Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you assist with calculating the return on asset and return on equity for coca-cola and Pepsico for year 2019 and 2020. I have

Please can you assist with calculating the return on asset and return on equity for coca-cola and Pepsico for year 2019 and 2020. I have attached the balance sheet and income statement of both companies. Please feel free to double check the information online. Thanks

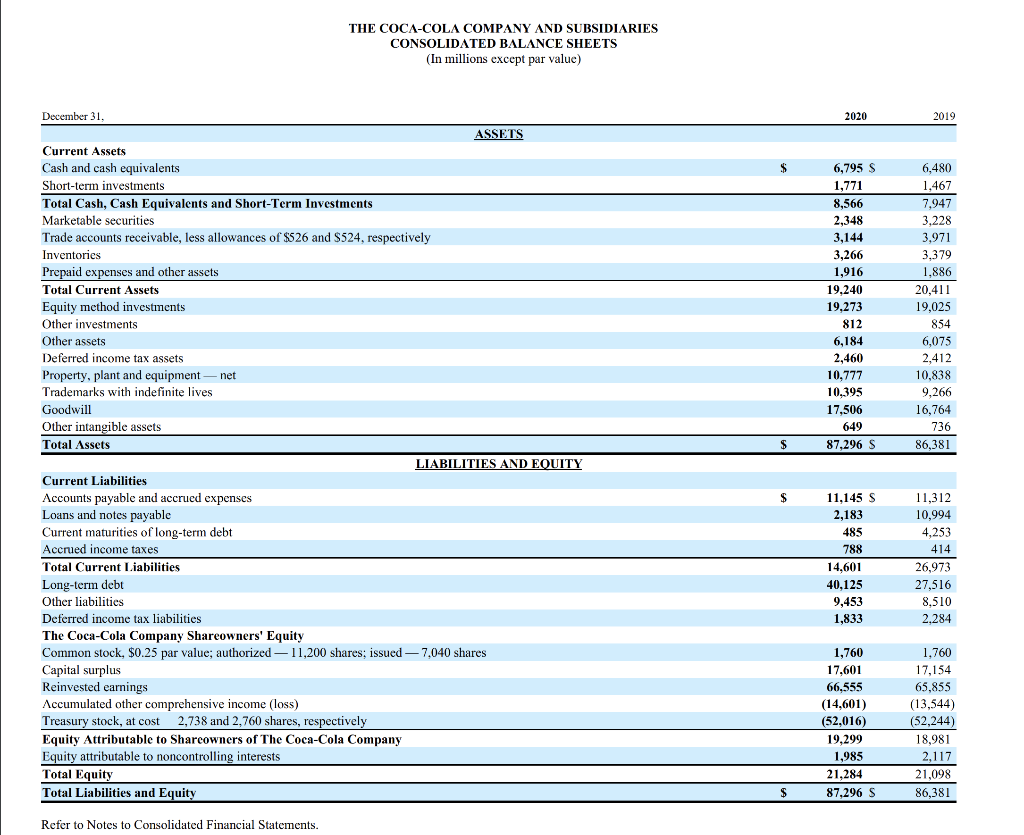

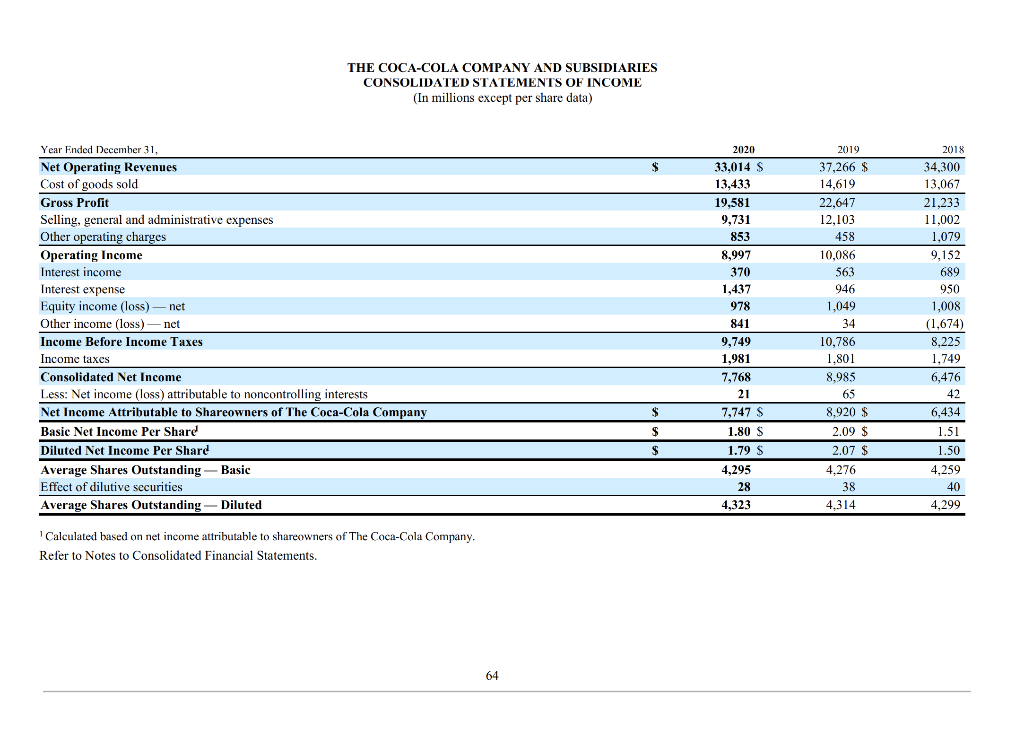

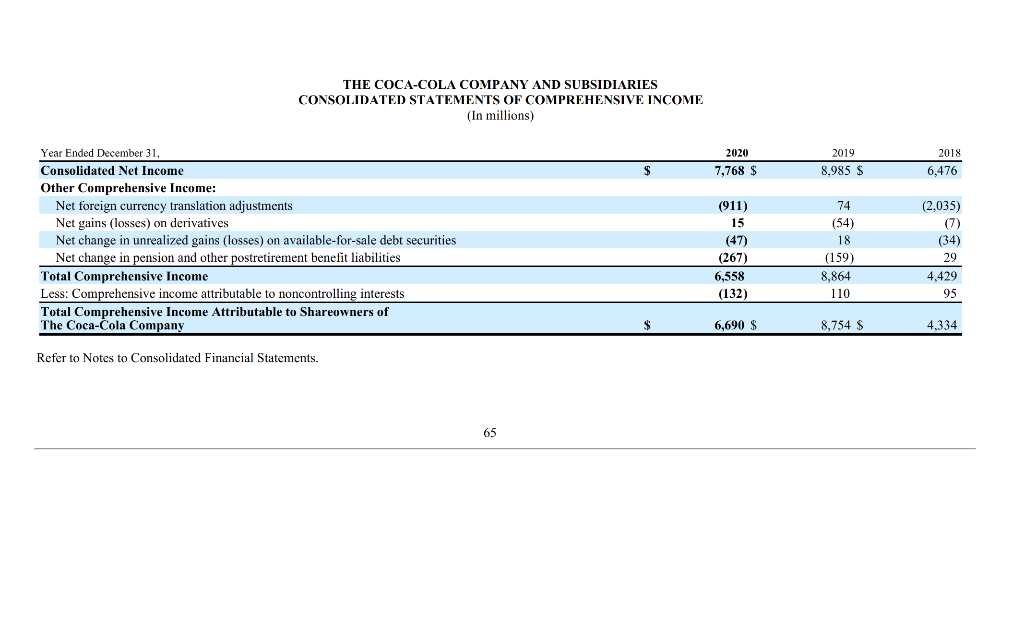

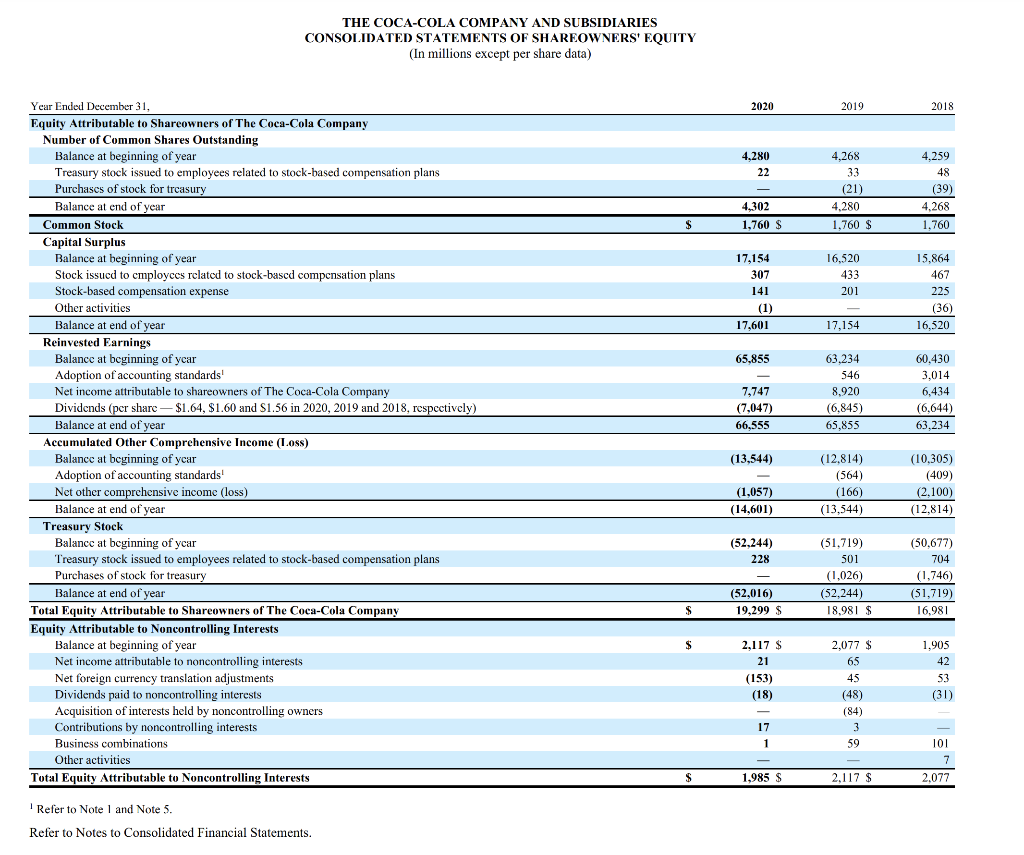

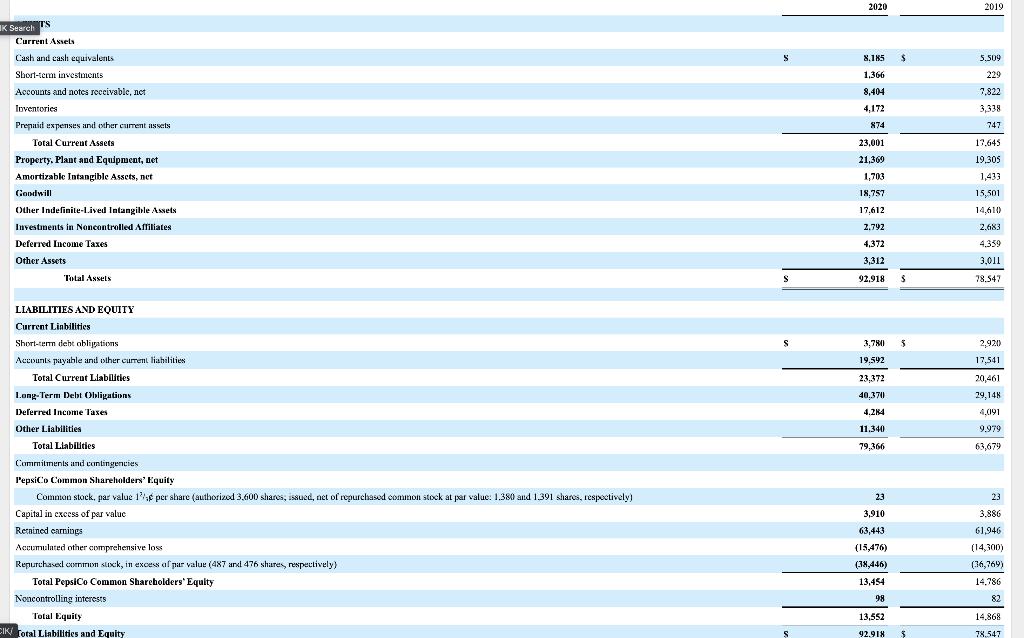

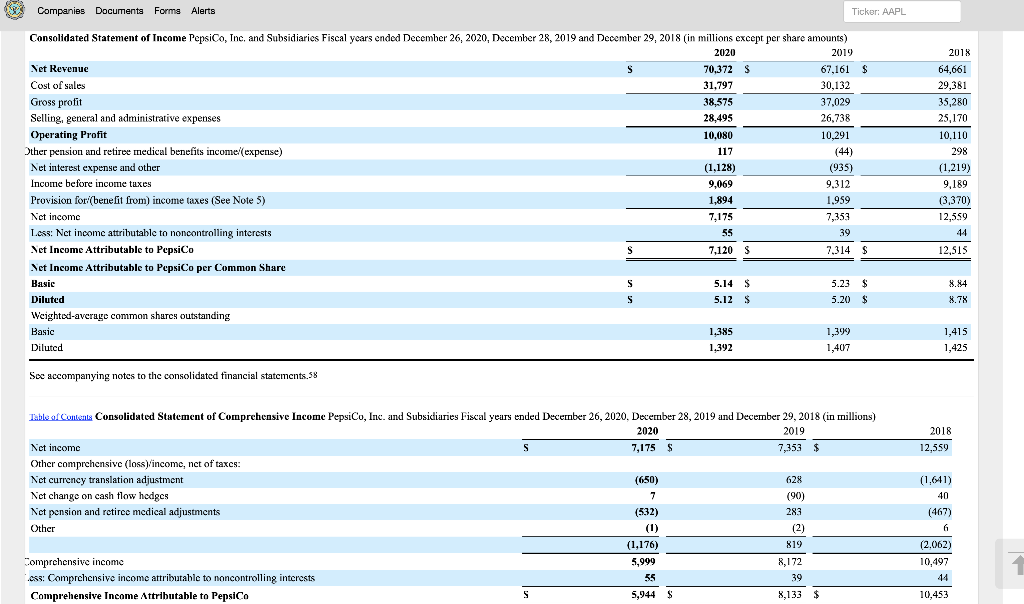

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions except par value) 2020 2019 6,795 $ 1,771 8,566 2,348 3,144 3,266 1,916 19,240 19,273 6,480 1,467 7,947 3,228 3,971 3.379 1,886 20,411 19,025 854 6,075 2,412 10,838 9,266 16,764 736 86,381 812 6,184 2,460 10,777 10,395 17.506 649 87,296 S $ December 31, ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $526 and $524, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized 11,200 shares; issued 7.040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,738 and 2,760 shares, respectively Equity Attributable to Sharcowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity $ 11,145 S 2,183 485 788 14.601 40,125 9,453 1,833 11,312 10,994 4,253 414 26,973 27,516 8.510 2.284 1,760 17.601 66.555 (14,601) (52,016) 19,299 1,985 21,284 87,296 S 1,760 17,154 65,855 (13,544) (52,244) 18,981 2,117 21,098 86,381 $ Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) 2018 $ Year Ended December 31 Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) net Other income (loss) - net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share Diluted Net Income Per Shard Average Shares Outstanding - Basic Effect of dilutive securities Average Shares Outstanding - Diluted 2020 33.014 S 13,433 19,581 9,731 853 8,997 370 1,437 978 841 9,749 1,981 7,768 21 7,747 S 1.80 S 1.79 S 2019 37,266 $ 14,619 22,647 12,103 458 10,086 563 946 1,049 34 10,786 1.801 8,985 65 8,920 $ 2.09 $ 2.07 $ 4,276 38 4.314 34,300 13,067 21,233 11,002 1,079 9,152 689 950 1,008 (1,674) 8.225 1,749 6,476 42 6,434 $ $ 1.51 $ $ 4,295 28 4,323 1.50 4,259 40 4.299 Calculated based on net income attributable to shareowners of The Coca-Cola Company. Refer to Notes to Consolidated Financial Statements. 64 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) 2020 7,768 $ 2019 8,985 $ 2018 6,476 $ Year Ended December 31, Consolidated Net Income Other Comprehensive Income: Net foreign currency translation adjustments Net gains (losses) on derivatives Net change in unrealized gains (losses) on available-for-sale debt securities Net change in pension and other postretirement benefit liabilities Total Comprehensive Income Less: Comprehensive income attributable to noncontrolling interests Total Comprehensive Income Attributable to Shareowners of The Coca-Cola Company (911) 15 (47) (267) 6,558 (132) 74 (54) 18 (159) 8,864 110 (2,035) (7) ( (34) 29 4,429 95 6,690 S 8,754 $ 4.334 Refer to Notes to Consolidated Financial Statements. 65 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY (In millions except per share data) 2020 2019 2018 4.280 22 4.268 33 (21) 4,280 1,760 $ 4.259 48 (39) 4.268 1,760 4,302 1,760 S S 17,154 307 141 (1) 17,601 16.520 433 201 15,864 467 225 (36) 16,520 17,154 65.855 7,747 (7,047) 66,555 63.234 546 8.920 (6.845) 65,855 60.430 3,014 6,434 (6,644) 63,234 Year Ended December 31, Equity Attributable to Shareowners of The Coca-Cola Company Number of Common Shares Outstanding Balance at beginning of year Treasury stock issued to employees related to stock-based compensation plans Purchases of stock for trcasury Balance at end of year Common Stock Capital Surplus Balance at beginning of year Stock issued to employces related to stock-based compensation plans Stock-based compensation expense Other activities Balance at end of year Reinvested Earnings Balance at beginning of year Adoption of accounting standards! Net income attributable to shareowners of The Coca-Cola Company Dividends (per share $1.64, $1.60 and $1.56 in 2020, 2019 and 2018, respectively) Balance at end of year Accumulated Other Comprehensive Income Loss) Balance at beginning of ycar Adoption of accounting standards Net other comprehensive income (loss) Balance at end of year Treasury Stock Balance at beginning of ycar Treasury stock issued to employees related to stock-based compensation plans Purchases of stock for treasury Balance at end of year Total Equity Attributable to Shareowners of The Coca-Cola Company Equity Attributable to Noncontrolling Interests Balance at beginning of year Net income attributable to noncontrolling interests Net foreign currency translation adjustments Dividends paid to noncontrolling interests Acquisition of interests held by noncontrolling owners Contributions by noncontrolling interests Business combinations Other activities Total Equity Attributable to Noncontrolling Interests (13,544) (12.814) (564) (1,057) (10,305) (409) (2.100) (12,814) (166) (14,601) (13,544) (52.244) 228 (51.719) 501 (1,026) (52,244) 18,981 $ (50.677) 704 (1.746) (51,719) 16,981 (52,016) 19,299 $ S $ 2,117 $ 21 (153) (18) 2,077 $ 65 45 (48) (84) 3 59 1,905 42 53 (31) 17 1 101 7 2.077 S 1,985 $ 2,117 $ Refer to Note 1 and Note 5. Refer to Notes to Consolidated Financial Statements. 2020 2019 IK Search TS S 8.185 $ 5.509 1.366 229 8,404 4,172 7,822 3.338 747 874 17.645 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable, net loventories Prepaid expenses and other cument assets Total Current Assets Property. Plant and Equipment, Det Amortizabk Intangible Assets, nct Goodwill Other Indefinite-Lived Intangible Axels Investments in Noncontrolled Affiliates Deferred Income Taxes Other Assets Total Assels 23.001 21,369 1,703 18.757 17.612 2.792 19.305 1,433 15,501 14,610) 2.683 4,372 4.359 3.011 3,312 92,918 $ $ 78.547 S 5 LIABILITIES AND EQUITY Current Linbilities Short-term debt obligations Accounts payable and other cument liabilities Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes 3,780 19.592 23.372 2,921) 17,541 20,461 29,148 4.0191 40,370 4.214 11.340 9.979 63,679 79.366 23 23 Other Liabilities Total Liabilities Commitments and contingencies PepsiCo Common Shareholders' Equity Come on stock, par value 174 per share (authorized 3.600 shares, issued, net of repurchased common stock at par value: 1.380 and 1.391 shares, respectively) Capital in excess of par value Retnined earnings Accumulated other comprehensive loss Repurchased a stick, in excess of par value (487 arxi 476 shares, respectively) Total PepsiCo Common Shareholders' Equity Noncontrolling interests Total Equity CIK/ total Liabilities and Equity 3,910 63,443 (18,476) (38,446) 13,454 98 3.886 61.946 (14,300) (36,769) 14.786 82 14.868 13,552 S 92.918 $ 78,547 Companies Documents Forms Alerts Ticker: AAPL Gross profit Consolidated Statement of Income PepsiCo, Inc, and Subsidiaries Fiscal years ended December 26, 2020, December 28, 2019 and December 29, 2018 (in millions except per share amounts) 2020 2019 Net Revenue S 70,372 $ 67,161 $ $ Cost of sales 31,797 30,132 38,575 37,029 Selling, general and administrative expenses 28,495 26,738 Operating Profit 10,080 10,291 Other pension and retirve medical benefits income (expense) 117 (44) Net interest expense and other * Income before income taxes (1,128) (935) MOLLIS 9,069 9.312 Provision for (benefit from) income taxes (See Note 5) 1,894 1.959 Net income 7,175 7,353 Less: Nct income attributable to noncontrolling interests 55 39 Net Income Attributable to PepsiCo S S 7,120 S 7,314 $ Net Income Attributable to PepsiCo per Common Share Basic S 5.14 S 5.23 $ Diluted S 5.12 $ 5.20 $ Weighted average common shares outstanding Basic 1.385 1,399 Diluted 1.392 1,407 2018 64,661 29,381 35,280 25,170 10.110 298 120 (1,219) 9,189 (3,370) 12,559 44 12,515 8.84 8.78 1,415 1,425 See accompanying notes to the consolidated financial statements. 38 2018 12,559 Table of Contents Consolidated Statement of Comprehensive Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 26, 2020. December 28, 2019 and December 29, 2018 (in millions) 2020 2019 Not income S 7,175 $ 7,353 $ Other comprehensive (loss)/income, nct of taxes: Nct currency translation adjustment (650) 628 Nct change on cash flow hodges 7 (90) Net pension and retiree medical adjustments (532) 283 Other (1) (2) 2 (1,176) 819 Comprehensive income 5,999 8,172 : Comprchensive income attributable to noncontrolling interests 55 39 Comprehensive Income Attributable to PepsiCo S 5,944 $ 8,133 $ (1,641) 40 (467) 6 (2.062) 10,497 1 10,453Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started