Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please calculate with formulas and answer the questions below. what is not clear??? i took screen shots and its very clear on my end. i

please calculate with formulas and answer the questions below.

what is not clear??? i took screen shots and its very clear on my end. i already took a lot of pictures. which one exactly is not clear?

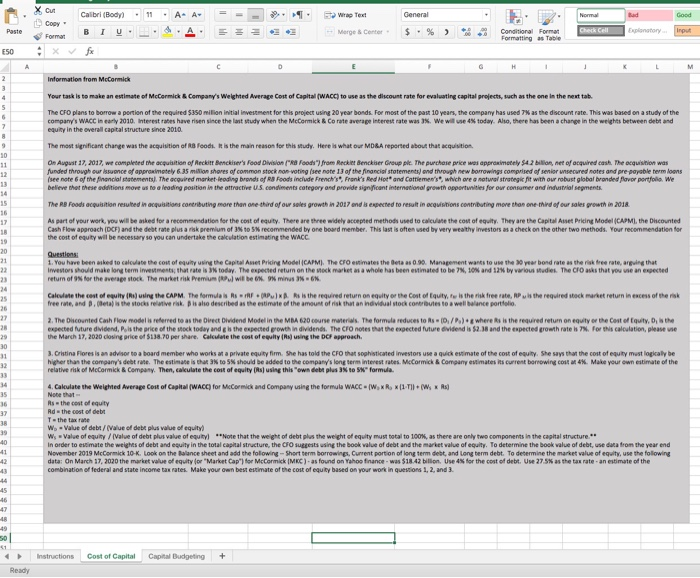

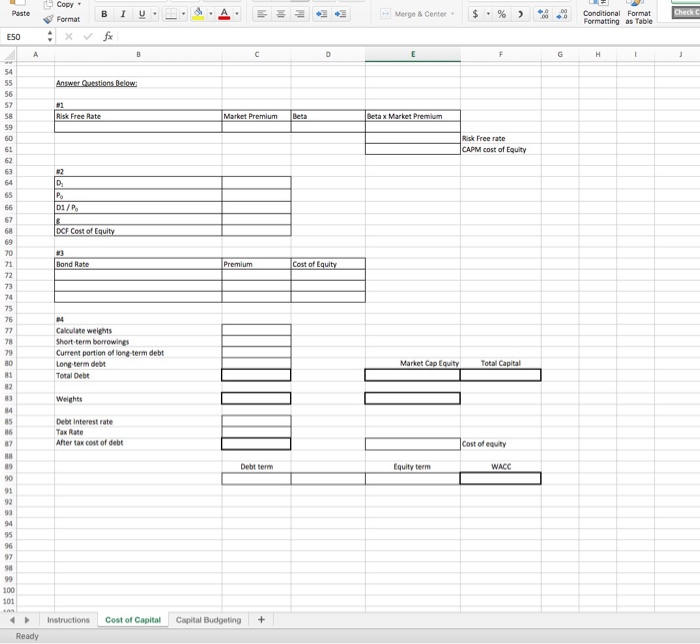

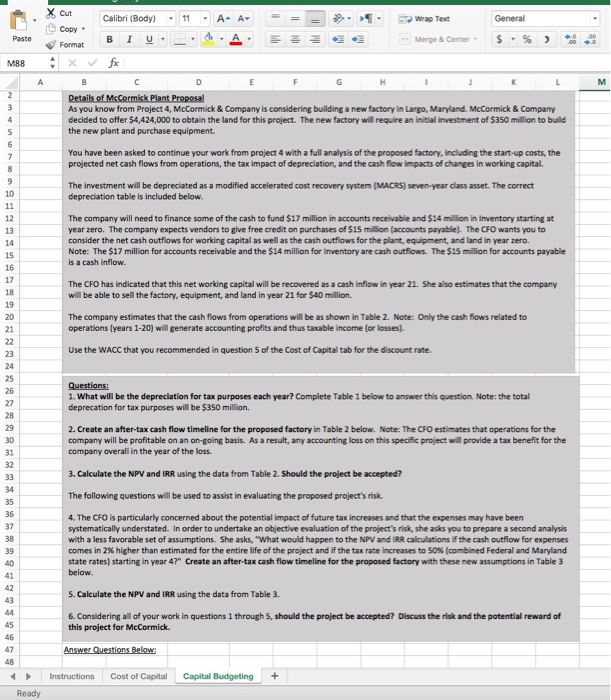

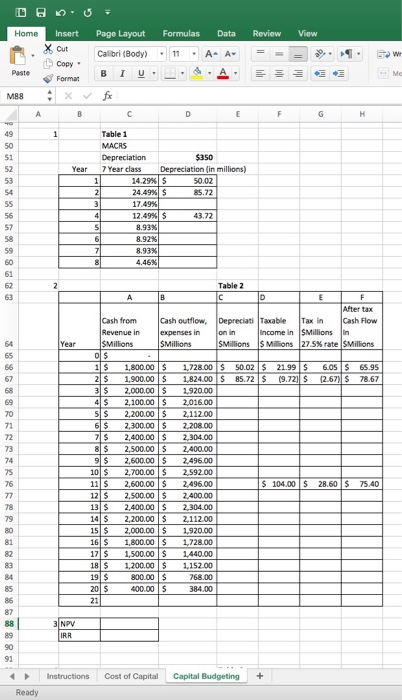

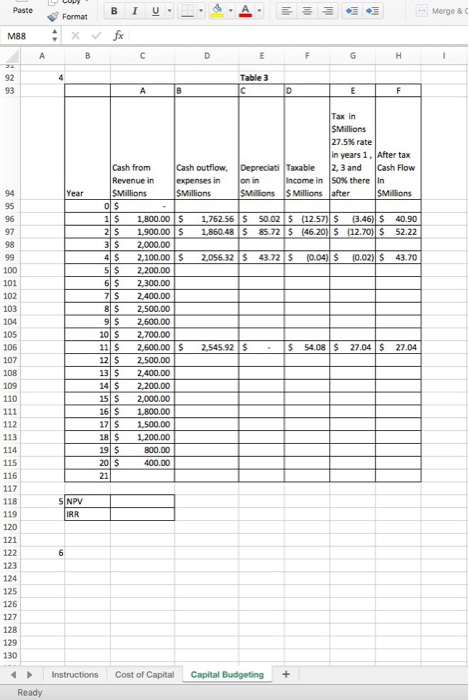

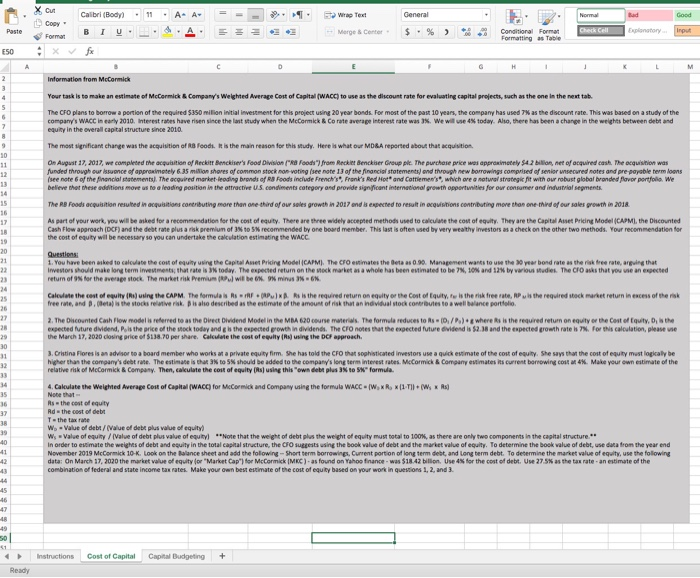

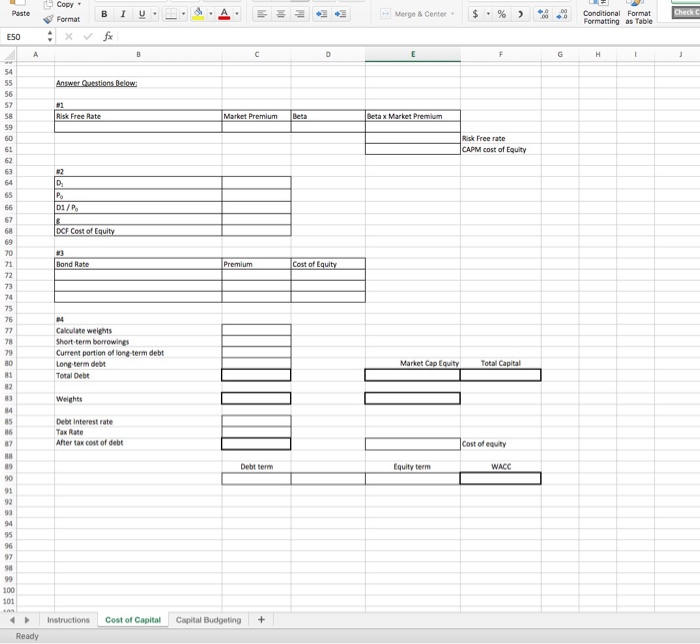

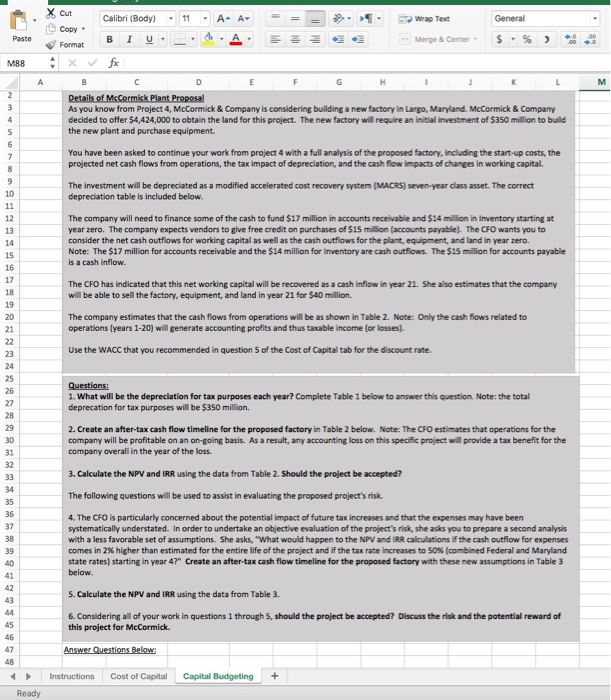

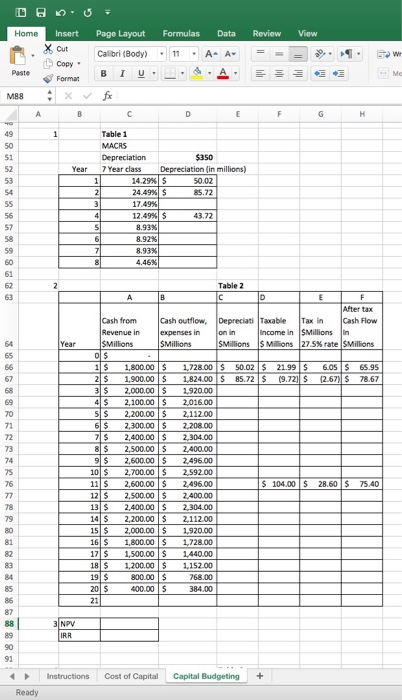

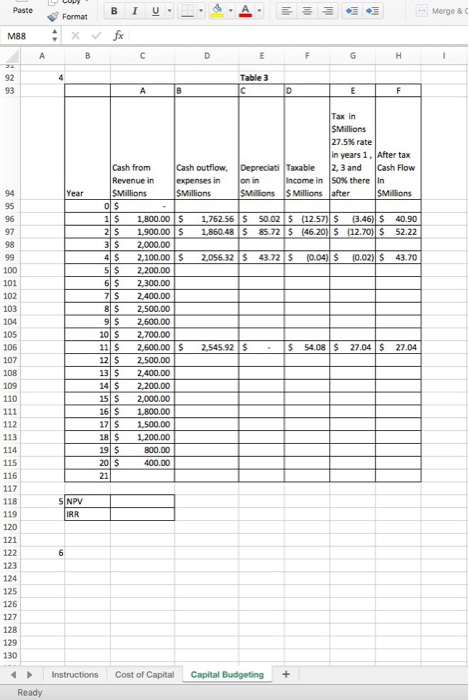

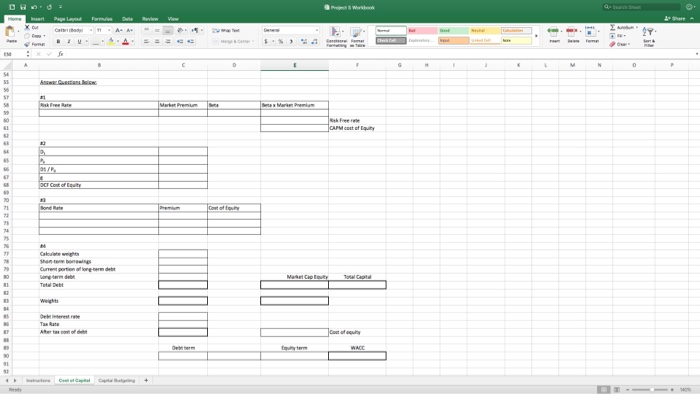

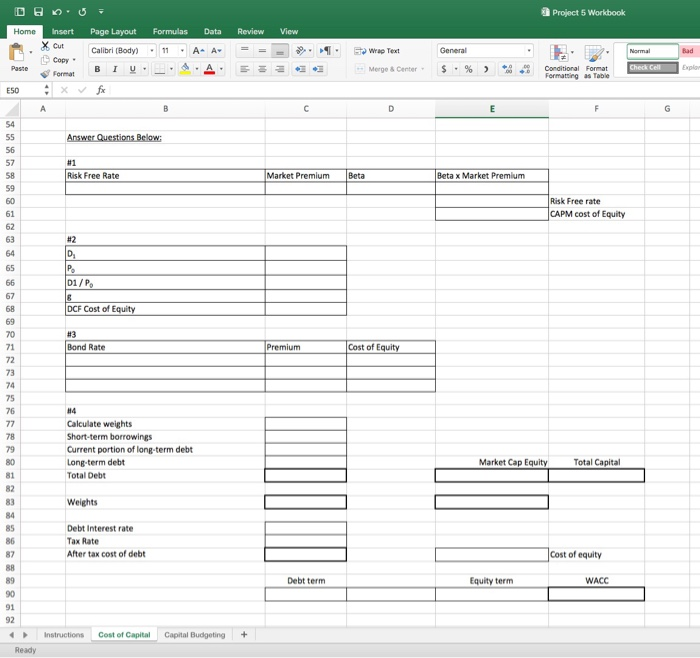

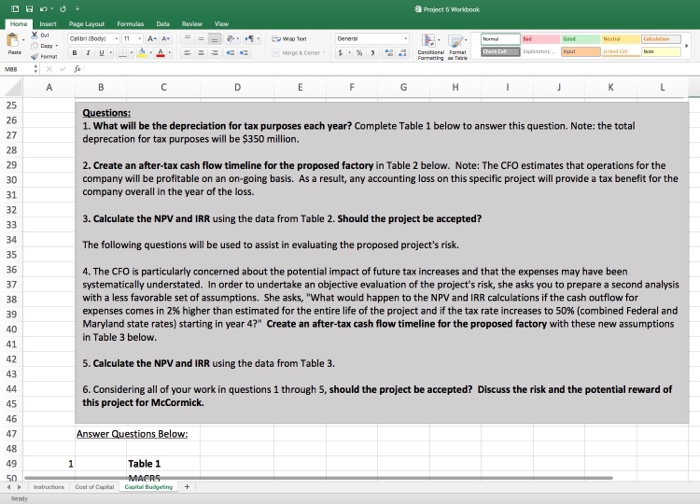

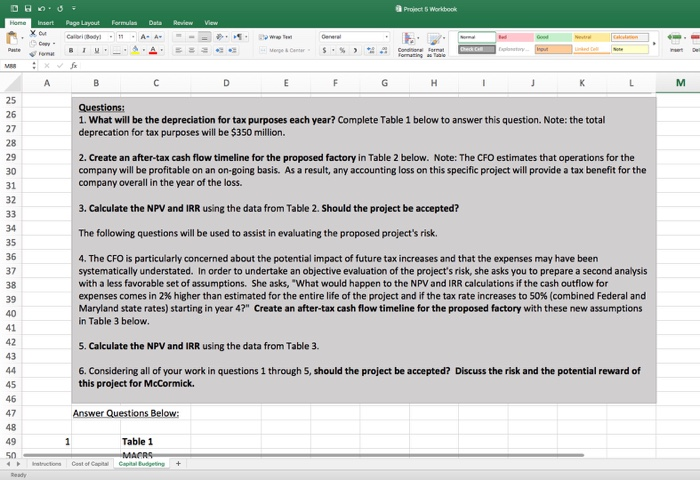

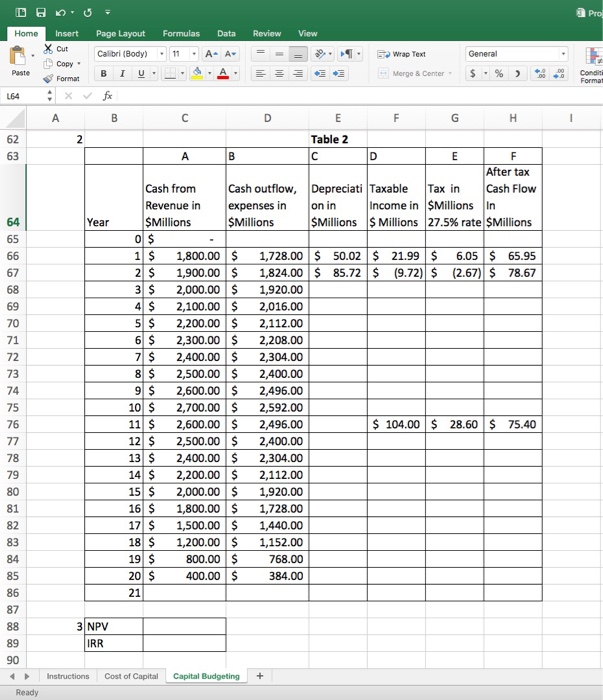

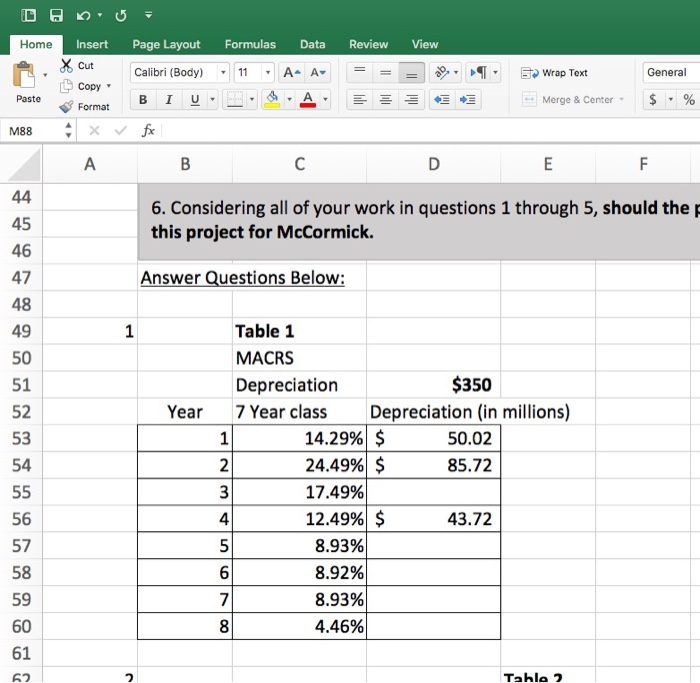

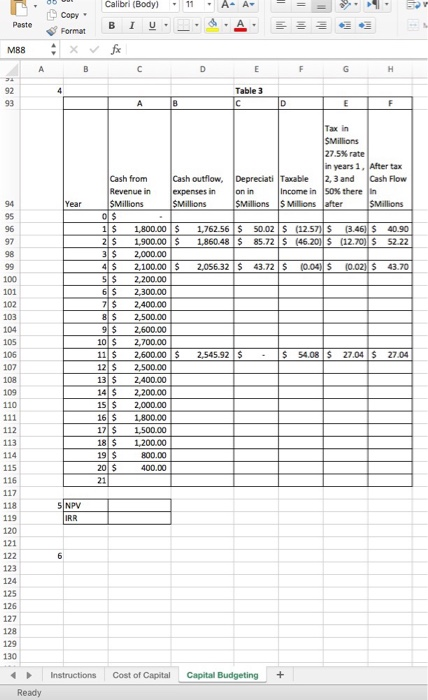

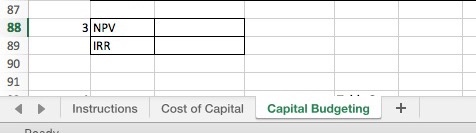

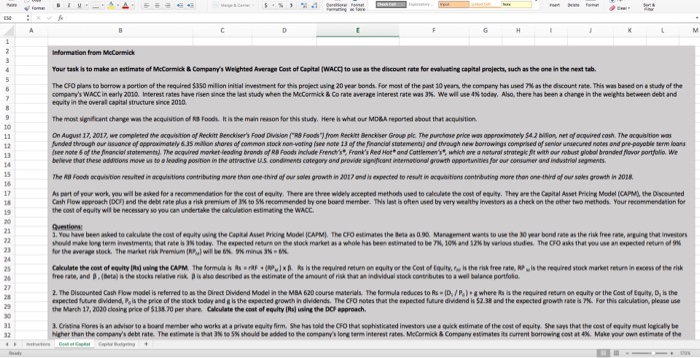

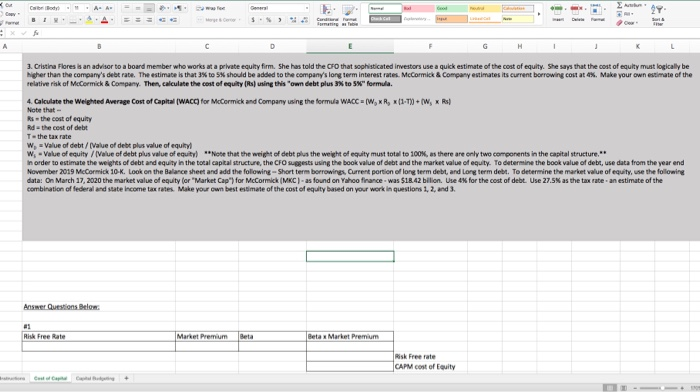

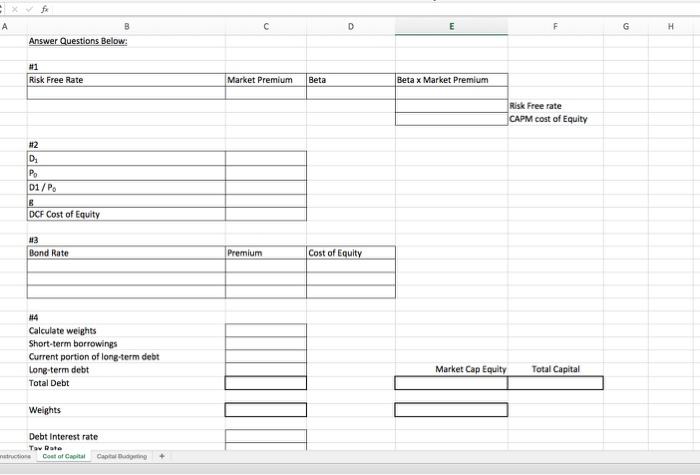

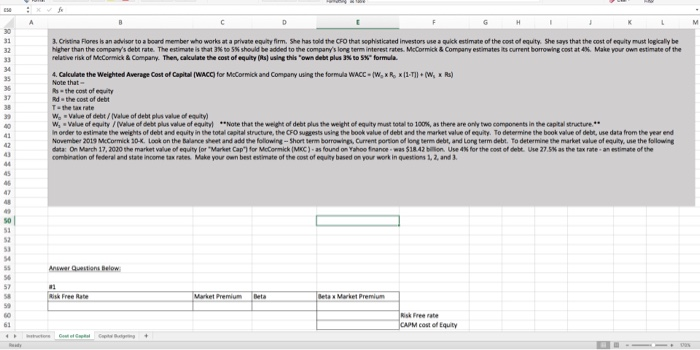

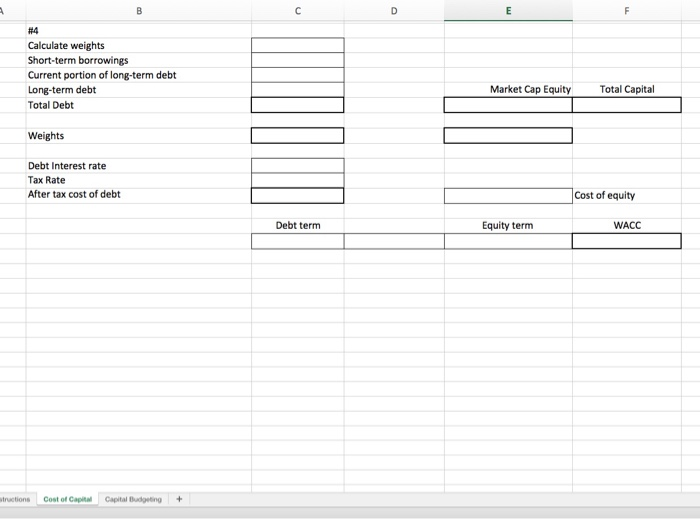

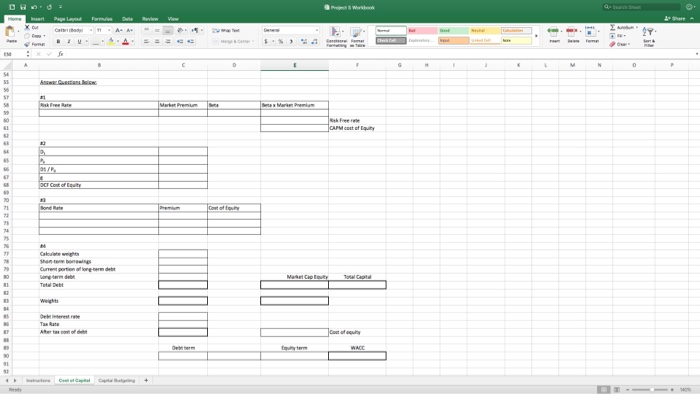

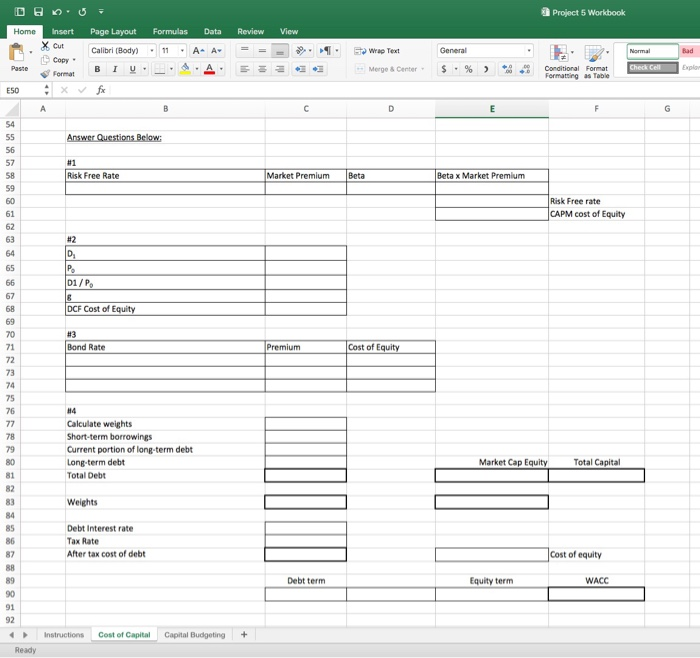

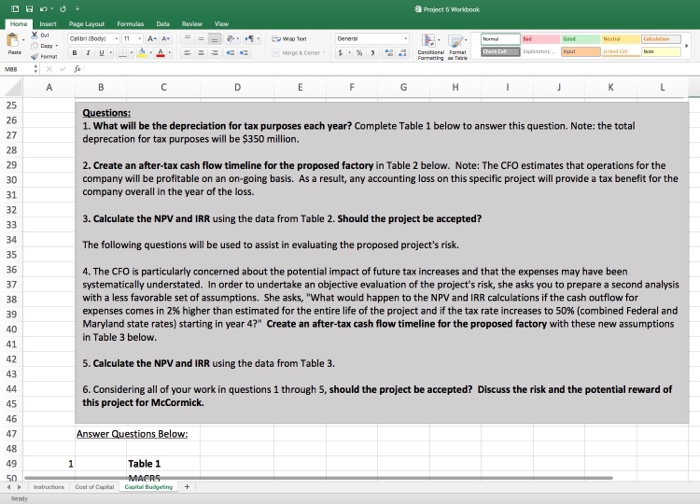

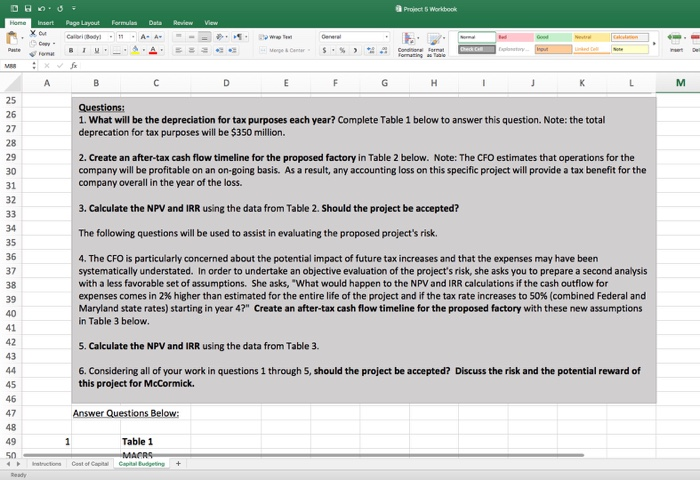

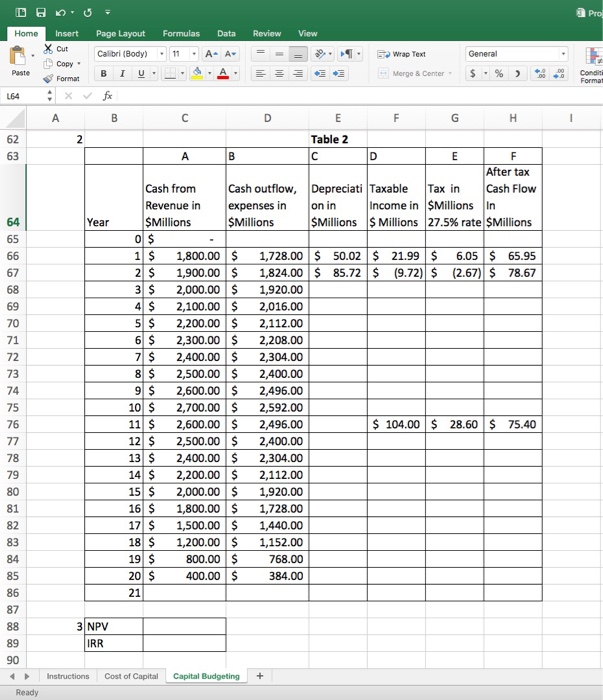

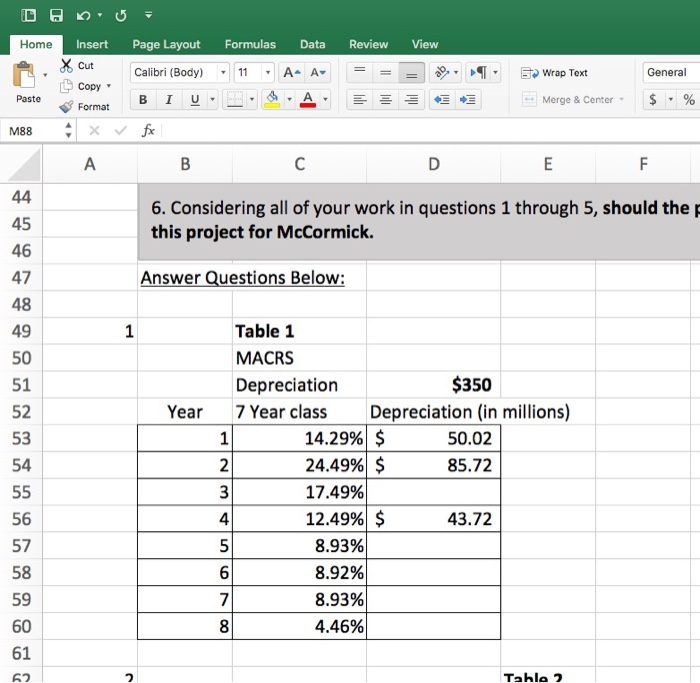

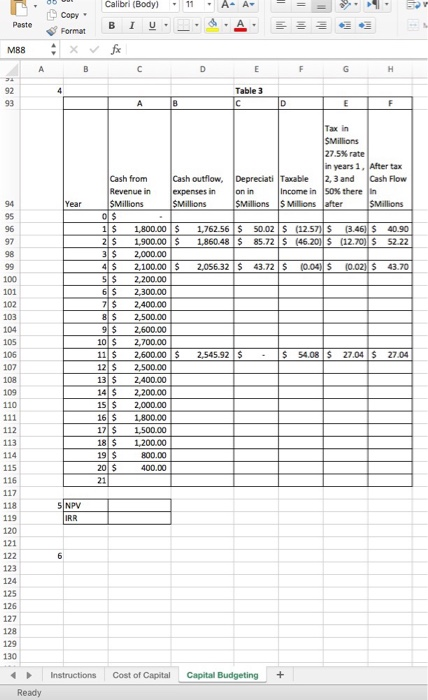

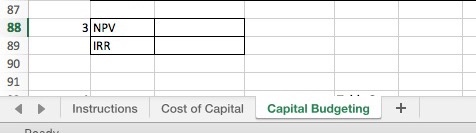

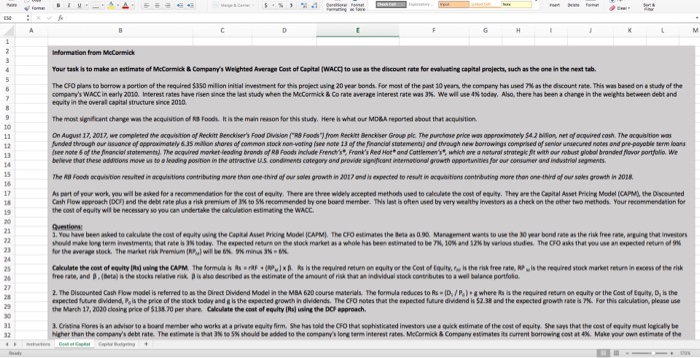

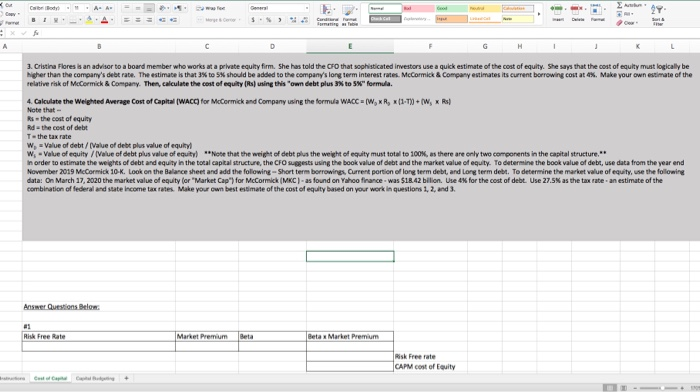

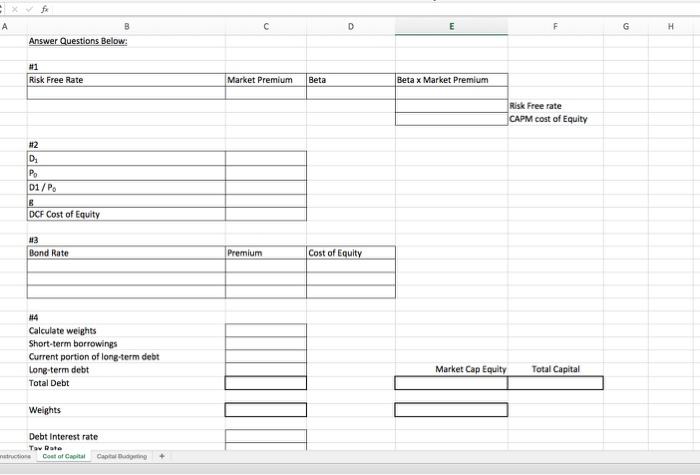

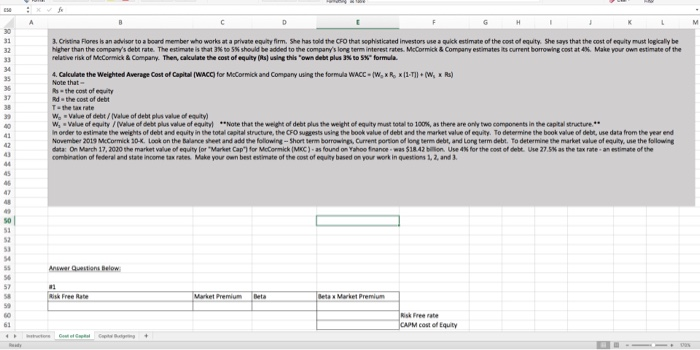

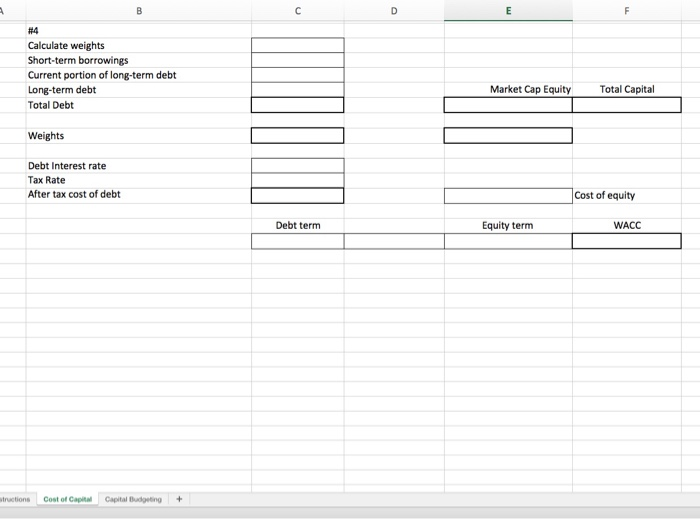

- 11 A. A Wrap Text General Normal Good Paste X cui Calibri (Body Copy B U Format Xfx Morge & Conter $ . % ) Check Cell Explanatory Input Conditional Format Formatting as Table E50 A M Information from McCormick 2 3 4 5 6 7 9 10 11 12 13 14 16 17 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Your task is to make an estimate of McCormick & Company's Weighted Average cost of Capital (WACC) to use as the discount rate for evaluating capital projects, such as the one in the next tab. The CFO plans to borrow a portion of the required $350 million initial investment for this project using 20 year bonds. For most of the past 10 years, the company has used as the discount rate. This was based on a study of the company's WACC in early 2010. Interest rates have risen since the last study when the McCormick & Co rate average interest rate was. We will use 4 today. Also, there has been a change in the weights between debt and equity in the overall capital structure since 2010 The most significant change was the acquisition of foods. It is the main reason for this study. Here is what our MD&A reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ('8 Foods") from Reckitt Benckiser Group ple. The purchase price was approximately $4.2 billion, net of acquired cash. The acquisition was funded through our issuance of approximately 6.35 milion shores of common stock non voting (see note 13 of the financial statements, and through new borrowings comprised of senior unsecured notes and prepayable term loons see note of the financial statements. The acquired market leading brands of Ra Foods include French's, Front's Red Hot and Cotriemer's, which are notwestrategic fit with our robust global branded over portfolio We believe that these additions move us to a leading position in the attractive U.S.condiments category and provide significant international growth opportunities for our consumer and industrial segments The RB Foods acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3 to 5% recommended by one board member This last is often used by very wealthy investors as a check on the other two methods. Your recommendation for the cost of equity wil be necessary so you can undertake the calculation estimating the WACC Questions 1. You have been asked to calculate the cost of equity using the Capital Asset Pricing Model CAPM), The CrO estimates the beta as 0.90. Management wants to use the year bond rate as the risk tree rate, arguing that Investors should make long term investments that rate is today. The expected retum on the rock market as a whole has been estimated to be 7%, 10and 12% by various studies. The CFO asks that you use an expected return of for the wenge stock. The market risk Premium RP wil beox 9 minus -6%. Calculate the cost of cality () using the CAPM. The formules Puis is the required return on equity or the cost of Equity, w is the risk free to, u is the required stock market return in excess of the risk free rate, and Detay is the stocks relative risk is also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Dicounted Cash Flow modelis referred to as the Direct Dividend Model in the MBA 620 counte Materials. The formula reduces to Rs.0./.) where Rs is the required return on equity or the cost of Equity, D, is the expected isture dividend, Pols the price of the stock today and is the expected growth individends. The CrO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please vie the March 17, 2020 closing price of $138.70 per share. Calculate the cost of equity (R) using the DC approach. 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be higher than the company's debt rate. The estimate is that 3% to 5 should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing cost 4%. Make your own estimate of the relative risk of McCormick & Company. Then, calculate the cost of equity (Rs) using this own debt plus 3 to 5 formula 4. Calculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula WACC - IW XR, X[11])+(W x Rs) Note that As the cost of equity Rd the cost of debt W-Value of debt/(Value of debt plus value of equity) Ws - Value of equity / Value of debt plus value of equity) **Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure." In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10-K. Look on the Balance sheet and add the folowing - Short term borrowing, Current portion of long term debt and long term debt. To determine the market value of equity, use the following data: On March 17, 2020 the market value of equity for Market Cap") for McCormick (MKC) - as found on Yahoo finance - was $18.42 billion. Use 4 for the cost of debt. Use 27.5% as the tax rate an estimate of the combination of federal and state income tax rates. Make your own best estimate of the cost of equity based on your work in questions 1, 2 and 3. 34 35 36 37 38 39 40 41 T = the tax rate 44 45 46 50 Instructions Cost of Capital Capital Budgeting + Ready Cut Calibri (Body 11 A- A Wira Text General Copy Paste B 1 U Merge & Center $. % 2 Format 4 x M88 B M 2 3 4 5 6 7 9 10 11 12 13 14 15 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment. You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included below. The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment and land in year zero. Note: The $17 million for accounts receivable and the $14 million for inventory are cash outflows. The $15 million for accounts payable is a cash inflow. The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Use the WACC that you recommended in question 5 of the Cost of Capital tab for the discount rate. 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick Answer Questions Below Instructions Cost of Capital Capital Budgeting + Ready DBOU Home Insert Page Layout Formulas Data Review View Cut Calibri (Body) AA Wr Paste Copy * Format Me M88 B C D E F H 1 Year 50.02 YO 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 2 24.49% $ 85.72 3 17.49% 4 12.49% $ 43.72 5 8.93M 6 8.92% 7 8.93% 8 4.46% 2 64 Year 65 66 67 68 69 70 71 72 73 74 75 76 77 Table 2 A B C D E F After tax Cash from Cash outflow, Depreciati Taxable Tax in Cash Flow Revenue in expenses in on in Income in Millions in SMillions SMillions SMillions $ Millions 27.5% rate Millions OS 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 $ 65.95 21 $ 1,900.00 $ 1.824.00 S 85.72 S (9.721 $ (2.67) $ 78.67 3 $ 2,000.00 1,920.00 45 2,100.00 $ 2,016,00 5$ 2,200.00 $ 2,112.00 65 2,300.00 2.208.00 7 $ 2,400.00 2,304.00 8$ 2,500.00 $ 2,400.00 9 $ 2,600.00 $ 2.496.00 10$ 2,700.00 $ 2,592.00 11$ 2,600.00 $ 2.496.00 $ 104.00 $ 28.60 S 75.40 125 2,500.00 $ 2,400.00 13 S 2,400.00 S 2,304.00 14 $ 2,200.00 $ 2,112.00 15$ 2,000.00 $ 1,920.00 161 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18$ 1,200.00 $ 1.152.00 19 $ 800.00 S 768.00 201$ 400.00 $ 384.00 21 79 80 81 83 84 85 3. NPV 87 88 89 90 91 IRR > Instructions Cost of Capital Capital Budgeting + Ready Paste U Merge & Format M88 B D E F G H 27 92 4 Table 3 c 93 B D E F Year 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 Tax in SMillions 27.5% rate in years 1. After tax Cash from Cash outflow, Depreciati Taxable 2.3 and Cash Flow Revenue in expenses in on in Income in 50% there in SMillions SMillions SMillions $ Millions after SMillions 0$ 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) S (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.485 85.72 S (46.20) S (12.70) $ 52.22 3 $ 2,000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 S (0.04) S (0.02) S 43.70 S $ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 S 2,700.00 111 $ 2,600.00 $ 2,545.925 $ 54.08 $ 27.04 $ 27.04 12 $ 2,500.00 13 $ 2,400.00 145 2,200.00 15$ 2,000.00 16 $ 1,800.00 17 $ 1,500.00 $ 1,200.00 19 $ 800.00 20 $ 400.00 21 110 111 112 113 114 115 116 117 118 119 120 SINPV IRR 121 6 122 123 124 125 126 127 128 129 130 Instructions Cost of Capital Capital Budgeting Ready V Page Layout City 29: 2 : A . G N 0 56 ST Bree Marlem Role Free ra mat e last, 51 /P 6 Couty Sate > Cathewight Thermos Current portion of long-term debt Map Boty Weight Tax Rate Derm WALE Project 5 Workbook Home Page Layout Formulas Data Review View Insert Cut Copy * Format - 11 A- Ar 5 Wrap Text General Normal Bad Calibri (Body BIU Paste Merge & Center Check Cell Explor Conditional Format Formatting as Table ESO B D G 54 55 Answer Questions Below: 56 #1 Risk Free Rate Market Premium Beta Beta x Market Premium 57 58 59 60 Risk Free rate CAPM cost of Equity 61 62 63 64 65 #2 D. P 01/P B DCF Cost of Equity 66 67 #3 Bond Rate Premium Cost of Equity 68 69 70 71 72 73 74 75 76 77 78 H4 Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt 79 80 Market Cap Equity Total Capital 81 82 83 Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity 85 86 87 88 89 90 91 92 Debt term Equity term WACC Instructions Cost of Capital Capital Budgeting + Ready Project Workbook Home View Insert Page Layout Formulas Duta Review ou Calbrody 11 A- A Dasy Format BIU. Go Ewop Test Gener werpos Cerer $ %) Chel Dancional Format Formatting B D E K 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million. 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk. 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick Answer Questions Below: 1 Table 1 MACRS Cost of Capital Cataludgeting Renty Projects Workbook Home Insert Page Layout Formulas Data Review View wa Patie Morge Cars Candel Forming A B H M 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million. 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk. 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick. 40 41 42 43 44 45 46 47 Answer Questions Below: 48 1 49 50 Table 1 MARS Capital Budgeting Instructed Cost of Cap + Pro DOU Home Insert Page Layout Formulas Data Review View Calibri (Body) A- A Wrap Text General Copy * Paste U Merge & Center $ % Format Conditi Format L64 B D E G H 2 62 63 Year 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 Table 2 B C D E F After tax Cash from Cash outflow, Depreciati Taxable Tax in Cash Flow Revenue in expenses in on in Income in Millions in $Millions $Millions $Millions $ Millions 27.5% rate $Millions 0 $ 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 $ 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 4 $ 2,100.00 $ 2,016.00 5 $ 2,200.00 $ 2,112.00 6 $ 2,300.00 $ 2,208.00 7 $ 2,400.00 $ 2,304.00 8 $ 2,500.00 $ 2,400.00 9 $ 2,600.00 $ 2,496.00 10 $ 2,700.00 $ 2,592.00 11 $ 2,600.00 $ 2,496.00 $ 104.00 $ 28.60 $ 75.40 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 14 $ 2,200.00 $ 2,112.00 15 $ 2,000.00 $ 1,920.00 16 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18 $ 1,200.00 $ 1,152.00 19 $ 800.00 $ 768.00 20 $ 400.00 $ 384.00 21 80 81 82 83 84 85 86 87 88 89 90 3 NPV IRR > Instructions Cost of Capital Capital Budgeting + Ready Calibri (Body) 11 OV Copy Paste U Format MBS A B D E F G H 33 92 93 4 Table 3 B D E F Year 94 95 96 97 98 99 100 101 102 103 104 105 Tax in SMillions 27.5% rate in years 1. After tax Cash from Cash outflow, Depreciati Taxable 2.3 and Cash Flow Revenue in expenses in on in Income in 50% there in SMillions SMillions SMillions $ Millions after SMillions 0 $ 1 $ 1,800.00 $ 1,762.56 $ 50.02s (12.57) S (3.46) 40.90 2 $ 1,900.00 $ 1,860.48S 85.72 S (46.20) S (12.70) S 52.22 3 $ 2,000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 S (0.04) 10.02) $ 43.70 S $ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 11 $ 2,600.00 $ 2,545.92 $ $ 54.085 27.04 $ 27.04 12 $ 2,500.00 13 $ 2,400.00 14 $ 2,200.00 15$ 2,000.00 16 S 1.800.00 17 $ 1,500.00 18 S 1,200.00 19 $ 800.00 20 $ 400.00 21 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 5 NPV IRR 122 6 123 124 125 126 127 128 129 130 Instructions Cost of Capital Capital Budgeting + Ready 87 88 89 90 3 NPV IRR 91 Instructions Cost of Capital Capital Budgeting + CN H K M 3 4 9 10 11 12 Information from McCormick Your task is to make an estimate of McCormick & Company's Weighted Average Cost of Capital (WACC) to use as the discount rate for evaluating capital projects, such as the one in the next tab. The CFO plans to borrow a portion of the required $350 milion initial investment for this project using 20 year bonds. For most of the past 10 years, the company has used as the discount rate. This was based on a study of the company's WACC in early 2010. Interest rates have risen since the last study when the McCormick & Co rate average Interest rate was 3%. We will use 4% today. Also, there has been a change in the weights between debt and equity in the overal capital structure since 2010 The most significant change was the acquisition of RS Foods. It is the main reason for this study. Here is what our MOBA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division (R8 Foods from Reckitt Benckiser Group pic. The purchase price was approximately $4.2 billion, net of acquired cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting enote 13 of the financial statement and through newborrowings comprised of senior unsecured notes and pre-payable term loans see note of the financial statements. The acquired market leading brands of Ra Foods include French's, Frank's Red Hot and Cattlemen's, which are a natural strategieft with our robust global branded flavor portfolio. We believe that these additions move us to leading position in the attractive u..condiments category and provide significant intemotional growth opportunities for our consumer and industrial segments The AB Foods acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one-third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of 3% to recommended by one board member. This last is often used by very wealthy investors as a check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC. 14 15 16 17 18 20 23 24 20 27 1. You have been asked to cakulate the cost of equity wing the Call Asset Pricing Model CAPM). The CTO estimates the leta s 0.90. Management wants to the 30 year bond rate as the risk free run, wing that investors would make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be 7%, 10% and 12% by various studies. The CFO asks that you use an expected return of 9 for the werage stock. The market rike Premium (RP) will be on minus % Calculate the cost of equity is using the CAPM. The formula is sur Is is the required return on equity or the cost of Equity, is the risk free rute, is the required stock market return in excess of the risk free rate and D. (Ita) is the stocks relative risk is also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs - 10./P.) og where his is the required return on equity or the cost of Equity, D, is the expected future dividend, Po is the price of the stock today and is the expected growth individends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 78. For this calculation, please use the March 17, 2020 closing price of $138.70 per here. Calculate the cost of equity is using the DCF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be Higher than the company's debt rate. The estimate is that to should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing costat 4%. Make your own estimate of the 29 0 31 Kou 29 SIM ) Car G 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be higher than the company's debt rate. The estimate is that 3% to 5% should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing costat . Make your own estimate of the relative risk of McCormick & Company. Then, calculate the cost of equity (Rs) using this own debt plus 3% to 5x" formula. 4. Calculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula WACC = (W XR, (1-7)+(W x Rs Note that - Rs the cost of equity Rd the cost of debt T-the tax rate W, = Value of debt/Value of debt plus value of equity W-Value of equity Value of debt plus value of equity) Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure." In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10-K. Look on the Balance sheet and add the following - Short term borrowings. Current portion of long term debt, and long term debt. To determine the market value of equity, use the following data: on March 17, 2020 the market value of equity (or "Market Cap") for McCormick (MC) - as found on Yahoo finance - was $18.42 billion. Use 4% for the cost of debt. Use 27.5% as the tax rate - an estimate of the combination of federal and state income tax rates. Make your own best estimate of the cost of equity based on your work in questions 1, 2 and 3. Answer Questions Below 21 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity D G H B Answer Questions Below: #1 Risk Free Rate Market Premium Beta Beta x Market Premium Risk Free rate CAPM cost of Equity #2 D Po 01/P 6 DCF Cost of Equity 13 Bond Rate Premium Cost of Equity Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Taw Rate Cost of Capital Capital Budgeting M 31 32 33 34 35 35 37 30 3 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be higher than the company's debt rate. The estimate is that 3% to 5% should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing cost at 4%. Make your own estimate of the relative risk of McCormick & Company. Then, calculate the cost of equity using this own debt plus 3 to 5 formula 4. Calculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula WACC (W, XR, X (1-T1+ W, 2 R) Note that the cost of equity Rd the cost of debt To the rate W-Value of debt/Value of debt plus value out) W. -Value of equity Value of debt plus value of equity **Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure. ** In order to estimate the weights of debt and equity in the total capital structure, the CFO Suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10K. Look on the balance sheet and add the following - Short term borrowings. Current portion of long term debt, and long term debt. To determine the market value of equity, use the following data: On March 17, 2020 the market value of equity for Market Cap for McCormick (MC) - as found on Yahoo finance was $18.42 bilion. Use 4% for the cost of debt. Use 27.5% as the tax rate an estimate of the combination of federal and state income tax rates. Make your own best estimate of the cost of equity based on your work in questions 1, 2, and 3. 51 S3 S4 55 56 57 Answer Question below . Risk Free Rate Market Premium Beta Beta Market Premium SO 61 Risk Prerate CAPM cost of Equity + P B D E F Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt Market Cap Equity Total Capital Weights Debt Interest rate Tax Rate After tax cost of debt Cost of equity Debt term Equity term WACC structions Cost of Capital Capital Budgeting +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started