Please calculate the value you'd be willing to pay today by using the table at the bottom

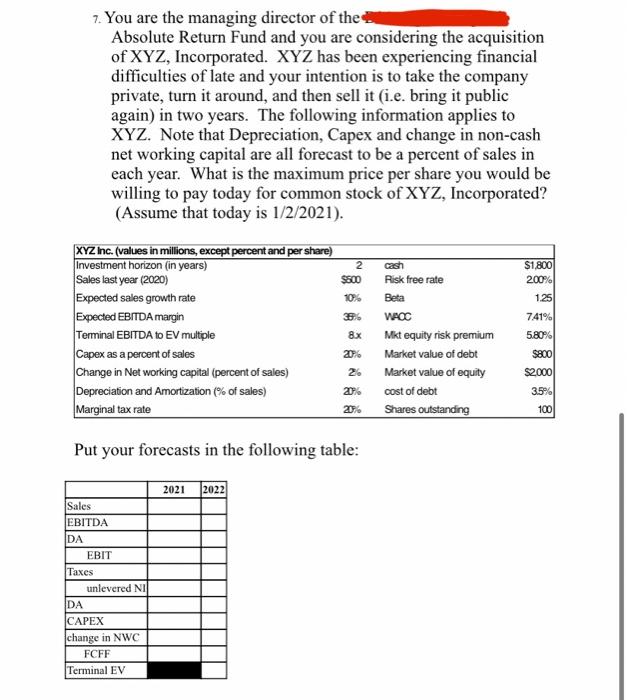

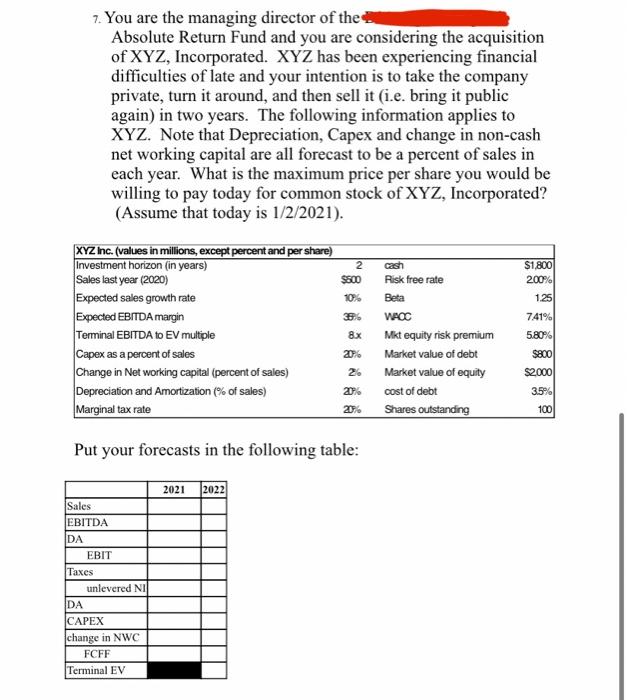

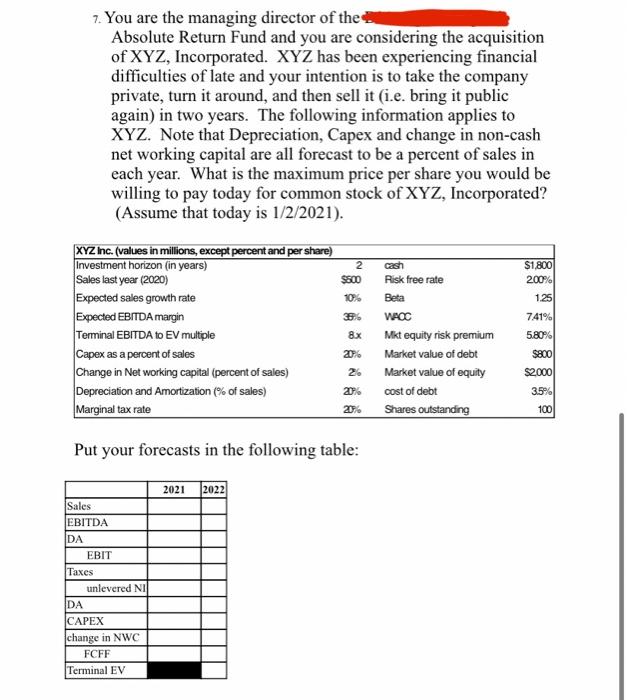

7. You are the managing director of the Absolute Return Fund and you are considering the acquisition of XYZ, Incorporated. XYZ has been experiencing financial difficulties of late and your intention is to take the company private, turn it around, and then sell it (i.e. bring it public again) in two years. The following information applies to XYZ. Note that Depreciation, Capex and change in non-cash net working capital are all forecast to be a percent of sales in each year. What is the maximum price per share you would be willing to pay today for common stock of XYZ, Incorporated? (Assume that today is 1/2/2021). 2 $1,800 200% 1.25 Beta XYZ Inc. (values in millions, except percent and per share) Investment horizon (in years) cash Sales last year (2020) $800 Risk free rate Expected sales growth rate 10% Expected EBITDA margin WPOC Terminal EBITDA to EV multiple Mkt equity risk premium Capex as a percent of sales Market value of debt Change in Net working capital (percent of sales) Market value of equity Depreciation and Amortization (% of sales) 20% cost of debt Marginal tax rate 2% Shares outstanding 8.x 741% 5.80% $800 52000 3.5% 100 26 Put your forecasts in the following table: 2021 2022 Sales EBITDA DA EBIT Taxes unlevered NI DA CAPEX change in NWC FCFF Terminal EV 7. You are the managing director of the Absolute Return Fund and you are considering the acquisition of XYZ, Incorporated. XYZ has been experiencing financial difficulties of late and your intention is to take the company private, turn it around, and then sell it (i.e. bring it public again) in two years. The following information applies to XYZ. Note that Depreciation, Capex and change in non-cash net working capital are all forecast to be a percent of sales in each year. What is the maximum price per share you would be willing to pay today for common stock of XYZ, Incorporated? (Assume that today is 1/2/2021). 2 $1,800 200% 1.25 Beta XYZ Inc. (values in millions, except percent and per share) Investment horizon (in years) cash Sales last year (2020) $800 Risk free rate Expected sales growth rate 10% Expected EBITDA margin WPOC Terminal EBITDA to EV multiple Mkt equity risk premium Capex as a percent of sales Market value of debt Change in Net working capital (percent of sales) Market value of equity Depreciation and Amortization (% of sales) 20% cost of debt Marginal tax rate 2% Shares outstanding 8.x 741% 5.80% $800 52000 3.5% 100 26 Put your forecasts in the following table: 2021 2022 Sales EBITDA DA EBIT Taxes unlevered NI DA CAPEX change in NWC FCFF Terminal EV