Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE can someone help with the unadjusted and adjusted trial balances, please? For my unadjusted trial balance my DR side is 89900 and my Cr

PLEASE can someone help with the unadjusted and adjusted trial balances, please? For my unadjusted trial balance my DR side is 89900 and my Cr is 87500, I really don't know where I went wrong.

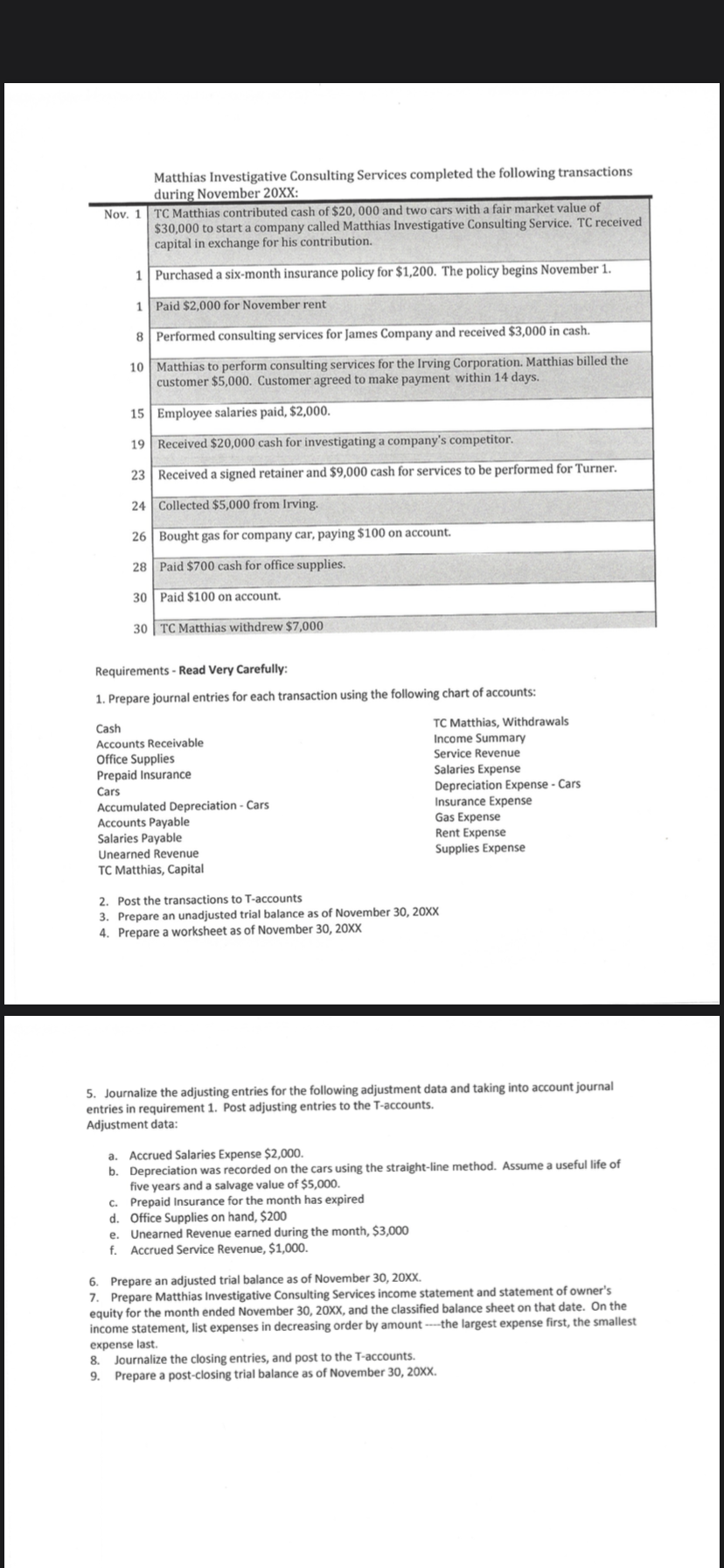

Matthias Investigative Consulting Services completed the following transactions during November 20XX: Nov. 1 TC Matthias contributed cash of $20,000 and two cars with a fair market value of $30,000 to start a company called Matthias Investigative Consulting Service. TC received capital in exchange for his contribution. 1 Purchased a six-month insurance policy for $1,200. The policy begins November 1. 1 Paid $2,000 for November rent 8 Performed consulting services for James Company and received $3,000 in cash. 10 Matthias to perform consulting services for the Irving Corporation. Matthias billed the customer $5,000. Customer agreed to make payment within 14 days. 15 Employee salaries paid, $2,000. 19 Received $20,000 cash for investigating a company's competitor. 23 Received a signed retainer and $9,000 cash for services to be performed for Turner. 24 Collected $5,000 from Irving. 26 Bought gas for company car, paying $100 on account. 28 Paid $700 cash for office supplies. 30 Paid $100 on account. 30 TC Matthias withdrew $7,000 Requirements - Read Very Carefully: 1. Prepare journal entries for each transaction using the following chart of accounts: Cash Accounts Receivable Office Supplies Prepaid Insurance Cars Accumulated Depreciation - Cars Accounts Payable Salaries Payable Unearned Revenue TC Matthias, Capital TC Matthias, Withdrawals Income Summary Service Revenue Salaries Expense Depreciation Expense - Cars Insurance Expense Gas Expense Rent Expense Supplies Expense 2. Post the transactions to T-accounts 3. Prepare an unadjusted trial balance as of November 30, 20XX 4. Prepare a worksheet as of November 30, 20XX 5. Journalize the adjusting entries for the following adjustment data and taking into account journal entries in requirement 1. Post adjusting entries to the T-accounts. Adjustment data: a. Accrued Salaries Expense $2,000. b. Depreciation was recorded on the cars using the straight-line method. Assume a useful life of five years and a salvage value of $5,000. c. Prepaid Insurance for the month has expired d. Office Supplies on hand, $200 e. Unearned Revenue earned during the month, $3,000 f. Accrued Service Revenue, $1,000. 6. Prepare an adjusted trial balance as of November 30, 20XX. 7. Prepare Matthias Investigative Consulting Services income statement and statement of owner's equity for the month ended November 30, 20XX, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount ----the largest expense first, the smallest expense last. 8. Journalize the closing entries, and post to the T-accounts. 9. Prepare a post-closing trial balance as of November 30, 20XXStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started