Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please bring the algorithm with you. Thank you Please bring the algorithm with you. Thank you Please bring the algorithm with you. Thank you Please

Please bring the algorithm with you. Thank you

Please bring the algorithm with you. Thank you

Please bring the algorithm with you. Thank you

Please bring the algorithm with you. Thank you

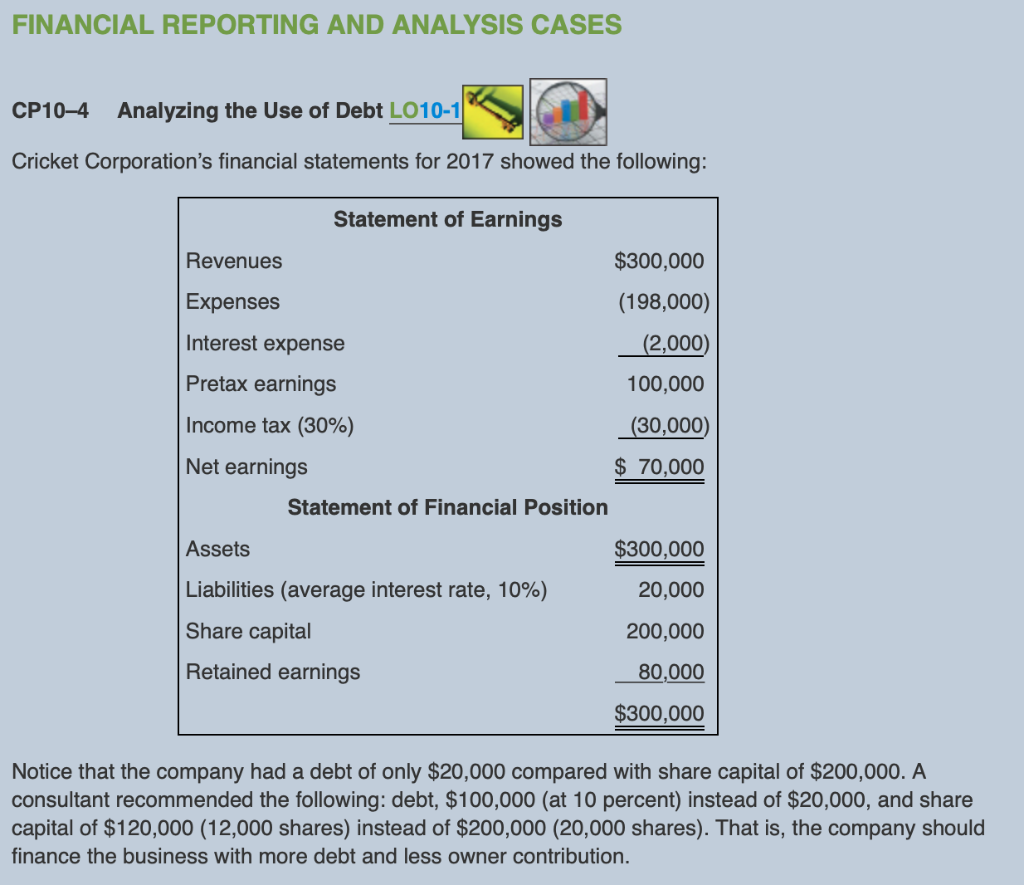

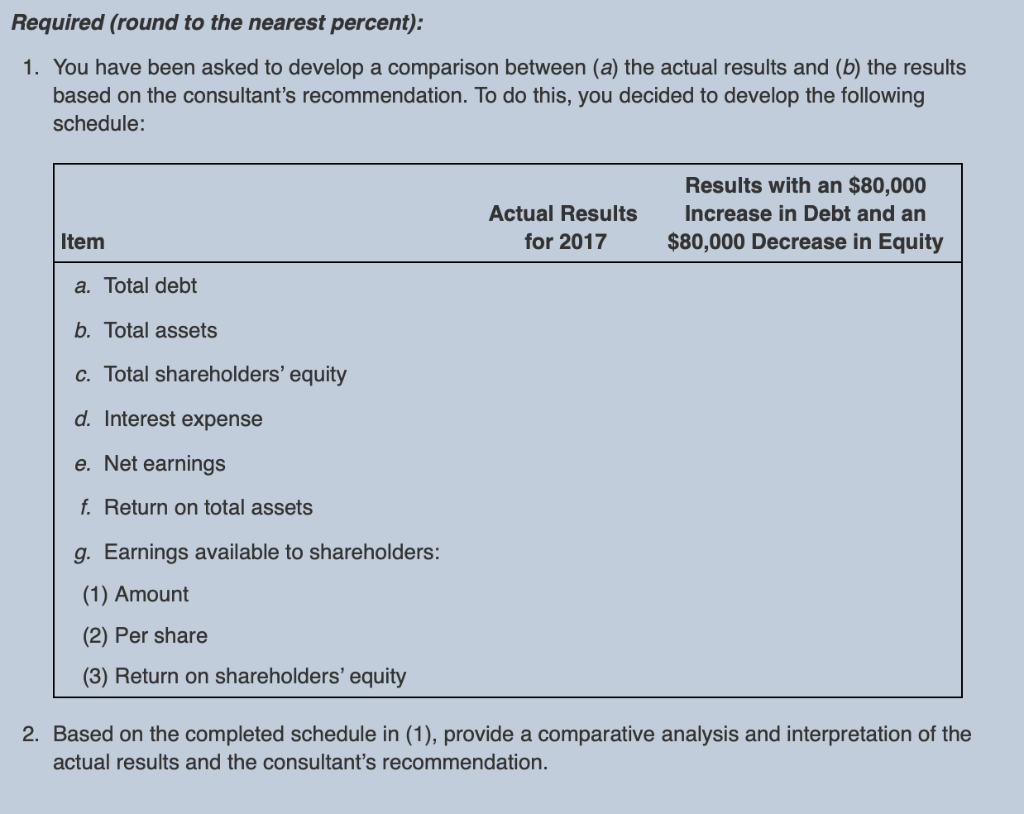

FINANCIAL REPORTING AND ANALYSIS CASES CP104 Analyzing the Use of Debt L010-1 Cricket Corporation's financial statements for 2017 showed the following: Statement of Earnings Revenues $300,000 Expenses (198,000) Interest expense (2,000) Pretax earnings 100,000 Income tax (30%) (30,000) Net earnings $ 70,000 Statement of Financial Position Assets $300,000 Liabilities (average interest rate, 10%) 20,000 Share capital 200,000 Retained earnings 80,000 $300,000 Notice that the company had a debt of only $20,000 compared with share capital of $200,000. A consultant recommended the following: debt, $100,000 (at 10 percent) instead of $20,000, and share capital of $120,000 (12,000 shares) instead of $200,000 (20,000 shares). That is, the company should finance the business with more debt and less owner contribution. Required (round to the nearest percent): 1. You have been asked to develop a comparison between (a) the actual results and (b) the results based on the consultant's recommendation. To do this, you decided to develop the following schedule: Actual Results for 2017 Results with an $80,000 Increase in Debt and an $80,000 Decrease in Equity Item a. Total debt b. Total assets c. Total shareholders' equity d. Interest expense e. Net earnings f. Return on total assets g. Earnings available to shareholders: (1) Amount (2) Per share (3) Return on shareholders' equity 2. Based on the completed schedule in (1), provide a comparative analysis and interpretation of the actual results and the consultant's recommendationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started