please check my answers for any errors, thank you.

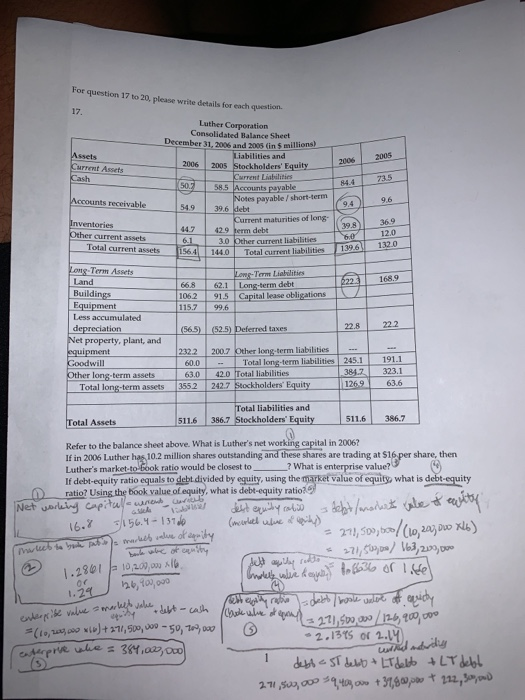

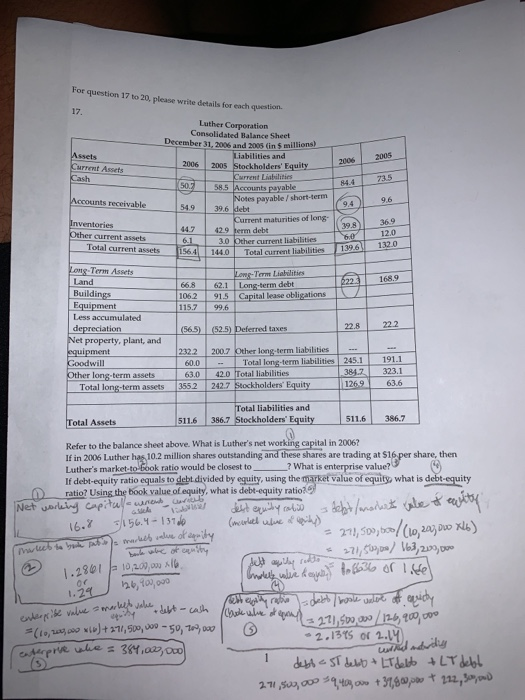

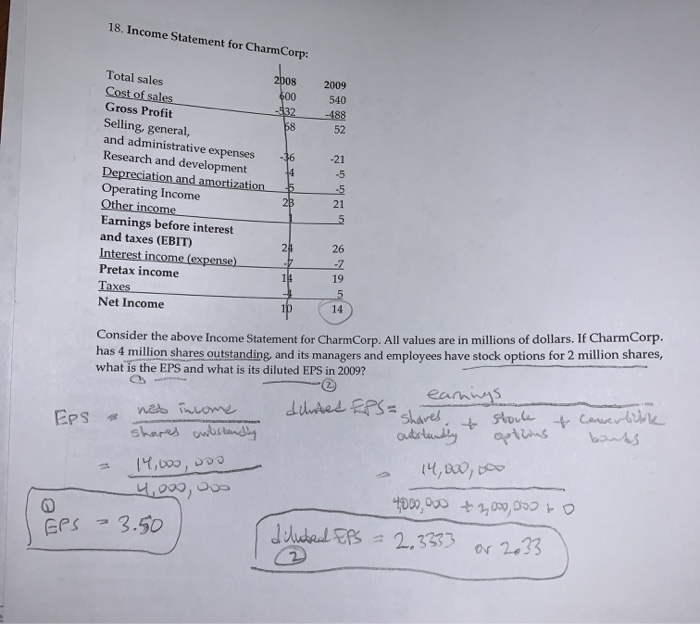

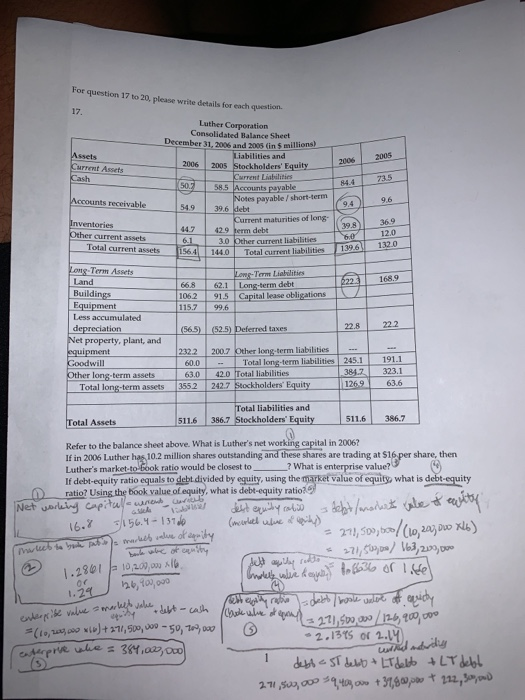

For question 17 to 20, please write details for each question. 2006 2005 73.5 Luther Corporation Consolidated Balance Sheet December 31, 2015 and 2005 in 5 millions) Assets Liabilities and 2006 2005 Stockholders' Equity Current Assets Current Liabilities Cash 503 58.5 Accounts payable Notes payable / short-term Accounts receivable 549 39.6 Webt Current maturities of long- Inventories 447 42.9 term debt Other current assets 16. 1 3 0 Other current liabilities Total current assets 1564 140 Total current liabilities 9.6 398 36.9 ther current liabilities Total current liabilities 6.0 139.6 120 1320 156.4 144.0 13.6 622 168.9 668 1062 115.7 Lowr-Term Liabilities Long-term debt Capital lease obligations 62.1 915 99.6 Long-Term Assets Land Buildings Equipment Less accumulated depreciation Net property, plant, and equipment Goodwill Other long-term assets Total long-term assets (56.5) (525) Deferred taxes 22.8 222 232.2 60.0 63.0 355 2 2007 Other long term liabilities Total long-term liabilities 42.0 Total liabilities 242.7 Stockholders' Equity 245.1 384.2 | 126 9 191.1 323.1 6 3.6 Total liabilities and 386.7 Stockholders' Equity Total Assets 511.6 511,6 386.7 market value of equity Thirteet to book latin 271,54900 / 163,200,000 Refer to the balance sheet above. What is Luther's net working capital in 2006? If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market to book ratio would be closest to _ _? What is enterprise value? If debt-equity ratio equals to debt divided by equity, using the market value of equity, what is debt-equity ratio? Using the book value of equity, what is debt-equity ratio) Net working capitayawe brises dest equity ratio debt/market vale & wry. 16.8 /156.4-13700 (incerbeel where of quity) = 271,500, bool(10,203, 0w xls) I boule who of equity 1.2861 10,200,000 lb Coolely we have to 636 ore enterpride value value market vake debt - cash debo book value of equity pastelysily ratio debt-cath Chalve o 221.500.000 12-6,909, ve (10, 000 ) +271,500,000 - 50, 700,000 -2.1345 of 2.14. enterprise whice = 384,000,000 wild marity I debt est debt + LT delt +LT debb 271,503,000 39403.00 +39,800 p + 112,3 Geht agits rette 1.29 226,900,000 18. Income Statement for CharmCorp: 2008 2009 540 -488 -532 Total sales Cost of sales Gross Profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating Income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net Income Consider the above Income Statement for CharmCorp. All values are in millions of dollars. If Charmcorp. has 4 million shares outstanding, and its managers and employees have stock options for 2 million shares, what is the EPS and what is its diluted EPS in 2009? earnings Eps Web income danted afs=shares stochet comersible shares outstandig outstundly grilius bonds. = 14,000,000 14,B2,Boo 4,000,ooo 4800,000 3,000,350 bo EPS 3.50 [ diluted Efs = 2.3333 or 2033) 2