Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please check if answers are correct Question 4 5 pts You currently earn $60,000 per year and plan to deposit 10% of your salary in

please check if answers are correct

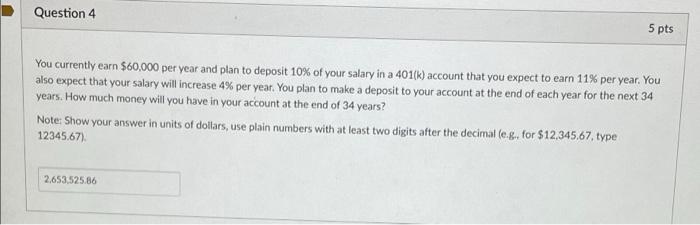

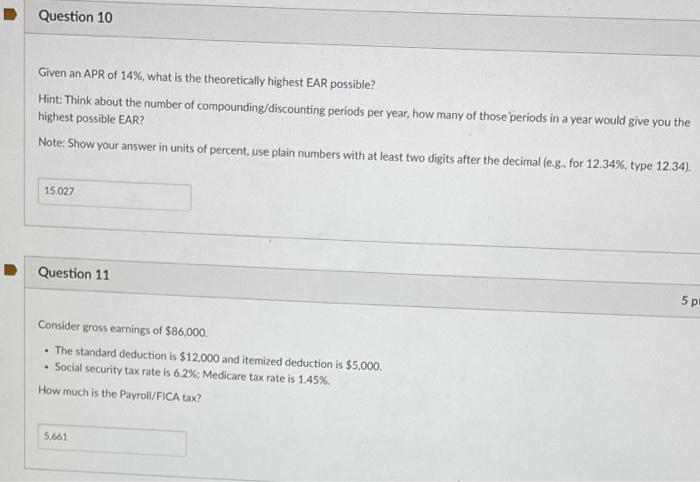

Question 4 5 pts You currently earn $60,000 per year and plan to deposit 10% of your salary in a 401(k) account that you expect to earn 11% per year. You also expect that your salary will increase 4% per year. You plan to make a deposit to your account at the end of each year for the next 34 years. How much money will you have in your account at the end of 34 years? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal leg, for $12,345.67, type 12345.67) 2.653.525.86 Question 10 Given an APR of 14%, what is the theoretically highest EAR possible? Hint: Think about the number of compounding/discounting periods per year, how many of those periods in a year would give you the highest possible EAR? Note: Show your answer in units of percent, use plain numbers with at least two digits after the decimal (e.g. for 12.34%, type 12.34). 15027 Question 11 5 p! Consider gross earnings of $86,000, The standard deduction is $12,000 and itemized deduction is $5,000 Social security tax rate is 6.2%; Medicare tax rate is 1.45%. How much is the Payroll/FICA tax? 5.661

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started