Answered step by step

Verified Expert Solution

Question

1 Approved Answer

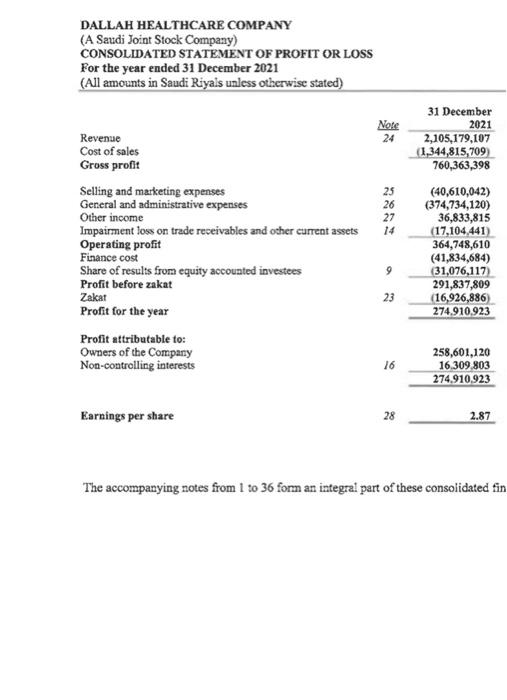

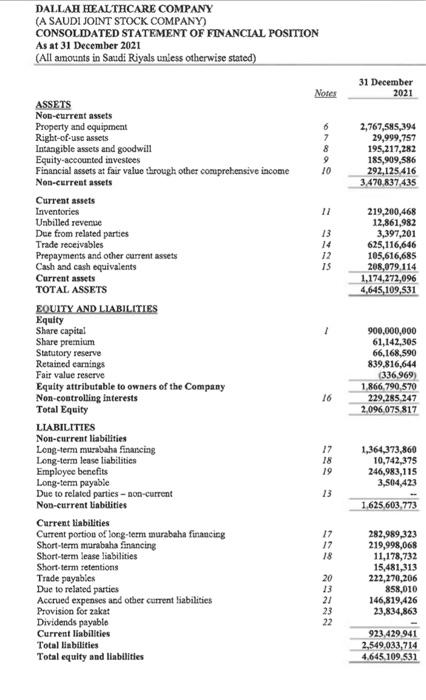

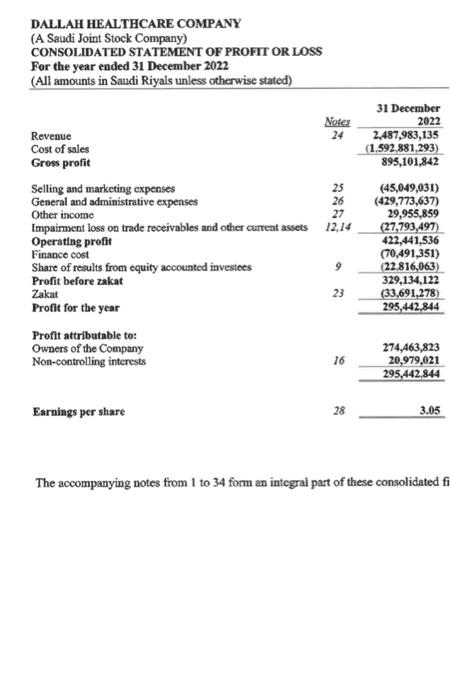

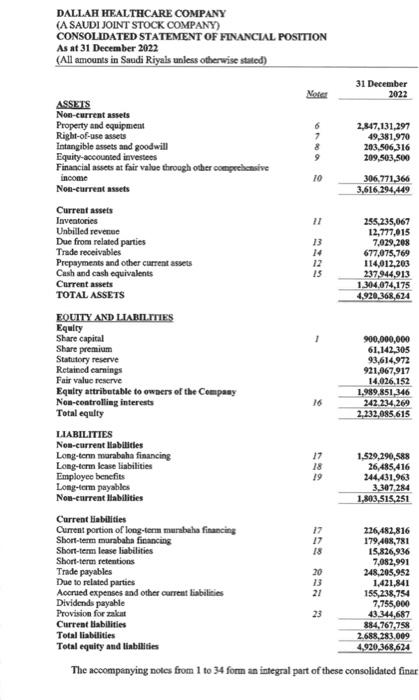

Please calculate/extract the following financial ratios: Return on assets (ROA) Return on equity (ROE) Equity Multiplier Profit margin Current ratio Quick ratio Total asset turnover

Please calculate/extract the following financial ratios:

- Return on assets (ROA)

- Return on equity (ROE)

- Equity Multiplier

- Profit margin

- Current ratio

- Quick ratio

- Total asset turnover

- Inventory turnover

- Average collection period (Days Sales Outstanding)

- Leverage ratio: Debt to assets; Debt to equity

- Times interest earned

- Market-to-book value ratio

- Price earnings ratio

* Note Please be careful there is two pics for year 2022 and two pics as well for 2021

what do you mean by not clear?

DALLAH HEALTHCARE COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF PROFIT OR LOSS For the year ended 31 December 2021 (All amounts in Saudi Riyals unless otherwise stated) The accompanying notes from 1 to 36 form an integral part of these consolidated fin DALLAH HEALTHCARE COMPANX (A SAUDI JONNT STOCK COMPANY) CONSOLDATED STATEMENT OF FINANCIAL POSITION As at 31 December 2021 (All amounts in Saudi Riyals uniess otherwise stated) 31DecemberNotes ASSETS Non-eurreat assets Property and equipmeat Right-of use assets Intangible assets and goodwill Equity-accounted investees Financial assets at fair value through other conuprehensive income Non-cerrent assets \begin{tabular}{rr} 6 & 2,767,595,394 \\ 7 & 29,999,757 \\ 8 & 195,217,282 \\ 9 & 185,909,586 \\ 10 & 292,125,416 \\ \hline & 3,470.837,435 \\ \hline \end{tabular} Current assets Inventories Uabilled revense Due from related parties Trade receivables Prepayments and other current assets Cash and cach oquivalents Current assets TOTAL ASSETS \begin{tabular}{lr} 11 & 219,200,468 \\ & 12,861,982 \\ 13 & 3,397,201 \\ 14 & 625,116,646 \\ 12 & 105,616,685 \\ 15 & 208,079,114 \\ \hline & 1,174,272,096 \\ \hline & 4,645,109,531 \\ \hline \end{tabular} EOUITY AND LLABILITIES Bquity Share capital Share premium Statutory reserve Retaired eannings Fair value reserve Equity attributable to owners of the Company Non-controlling interests Total Equity LIABILITIES Non-current liabilities Long-term murabaha financing Leng-term lease liabilities Employee benefits Long-term payable Due to related parties - non-current Non-current liabilities Current liabilities Current portiou of long-term murabaha finaneing Short-erm marabaha Sinancing Short-term lease liabilities Short term retentions Trade payabies Due to related parties Acerued expenses and otber current liabilities Provision for zakat Dividends payable Current liabilties Total liablities Total equity and liablities \begin{tabular}{lr} 17 & \\ 18 & 1,364,373,860 \\ 18 & 10,742,375 \\ 19 & 246,983,115 \\ 13 & 3,504,423 \\ & 1,625,603,773 \\ \hline & \\ 17 & 282,989,323 \\ 17 & 21,99,393 \\ 18 & 11,178,032 \\ & 15,481,313 \\ 20 & 222,270,206 \\ 13 & 858,010 \\ 21 & 146,819,426 \\ 23 & 23,834,863 \\ 22 & -9 \\ & 923,429941 \\ \hline & 2,549,033,714 \\ \hline & 4,645,109,531 \\ \hline \end{tabular} DALLAH HEALTHCARE COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF PROFIT OR LOSS For the year ended 31 December 2022 (All amounts in Saudi Riyals unless otherwise stated) The accompanying notes from 1 to 34 form an integral part of these consolidated DALIAH HEALTHCARE COMPANY (A SAUDI JOLNT STOCK COMPANY) CONSOLIDATED STATEMENT OF FINANCLL POSITION As at 31 December 2022 (All amounts in Saudi Riyals unless otherwise stited) \begin{tabular}{cr} & 31 December \\ Notet & 2022 \\ \hline & \\ 6 & 2,347,131,297 \\ 7 & 49,381,970 \\ 8 & 203,506,316 \\ 9 & 209,503,500 \\ 10 & 306,771,366 \\ \hline & 3,616,294,449 \\ \hline \end{tabular} LAABIITIES Nom-current Hablities Long-tenn marabaha financing Long-term lease liabilities Employee benefits Long-term payshlos Non-eurrent llablities The accompanying notes from 1 to 34 form an integral part of these consolidated finar DALLAH HEALTHCARE COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF PROFIT OR LOSS For the year ended 31 December 2021 (All amounts in Saudi Riyals unless otherwise stated) The accompanying notes from 1 to 36 form an integral part of these consolidated fin DALLAH HEALTHCARE COMPANX (A SAUDI JONNT STOCK COMPANY) CONSOLDATED STATEMENT OF FINANCIAL POSITION As at 31 December 2021 (All amounts in Saudi Riyals uniess otherwise stated) 31DecemberNotes ASSETS Non-eurreat assets Property and equipmeat Right-of use assets Intangible assets and goodwill Equity-accounted investees Financial assets at fair value through other conuprehensive income Non-cerrent assets \begin{tabular}{rr} 6 & 2,767,595,394 \\ 7 & 29,999,757 \\ 8 & 195,217,282 \\ 9 & 185,909,586 \\ 10 & 292,125,416 \\ \hline & 3,470.837,435 \\ \hline \end{tabular} Current assets Inventories Uabilled revense Due from related parties Trade receivables Prepayments and other current assets Cash and cach oquivalents Current assets TOTAL ASSETS \begin{tabular}{lr} 11 & 219,200,468 \\ & 12,861,982 \\ 13 & 3,397,201 \\ 14 & 625,116,646 \\ 12 & 105,616,685 \\ 15 & 208,079,114 \\ \hline & 1,174,272,096 \\ \hline & 4,645,109,531 \\ \hline \end{tabular} EOUITY AND LLABILITIES Bquity Share capital Share premium Statutory reserve Retaired eannings Fair value reserve Equity attributable to owners of the Company Non-controlling interests Total Equity LIABILITIES Non-current liabilities Long-term murabaha financing Leng-term lease liabilities Employee benefits Long-term payable Due to related parties - non-current Non-current liabilities Current liabilities Current portiou of long-term murabaha finaneing Short-erm marabaha Sinancing Short-term lease liabilities Short term retentions Trade payabies Due to related parties Acerued expenses and otber current liabilities Provision for zakat Dividends payable Current liabilties Total liablities Total equity and liablities \begin{tabular}{lr} 17 & \\ 18 & 1,364,373,860 \\ 18 & 10,742,375 \\ 19 & 246,983,115 \\ 13 & 3,504,423 \\ & 1,625,603,773 \\ \hline & \\ 17 & 282,989,323 \\ 17 & 21,99,393 \\ 18 & 11,178,032 \\ & 15,481,313 \\ 20 & 222,270,206 \\ 13 & 858,010 \\ 21 & 146,819,426 \\ 23 & 23,834,863 \\ 22 & -9 \\ & 923,429941 \\ \hline & 2,549,033,714 \\ \hline & 4,645,109,531 \\ \hline \end{tabular} DALLAH HEALTHCARE COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF PROFIT OR LOSS For the year ended 31 December 2022 (All amounts in Saudi Riyals unless otherwise stated) The accompanying notes from 1 to 34 form an integral part of these consolidated DALIAH HEALTHCARE COMPANY (A SAUDI JOLNT STOCK COMPANY) CONSOLIDATED STATEMENT OF FINANCLL POSITION As at 31 December 2022 (All amounts in Saudi Riyals unless otherwise stited) \begin{tabular}{cr} & 31 December \\ Notet & 2022 \\ \hline & \\ 6 & 2,347,131,297 \\ 7 & 49,381,970 \\ 8 & 203,506,316 \\ 9 & 209,503,500 \\ 10 & 306,771,366 \\ \hline & 3,616,294,449 \\ \hline \end{tabular} LAABIITIES Nom-current Hablities Long-tenn marabaha financing Long-term lease liabilities Employee benefits Long-term payshlos Non-eurrent llablities The accompanying notes from 1 to 34 form an integral part of these consolidated finar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started