Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE BREAK DOWN THE STEPS OF WHERE THE NUMBERS CAME FROM AND INDICATE WHETHER YOU USED THE TAX RATE SCHEDULES OR SOMETHING ELSE FOR THE

PLEASE BREAK DOWN THE STEPS OF WHERE THE NUMBERS CAME FROM AND INDICATE WHETHER YOU USED THE TAX RATE SCHEDULES OR SOMETHING ELSE FOR THE INCOME TAX AND NET INVESTMENT INCOME TAX.

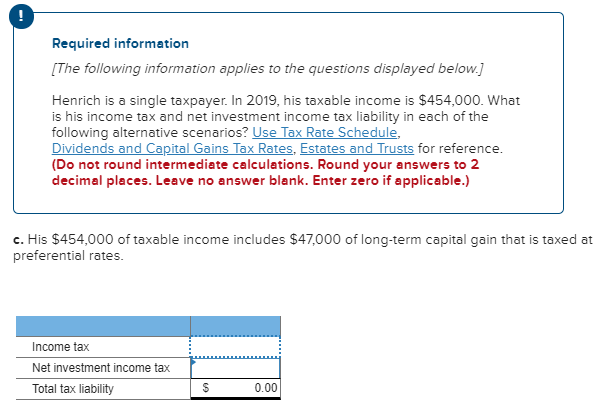

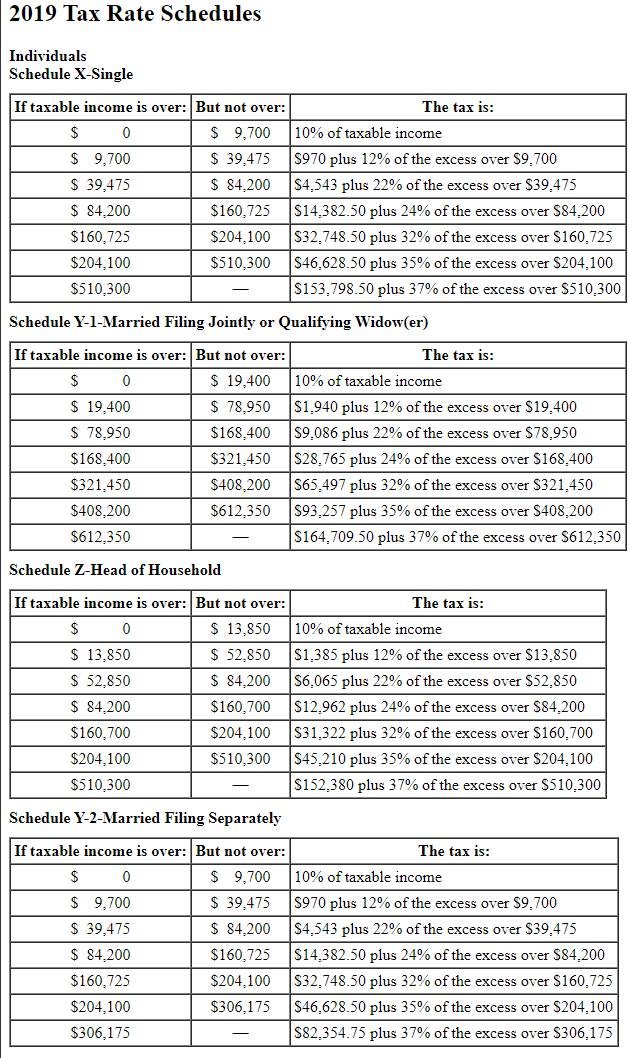

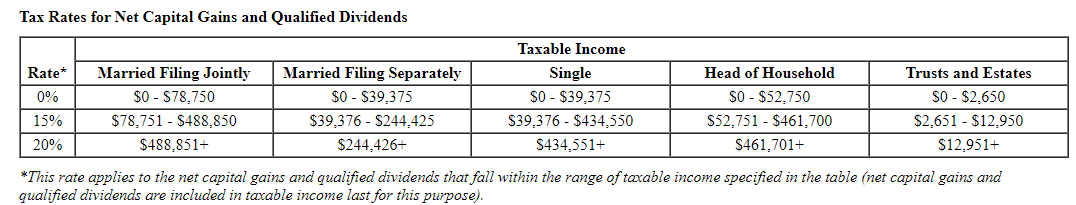

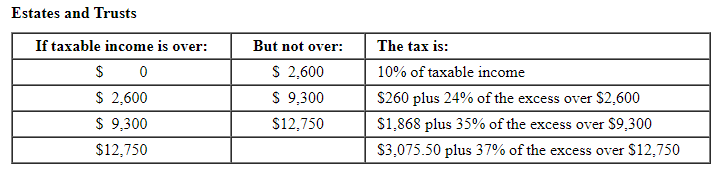

! Required information [The following information applies to the questions displayed below] Henrich is a single taxpayer. In 2019, his taxable income is $454,000. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) c. His $454,000 of taxable income includes $47,000 of long-term capital gain that is taxed at preferential rates Income tax Net investment income tax Total tax liability 0.00 2019 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over The tax is: $ 9,700 10% of taxable income $ 0 $ 9,700 39.475 % of the excess over S9,700 $970 plus 12 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $160,725 $160,725 $204,100 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 $204,100 $510,300 $510,300 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over The tax is: 10% of taxable income $ 0 19,400 $ 19,400 $ 78,950 $1,940 plus 12% of the excess over S19,400 78,950 $168,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168,400 $168,400 $321,450 $65,497 plus 32% of the excess over $321,450 $321,450 $408,200 $93,257 plus 35% of the excess over S408,200 $408,200 $612,350 $612,350 $164,709.50 plus 37% of the excess over S612,350 Schedule Z-Head of Household If taxable income is over: But not over The tax is 10% of taxable income $ 13,850 0 $ 13,850 $1,385 plus 12% of the excess over S13,850 52,850 84,200 52,850 $6,065 plus 22% of the excess over S52,850 $ 84,200 $12,962 plus 24% of the excess over $84,200 $160,700 $31,322 plus 32% of the excess over $160,700 $160,700 $204,100 $45,210 plus 35% of the excess over $204,100 $204,100 $510,300 $152,380 plus 37% of the excess over $510,300 $510,300 Schedule Y-2-Married Filing Separately If taxable income is over: But not over The tax is $ 9,700 $ 10% of taxable income 0 $ 9,700 $ 39,475 $970 plus 12 % of the excess over S9,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $160,725 $160,725 $204,100 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 $204,100 $306,175 $306,175 Tax Rates for Net Capital Gains and Qualified Dividends Taxable Income Married Filing Separately Single Rate* Married Filing Jointly Head of Household Trusts and Estates $0 $78,750 $0 S39,375 SO - $39,375 S0 $52,750 $0 $2,650 0% $78,751 $488.850 $39,376 - S244,425 $39,376 - $434,550 S52,751 - $461,700 $2,651 - $12,950 15% $488,851+ $244,426+ 20% $434,551+ $461,701 $12,951+ *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). Estates and Trusts If taxable income is over: But not over The tax is: S 2,600 10% of taxable income S 2,600 $ 9,300 $260 plus 24% of the excess over $2,600 9,300 S1,868 plus 35% of the excess over S9,300 $12,750 S3,075.50 plus 37% of the excess over $12,750 $12,750 _

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started