Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you answer question 17-24? Thanks 17. In focal 2021. Pecos Company reported a story as 21 and effective tax rate of 18%. Pecosincome

Please can you answer question 17-24? Thanks

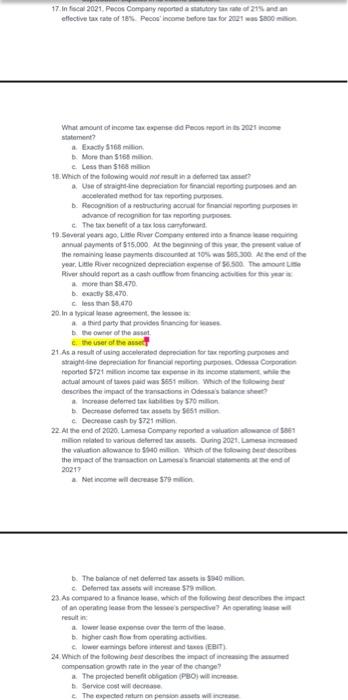

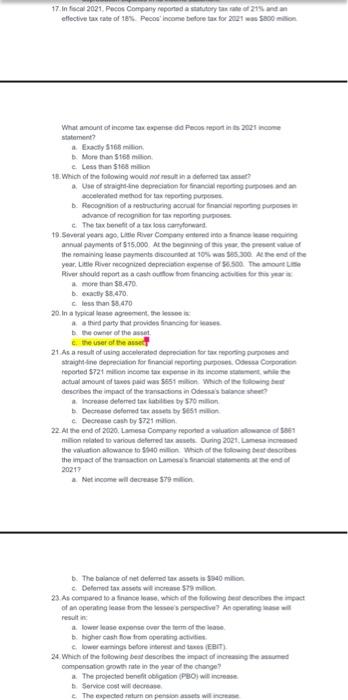

17. In focal 2021. Pecos Company reported a story as 21 and effective tax rate of 18%. Pecosincome before tax for 2021 800 What amount of income tax expense di Posreportin 202 income statement? Exacy 5168 milion More than $16 milion c. Less than $168 18. Which of the following would not result in a deed tax Use of right-line depreciation for financial reporting and worted method for tax reporting purposes D. Recognition of a restructuring accrual fornancial reporting purposes advance of recognition for tax reporting po The tax benefit of a tax is cryward 19. Several years ago. Lise River Company entered into final annual payments of $15.000. At the beginning of this year, the prof the remaining lase payments discounted at 10% was 6.300 A the end of the year, Little River recognised depreciation expense of 6.500 The amount River should report as a chow from financing storya more than $8.470 chy 58.470 less than $8.470 20.In a typical fase agrement, the a third party that provides financing for the owner of the asset the use of the 21. As a result of using accelerated depreciation for a moring papers and sraigne depreciation for financial reporting purpose Ossa Corporation reported 5721 milion income and comment actual amount of spaid was 5651 milion Which of the town inscribes the impact of the transactions in Odessa's Dance sheet Increase delored talates by 570 milion Deestore deferred to as by S5 million Decrease cash by 5721 million 22. At the end of 2020. Lamesa Company reported a valuation of 867 million related to various deferred taxes. During 2021, Lamesaineet the luation allowance to 10 milion. Which of the factors the impact of the transaction on Lames francaltamente do 20219 a Net income wilde The balance of met deferred to asi 5940 milion Deferred to a wide 5 milion 23 As come to lose which of the following tempat of an operating lease from the perspective? Anperating result lower sense over the form of the higher cash flow from operating activities clower aming before and (EBIT) 24. Which of the following best describes the impact of increasing themed compensation growth rate in the year of the change? The projected benefit obligation (PBOJ will increase Services will der The expected return on person wil 17. In focal 2021. Pecos Company reported a story as 21 and effective tax rate of 18%. Pecosincome before tax for 2021 800 What amount of income tax expense di Posreportin 202 income statement? Exacy 5168 milion More than $16 milion c. Less than $168 18. Which of the following would not result in a deed tax Use of right-line depreciation for financial reporting and worted method for tax reporting purposes D. Recognition of a restructuring accrual fornancial reporting purposes advance of recognition for tax reporting po The tax benefit of a tax is cryward 19. Several years ago. Lise River Company entered into final annual payments of $15.000. At the beginning of this year, the prof the remaining lase payments discounted at 10% was 6.300 A the end of the year, Little River recognised depreciation expense of 6.500 The amount River should report as a chow from financing storya more than $8.470 chy 58.470 less than $8.470 20.In a typical fase agrement, the a third party that provides financing for the owner of the asset the use of the 21. As a result of using accelerated depreciation for a moring papers and sraigne depreciation for financial reporting purpose Ossa Corporation reported 5721 milion income and comment actual amount of spaid was 5651 milion Which of the town inscribes the impact of the transactions in Odessa's Dance sheet Increase delored talates by 570 milion Deestore deferred to as by S5 million Decrease cash by 5721 million 22. At the end of 2020. Lamesa Company reported a valuation of 867 million related to various deferred taxes. During 2021, Lamesaineet the luation allowance to 10 milion. Which of the factors the impact of the transaction on Lames francaltamente do 20219 a Net income wilde The balance of met deferred to asi 5940 milion Deferred to a wide 5 milion 23 As come to lose which of the following tempat of an operating lease from the perspective? Anperating result lower sense over the form of the higher cash flow from operating activities clower aming before and (EBIT) 24. Which of the following best describes the impact of increasing themed compensation growth rate in the year of the change? The projected benefit obligation (PBOJ will increase Services will der The expected return on person wil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started