Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please check if answers are correct if not please correct them. no explanation required CC6.4 A Company has 3,500 bonds outstanding with 10 years to

please check if answers are correct

if not please correct them.

no explanation required

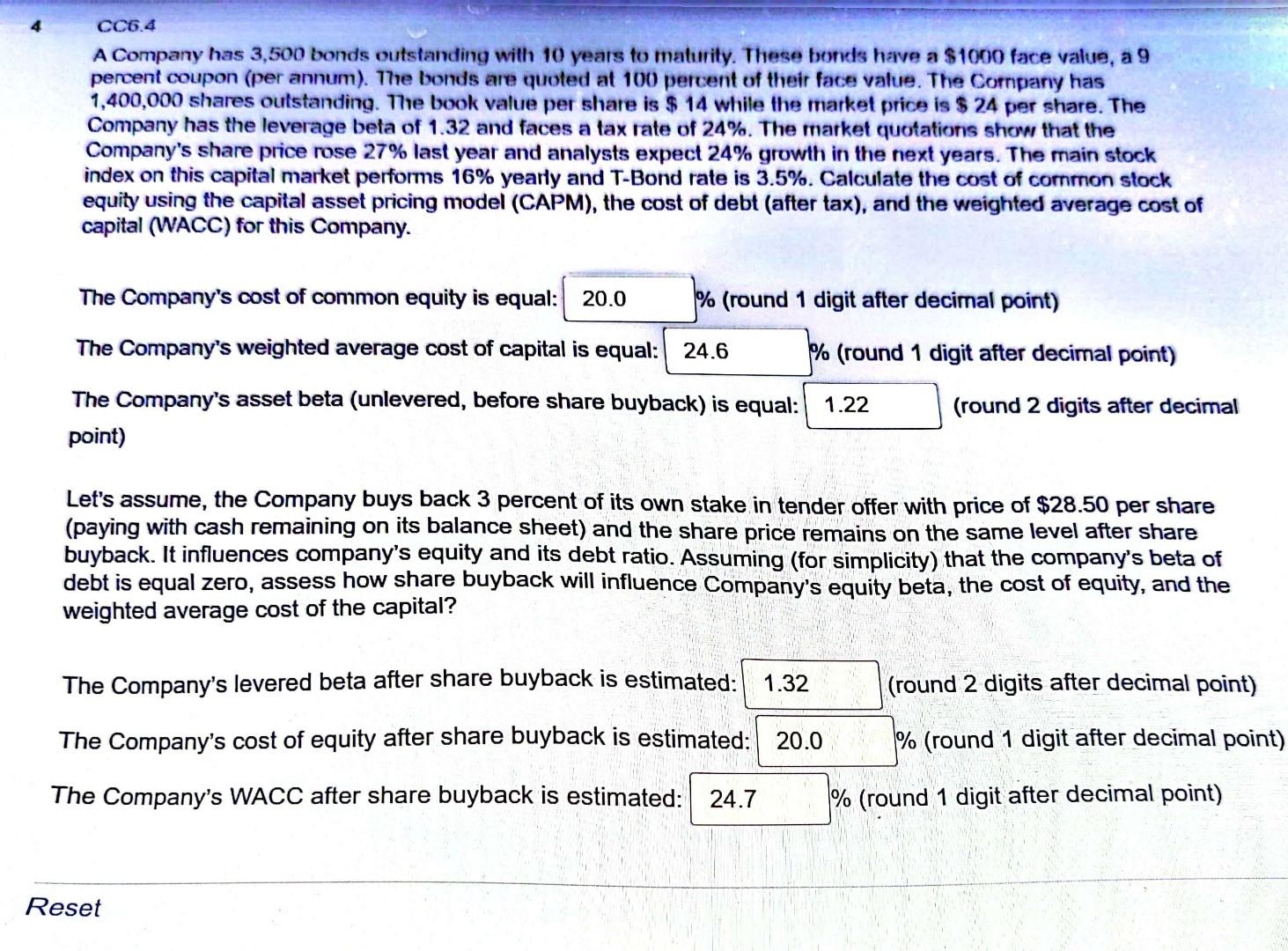

CC6.4 A Company has 3,500 bonds outstanding with 10 years to maturity. These borkds have a $1000 face value, a 9 percent coupon (per annum). The bonds are quoted at 100 percent of their face value. The Cornpary has 1,400,000 shares outstanding. The book value per share is \$ 14 while the market price is $24 per share. The Company has the leverage beta of 1.32 and faces a tax rate of 24%. The market quotations show that the Company's share price rose 27% last year and analysts expect 24% growth in the next years. The main stock index on this capital market performs 16% yearly and T-Bond rate is 3.5%. Calculate the cost of common stock equity using the capital asset pricing model (CAPM), the cost of debt (after tax), and the weighted average cost of capital (WACC) for this Company. The Company's cost of common equity is equal: % (round 1 digit after decimal point) The Company's weighted average cost of capital is equal: The Company's asset beta (unlevered, before share buyback) is equal: point) Let's assume, the Company buys back 3 percent of its own stake in tender offer with price of $28.50 per share (paying with cash remaining on its balance sheet) and the share price remains on the same level after share buyback. It influences company's equity and its debt ratio. Assuming (for simplicity) that the company's beta of debt is equal zero, assess how share buyback will influence Company's equity beta, the cost of equity, and the weighted average cost of the capital? The Company's levered beta after share buyback is estimated: (round 2 digits after decimal point) The Company's cost of equity after share buyback is estimated: % (round 1 digit after decimal poir The Company's WACC after share buyback is estimated: % (round 1 digit after decimal point)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started