Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please check my all datas. And I dont know how to complete the Net Income and Dividends in twelfth picture. Which picture? Lenny's Lawn Service,

Please check my all datas. And I dont know how to complete the Net Income and Dividends in twelfth picture.

Which picture?

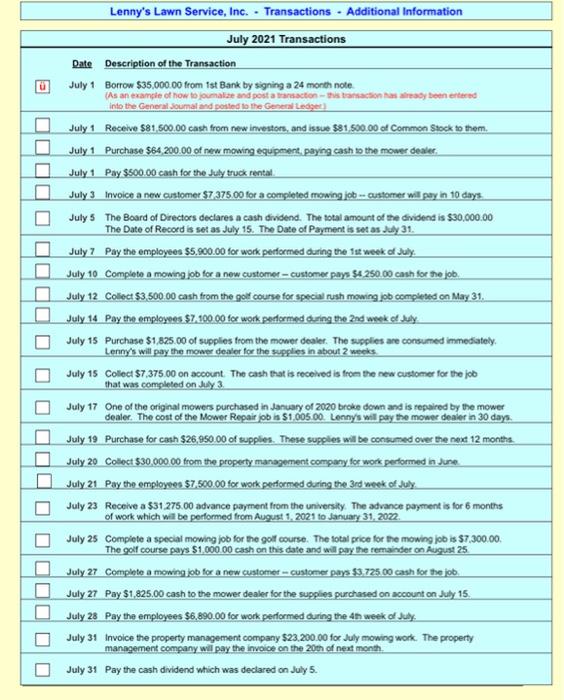

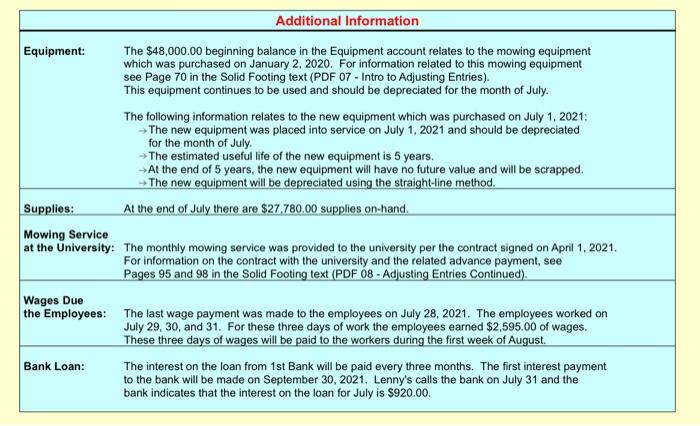

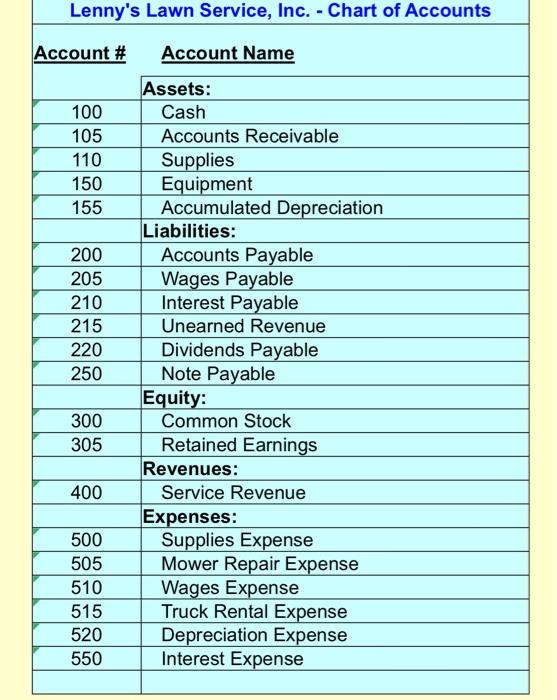

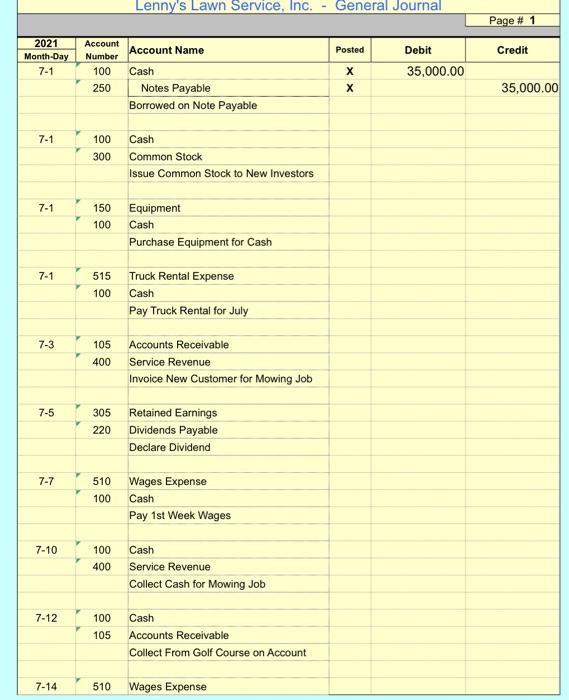

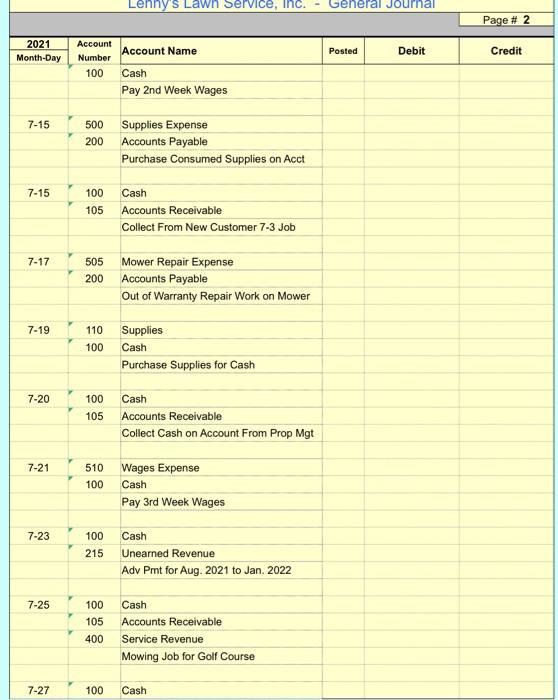

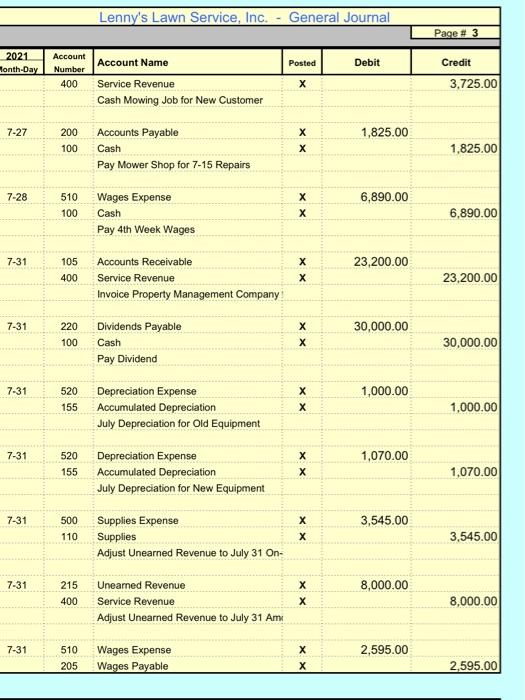

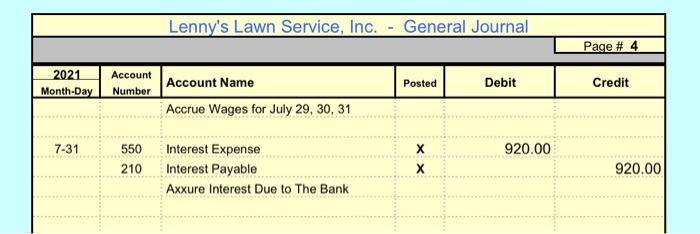

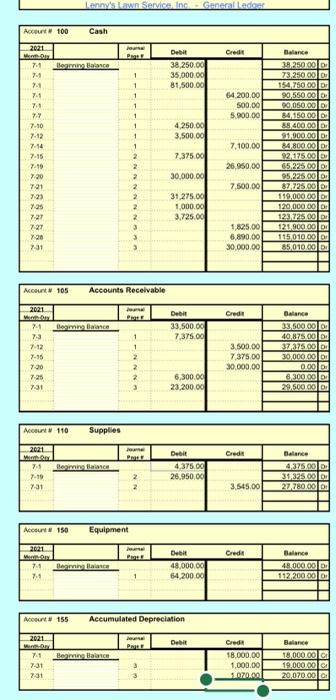

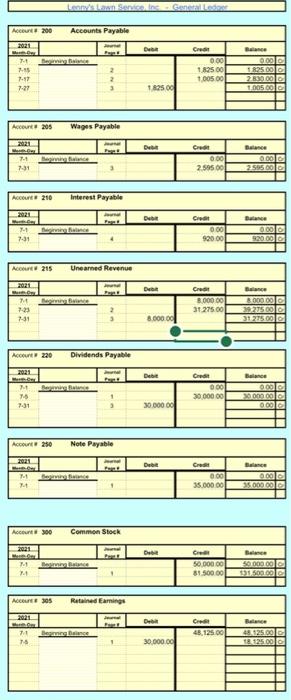

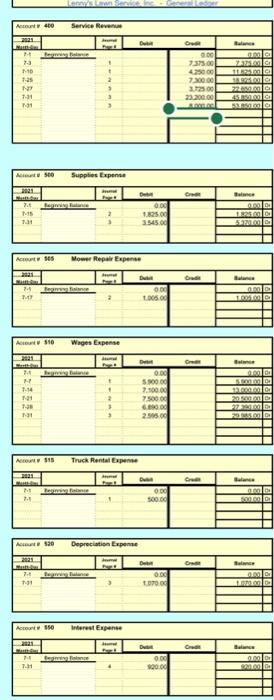

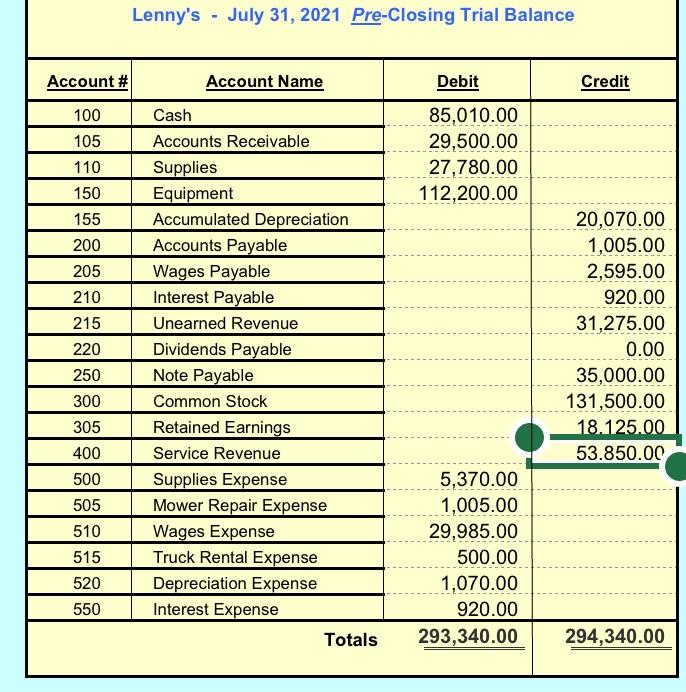

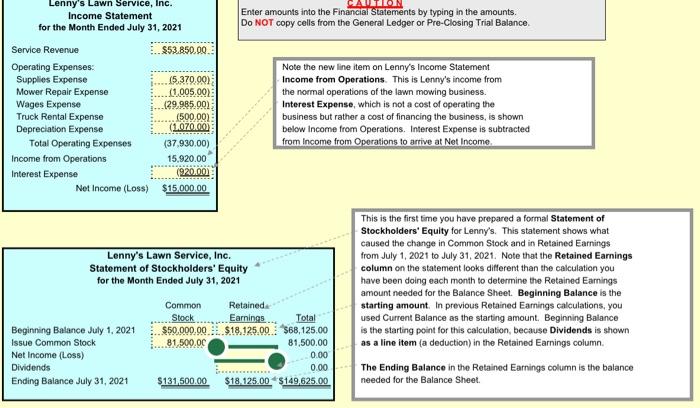

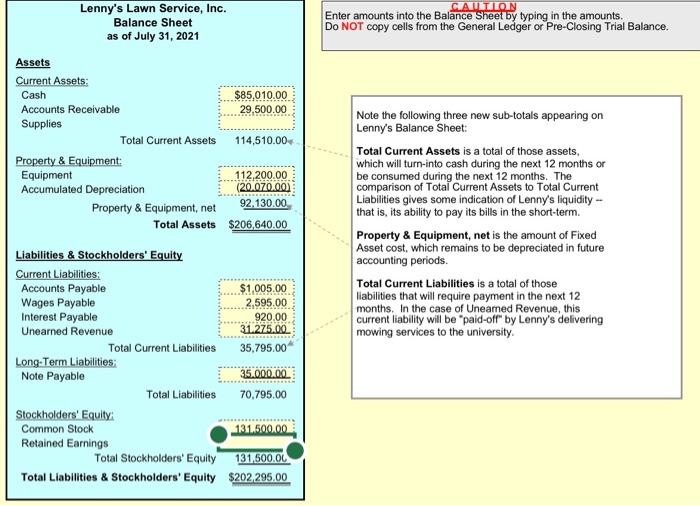

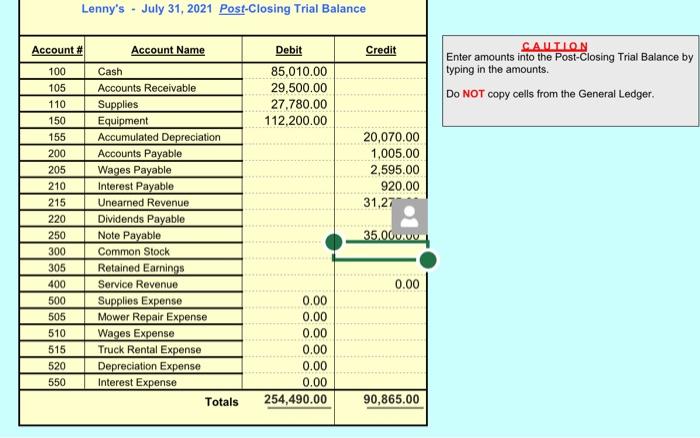

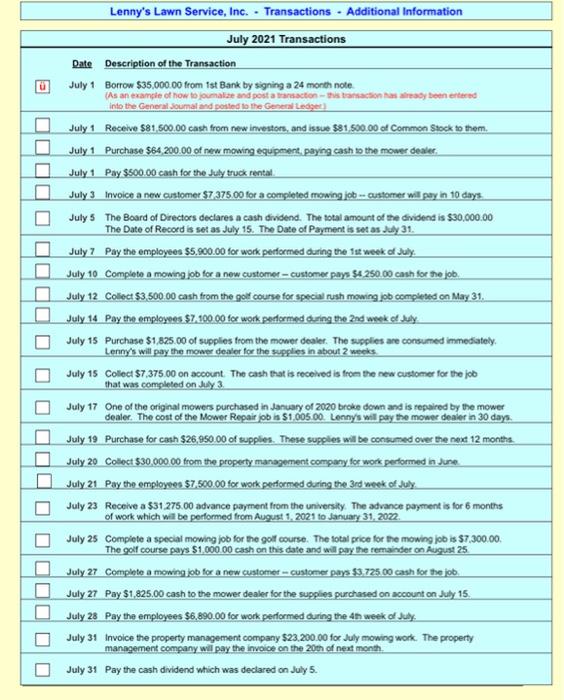

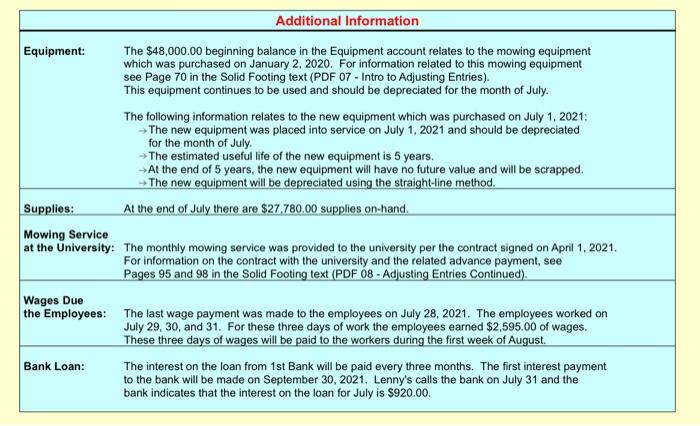

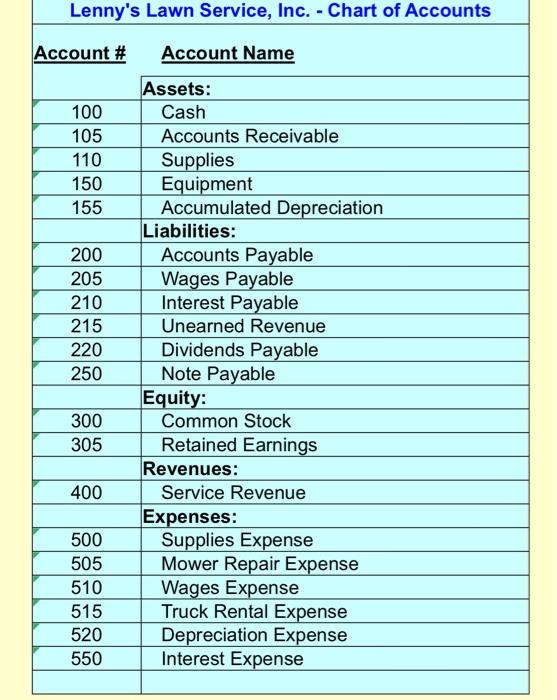

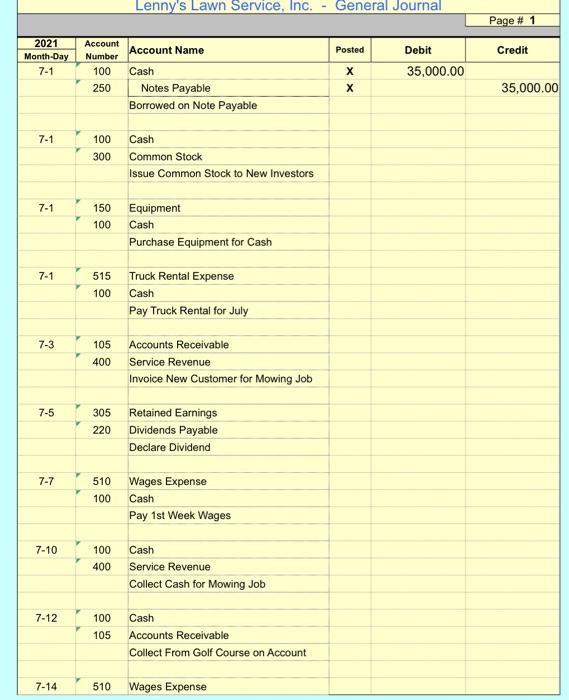

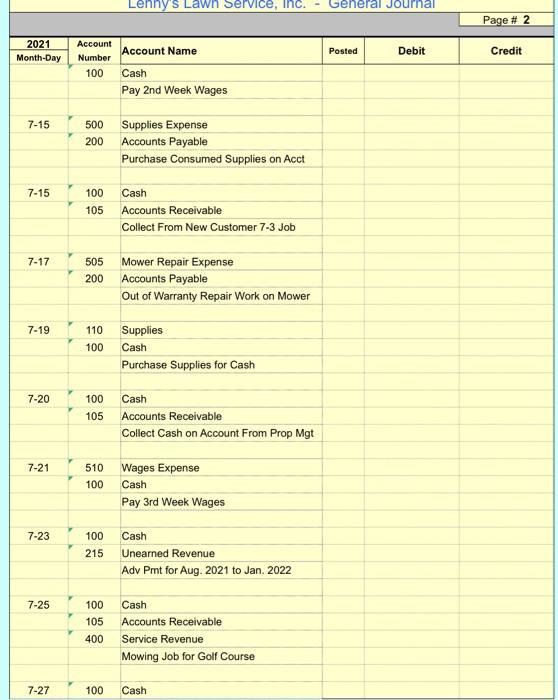

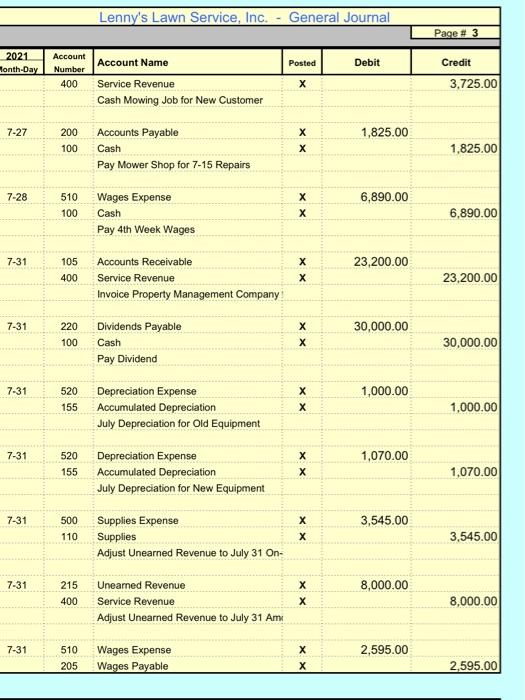

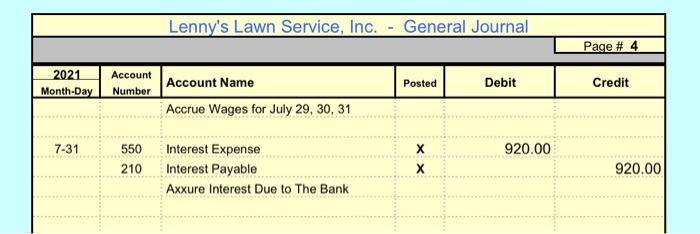

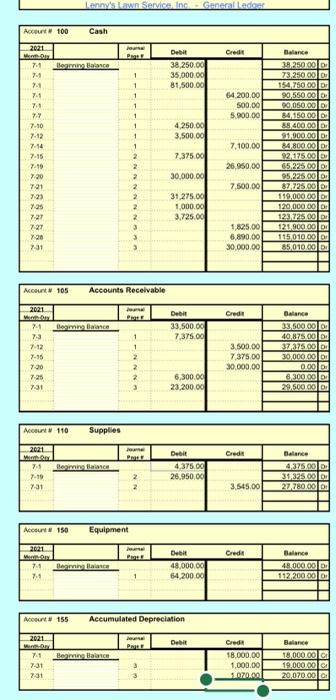

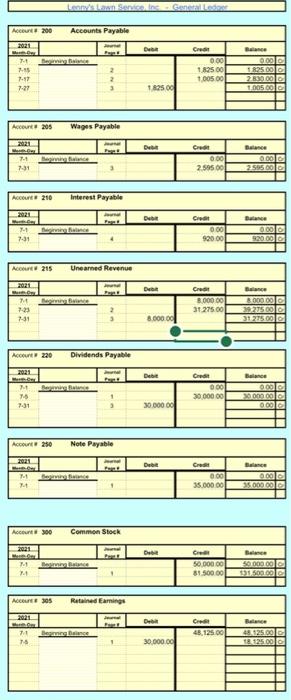

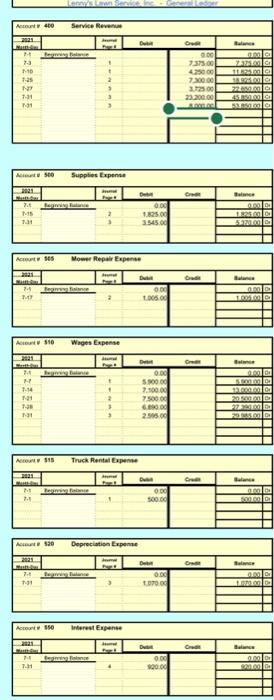

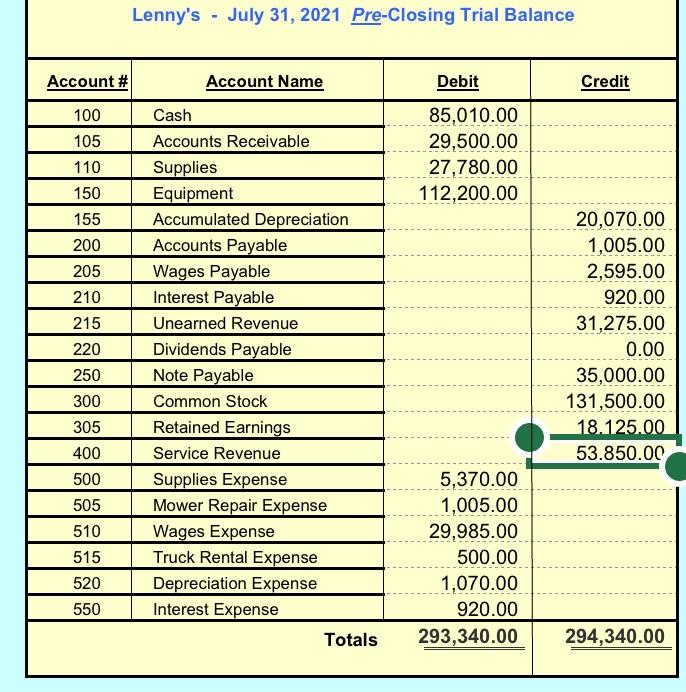

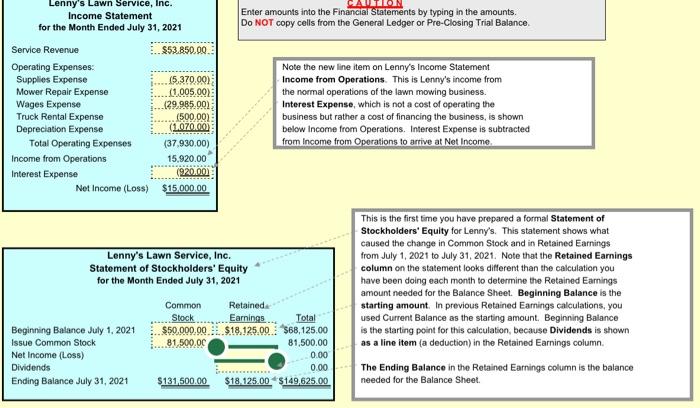

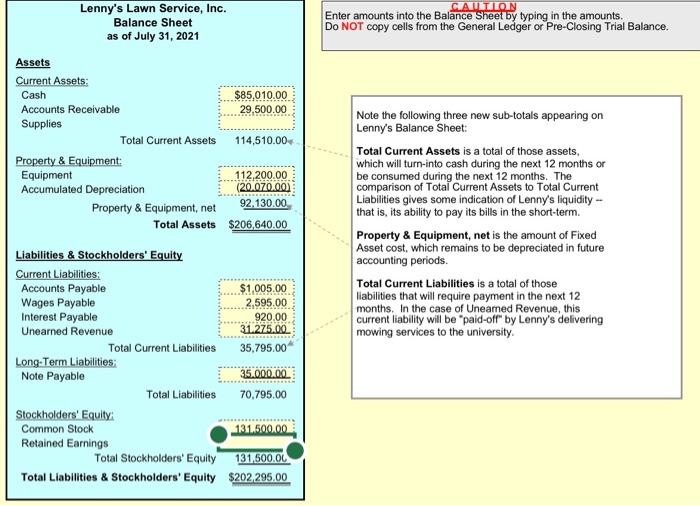

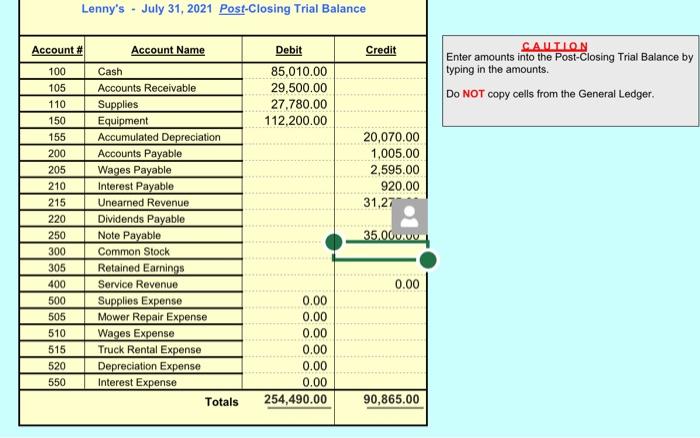

Lenny's Lawn Service, Inc. Transactions - Additional Information July 2021 Transactions Date Description of the Transaction July 1 Borrow $35,000.00 from 1st Bank by signing a 24 month note (As an example of how to journalize and post a transaction-this transaction has already been entered into the General Journal and posted to the General Ledger July 1 Receive $81,500.00 cash from new investors, and issue $81,500.00 of Common Stock to them. July 1 Purchase $64,200.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental July 3 July 5 Invoice a new customer $7.375.00 for a completed mowing job-customer will pay in 10 days. The Board of Directors declares a cash dividend. The total amount of the dividend is $30,000.00 The Date of Record is set as July 15. The Date of Payment is set as July 31. July 7 Pay the employees $5.900.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer-customer pays $4,250.00 cash for the job. July 12 Collect $3,500.00 cash from the golf course for special rush mowing job completed on May 31, July 14 Pay the employees $7,100.00 for work performed during the 2nd week of July July 15 Purchase $1,825.00 of supplies from the mower dealer. The supplies are consumed immediately. Lenny's will pay the mower dealer for the supplies in about 2 weeks July 15 Collect $7.375.00 on account. The cash that is received is from the new customer for the job that was completed on July 3 July 17 One of the original mowers purchased in January of 2020 broke down and is repaired by the mower dealer. The cost of the Mower Repair job is $1.005.00 Lenny's will pay the mower dealer in 30 days. July 19 Purchase for cash $26,950.00 of supplies. These supplies will be consumed over the next 12 months. July 20 Collect $30,000.00 from the property management company for work performed in June Pay the employees $7,500.00 for work performed during the 3rd week of July July 21 July 23 Receive a $31.275.00 advance payment from the university. The advance payment is for 6 months of work which will be performed from August 1, 2021 to January 31, 2022. July 25 Complete a special mowing job for the golf course. The total price for the mowing job is $7,300.00. The golf course pays $1,000.00 cash on this date and will pay the remainder on August 25 July 27 Complete a mowing job for a new customer-customer pays $3,725.00 cash for the job. July 27 Pay $1,825.00 cash to the mower dealer for the supplies purchased on account on July 15. Pay the employees $6,890.00 for work performed during the 4th week of July. July 28 July 31 Invoice the property management company $23,200.00 for July mowing work. The property management company will pay the invoice on the 20th of next month. July 31 Pay the cash dividend which was declared on July 5. Equipment: Supplies: Mowing Service at the University: Wages Due the Employees: Bank Loan: Additional Information The $48,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For information related to this mowing equipment see Page 70 in the Solid Footing text (PDF 07 - Intro to Adjusting Entries). This equipment continues to be used and should be depreciated for the month of July. The following information relates to the new equipment which was purchased on July 1, 2021: The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July. The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment will be depreciated using the straight-line method. At the end of July there are $27,780.00 supplies on-hand. The monthly mowing service was provided to the university per the contract signed on April 1, 2021. For information on the contract with the university and the related advance payment, see Pages 95 and 98 in the Solid Footing text (PDF 08-Adjusting Entries Continued). The last wage payment was made to the employees on July 28, 2021. The employees worked on July 29, 30, and 31. For these three days of work the employees earned $2,595.00 of wages. These three days of wages will be paid to the workers during the first week of August. The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2021. Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $920.00. Lenny's Lawn Service, Inc. - Chart of Accounts Account # Account Name Assets: 100 Cash 105 Accounts Receivable 110 Supplies 150 Equipment 155 Accumulated Depreciation Liabilities: 200 Accounts Payable 205 Wages Payable 210 Interest Payable 215 Unearned Revenue 220 Dividends Payable 250 Note Payable 300 Common Stock 305 Retained Earnings 400 Service Revenue 500 Supplies Expense 505 Mower Repair Expense 510 Wages Expense 515 Truck Rental Expense 520 Depreciation Expense 550 Interest Expense Equity: Revenues: Expenses: Lenny's Lawn Service, Inc. Account 2021 Month-Day Number Account Name 7-1 100 Cash 250 Notes Payable Borrowed on Note Payable 7-1 100 Cash 300 Common Stock Issue Common Stock to New Investors 7-1 150 Equipment 100 Cash Purchase Equipment for Cash 7-1 515 Truck Rental Expense 100 Cash Pay Truck Rental for July 7-3 105 Accounts Receivable 400 Service Revenue Invoice New Customer for Mowing Job 7-5 305 Retained Earnings 220 Dividends Payable Declare Dividend 7-7 510 Wages Expense 100 Cash Pay 1st Week Wages 7-10 100 Cash 400 Service Revenue 7-12 100 105 7-14 510 Wages Expense Collect Cash for Mowing Job Cash Accounts Receivable Collect From Golf Course on Account General Journal Posted Debit X 35,000.00 X Page #1 Credit 35,000.00 Lenny's Lawn Service, Inc. 2021 Account Account Name Month-Day Number 100 Cash Pay 2nd Week Wages 7-15 500 Supplies Expense 200 Accounts Payable Purchase Consumed Supplies on Acct 7-15 100 Cash 105 Accounts Receivable Collect From New Customer 7-3 Job 7-17 505 Mower Repair Expense 200 Accounts Payable Out of Warranty Repair Work on Mower 7-19 110 Supplies 100 Cash Purchase Supplies for Cash 7-20 100 Cash 105 Accounts Receivable Collect Cash on Account From Prop Mgt 510 Wages Expense 100 Cash Pay 3rd Week Wages 100 Cash 215 Unearned Revenue Adv Pmt for Aug. 2021 to Jan. 2022 100 Cash 105 Accounts Receivable 400 Service Revenue Mowing Job for Golf Course 100 Cash 7-21 7-23 7-25 7-27 General Jou Posted Debit Page # 2 Credit Lenny's Lawn Service, Inc. - General Journal 2021 Account Month-Day Number Account Name Posted Debit 400 Service Revenue X Cash Mowing Job for New Customer 7-27 200 Accounts Payable X 100 Cash X Pay Mower Shop for 7-15 Repairs 7-28 510 Wages Expense 100 Cash Pay 4th Week Wages 7-31 105 Accounts Receivable 400 Service Revenue Invoice Property Management Company 7-31 220 Dividends Payable 100 Cash Pay Dividend 7-31 520 Depreciation Expense 155 Accumulated Depreciation July Depreciation for Old Equipment 7-31 520 Depreciation Expense 155 Accumulated Depreciation July Depreciation for New Equipment 7-31 500 Supplies Expense 110 Supplies Adjust Unearned Revenue to July 31 On- 7-31 215 Unearned Revenue 400 Service Revenue Adjust Unearned Revenue to July 31 Am 7-31 510 Wages Expense 205 Wages Payable x x XX X X X xx X X xx XX X xx X X X X x x xx X X X 1,825.00 6,890.00 23,200.00 30,000.00 1,000.00 1,070.00 3,545.00 8,000.00 2,595.00 Page # 3 Credit 3,725.00 1,825.00 6,890.00 23,200.00 30,000.00 1,000.00 1,070.00 3,545.00 8,000.00 2,595.00 2021 Account Month-Day Number 7-31 550 210 Lenny's Lawn Service, Inc. - General Journal Account Name Posted Debit Accrue Wages for July 29, 30, 31 Interest Expense X Interest Payable X Axxure Interest Due to The Bank 920.00 Page # 4 Credit 920.00 Lenny's Lawn Service, Inc. General Ledger Cash Credit POOLE Debit 38,250.00 7-1 Begring Balance 7-1 1 35,000.00 7-1 81,500.00 7-41 64,200.00 7-1 500.00 7-7 5.900.00 7-10 4,250.00 7-12 3,500.00 7-14 7,100.00 7-15 7,375.00 7-19 26,950.00 7:20 30,000.00 7:21 7.500.00 7:23 31,275.00 7.25 1,000.00 7-27 3,725.00 7-27 1,825.00 7:28 6,890.00 7-31 30,000.00 Account # 105 2021 Went Dry Credit 7-1 7-3 7-12 7-15 7-20 7:25 7.-31 Account 110 2021 Men Da 7-1 7-19 7-31 Account #150 2021 Met-Ory 7-1 Beginning Balance 7-1 1 Account # 155 Accumulated Depreciation 2021 Ja Debit Wirth Day POILE 7-1 Beginning Balance 7-31 3 7:31 3 Account# 100 2021 Mere Dy Beginning Balance Supplies 1 2 2 2 2 2 2 2 3 3 Accounts Receivable band Prot 1 1 2 2 2 3 Beginning Balance 1 1 1 1 Equipment J 1 1 Jone Prat 2 2 Debit 33,500.00 7,375.00 6,300.00 23,200.00 Debit 4,375.00 26,950.00 Debit 48,000.00 64,200.00 3,500.00 7.375.00 30,000,00 Credit 3,545.00 Credit Credit 18,000.00 1,000.00 1.070.00 Balance 38,250.00 D 73,250.00 D 154,750.00 D 90,550.00 Dr 90,050.00 D 84,150.00 D 88,400.00 Dr 91,900.00 Dr 84,800.00 Dr 92,175.00 D 65,225.00 D 95,225.00 D 87,725.00 D 119,000.00 D 120,000.00 Dr 123.725.00 D 121,900.00 D 115,010 00 Dr 85,010.00 Dr Balance 33,500.00 Dr 40,875.00 Dr 37,375.00 Dr 30,000.00 D 0.00 D 6,300.00 D 29.500.00 D Balarce 4,375.00 D 31,325 00 D 27,780.00 Dr Balance 48,000.00 Dr 112,200 00 Dr Balance 18,000.00 Cr 19,000.00 or 20,070.00 C Lenny's Lawn Service, Inc - General Ledger Account 200 Accounts Payable 2021 Mut. Der Debi Credit 7-4 7-15 7-17 7-27 Account 205 Wages Payable 2021 Mo 74 7-31 Account# 210 Interest Payable 2021 7-1 Beginning Balance 7-31 Accu 215 Unearned Revenue March Day M 7-23 7-31 Account# 220 Dividends Payable Mermer M 76 7:31 Account# 250 Note Payable 2021 Must-ap M Begiving france 1 Account# 300 Common Stock 2021 And MO Post M4 Bering Balance 24 Accu 305 Retained Earnings 2021 Begining Balance 71 76 1 1,825,00 Debi DVD De 8.000.00 Debit 30,000 00 Debit Debi 30,000.00 0.00 1.825.00 1,005.00 Credit 0.00 2.595.00 Credit 0.00 920.00 Cred 8.00000 31.275.00 Credit 0.00 30,000 00 Credit 0.00 35.000.00 Cred 50,000.00 81.500.00 Credit 48,125.00 Balance 0.00 1.825.000 2.830.000 1.005.00 Balance 2.595.00 Balance 0.00 0 0.00 920.00 Balance 8.000 000 39.275.00 31.275.00 Balance 0.00 30 000 00 0.00 Balance 0.00 35.000 00 Balance 50.000.00 131.500.00 Balance 48,125.00 18.125.00 Account 400 Service Revenue 2021 Mundia M 73 7-25 N7 7.-31 7.-31 A 500 2021 7. M5 731 Account 505 7.4 Begr fiance 147 D "Velt" RADIC A $10 2021 Muthba 24 H 7-14 7:01 7.-28 7:31 Account $15 2021 MAURICE Lenny's Lawn Service Inc Dub Muth- M 7-1 Account 520 2021 Muthia 7. 7:31 Account $50 731 Beginning balance Supplies Expense Mower Repair Expense Hund Wages Expense Beging face Regoving fabance 3 Truck Rental Expense 1 Begining Balance 1 2 3 Begreng Balance Depreciation Expense 3 Interest Expense J 0.00 1.825.00 3.545.00 0.00 1.005.00 D 0.00 5.900.00 7.100.00 7.500 00 6.890.00 2.500.00 Ov 0:00 500.00 Deb 0.00 1,070.00 Dv 0.00 $20.00 Crest 0:00 7.375.00 4.250 00 7.300.00 3.725 00 23,200.00 8.000.00 Cre Cra Crest Cred 0.00 7.375.00 11.825.00 18.925.00 72 850 00 45.850.00 53.850.00 Balance 1.825.00 5.320.00 Balance 0.00 1.005.00 Balance 0.0000 5.000.000 13.000.000 20 500 00 27.290.00 2004500 Balance 0.00 0 0.00 500.000 Balance 0.00 1.000.00 Balance 0.00 922.00 Account # 100 105 110 150 155 200 205 210 215 220 250 300 305 400 500 505 510 515 520 550 Lenny's July 31, 2021 Pre-Closing Trial Balance - Account Name Debit Cash 85,010.00 Accounts Receivable 29,500.00 Supplies 27,780.00 Equipment 112,200.00 Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Unearned Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense 5,370.00 Mower Repair Expense 1,005.00 Wages Expense 29,985.00 Truck Rental Expense 500.00 Depreciation Expense 1,070.00 Interest Expense 920.00 293,340.00 Totals Credit 20,070.00 1,005.00 2,595.00 920.00 31,275.00 0.00 35,000.00 131,500.00 18.125.00 53.850.00 294,340.00 Lenny's Lawn Service, Inc. Income Statement for the Month Ended July 31, 2021 Service Revenue Operating Expenses: Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Income from Operations Interest Expense Beginning Balance July 1, 2021 Issue Common Stock Net Income (Loss) Dividends Ending Balance July 31, 2021 $53.850.00. (5.370,00) (1.005.00): (29.985.00) (500,00) (1.070.00) (37,930.00) 15,920.00 (920.00) Net Income (Loss) $15.000.00 Lenny's Lawn Service, Inc. Statement of Stockholders' Equity for the Month Ended July 31, 2021 Retained Common Stock Earnings Total $18.125.00 $68,125.00 $50,000.00 81,500,00 81,500.00 0.00 0.00 $131,500.00 $18,125.00 $149,625.00 Enter amounts into the Financial Statements by typing in the amounts. Do NOT copy cells from the General Ledger or Pre-Closing Trial Balance. Note the new line item on Lenny's Income Statement Income from Operations. This is Lenny's income from the normal operations of the lawn mowing business. Interest Expense, which is not a cost of operating the business but rather a cost of financing the business, is shown below Income from Operations. Interest Expense is subtracted from Income from Operations to arrive at Net Income. Total Operating Expenses This is the first time you have prepared a formal Statement of Stockholders' Equity for Lenny's. This statement shows what caused the change in Common Stock and in Retained Earnings from July 1, 2021 to July 31, 2021. Note that the Retained Earnings column on the statement looks different than the calculation you have been doing each month to determine the Retained Earnings amount needed for the Balance Sheet. Beginning Balance is the starting amount. In previous Retained Earnings calculations, you used Current Balance as the starting amount. Beginning Balance is the starting point for this calculation, because Dividends is shown as a line item (a deduction) in the Retained Earnings column. The Ending Balance in the Retained Earnings column is the balance needed for the Balance Sheet. Lenny's Lawn Service, Inc. Balance Sheet as of July 31, 2021 Total Current Assets Property & Equipment, net Total Assets Assets Current Assets: Cash $85,010.00 29,500.00 Accounts Receivable Supplies 114,510.00 Property & Equipment: Equipment Accumulated Depreciation 112,200.00 (20.070.00) 92,130.00 $206,640.00 Liabilities & Stockholders' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable $1,005.00 2,595.00 920.00 31.275.00 35,795.00 Unearned Revenue Total Current Liabilities Long-Term Liabilities: Note Payable 35.000.00 Total Liabilities 70,795.00 Stockholders' Equity: Common Stock 131.500.00 Retained Earnings Total Stockholders' Equity 131.500.00 Total Liabilities & Stockholders' Equity $202,295.00 CAUTION Enter amounts into the Balance Sheet by typing in the amounts. Do NOT copy cells from the General Ledger or Pre-Closing Trial Balance. Note the following three new sub-totals appearing on Lenny's Balance Sheet: Total Current Assets is a total of those assets, which will turn-into cash during the next 12 months or be consumed during the next 12 months. The comparison of Total Current Assets to Total Current Liabilities gives some indication of Lenny's liquidity -- that is, its ability to pay its bills in the short-term. Property & Equipment, net is the amount of Fixed Asset cost, which remains to be depreciated in future accounting periods. Total Current Liabilities is a total of those liabilities that will require payment in the next 12 months. In the case of Unearned Revenue, this current liability will be "paid-off" by Lenny's delivering mowing services to the university. Lenny's July 31, 2021 Post-Closing Trial Balance Account Name Debit Cash 85,010.00 Accounts Receivable 29,500.00 Supplies 27,780.00 Equipment 112,200.00 Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Unearned Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense Account # 100 105 110 150 155 200 205 210 215 220 250 300 305 400 500 505 510 515 520 550 Totals 0.00 0.00 0.00 0.00 0.00 0.00 254,490.00 Credit 20,070.00 1,005.00 2,595.00 920.00 31,27 35.000 0.00 90,865.00 CAUTION Enter amounts into the Post-Closing Trial Balance by typing in the amounts. Do NOT copy cells from the General Ledger Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started