Question: Please can you ansew these 5 multiple choice question 17. Consider the scenario of one risky asset (S&P500 index) and a risk free (T-bill) asset.

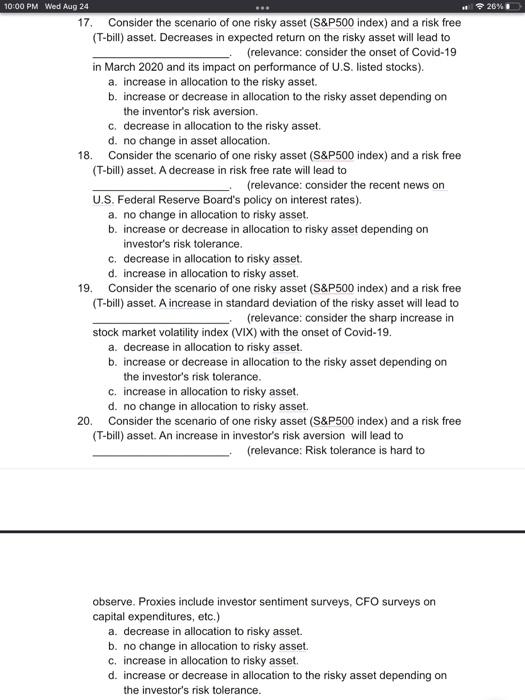

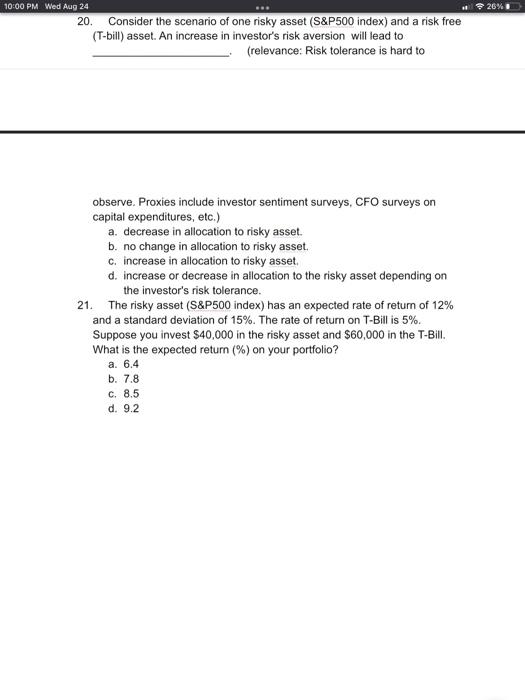

17. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. Decreases in expected return on the risky asset will lead to (relevance: consider the onset of Covid-19 in March 2020 and its impact on performance of U.S. listed stocks). a. increase in allocation to the risky asset. b. increase or decrease in allocation to the risky asset depending on the inventor's risk aversion. c. decrease in allocation to the risky asset. d. no change in asset allocation. 18. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. A decrease in risk free rate will lead to U.S. Federal Reserve Board's policy on interest rates). a. no change in allocation to risky asset. b. increase or decrease in allocation to risky asset depending on investor's risk tolerance. c. decrease in allocation to risky asset. d. increase in allocation to risky asset. 19. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. A increase in standard deviation of the risky asset will lead to (relevance: consider the sharp increase in stock market volatility index (VIX) with the onset of Covid-19. a. decrease in allocation to risky asset. b. increase or decrease in allocation to the risky asset depending on the investor's risk tolerance. c. increase in allocation to risky asset. d. no change in allocation to risky asset. 20. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. An increase in investor's risk aversion will lead to (relevance: Risk tolerance is hard to observe. Proxies include investor sentiment surveys, CFO surveys on capital expenditures, etc.) a. decrease in allocation to risky asset. b. no change in allocation to risky asset. c. increase in allocation to risky asset. d. increase or decrease in allocation to the risky asset depending on the investor's risk tolerance. 20. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. An increase in investor's risk aversion will lead to (relevance: Risk tolerance is hard to observe. Proxies include investor sentiment surveys, CFO surveys on capital expenditures, etc.) a. decrease in allocation to risky asset. b. no change in allocation to risky asset. c. increase in allocation to risky asset. d. increase or decrease in allocation to the risky asset depending on the investor's risk tolerance. 21. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of retum on T-Bill is 5%. Suppose you invest $40,000 in the risky asset and $60,000 in the T-Bill. What is the expected return (\%) on your portfolio? a. 6.4 b. 7.8 c. 8.5 d. 9.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts