Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please bold the answers, thank you 5. Computation of finance charges - Periodic rate and average daily balance Aa Aa E If you divide the

Please bold the answers, thank you

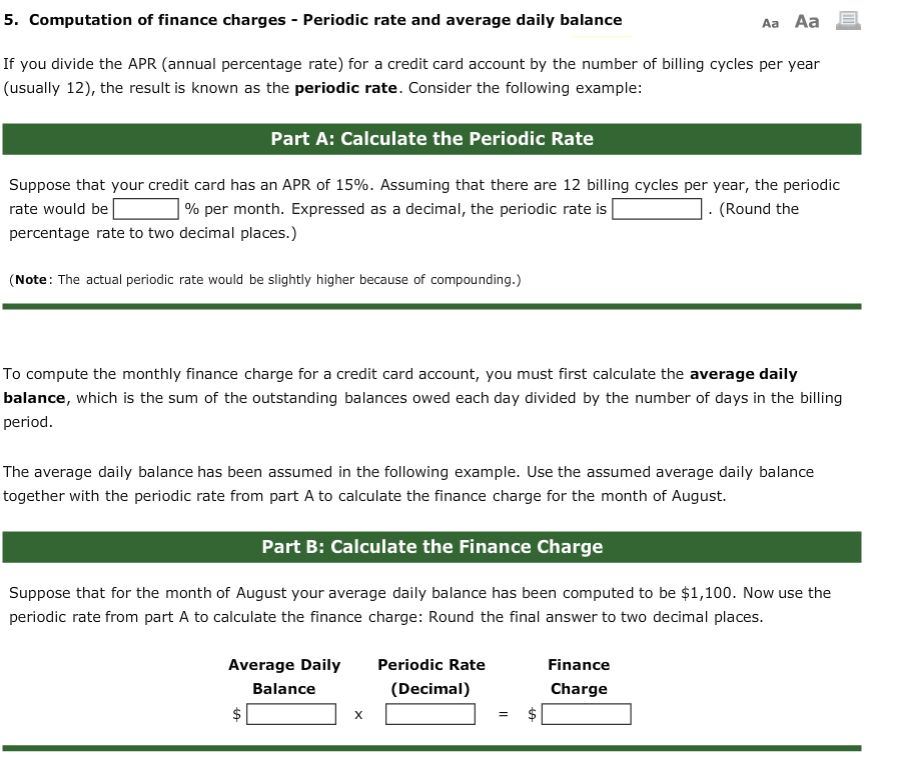

5. Computation of finance charges - Periodic rate and average daily balance Aa Aa E If you divide the APR (annual percentage rate) for a credit card account by the number of billing cycles per year (usually 12), the result is known as the periodic rate. Consider the following example: Part A: Calculate the Periodic Rate Suppose that your credit card has an APR of 15%. Assuming that there are 12 billing cycles per year, the periodic rate would be % per month. Expressed as a decimal, the periodic rate is - (Round the percentage rate to two decimal places.) (Note: The actual periodic rate would be slightly higher because of compounding.) To compute the monthly finance charge for a credit card account, you must first calculate the average daily balance, which is the sum of the outstanding balances owed each day divided by the number of days in the billing period. The average daily balance has been assumed in the following example. Use the assumed average daily balance together with the periodic rate from part A to calculate the finance charge for the month of August. Part B: Calculate the Finance Charge Suppose that for the month of August your average daily balance has been computed to be $1,100. Now use the periodic rate from part A to calculate the finance charge: Round the final answer to two decimal places. Average Daily Balance $ Periodic Rate (Decimal) Finance Charge $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started