Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE BE SPECIFIC, I TELL ME HOW YOU DID IT, AND WRITE YOUR ANSWERS IN BOLD SO I CAN SEE THE ANSWER QUICKLY ! Problem

PLEASE BE SPECIFIC, I TELL ME HOW YOU DID IT, AND WRITE YOUR ANSWERS IN BOLD SO I CAN SEE THE ANSWER QUICKLY !

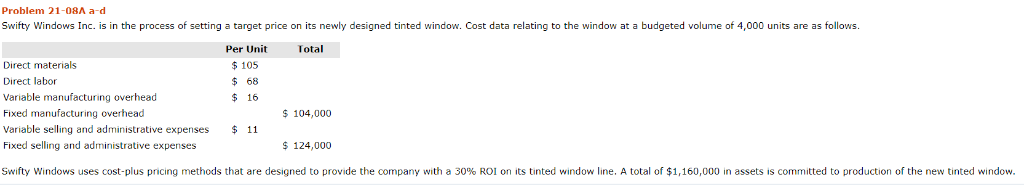

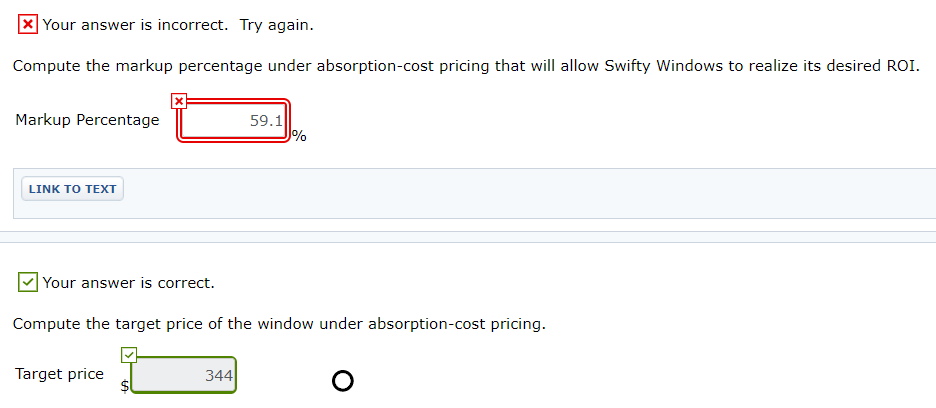

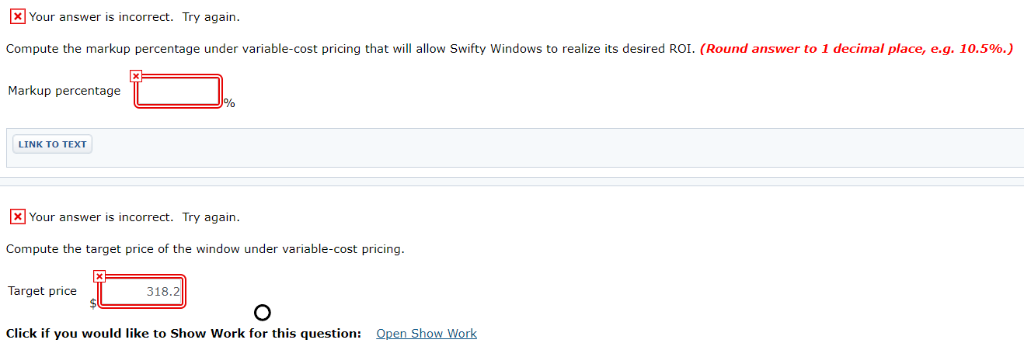

Problem 21-08 a-d Swifty Windows Inc. is in the process of setting a target price on its newly designed tinted window. Cost data relating to the window at a budgeted volume of 4,000 units are as follows. Per Unit $105 $ 68 $ 16 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses 104,000 11 $124,000 Swifty Windows uses cost us pr c ng methods that are designed to ovde the company w th a 30% n assets is commit ei toproduction i hene l on its tinte ne. A total o o tinte w n. n ow Your answer is incorrect. Try again. Compute the markup percentage under absorption-cost pricing that will allow Swifty Windows to realize its desired ROI Markup Percentage 59.1 LINK TO TEXT Your answer is correct. Compute the target price of the window under absorption-cost pricing Target price 344 XYour answer is incorrect. Try again Compute the markup percentage under variable-cost pricing that will allow Swifty Windows to realize its desired ROI. (Round answer to 1 decimal place, eg, 10.5%.) Markup percentage LINK TO TEXT XYour answer is incorrect. Try again. Compute the target price of the window under variable-cost pricing. Target price 318.2 Click if you would like to Show Work for thisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started