Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can you help me to find leverage ratio earning yield dividend yield parts from this question? provided you with the following information & financial

please can you help me to find leverage ratio earning yield dividend yield parts from this question?

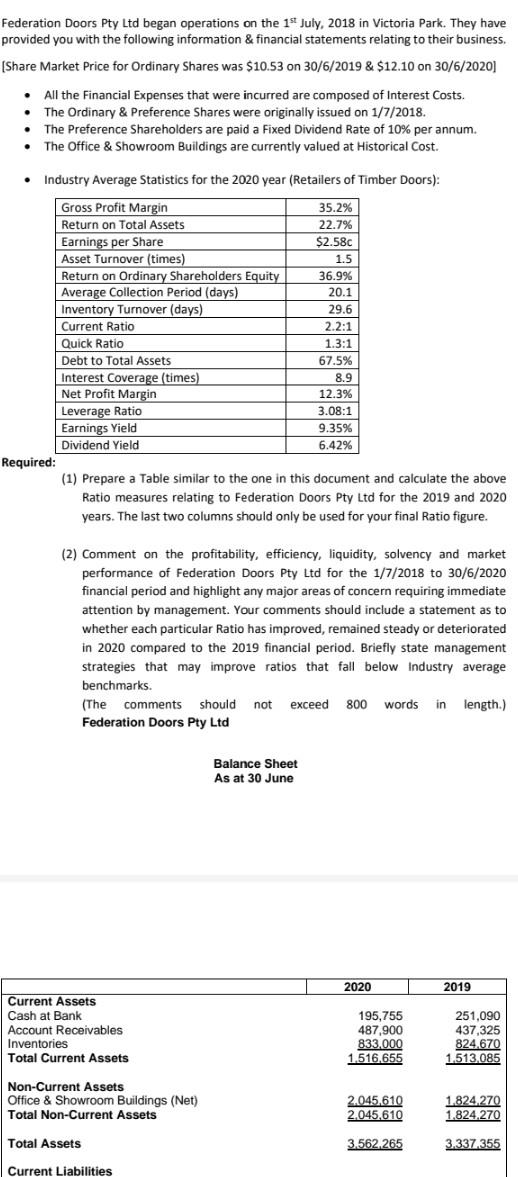

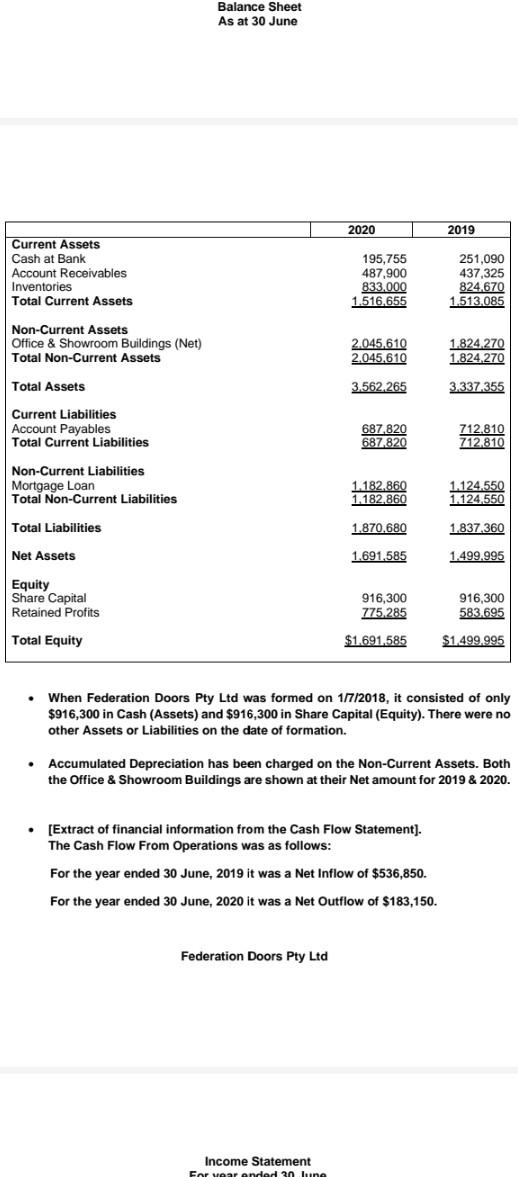

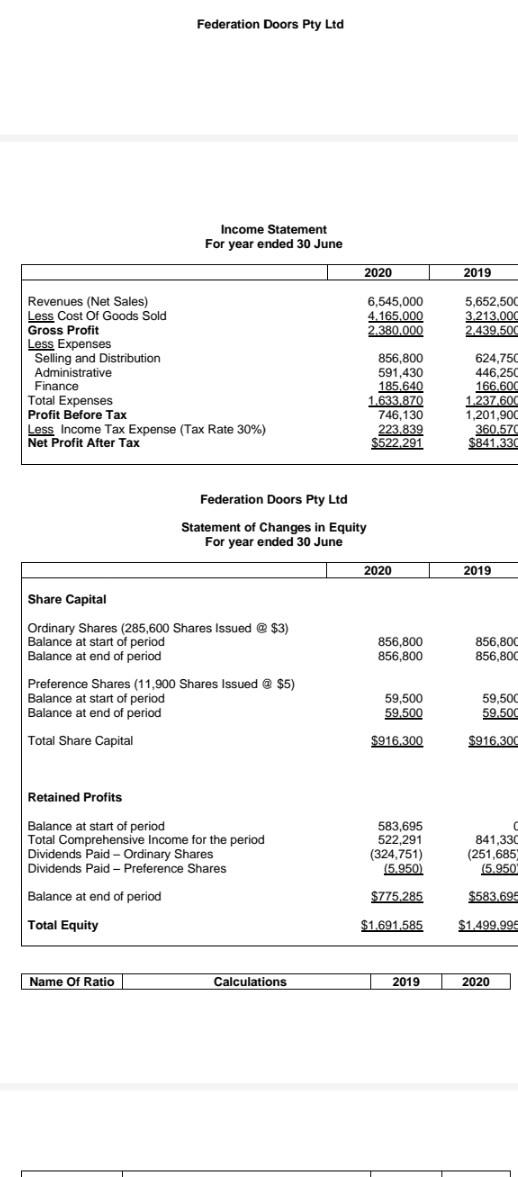

provided you with the following information \& financial statements relating to their business. [Share Market Price for Ordinary Shares was $10.53 on 30/6/2019 \& $12.10 on 30/6/2020] - All the Financial Expenses that were incurred are composed of Interest Costs. - The Ordinary \& Preference Shares were originally issued on 1/7/2018. - The Preference Shareholders are paid a Fixed Dividend Rate of 10% per annum. - The Office \& Showroom Buildings are currently valued at Historical Cost. - Industry Average Statistics for the 2020 year (Retailers of Timber Doors): Required: (1) Prepare a Table similar to the one in this document and calculate the above Ratio measures relating to Federation Doors Pty Ltd for the 2019 and 2020 years. The last two columns should only be used for your final Ratio figure. (2) Comment on the profitability, efficiency, liquidity, solvency and market performance of Federation Doors Pty Ltd for the 1/7/2018 to 30/6/2020 financial period and highlight any major areas of concern requiring immediate attention by management. Your comments should include a statement as to whether each particular Ratio has improved, remained steady or deteriorated in 2020 compared to the 2019 financial period. Briefly state management strategies that may improve ratios that fall below Industry average benchmarks. (The comments should not exceed 800 words in length.) Federation Doors Pty Ltd Income Statement For year ended 30 June Federation Doors Pty Ltd Statement of Changes in Equity For year ended 30 June - When Federation Doors Pty Ltd was formed on 1/7/2018, it consisted of only $916,300 in Cash (Assets) and $916,300 in Share Capital (Equity). There were no other Assets or Liabilities on the date of formation. - Accumulated Depreciation has been charged on the Non-Current Assets. Both the Office \& Showroom Buildings are shown at their Net amount for 2019 \& 2020. - [Extract of financial information from the Cash Flow Statement]. The Cash Flow From Operations was as follows: For the year ended 30 June, 2019 it was a Net Inflow of $536,850. For the year ended 30 June, 2020 it was a Net Outflow of $183,150. Federation Doors Pty LtdStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started