Answered step by step

Verified Expert Solution

Question

1 Approved Answer

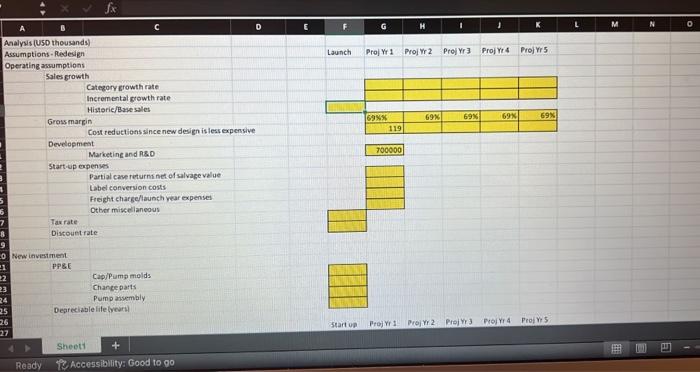

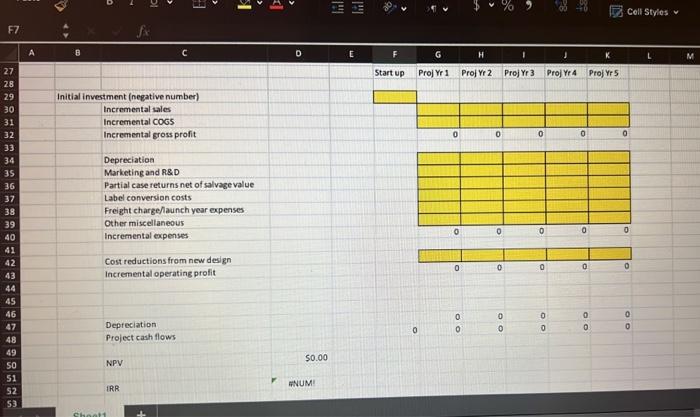

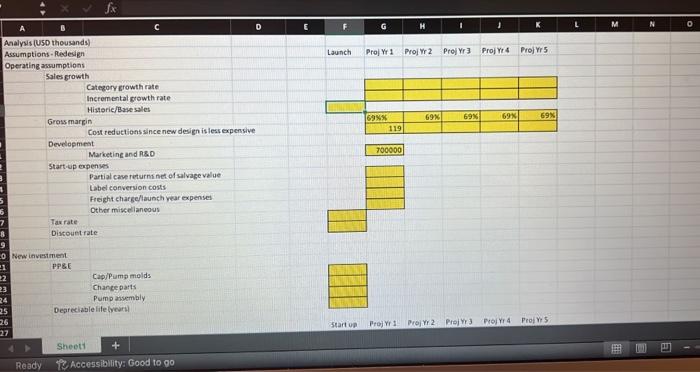

Please calculate the NPV and IRR given the information in the case study. New inwestment ppge Capilpuma molds Chanceparts Pump assembly Deareciablelite(yeuri) Ready R Accessibility

Please calculate the NPV and IRR given the information in the case study.

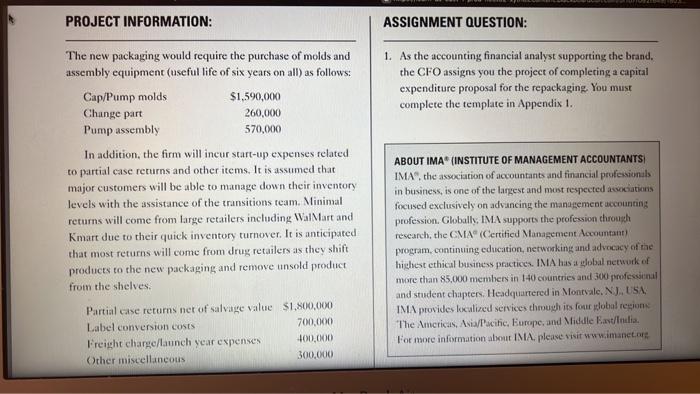

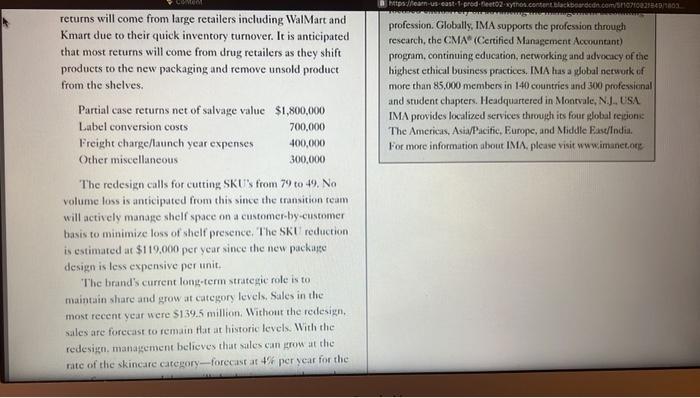

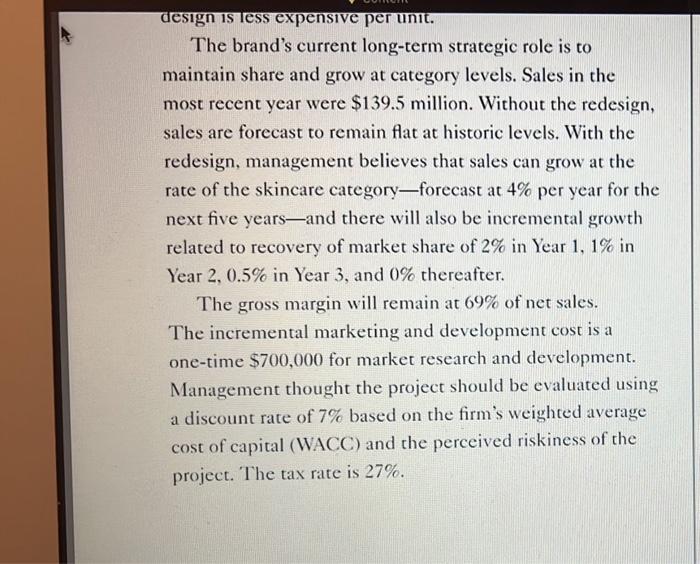

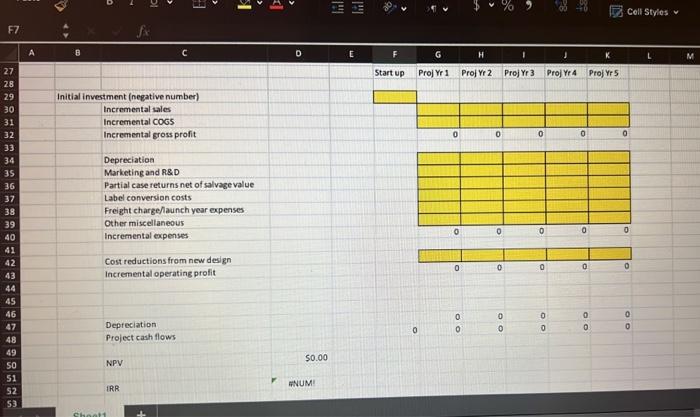

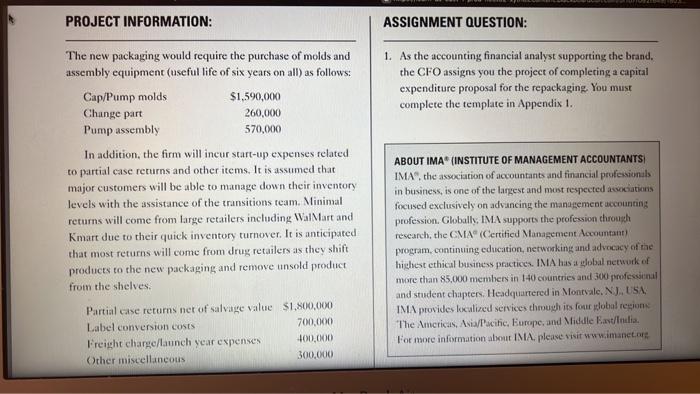

New inwestment ppge Capilpuma molds Chanceparts Pump assembly Deareciablelite(yeuri) Ready R Accessibility Good to 00 0 Incremental expenses Cost reductions from new design Incremental operating profit Depreciation Project cash flows NPV \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & 0 & & & \\ \hline 0 & 0 & 0 & 0 \\ \hline \end{tabular} IRR 50.00 mNUM! * PROJECT INFORMATION: The redesign calls for cutting SKU's from 79 to 49 . No volume loss is anticipated from this since the transition team will actively manage shelf space on a customer-by-eustomer basis to minimize loss of shelf presence. The SKL reduction is estimated at $119.000 per year since the new package design is less expensive per unit. The brand's current long-term strategie role is to maintain share and grow at category levels, Sales in the most recent year were \$139.5 million. Without the redesign. sales are forectist to remain flat at historic levels. With the redesign. management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the The brand's current long-term strategic role is to maintain share and grow at category levels. Sales in the most recent year were $139.5 million. Without the redesign, sales are forecast to remain flat at historic levels. With the redesign, management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the next five years-and there will also be incremental growth related to recovery of market share of 2% in Year 1,1% in Year 2, 0.5% in Year 3 , and 0% thereafter. The gross margin will remain at 69% of net sales. The incremental marketing and development cost is a one-time $700,000 for market research and development. Management thought the project should be evaluated using a discount rate of 7% based on the firm's weighted average cost of capital (WACC) and the perceived riskiness of the project. The tax rate is 27%. New inwestment ppge Capilpuma molds Chanceparts Pump assembly Deareciablelite(yeuri) Ready R Accessibility Good to 00 0 Incremental expenses Cost reductions from new design Incremental operating profit Depreciation Project cash flows NPV \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & 0 & & & \\ \hline 0 & 0 & 0 & 0 \\ \hline \end{tabular} IRR 50.00 mNUM! * PROJECT INFORMATION: The redesign calls for cutting SKU's from 79 to 49 . No volume loss is anticipated from this since the transition team will actively manage shelf space on a customer-by-eustomer basis to minimize loss of shelf presence. The SKL reduction is estimated at $119.000 per year since the new package design is less expensive per unit. The brand's current long-term strategie role is to maintain share and grow at category levels, Sales in the most recent year were \$139.5 million. Without the redesign. sales are forectist to remain flat at historic levels. With the redesign. management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the The brand's current long-term strategic role is to maintain share and grow at category levels. Sales in the most recent year were $139.5 million. Without the redesign, sales are forecast to remain flat at historic levels. With the redesign, management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the next five years-and there will also be incremental growth related to recovery of market share of 2% in Year 1,1% in Year 2, 0.5% in Year 3 , and 0% thereafter. The gross margin will remain at 69% of net sales. The incremental marketing and development cost is a one-time $700,000 for market research and development. Management thought the project should be evaluated using a discount rate of 7% based on the firm's weighted average cost of capital (WACC) and the perceived riskiness of the project. The tax rate is 27%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started