Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please calculate and answer all the questions below with formulas. Projects Workbook Home Page Layout Formulas Data Review View Out Gary Ger > We area

please calculate and answer all the questions below with formulas.

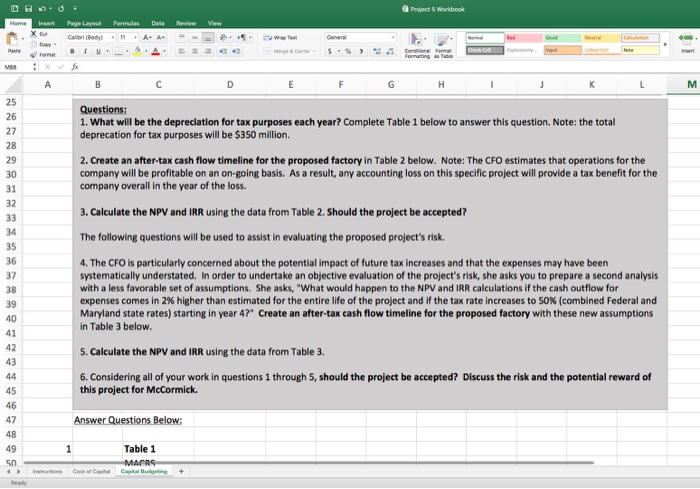

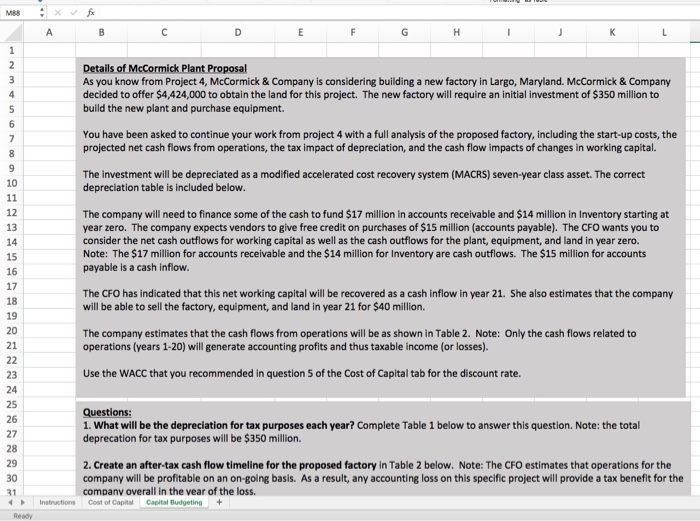

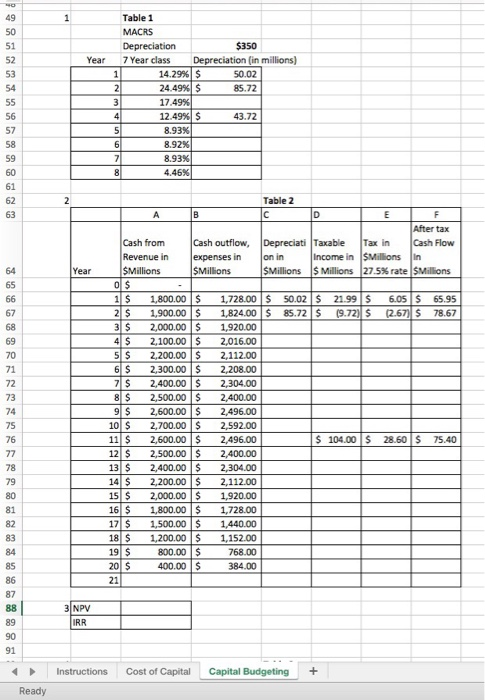

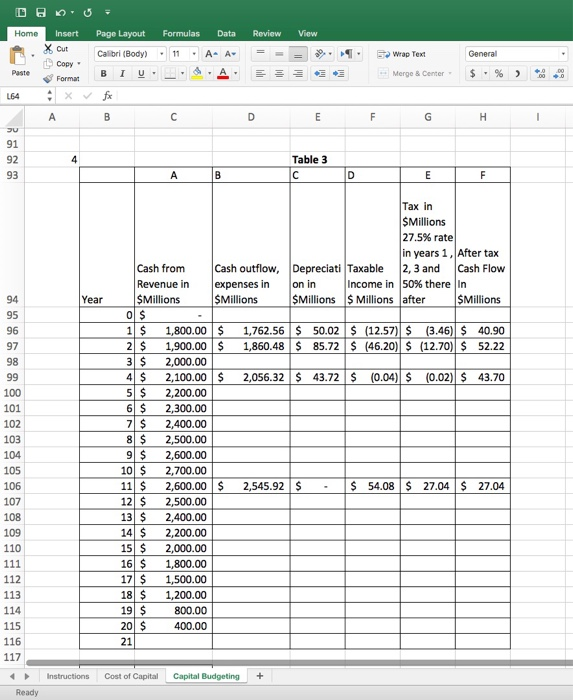

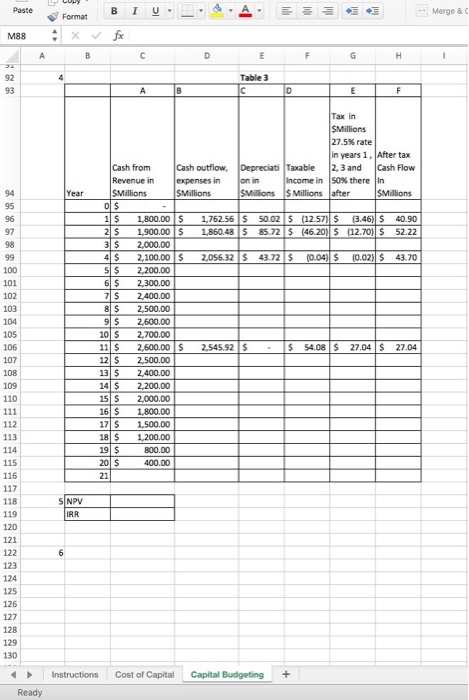

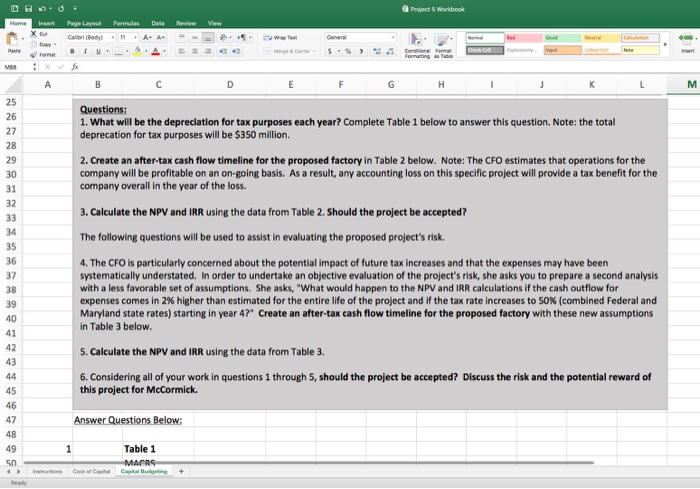

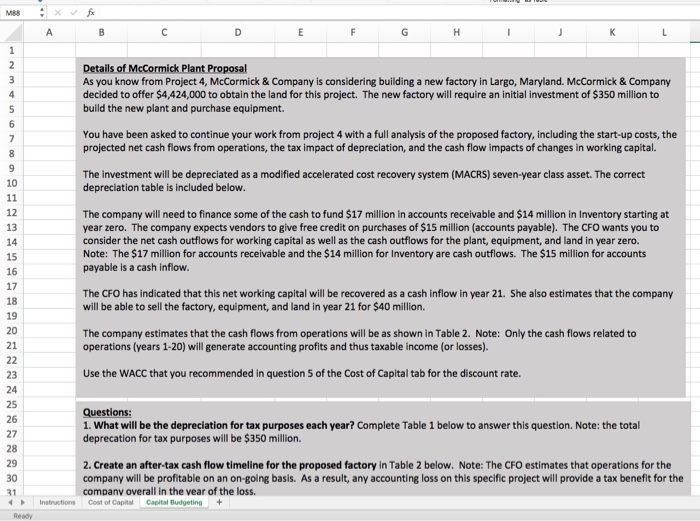

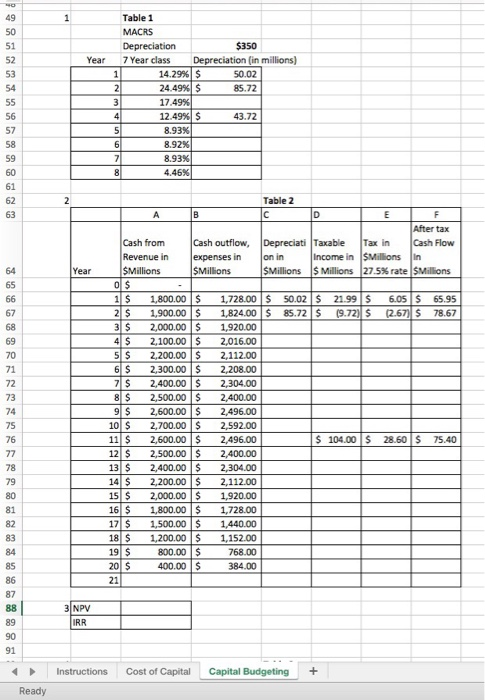

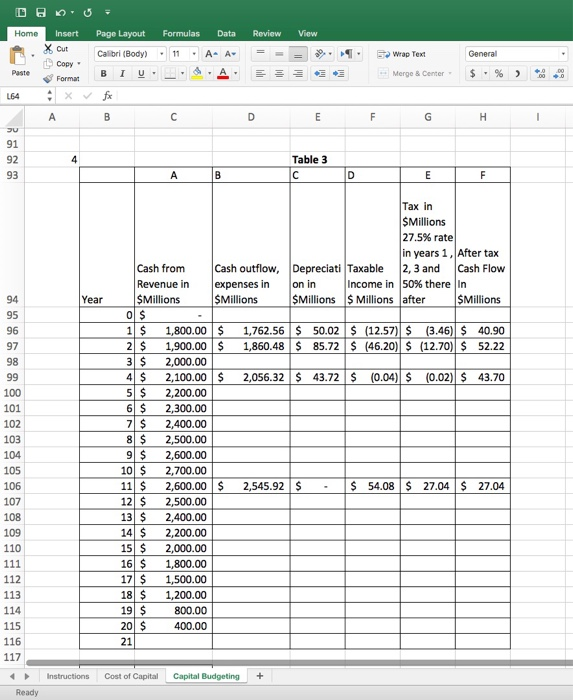

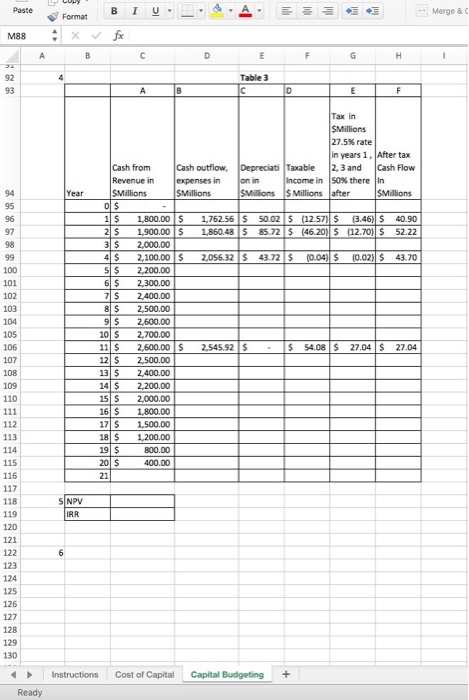

Projects Workbook Home Page Layout Formulas Data Review View Out Gary Ger > We area Dhe Con Format Formating sa Fort X A B E H K M 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk. 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick. Answer Questions Below: 1 50 Table 1 MARS Capital Buleting Costel + dy M A B D E F H K L 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment. You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included below. The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment, and land in year zero. Note: The $17 million for accounts receivable and the $14 million for Inventory are cash outflows. The $15 million for accounts payable is a cash inflow. The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million. The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Use the WACC that you recommended in question 5 of the Cost of Capital tab for the discount rate. Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million. 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the vear of the loss. Instructions Cost of Capital Capital Budgeting + 0 49 1 50 51 52 53 54 Year Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 50.02 2 24.49% $ 85.72 3 17.49% 4 12.49% $ 43.72 5 8.93% 6 8.92% 7 8.93% 8 4.46% 55 56 57 58 59 60 61 62 2 Year 64 65 66 67 68 69 70 71 72 Table 2 B D E F After tax Cash from Cash outflow, Depreciati Taxable Tax in Cash Flow Revenue in expenses in on in Income in Millions In SMillions SMillions $Millions $ Millions 27.5% rate SMillions ol $ 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05$ 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72$ (9.72) S (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 4 $ 2,100.00 $ 2,016.00 5 $ 2,200.00 $ 2,112.00 6 $ 2,300.00 $ 2,208.00 7 $ 2,400.00 $ 2,304.00 8 $ 2,500.00 2,400.00 9 $ 2,600.00 $ 2,496.00 10 $ 2,700.00 $ 2,592.00 11 S 2,600.00 $ 2,496.00 $ 104.00 $ 28.60 $ 75.40 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 14 $ 2,200.00 $ 2,112.00 15$ 2,000.00 $ 1,920.00 16 $ 1,800.00 $ 1,728.00 17$ 1,500.00 $ 1,440.00 18$ 1,200.00 $ 1,152.00 19 $ 800.00 $ 768.00 20 S 400.00 $ 384.00 21 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 3 NPV IRR Instructions Cost of Capital Capital Budgeting + Ready DBOU Home Insert Page Layout Formulas Data Review View Calibri (Body) A- A = Wrap Text General Paste Copy * Format B I Merge & Center $ - % 2 0 00 0 L64 A B c D E F G H - JU 91 92 93 4 Table 3 C B D E F Year 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 Tax in $Millions 27.5% rate in years 1, After tax Cash from Cash outflow, Depreciati Taxable 2, 3 and Cash Flow Revenue in expenses in on in Income in 50% there in $Millions $Millions $Millions $ Millions after SMillions 0 $ 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) $ (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 S (46.20) S (12.70) $ 52.22 3 $ 2,000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 5 $ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 11 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 12 $ 2,500.00 13 $ 2,400.00 141 $ 2,200.00 15 $ 2,000.00 16 $ 1,800.00 17 $ 1,500.00 18 $ 1,200.00 19 $ 800.00 20 $ 400.00 21 111 112 113 114 115 116 117 Instructions Cost of Capital Capital Budgeting + Ready Paste U === Merge & Format M88 fx B D E F G H 4 92 93 Table 3 c A B D E F Year 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 Tax in SMillions 27.5% rate in years 1. After tax Cash from Cash outflow, Depreciati Taxable 2.3 and Cash Flow Revenue in expenses in on in Income in 50% there in SMillions SMillions SMillions $ Millions after SMillions 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) S (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 S (46.20) S (12.70) $ 52.22 3 $ 2.000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 S (0.04) (0.02) S 43.70 5$ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2.500.00 9 $ 2,600.00 10 S 2,700.00 111 $ 2,600.00 $ 2.545.92 $ $ 54.08 $ 27.04 $ 27.04 12 $ 2,500.00 13 $ 2,400.00 14 $ 2,200.00 15 S 2,000.00 16 $ 1,800.00 17 $ 1,500.00 $ 1,200.00 19 $ 800.00 20 $ 400.00 21 110 111 112 113 114 115 116 117 118 119 120 SNPV IRR 121 6 122 123 124 125 126 127 128 129 130 Instructions Cost of Capital Capital Budgeting Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started