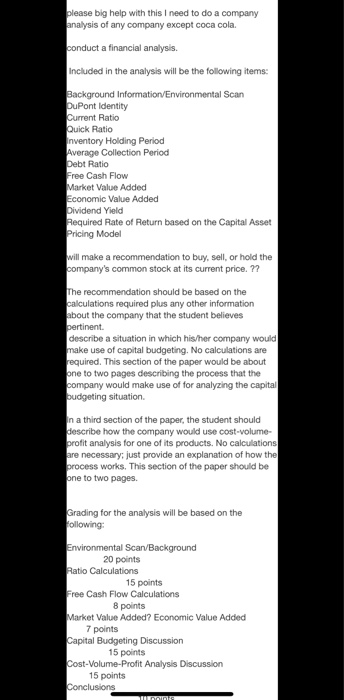

please big help with this I need to do a company analysis of any company except coca cola conduct a financial analysis. Included in the analysis will be the following items: Background Information Environmental Scan DuPont Identity Current Ratio Quick Ratio inventory Holding Period Average Collection Period Debt Ratio Free Cash Flow Market Value Added Economic Value Added Dividend Yield Required Rate of Return based on the Capital Asset Pricing Model will make a recommendation to buy, sell, or hold the company's common stock at its current price. ?? The recommendation should be based on the calculations required plus any other information about the company that the student believes pertinent. describe a situation in which his/her company would make use of capital budgeting. No calculations are required. This section of the paper would be about one to two pages describing the process that the company would make use of for analyzing the capital budgeting situation In a third section of the paper, the student should describe how the company would use cost-volume- profit analysis for one of its products. No calculations are necessary, just provide an explanation of how the process works. This section of the paper should be one to two pages Grading for the analysis will be based on the following: Environmental Scan/Background 20 points Ratio Calculations 15 points Free Cash Flow Calculations 8 points Market Value Added? Economic Value Added 7 points Capital Budgeting Discussion 15 points Cost-Volume-Profit Analysis Discussion 15 points Conclusions minn please big help with this I need to do a company analysis of any company except coca cola conduct a financial analysis. Included in the analysis will be the following items: Background Information Environmental Scan DuPont Identity Current Ratio Quick Ratio inventory Holding Period Average Collection Period Debt Ratio Free Cash Flow Market Value Added Economic Value Added Dividend Yield Required Rate of Return based on the Capital Asset Pricing Model will make a recommendation to buy, sell, or hold the company's common stock at its current price. ?? The recommendation should be based on the calculations required plus any other information about the company that the student believes pertinent. describe a situation in which his/her company would make use of capital budgeting. No calculations are required. This section of the paper would be about one to two pages describing the process that the company would make use of for analyzing the capital budgeting situation In a third section of the paper, the student should describe how the company would use cost-volume- profit analysis for one of its products. No calculations are necessary, just provide an explanation of how the process works. This section of the paper should be one to two pages Grading for the analysis will be based on the following: Environmental Scan/Background 20 points Ratio Calculations 15 points Free Cash Flow Calculations 8 points Market Value Added? Economic Value Added 7 points Capital Budgeting Discussion 15 points Cost-Volume-Profit Analysis Discussion 15 points Conclusions minn