense was incurred for the 8% loan from a financial institution. A penalty of RM5,000 was imposed by the government on the company in current financial year. 4. 5. 6. 7. 8. 9. Unearned revenue is a deposit required under Penchala Bhd's policy that require new clients to make advance payments before the delivery of goods is made to them. Product warranties were estimated to be RM50,000 in 2021. Actual repair and labor costs related to the warranties in 2021 were RM20,000. The remainder is estimated to be paid evenly in 2022 and 2023. The balance of deferred tax asset on 1 January 2020 was RM10,500. The tax rate for the assessment year 2021 was 24%. 10. REQUIRED: (a) Determine the carrying amount and tax base of asset and liabilities for Penchala Bhd and calculate the difference as at 31 December 2021. Indicate whether the difference is taxable temporary difference, deductible temporary difference or permanent difference. Prepare your answer in the following format. Asset/liability Carrying Tax base Taxable Deductible Permanent amount temporary temporary differences differences differences Receivable Carrying Tax base Amount Amount Amount amount amount Payable Carrying Tax base Amount Amount Amount amount amount (12 Marks) (b) Compute the deferred tax expenses for 2021. (3 Marks) (c) Determine the amount of deferred tax to be reported in Statement of Profit or Loss and Other Comprehensive Income and Statement of Financial Position for the year ended 31 December 2021. (2 Marks) (d) Calculate the adjusted deferred tax expense of Penchala Bhd's assuming that the tax rate used in 2020 was 25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started