Answered step by step

Verified Expert Solution

Question

1 Approved Answer

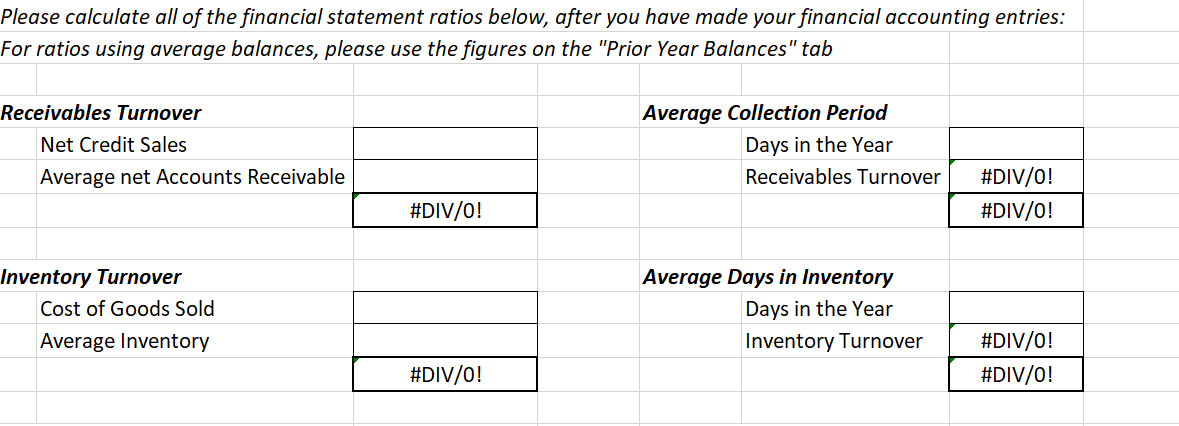

Please calculate all of the financial statement ratios below, after you have made your financial accounting entries: For ratios using average balances, please use

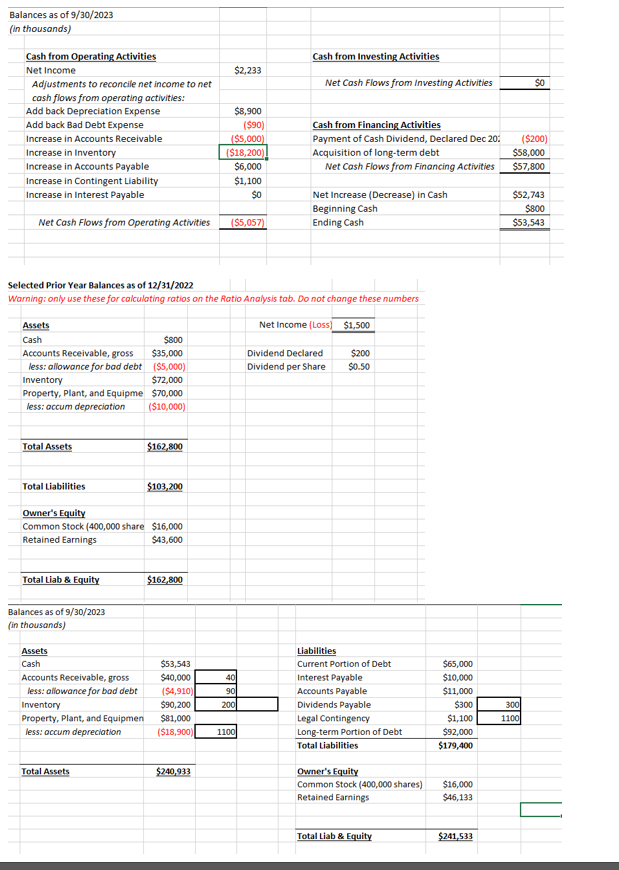

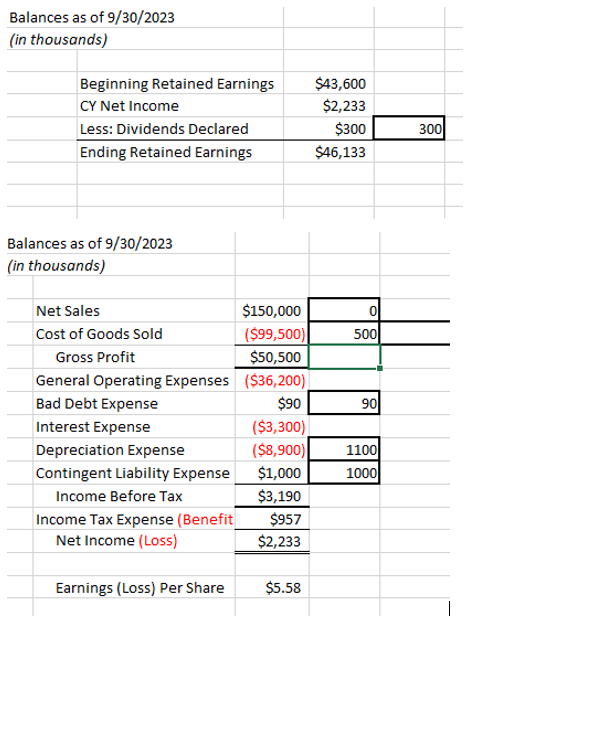

Please calculate all of the financial statement ratios below, after you have made your financial accounting entries: For ratios using average balances, please use the figures on the "Prior Year Balances" tab Receivables Turnover Net Credit Sales Average net Accounts Receivable Inventory Turnover Cost of Goods Sold Average Inventory #DIV/0! #DIV/0! Average Collection Period Days in the Year Receivables Turnover Average Days in Inventory Days in the Year Inventory Turnover #DIV/O! #DIV/0! #DIV/O! #DIV/0! Balances as of 9/30/2023 (in thousands) Cash from Operating Activities Net Income Adjustments to reconcile net income to net cash flows from operating activities: Add back Depreciation Expense Add back Bad Debt Expense Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Contingent Liability Increase in Interest Payable Net Cash Flows from Operating Activities Assets Cash Accounts Receivable, gross less: allowance for bad debt Inventory Property, Plant, and Equipme less: accum depreciation Total Assets Total Liabilities Total Liab & Equity Balances as of 9/30/2023 (in thousands) Owner's Equity Common Stock (400,000 share $16,000 Retained Earnings $43,600 Assets Cash Selected Prior Year Balances as of 12/31/2022 Warning: only use these for calculating ratios on the Ratio Analysis tab. Do not change these numbers Net Income (Loss) $1,500 Accounts Receivable, gross less: allowance for bad debt Inventory Property, Plant, and Equipmen less: accum depreciation $800 $35,000 ($5,000) $72,000 $70,000 ($10,000) Total Assets $162,800 $103,200 $162,800 $2,233 $8,900 $240,933 ($90) ($5,000) ($18,200) $6,000 $1,100 $0 ($5,057) $53,543 $40,000 ($4,910) $90,200 $81,000 ($18,900) 1100 Cash from Investing Activities 40 90 200 Net Cash Flows from Investing Activities Cash from Financing Activities Payment of Cash Dividend, Declared Dec 20: Acquisition of long-term debt Net Cash Flows from Financing Activities Net Increase (Decrease) in Cash Beginning Cash Ending Cash Dividend Declared Dividend per Share $200 $0.50 Liabilities Current Portion of Debt Interest Payable Accounts Payable Dividends Payable Legal Contingency Long-term Portion of Debt Total Liabilities Owner's Equity Common Stock (400,000 shares) Retained Earnings Total Liab & Equity $65,000 $10,000 $11,000 $300 $1,100 $92,000 $179,400 $16,000 $46,133 $241,533 $0 ($200) $58,000 $57,800 $52,743 $800 $53,543 300 1100 Balances as of 9/30/2023 (in thousands) Beginning Retained Earnings CY Net Income Less: Dividends Declared Ending Retained Earnings Balances as of 9/30/2023 (in thousands) Net Sales $150,000 Cost of Goods Sold ($99,500) Gross Profit $50,500 General Operating Expenses ($36,200) Bad Debt Expense $90 Interest Expense ($3,300) ($8,900) $1,000 $3,190 $957 $2,233 Depreciation Expense Contingent Liability Expense Income Before Tax Income Tax Expense (Benefit Net Income (Loss) Earnings (Loss) Per Share $5.58 $43,600 $2,233 $300 $46,133 0 500 90 1100 1000 300

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the financial statement ratios well use the pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started