Answered step by step

Verified Expert Solution

Question

1 Approved Answer

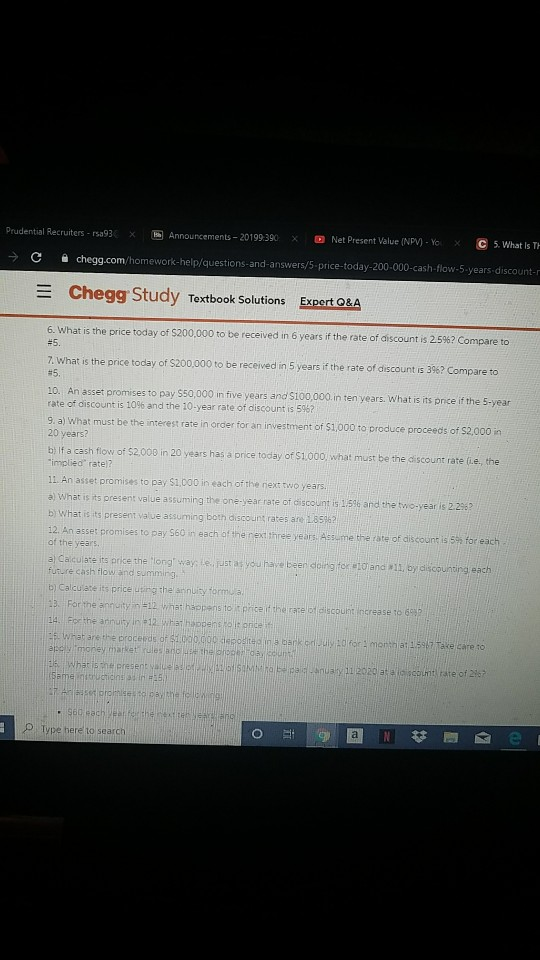

Please can I get the answers to Questions 6 through 18 in de next couple of minutes please? Prudential Recruiters - 5a93 X 1 Announcements

Please can I get the answers to Questions 6 through 18 in de next couple of minutes please?

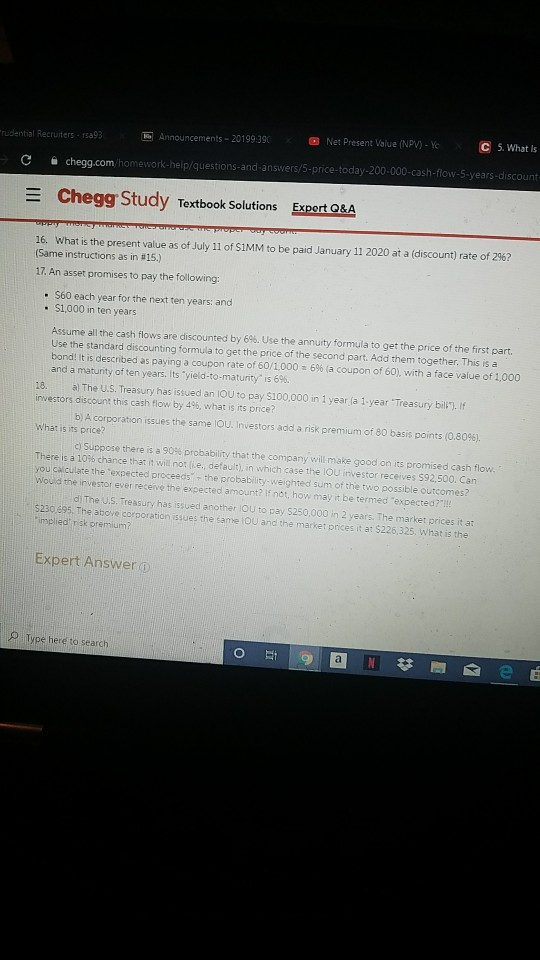

Prudential Recruiters - 5a93 X 1 Announcements - 20199:390X Net Present Value (NPV) - Yox 5. What is C chegg.com/homework help/questions and answers/5-price-today: 200-000-cash-flow.5 years.discount = Chegg Study Textbook Solutions Expert Q&A 6. What is the price today of $200.000 to be received in 6 years if the rate of discount is 2.596? Compare to 7. What is the price today of $200,000 to be received in 5 years if the rate of discount is 396? Compare to 10. An asset promises to pay $50,000 in five years and $100,000.in ten years. What is its pnce if the 5-year rate of discount is 10% and the 10-year rate of discount is 596? 9. a) What must be the interest rate in order for an investment of $1,000 to produce proceeds of $2,000 in 20 years? bilf a cash flow of $2.000 in 20 years has a price today of $1,000, what must be the discount rate te the imoborate? 11. An asset promises to pay $1.000 in each of the next two years. a) What is its present value assuming the one-year rate of discount is 1556 and the two-year is 2.29? b) What is its present value assuming both discount rates and 285962 12. An asset promises to pay $60 in each of the next three years. Assume the rate of discount is for each of the years al Calculate its price the long way stat you have been doing for 10 and 11, by discounting each future cash flow and summing by Calculate its price using the annuity formula B. For the annuity =12 what happens to price if there all count increase to 6 14 the 12 wat he t once What are the proceeds of 0.000 deposite in a barked for month at 1.597 Take care to and money trul What is the presenta o SIM paanuar 11 2020 at account rate of 2.7 aroma cheather 0 TDe here to search oane Sential Recruiters. 15893 Announcements - 20199390 Net Present Value (NPV) - Y C S. What is c c hegg.com/homework.help/questions and answers/5-price-today.200.000-cash-flow .years-discount E Chegg Study Textbook Solutions Expert Q&A 16. What is the present value as of July 11 of SIMM to be paid January 11 2020 at a discount) rate of 296? (Same instructions as in #15.) 17. An asset promises to pay the following: S60 each year for the next ten years, and $1,000 in ten years Assume all the cash flows are discounted by 696. Use the annuity formula to get the price of the first part. Use the standard discounting formula to get the price of the second part. Add them together. This is a bond! It is described as paying a coupon rate of 60/1000 = 6% la coupon of 60), with a face value of 1,000 and a maturity of ten years. Its yield-to-maturity is 6%. 18. a) The U.S. Treasury has issued an IOU to pay $100,000 in 1 year (a 1-year "Treasury bill"). If investors discount this cash flow by 4, what is its price? b) A corporation issues the same IOU. Investors add a risk premium of 80 basis points (0.80961. What is its price? c) Suppose there is a 90% probability that the company will make good on its promised cash flow." There is a 10% chance that it will not be default, in which case the lo investor receives 592.500. Can you calculate the expected proceeds - the probability-weighted sum of the two possible outcomes Woud the investor ever receive the expected amount? If not, how may it be termed "expected?!! di The U.S. Treasury has issued another lou to pay $250.000 in 2 years. The market pricesitar $230,895. The above corporation issues the same lou and the market oncesit at $226,325. What is the impliedriskpremium? Expert Answer Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started