Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can I get help with this urgently Lacie Plc will require various additional machinery and equipment once the new factory has been acquired. For

Please can I get help with this urgently

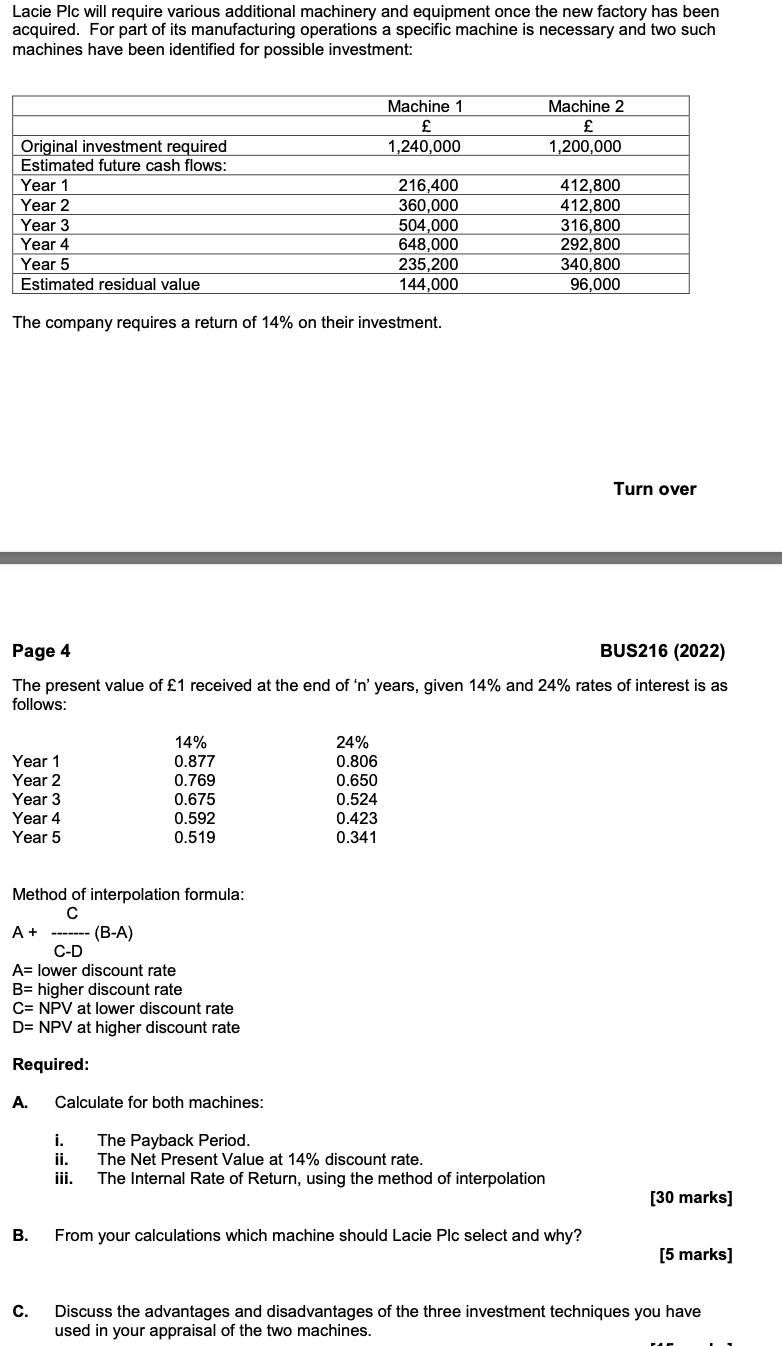

Lacie Plc will require various additional machinery and equipment once the new factory has been acquired. For part of its manufacturing operations a specific machine is necessary and two such machines have been identified for possible investment: Machine 1 1,240,000 Machine 2 1,200,000 Original investment required Estimated future cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Estimated residual value 216,400 360,000 504,000 648,000 235,200 144,000 412,800 412,800 316,800 292,800 340,800 96.000 The company requires a return of 14% on their investment. Turn over Page 4 BUS216 (2022) The present value of 1 received at the end of 'n' years, given 14% and 24% rates of interest is as follows: Year 1 Year 2 Year 3 Year 4 Year 5 14% 0.877 0.769 0.675 0.592 0.519 24% 0.806 0.650 0.524 0.423 0.341 ------- Method of interpolation formula: A A + (B-A) A) C-D A= lower discount rate B= higher discount rate C= NPV at lower discount rate D= NPV at higher discount rate Required: A. Calculate for both machines: i. ii. . iii. The Payback Period. The Net Present Value at 14% discount rate. The Internal Rate of Return, using the method of interpolation [30 marks] B. From your calculations which machine should Lacie Plc select and why? [5 marks] c. Discuss the advantages and disadvantages of the three investment techniques you have used in your appraisal of the two machinesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started