Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you solve these questions quickly Please solved!!!! QUESTION 1 Presented here are cash flows (in $ Millions) for Abu Dhabi Corporation's most recent

Please can you solve these questions quickly

Please solved!!!!

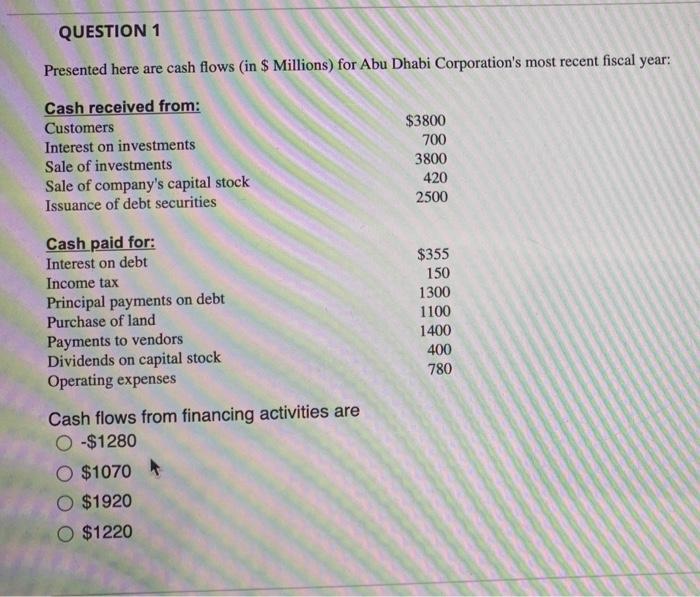

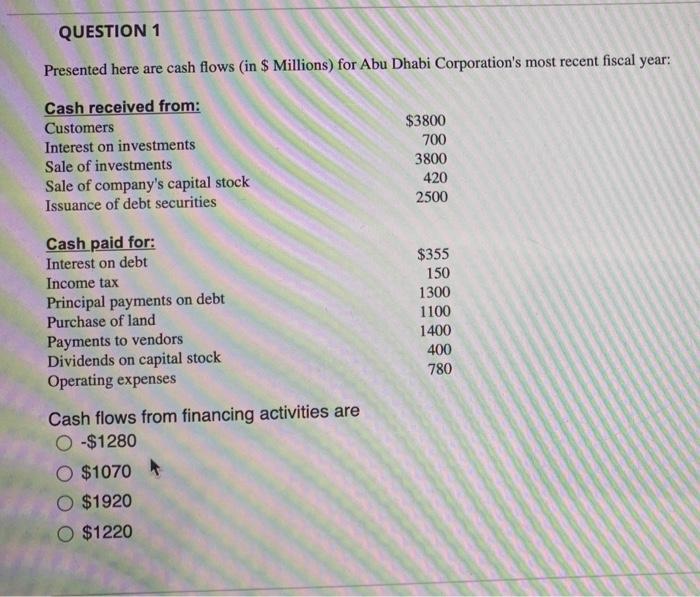

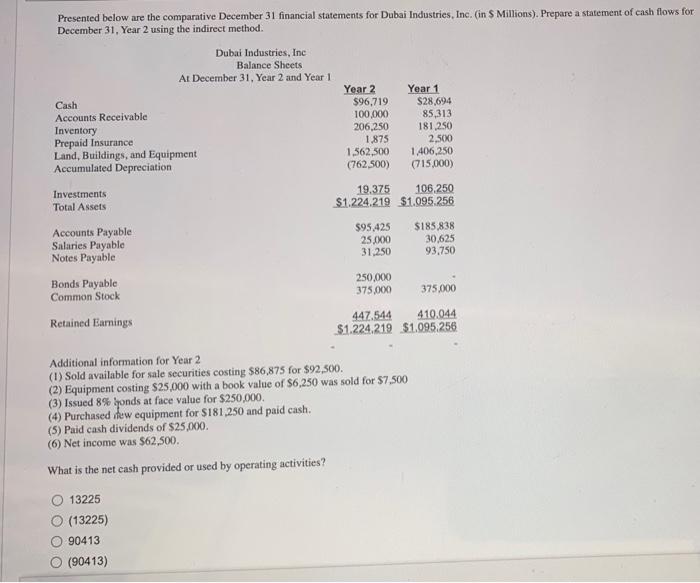

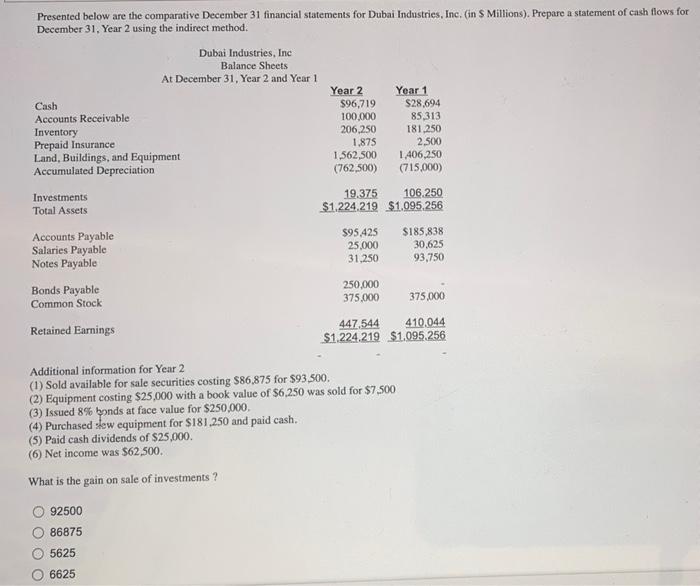

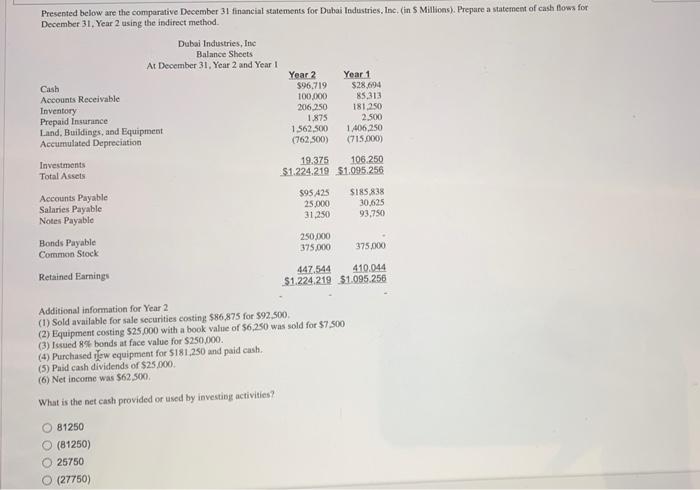

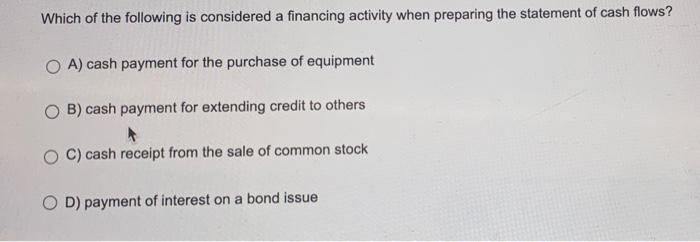

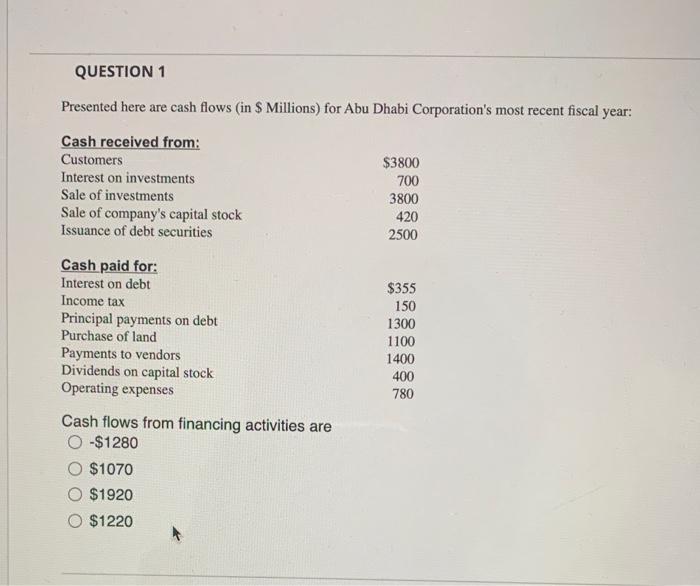

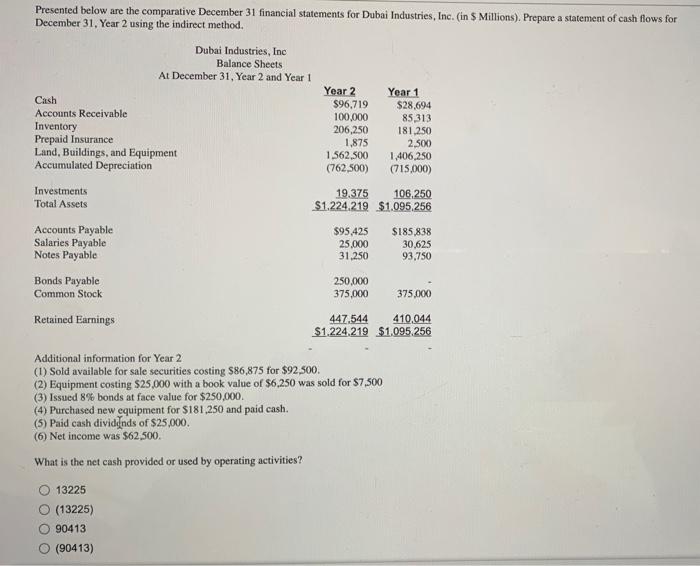

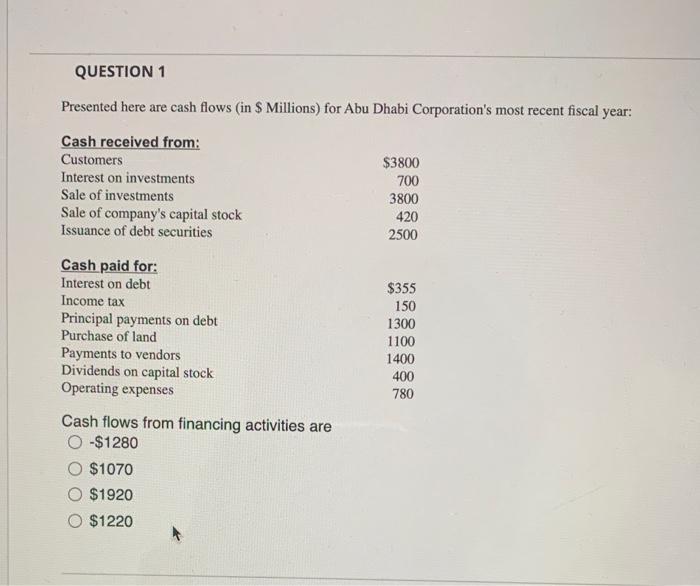

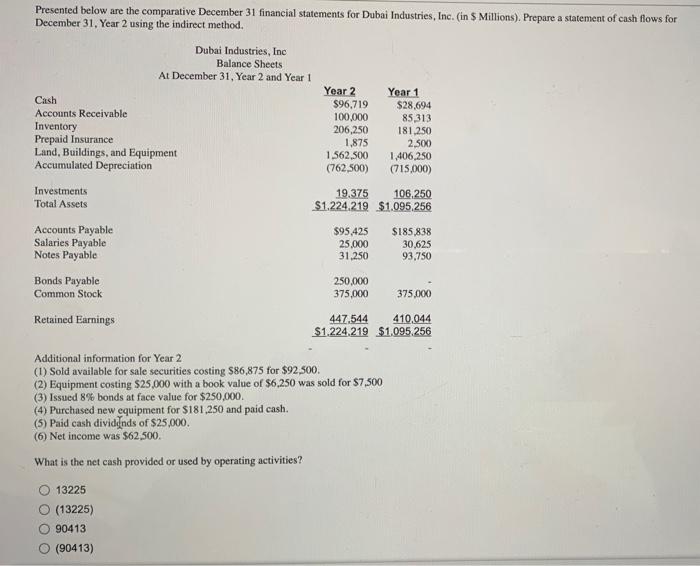

QUESTION 1 Presented here are cash flows (in $ Millions) for Abu Dhabi Corporation's most recent fiscal year: Cash received from: Customers $3800 Interest on investments 700 Sale of investments 3800 Sale of company's capital stock 420 Issuance of debt securities 2500 $355 150 1300 1100 1400 400 780 Cash paid for: Interest on debt Income tax Principal payments on debt Purchase of land Payments to vendors Dividends on capital stock Operating expenses Cash flows from financing activities are 0-$1280 O $1070 O $1920 O $1220 Presented below are the comparative December 31 financial statements for Dubai Industries, Inc. (in Millions). Prepare a statement of cash flows for December 31, Year 2 using the indirect method. Dubai Industries, Inc Balance Sheets At December 31. Year 2 and Year 1 Year 2 Year 1 Cash $96,719 $28,694 Accounts Receivable 100,000 85,313 Inventory 206,250 181,250 Prepaid Insurance 1.875 2,500 Land, Buildings, and Equipment 1.562,500 1.406,250 Accumulated Depreciation (762 500) (715,000) Investments 19.375 106,250 Total Assets $1.224.219 $1.095,256 Accounts Payable Salaries Payable Notes Payable $95.425 25.000 31.250 $185,838 30,625 93.750 Bonds Payable Common Stock 250,000 375.000 375.000 447,544 410.044 $1.224.219 $1.095,256 Retained Earnings Additional information for Year 2 (1) Sold available for sale securities costing S86,875 for $92,500. (2) Equipment costing $25,000 with a book value of $6,250 was sold for $7,500 (3) Issued 8% qonds at face value for $250,000 (4) Purchased few equipment for $181,250 and paid cash. (5) Paid cash dividends of $25,000 (6) Net income was $62,500. What is the net cash provided or used by operating activities? 13225 (13225) 90413 (90413) Presented below are the comparative December 31 financial statements for Dubai Industries, Inc. (in Millions). Prepare a statement of cash flows for December 31, Year 2 using the indirect method. Dubai Industries, Inc Balance Sheets At December 31, Year 2 and Year 1 Year 2 Year 1 Cash $96,719 $28,694 Accounts Receivable 100,000 85,313 Inventory 206,250 181,250 Prepaid Insurance 1.875 2.500 Land, Buildings, and Equipment 1.562,500 1.406,250 Accumulated Depreciation (762,500) (715,000) Investments 19.375 106.250 Total Assets $1.224.219 $1.095,256 Accounts Payable Salaries Payable Notes Payable $95 425 25.000 31,250 $185,838 30.625 93,750 250,000 375.000 375,000 Bonds Payable Common Stock Retained Earnings 447,544 410,044 $1.224.219 $1.095,256 Additional information for Year 2 (1) Sold available for sale securities costing $86,875 for $93.500. (2) Equipment costing $25,000 with a book value of $6,250 was sold for $7.500 (3) Issued 8% bonds at face value for $250,000 (4) Purchased slew equipment for $181.250 and paid cash. (5) Paid cash dividends of $25,000. (6) Net income was $62,500. What is the gain on sale of investments ? 92500 86875 5625 6625 Presented below are the comparative December 31 financial statements for Dubai Industries, Inc. (in Millions). Prepare a statement of cash flows for December 31, Year 2 using the indirect method. Dubai Industries, Inc Balance Sheets At December 31. Year 2 and Year 1 Cash Accounts Receivable Inventory Prepaid Insurance Land, Buildings, and Equipment Accumulated Depreciation Year 2 $96.719 100,000 206,250 1.875 1.562.500 (762,500) Year 1 $28.694 85313 181,250 2.500 1.406,250 (715.000) Investments Total Assets 19.375 106.250 $1.224.219 $1.095,256 $95 425 $185838 25,000 30.625 31,250 93.750 Accounts Payable Salaries Payable Notes Payable Bonds Payable Common Stock 250/00 375.000 375.000 Retained Earnings 447,544 410.044 $1.224.219 $1.095.256 Additional information for Year 2 (1) Sold available for sale securities costing $86,875 for $92,500. (2) Equipment costing $25.000 with a book value of 56,250 was sold for $7.500 (3) Issued 8 bonds at face value for $250,000. (1) Purchased new equipment for $181.250 and paid cash. (5) Paid cash dividends of $25.000 (6) Net income was $62.500 What is the net cash provided or used by investing activities? 81250 (81250) 25750 O (27750) Which of the following is considered a financing activity when preparing the statement of cash flows? O A) cash payment for the purchase of equipment B) cash payment for extending credit to others OC) cash receipt from the sale of common stock OD) payment of interest on a bond issue QUESTION 1 Presented here are cash flows (in Millions) for Abu Dhabi Corporation's most recent fiscal year: Cash received from: Customers Interest on investments Sale of investments Sale of company's capital stock Issuance of debt securities $3800 700 3800 420 2500 Cash paid for: Interest on debt Income tax Principal payments on debt Purchase of land Payments to vendors Dividends on capital stock Operating expenses $355 150 1300 1100 1400 400 780 Cash flows from financing activities are -$1280 $1070 $1920 $1220 Presented below are the comparative December 31 financial statements for Dubai Industries, Inc. (in Millions), Prepare a statement of cash flows for December 31, Year 2 using the indirect method. Dubai Industries, Inc Balance Sheets At December 31, Year 2 and Year 1 Year 2 Year 1 Cash $96,719 $28,694 Accounts Receivable 100,000 85,313 Inventory 206,250 181,250 Prepaid Insurance 1,875 2,500 Land, Buildings, and Equipment 1.562,500 1,406,250 Accumulated Depreciation (762,500) (715,000) Investments 19.375 106,250 Total Assets $1.224.219 $1.095.256 Accounts Payable Salaries Payable Notes Payable $95,425 25.000 31,250 $185,838 30.625 93,750 Bonds Payable 250,000 Common Stock 375,000 375.000 Retained Earnings 447.544 410,044 $1,224.219 $1,095,256 Additional information for Year 2 (1) Sold available for sale securities costing $86,875 for $92,500 (2) Equipment costing $25,000 with a book value of $6,250 was sold for $7,500 (3) Issued 8% bonds at face value for $250,000 (4) Purchased new equipment for $181,250 and paid cash. (5) Paid cash dividends of $25,000. Net income was $62,500 What is the net cash provided or used by operating activities? 13225 (13225) 90413 (90413)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started