Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please calculate : conversion price,conversion ratio,conversion value and conversion premium ( in percentage ) . thank you a) Franky's board of management agreed to issue

please calculate : conversion price,conversion ratio,conversion value and conversion premium ( in percentage ) .

thank you

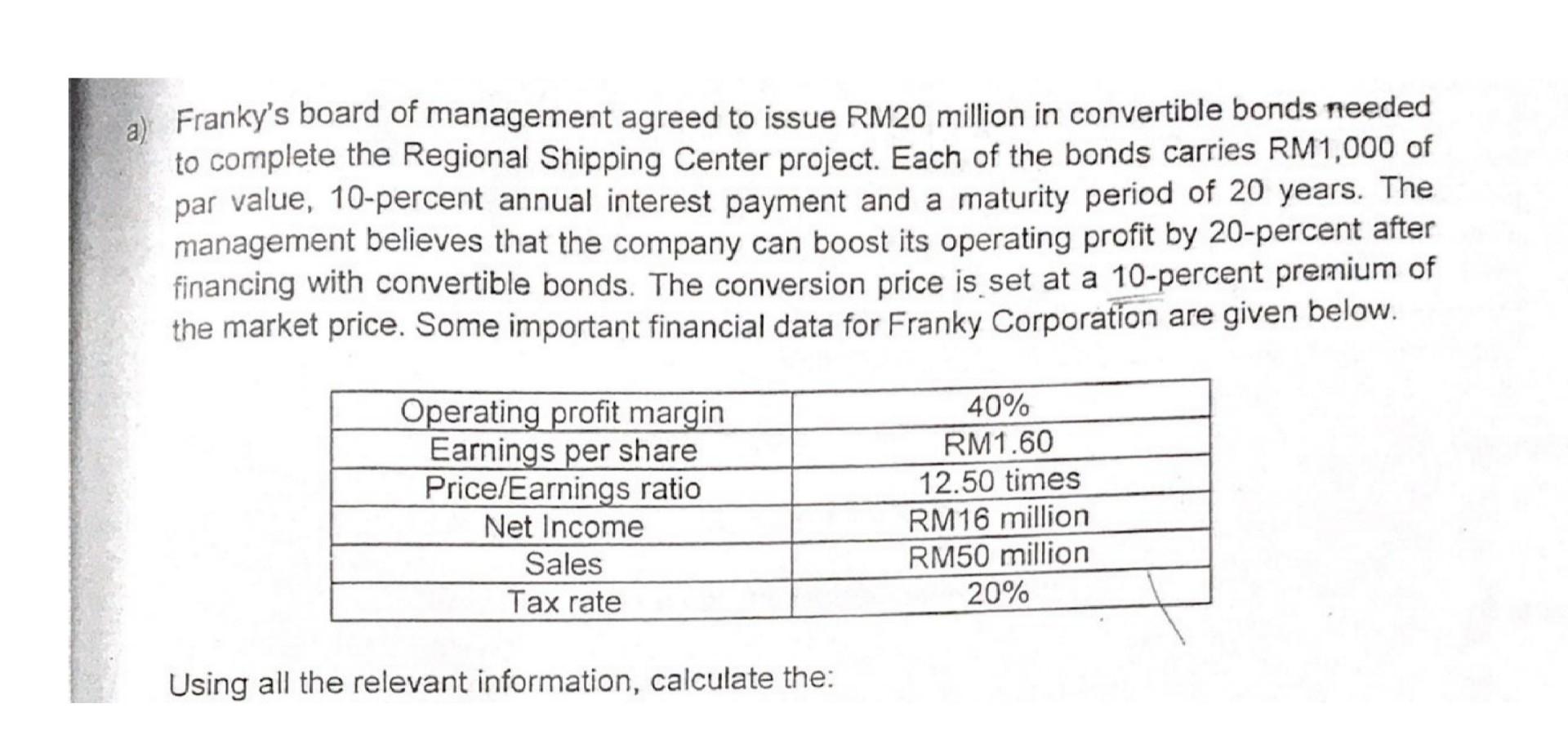

a) Franky's board of management agreed to issue RM20 million in convertible bonds needed to complete the Regional Shipping Center project. Each of the bonds carries RM1,000 of par value, 10-percent annual interest payment and a maturity period of 20 years. The management believes that the company can boost its operating profit by 20-percent after financing with convertible bonds. The conversion price is set at a 10-percent premium of the market price. Some important financial data for Franky Corporation are given below. Operating profit margin Earnings per share Price/Earnings ratio Net Income Sales Tax rate 40% RM1.60 12.50 times RM16 million RM50 million 20% Using all the relevant information, calculate theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started