please be quickly

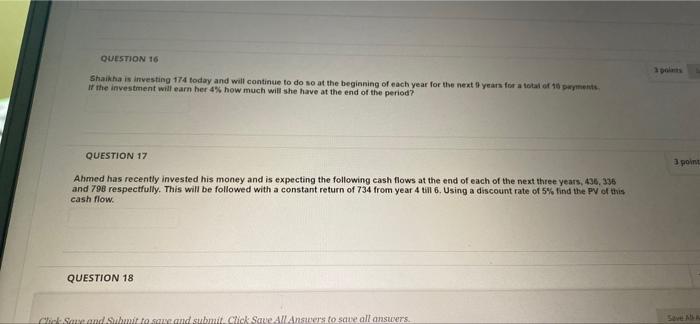

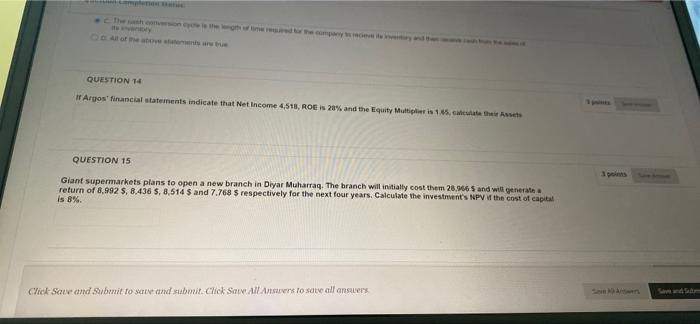

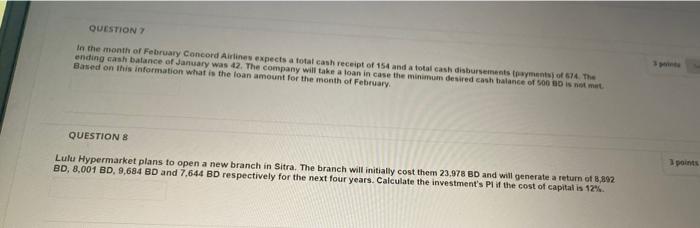

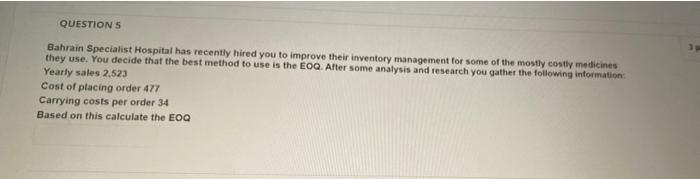

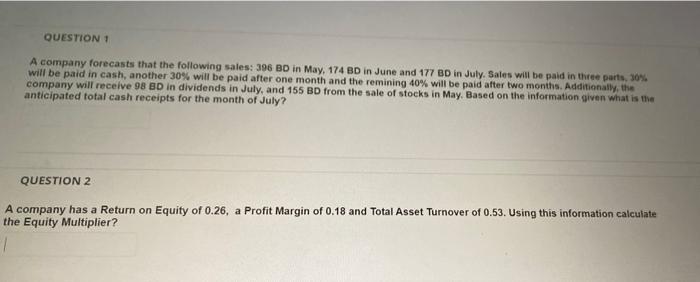

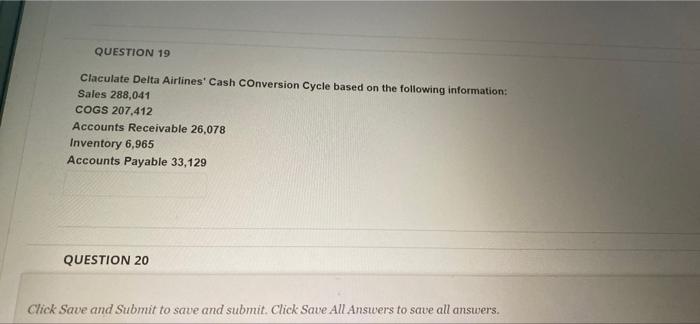

QUESTION 19 Claculate Delta Airlines' Cash Conversion Cycle based on the following information: Sales 288,041 COGS 207,412 Accounts Receivable 26,078 Inventory 6,965 Accounts Payable 33,129 QUESTION 20 Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 16 polis Shaikha is investing 174 today and will continue to do so at the beginning of each year for the next years for a total of 16 ents If the investment will earn her 4% how much will she have at the end of the period? QUESTION 17 3 point Ahmed has recently invested his money and is expecting the following cash flows at the end of each of the next three years, 436,336 and 798 respectfully. This will be followed with a constant return of 734 from year 4 till 6. Using a discount rate of 5% find the PV of this cash flow. QUESTION 18 Chale Sans and what to save and submit Click Save All Anster to save all ansurs QUESTION 14 If Argos' financial statements indicate that Net Income 4518, ROE i 20% and the Equity pris 145ch QUESTION 15 Giant supermarkets plans to open a new branch in Diyar Muharraq. The branch will initially cost them 28,946 5 and will generale return of 8,992 $, 8.436 5. 8,514 $ and 7.768 $ respectively for the next four years. Calculate the investment's NPV of the cost of capital is 8%. Click Save and submit to save and submit. Click Sant All Answers to see all answers QUESTION in the month of February Concord Airlines expects a total cash receipt of 154 and a total cash disbursements towyments of the ending cash balance of January was 42. The company will take a loan in case the minimum desired cash balance of SD is not Based on this information what is the loan amount for the month of February QUESTIONS Lulu Hypermarket plans to open a new branch in Sitra. The branch will initially cost them 23.978 BD and will generate a return of 8,892 BD, 8,001 BD, 9,684 BD and 7,644 BD respectively for the next four years. Calculate the investment's Plit the cost of capital is 12% points QUESTIONS 3 Bahrain Specialist Hospital has recently hired you to improve their inventory management for some of the mostly costly medicines they use. You decide that the best method to use is the EOQ. After some analysis and research you gather the following information Yearly sales 2,523 Cost of placing order 477 Carrying costs per order 34 Based on this calculate the EOQ QUESTION 1 A company forecasts that the following sales: 396 BD in May, 174 BD in June and 177 BD in July. Sales will be paid in three parts, 30% will be paid in cash, another 30% will be paid after one month and the remining 40% will be paid after two months. Additionally, the company will receive 98 BD in dividends in July, and 155 BD from the sale of stocks in May. Based on the information given what is the anticipated total cash receipts for the month of July? QUESTION 2 A company has a Return on Equity of 0.26, a Profit Margin of 0.18 and Total Asset Turnover of 0.53. Using this information calculat the Equity Multiplier

please be quickly

please be quickly