Question

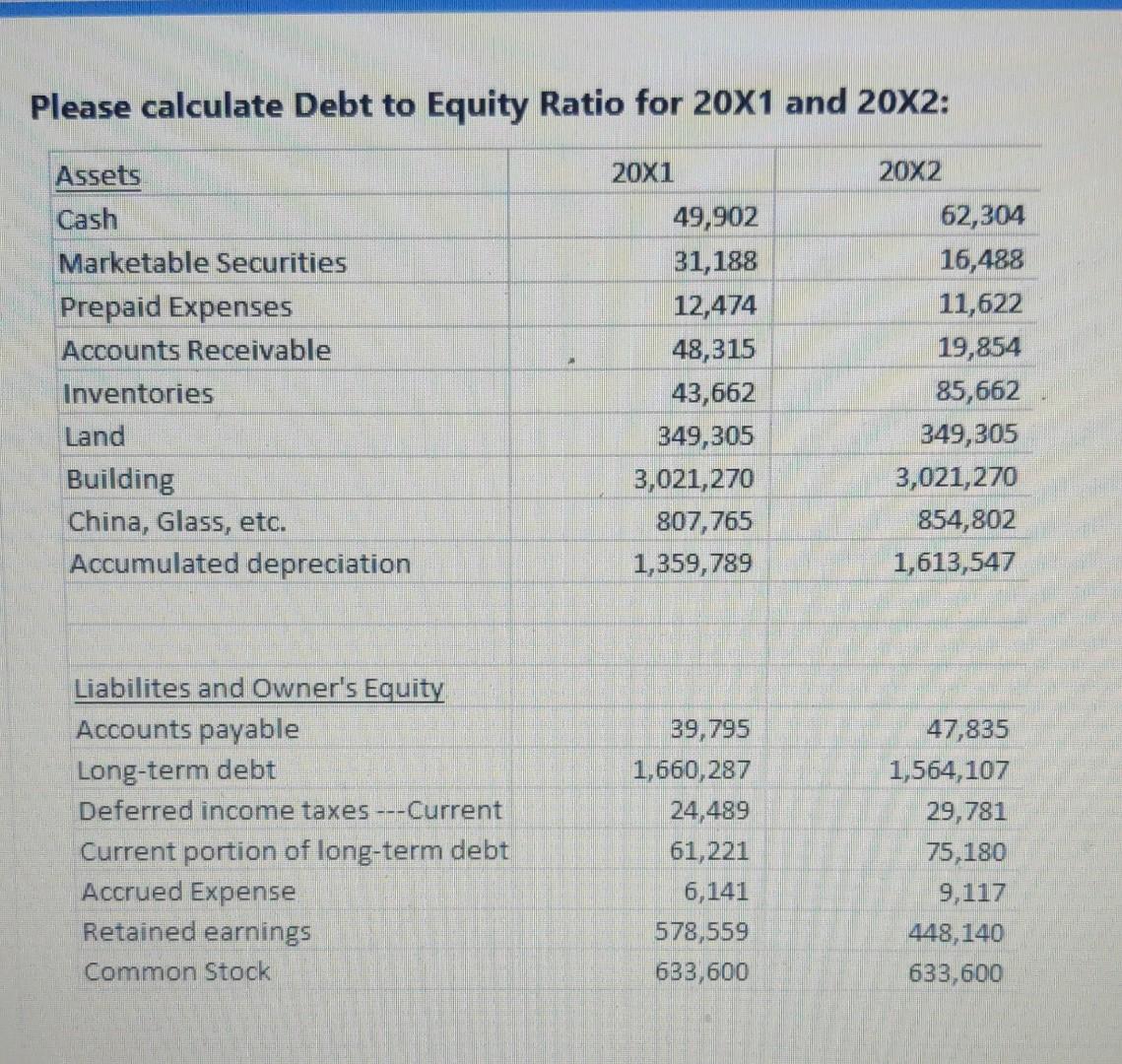

Please calculate Debt to Equity Ratio for 20X1 and 20X2: Assets 20X1 20X2 Cash 49,902 62,304 Marketable Securities 31,188 16,488 Prepaid Expenses 12,474 11,622

Please calculate Debt to Equity Ratio for 20X1 and 20X2: Assets 20X1 20X2 Cash 49,902 62,304 Marketable Securities 31,188 16,488 Prepaid Expenses 12,474 11,622 Accounts Receivable 48,315 19,854 85,662 43,662 349,305 3,021,270 Inventories Land 349,305 Building China, Glass, etc. Accumulated depreciation 3,021,270 807,765 854,802 1,359,789 1,613,547 Liabilites and Owner's Equity Accounts payable 39,795 47,835 Long-term debt Deferred income taxes ---Current 1,660,287 24,489 1,564,107 29,781 Current portion of long-term debt Accrued Expense Retained earnings 61,221 75,180 6,141 9,117 578,559 448,140 Common Stock 633,600 633,600

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Debt to Equity Ratio Hence Debtequity ratio 20X1 283 20X2 272 Total long te...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Construction accounting and financial management

Authors: Steven j. Peterson

2nd Edition

135017114, 978-0135017111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App