Question: Please can you help me solve this question? Renton Tractor Company was formed at the start of 2015 and produces a small garden tractor. The

Please can you help me solve this question?

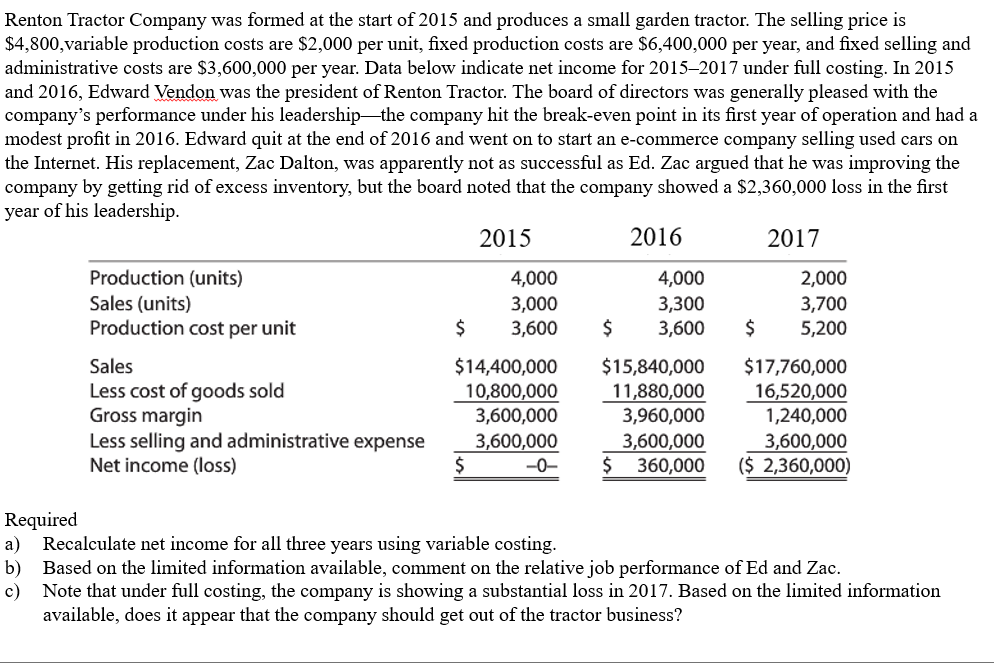

Renton Tractor Company was formed at the start of 2015 and produces a small garden tractor. The selling price is $4,800,variable production costs are $2,000 per unit, fixed production costs are $6,400,000 per year, and fixed selling and administrative costs are $3,600,000 per year. Data below indicate net income for 20152017 under full costing. In 2015 and 2016, Edward Vendon was the president of Renton Tractor. The board of directors was generally pleased with the company's performance under his leadershipthe company hit the break-even point in its first year of operation and had a modest profit in 2016. Edward quit at the end of 2016 and went on to start an e-commerce company selling used cars on the Internet. His replacement, Zac Dalton, was apparently not as successful as Ed. Zac argued that he was improving the company by getting rid of excess inventory, but the board noted that the company showed a $2,360,000 loss in the first year of his leadership. 2015 2016 2017 Production (units) Sales (units) Production cost per unit Sales Less cost of goods sold Gross margin Less selling and administrative expense Net income (loss) 4,000 3,000 $ 3,600 $14,400,000 | 10,800,000 3,600,000 3,600,000 4,000 3,300 $ 3,600 $15,840,000 11,880,000 3,960,000 3,600,000 $ 360,000 2,000 3,700 $ 5,200 $17,760,000 16,520,000 1,240,000 3,600,000 ($ 2,360,000) Required a) Recalculate net income for all three years using variable costing. b) Based on the limited information available, comment on the relative job performance of Ed and Zac. c) Note that under full costing, the company is showing a substantial loss in 2017. Based on the limited information available, does it appear that the company should get out of the tractor business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts