Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please calculate impairment using all 5 issues Solar Plc is a company which develops and manufactures electronic measuring equipment - Frequency counters. Solar Plc prepares

please calculate impairment using all 5 issues

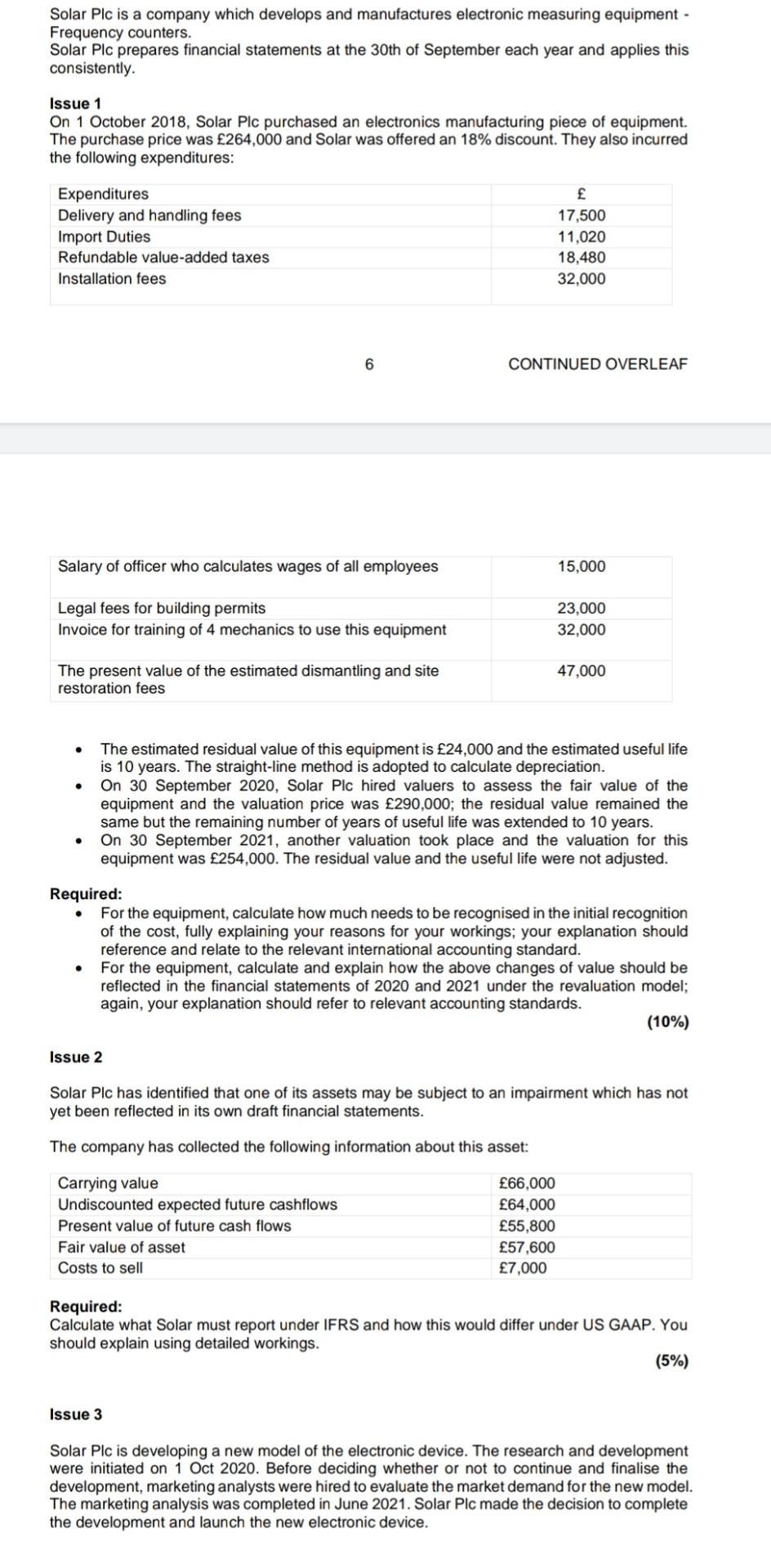

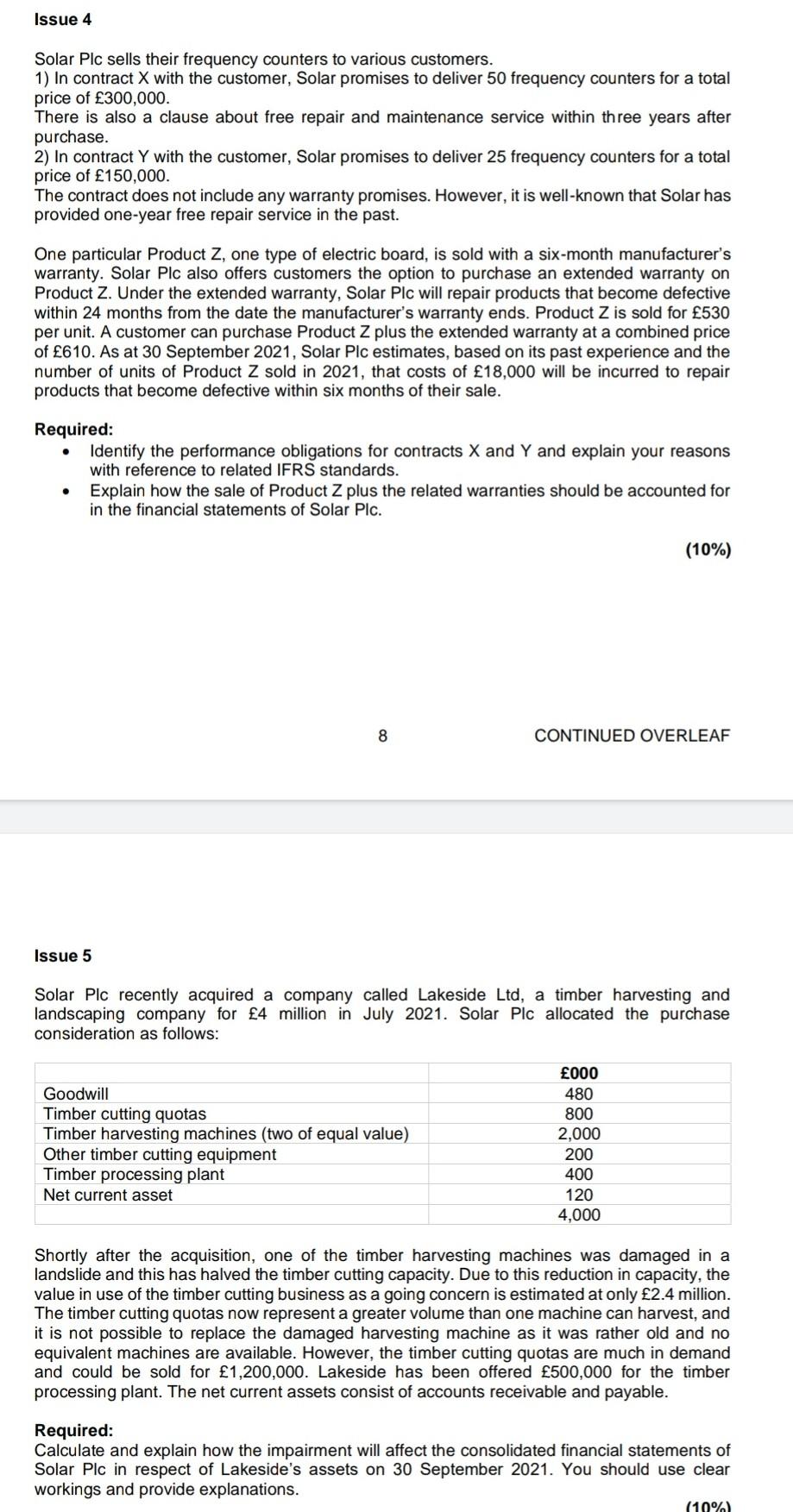

Solar Plc is a company which develops and manufactures electronic measuring equipment - Frequency counters. Solar Plc prepares financial statements at the 30th of September each year and applies this consistently. Issue 1 On 1 October 2018, Solar Plc purchased an electronics manufacturing piece of equipment. The purchase price was 264,000 and Solar was offered an 18% discount. They also incurred the following expenditures: Expenditures Delivery and handling fees Import Duties Refundable value-added taxes Installation fees 17,500 11,020 18,480 32,000 6 CONTINUED OVERLEAF Salary of officer who calculates wages of all employees 15,000 Legal fees for building permits Invoice for training of 4 mechanics to use this equipment 23,000 32,000 47,000 The present value of the estimated dismantling and site restoration fees The estimated residual value of this equipment is 24,000 and the estimated useful life is 10 years. The straight-line method is adopted to calculate depreciation. On 30 September 2020, Solar Plc hired valuers to assess the fair value of the equipment and the valuation price was 290,000; the residual value remained the same but the remaining number of years of useful life was extended to 10 years. On 30 September 2021, another valuation took place and the valuation for this equipment was 254,000. The residual value and the useful life were not adjusted. Required: For the equipment, calculate how much needs to be recognised in the initial recognition of the cost, fully explaining your reasons for your workings; your explanation should reference and relate to the relevant international accounting standard. For the equipment, calculate and explain how the above changes of value should be reflected in the financial statements of 2020 and 2021 under the revaluation model; again, your explanation should refer to relevant accounting standards. (10%) Issue 2 Solar Plc has identified that one of its assets may be subject to an impairment which has not yet been reflected in its own draft financial statements. The company has collected the following information about this asset: Carrying value Undiscounted expected future cashflows Present value of future cash flows Fair value of asset Costs to sell 66,000 64,000 55,800 57,600 7,000 Required: Calculate what Solar must report under IFRS and how this would differ under US GAAP. You should explain using detailed workings. (5%) Issue 3 Solar Plc is developing a new model of the electronic device. The research and development were initiated on 1 Oct 2020. Before deciding whether or not to continue and finalise the development, marketing analysts were hired to evaluate the market demand for the new model. The marketing analysis was completed in June 2021. Solar Plc made the decision to complete the development and launch the new electronic device. Issue 4 Solar Plc sells their frequency counters to various customers. 1) In contract X with the customer, Solar promises to deliver 50 frequency counters for a total price of 300,000. There is also a clause about free repair and maintenance service within three years after purchase. 2) In contract Y with the customer, Solar promises to deliver 25 frequency counters for a total price of 150,000. The contract does not include any warranty promises. However, it is well-known that Solar has provided one-year free repair service in the past. One particular Product Z, one type of electric board, is sold with a six-month manufacturer's warranty. Solar Plc also offers customers the option to purchase an extended warranty on Product Z. Under the extended warranty, Solar Plc will repair products that become defective within 24 months from the date the manufacturer's warranty ends. Product Z is sold for 530 per unit. A customer can purchase Product Z plus the extended warranty at a combined price of 610. As at 30 September 2021, Solar Plc estimates, based on its past experience and the number of units of Product Z sold in 2021, that costs of 18,000 will be incurred to repair products that become defective within six months of their sale. . Required: Identify the performance obligations for contracts X and Y and explain your reasons with reference to related IFRS standards. Explain how the sale of Product Z plus the related warranties should be accounted for in the financial statements of Solar Plc. (10%) 8 CONTINUED OVERLEAF Issue 5 Solar Plc recently acquired a company called Lakeside Ltd, a timber harvesting and landscaping company for 4 million in July 2021. Solar Plc allocated the purchase consideration as follows: Goodwill Timber cutting quotas Timber harvesting machines (two of equal value) Other timber cutting equipment Timber processing plant Net current asset 000 480 800 2,000 200 400 120 4,000 Shortly after the acquisition, one of the timber harvesting machines was damaged in a landslide and this has halved the timber cutting capacity. Due to this reduction in capacity, the value in use of the timber cutting business as a going concern is estimated at only 2.4 million. The timber cutting quotas now represent a greater volume than one machine can harvest, and it is not possible to replace the damaged harvesting machine as it was rather old and no equivalent machines are available. However, the timber cutting quotas are much in demand and could be sold for 1,200,000. Lakeside has been offered 500,000 for the timber processing plant. The net current assets consist of accounts receivable and payable. Required: Calculate and explain how the impairment will affect the consolidated financial statements of Solar Plc in respect of Lakeside's assets on 30 September 2021. You should use clear workings and provide explanations. (10%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started