Answered step by step

Verified Expert Solution

Question

1 Approved Answer

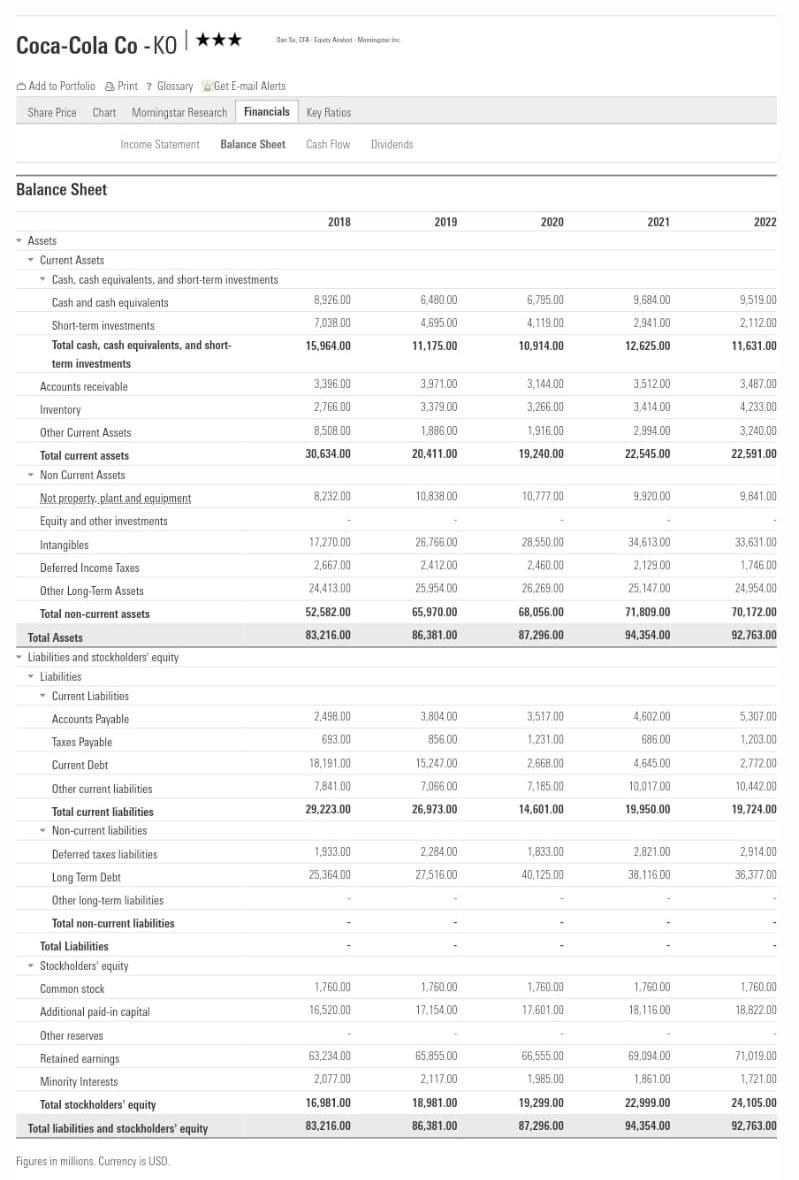

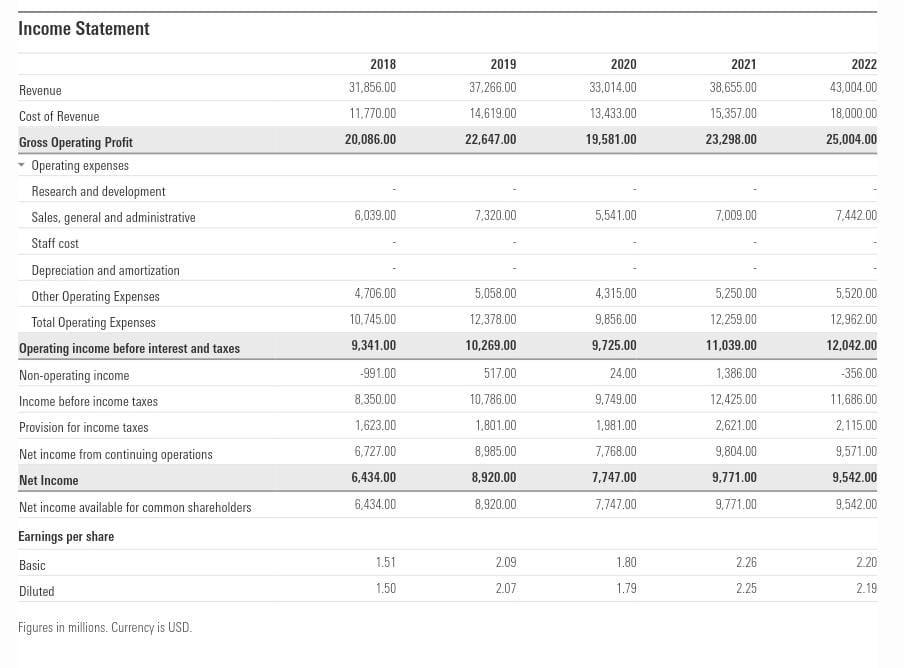

please calculate the finance statements depending on the questions in the last photo Add to Partolio ge Print ? Glossary LGet E-mail Alerts begin{tabular}{|c|c|c|c|c|c|c|c|c|} hline

please calculate the finance statements depending on the questions in the last photo

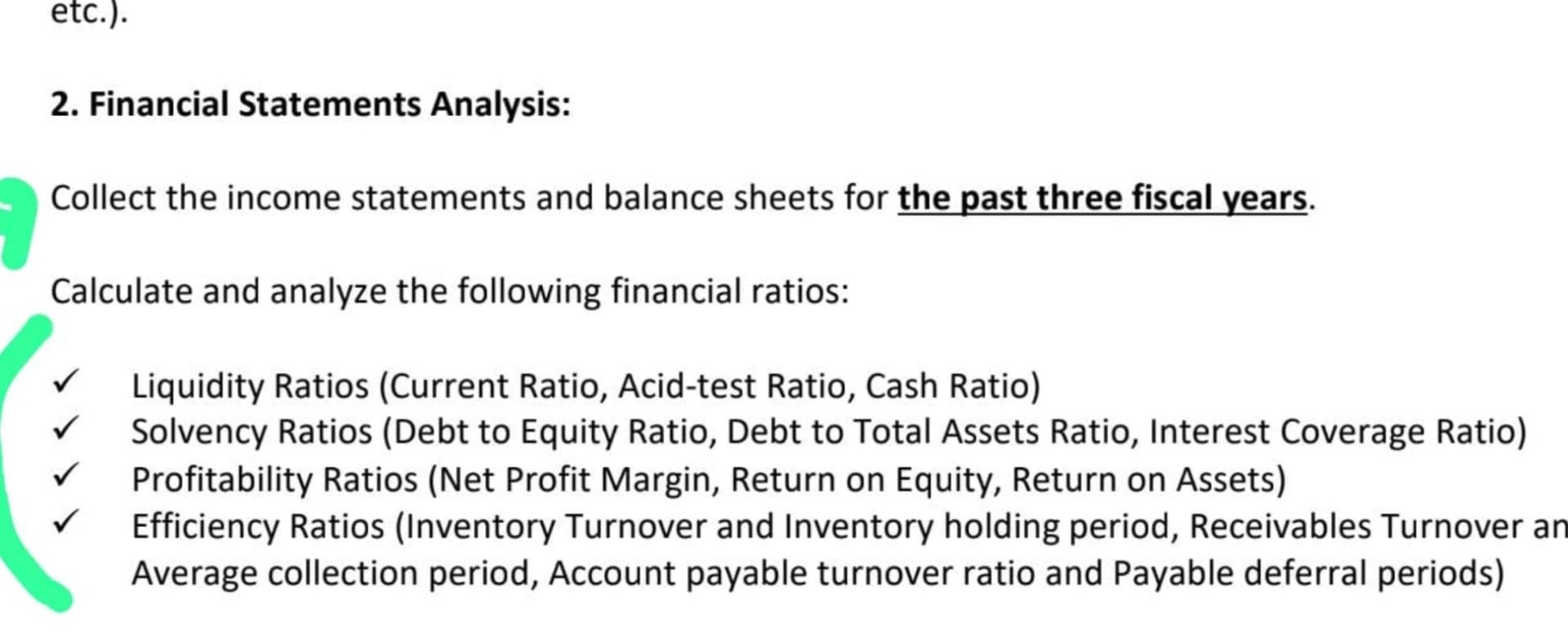

Add to Partolio ge Print ? Glossary LGet E-mail Alerts \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{ Share Price } & Chart & Morningstar Research & Financials & \multicolumn{5}{|l|}{ Key Ratios } \\ \hline & & Intome Statement & Balance Sheet & Cash Flow & Dividends & & & \\ \hline \multicolumn{9}{|c|}{ Balance Sheet } \\ \hline & & & & 2018 & 2019 & 2020 & 2021 & 2022 \\ \hline \end{tabular} - Assets - Curnent Assets - Cash, cash equivalents, and short-term investments \begin{tabular}{|c|c|c|c|c|c|} \hline Cash and cash equivalents & 8,926.00 & 6,480.00 & 6,795.00 & 9,684.00 & 9,519.00 \\ \hline Shart-term investments & 7,038.00 & 4,69500 & 4.118 .00 & 2,94100 & 2,11200 \\ \hline \begin{tabular}{l} Total cash, cash equivalents, and short- \\ tern investments \end{tabular} & 15,964.00 & 11,175.00 & 10,914.00 & 12,625.00 & 11,631.00 \\ \hline Accounts receivable & 3,396.00 & 3,971,00 & 3,144.00 & 3,51200 & 3,487,00 \\ \hline Inventory & 2,766.00 & 3,379,00 & 3,266.00 & 3,41400 & 4,233.00 \\ \hline Other Current Assets & 8,508.00 & 1,886,00 & 1,916.00 & 2,994.00 & 3,240.00 \\ \hline Total current assets & 30,634.00 & 20,411.00 & 19,240.00 & 22,545.00 & 22,591.00 \\ \hline \multicolumn{6}{|l|}{ - Non Currant Assets } \\ \hline Not property plant and equipment & 8,232.00 & 10.83800 & 10,777.00 & 9,92000 & 9,841.00 \\ \hline Equity and other investments & - & - & - & - & \\ \hline Intangibles & 17,27000 & 26.766 .00 & 28.550 .00 & 34,613,00 & 33,631,00 \\ \hline Deferred Income Taxes & 2,667,00 & 2,41200 & 2,460.00 & 2.12900 & 1,746.00 \\ \hline Other Long-Term Assets & 24,413.00 & 25,954.00 & 26.269 .00 & 25.147 .00 & 24,95400 \\ \hline Total non-current assets & 52,582.00 & 65,970.00 & 68,056.00 & 71,809.00 & 70,172.00 \\ \hline Total Assets & 83.216 .00 & 86,381.00 & 87.296 .00 & 94,354.00 & 92.763 .00 \\ \hline \multicolumn{6}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{6}{|l|}{ - Liabilities } \\ \hline \multicolumn{6}{|l|}{ - Current Liabilitios } \\ \hline Accounts Payable & 2,49800 & 3,30400 & 3,517,00 & 4,60200 & 5,307.00 \\ \hline Taxes Payable & 693.00 & 856.00 & 1,231.00 & 686.00 & 1.203 .00 \\ \hline Current Debt & 18,191.00 & 15.247 .00 & 2.66800 & 4,645.00 & 2.772 .00 \\ \hline Other current liabilities & 7,841,00 & 7,06600 & 7,185.00 & 10,017.00 & 10,44200 \\ \hline Total current fiabilities & 29.223 .00 & 26,973.00 & 14,601.00 & 19,950.00 & 19,724.00 \\ \hline \multicolumn{6}{|l|}{ - Non-current liabilities } \\ \hline Deferred taxes liabilities & 1,933.00 & 2,28400 & 1,833.00 & 2,821.00 & 2,914.00 \\ \hline Long Term Debt & 25,364.00 & 27,516,00 & 40,125.00 & 38,11600 & 36,377.00 \\ \hline Other long-term liabilities & & & - & & = \\ \hline Total non-current liabilities & - & - & - & & - \\ \hline Total Liabilities & - & - & - & - & - \\ \hline \multicolumn{6}{|l|}{ - Stockholders' equity } \\ \hline Common stock & 1.760 .00 & 1.760 .00 & 1.760 .00 & 1.76000 & 1.760 .00 \\ \hline Additional paid-in capital & 16,520,00 & 17.154 .00 & 17.601 .00 & 18,11600 & 18,82200 \\ \hline Other reserves & & & * & & - \\ \hline Retained earnings & 63,234.00 & 65,85500 & 66,555.00 & 69,094.00 & 71,019.00 \\ \hline Minority Interests & 2,07700 & 2,11700 & 1,985.00 & 1,861.00 & 1,721.00 \\ \hline Total stockholders' equity & 16,981.00 & 18,981.00 & 19,299.00 & 22,999.00 & 24,105.00 \\ \hline Total liabilities and stockholders' equity & 83,216.00 & 86,381.00 & 87,296.00 & 94,354.00 & 92,763.00 \\ \hline \end{tabular} Figures in millions. Curtency is USD. Income Statement \begin{tabular}{|c|c|c|c|c|c|} \hline & 2018 & 2019 & 2020 & 2021 & 2022 \\ \hline Revenue & 31,856.00 & 37,266.00 & 33,014.00 & 38,655.00 & 43,004.00 \\ \hline Cost of Revenue & 11.770 .00 & 14,619.00 & 13,433.00 & 15,357.00 & 18,000.00 \\ \hline Gross Operating Profit & 20,086.00 & 22,647.00 & 19,581.00 & 23,298.00 & 25,004.00 \\ \hline \multicolumn{6}{|l|}{ Operating expenses } \\ \hline Research and development & - & & - & - & - \\ \hline Sales, general and administrative & 6,039.00 & 7.320 .00 & 5,541.00 & 7.009 .00 & 7,442.00 \\ \hline Staff cost & - & - & - & - & - \\ \hline Depreciation and amortization & - & - & - & - & - \\ \hline Other Operating Expenses & 4.706 .00 & 5,058.00 & 4,315.00 & 5,250.00 & 5,520.00 \\ \hline Total Operating Expenses: & 10,745.00 & 12,378.00 & 9,856.00 & 12,259.00 & 12,962.00 \\ \hline Operating income before interest and taxes & 9,341.00 & 10,269.00 & 9,725.00 & 11,039.00 & 12,042.00 \\ \hline Non-operating income & -991.00 & 517.00 & 24.00 & 1,386.00 & -356.00 \\ \hline Income before income taxes & 8.350 .00 & 10,786.00 & 9,749.00 & 12,425.00 & 11,686.00 \\ \hline Provision for income taxes: & 1,623.00 & 1.801 .00 & 1,981.00 & 2,621.00 & 2,115.00 \\ \hline Net income from continuing operations & 6,727.00 & 8,985.00 & 7,768.00 & 9,804.00 & 9,571.00 \\ \hline Net Income & 6,434.00 & 8,920.00 & 7,747.00 & 9,771.00 & 9,542.00 \\ \hline Net income available for common shareholders & 6,434.00 & 8,920.00 & 7.747 .00 & 9.771 .00 & 9,542.00 \\ \hline \multicolumn{6}{|l|}{ Earnings per share } \\ \hline Basic & 1.51 & 209 & 1.80 & 2.26 & 2.20 \\ \hline Diluted & 1.50 & 2.07 & 1.79 & 2.25 & 2.19 \\ \hline \end{tabular} Figures in millions. Currency is USD. 2. Financial Statements Analysis: Collect the income statements and balance sheets for the past three fiscal years. Calculate and analyze the following financial ratios: Liquidity Ratios (Current Ratio, Acid-test Ratio, Cash Ratio) Solvency Ratios (Debt to Equity Ratio, Debt to Total Assets Ratio, Interest Coverage Ratio) Profitability Ratios (Net Profit Margin, Return on Equity, Return on Assets) Efficiency Ratios (Inventory Turnover and Inventory holding period, Receivables Turnover ar Average collection period, Account payable turnover ratio and Payable deferral periods)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started