Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please check my work for me and if any of it is incorrect please fix it for me ? Also help me do the ones

Please check my work for me and if any of it is incorrect please fix it for me ? Also help me do the ones I don't understand so I can study them. Thank you :) Please make it easy to read.

Worksheet, journalizing and posting adjusting and closing entries, and the postclosing trial balance. LO 6-1, 6-2

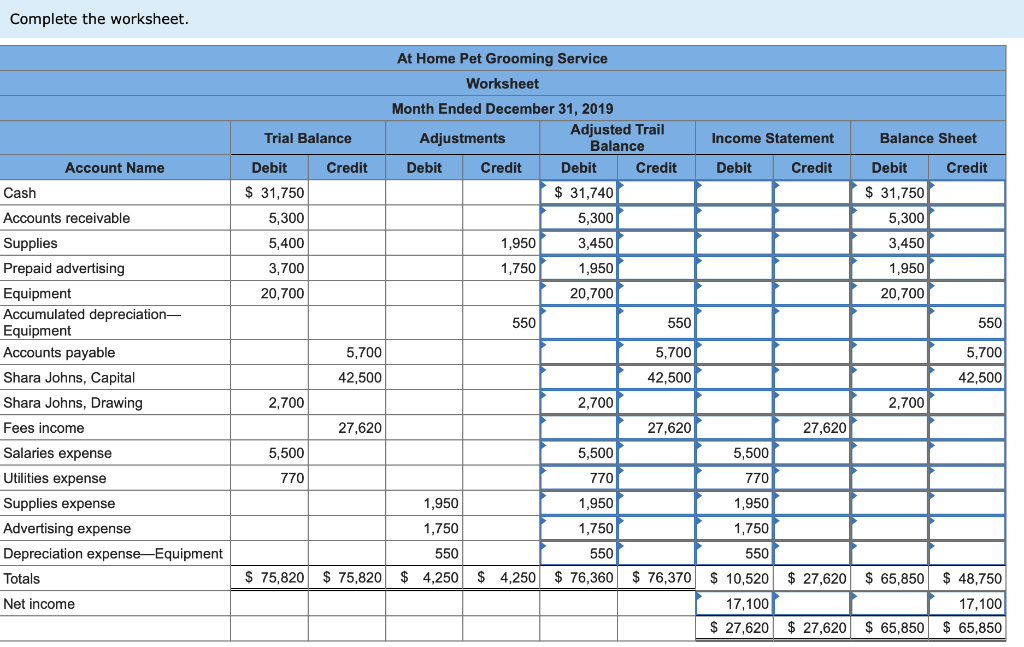

A partially completed worksheet for At Home Pet Grooming Service, a firm that grooms pets at the owners home, follows. Required:

- Complete the worksheet.

- Record the adjusting entries in the general journal (transactions 1-3).

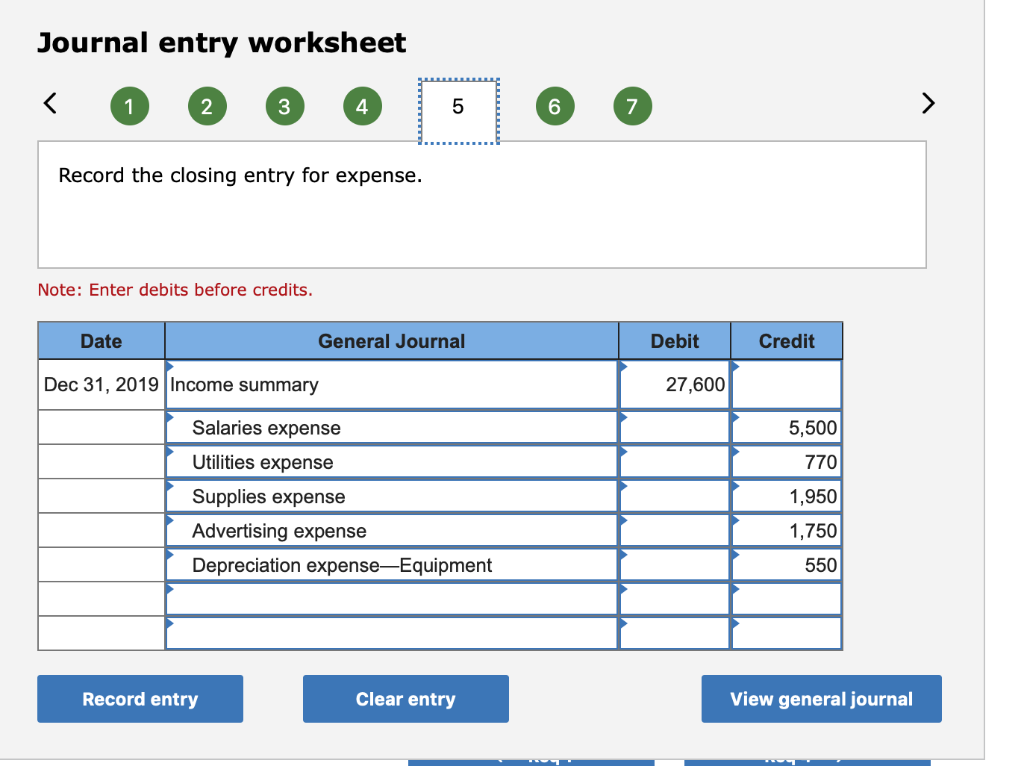

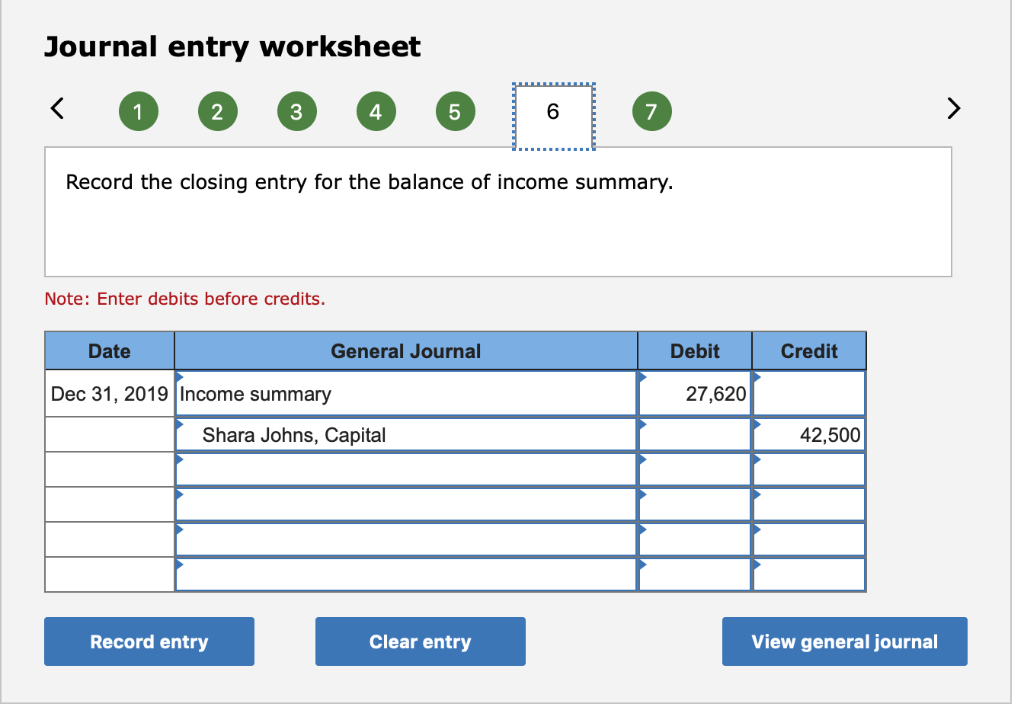

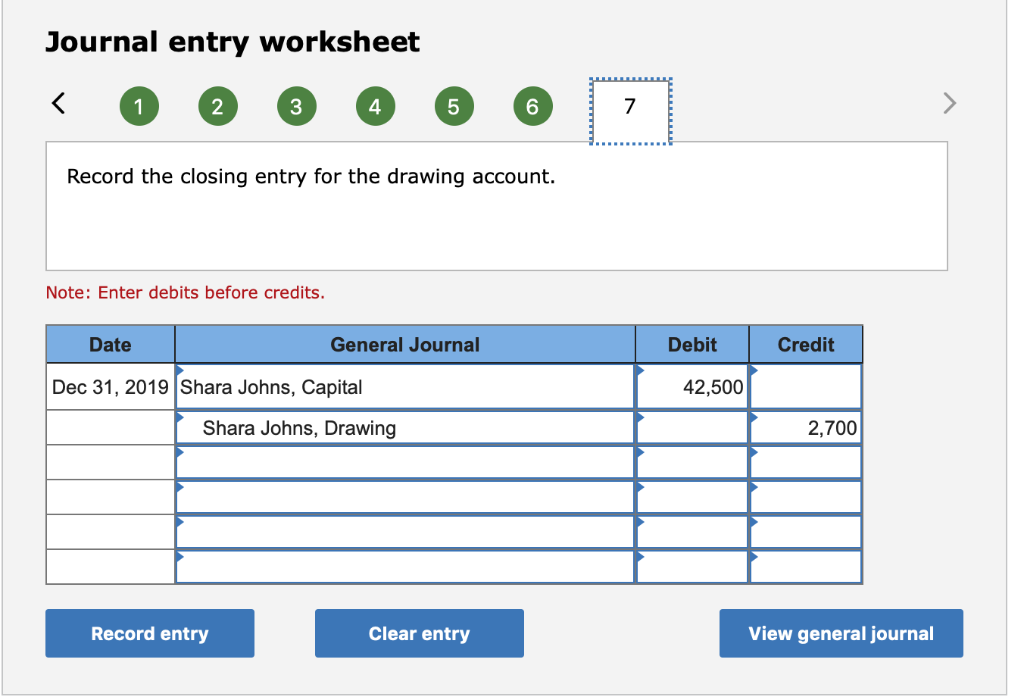

- Record the closing entries in the general journal (transactions 4-7).

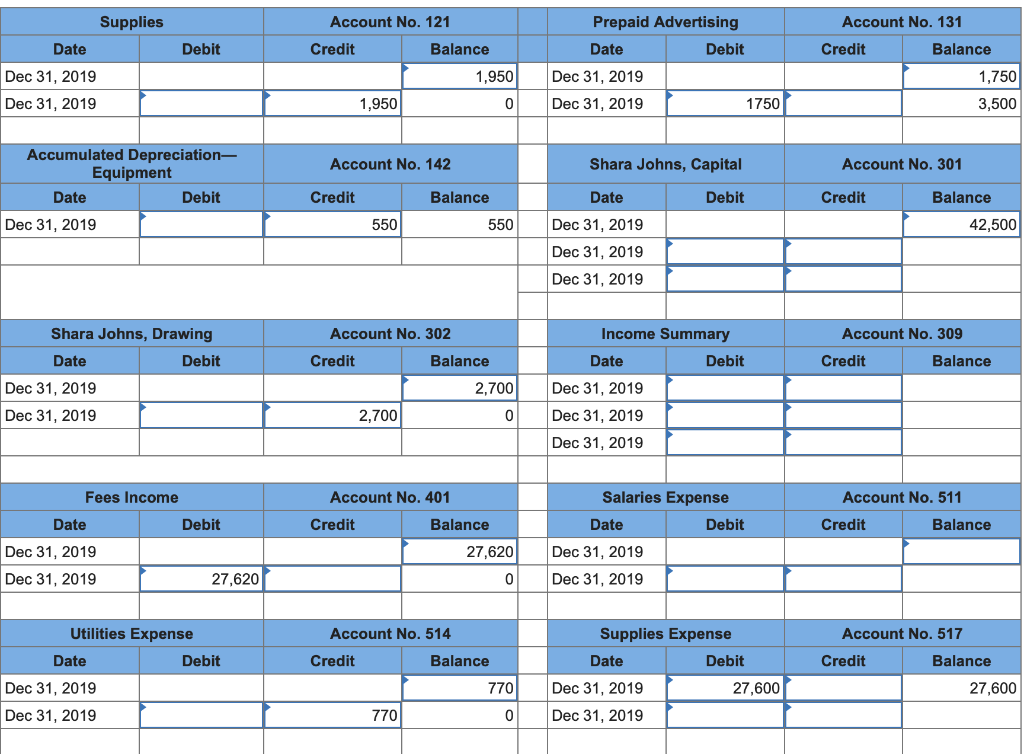

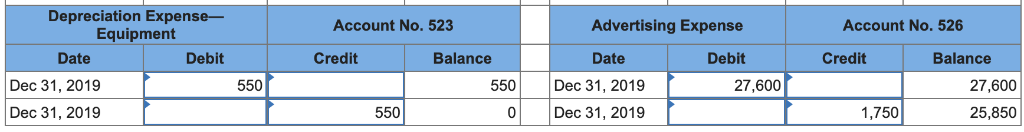

- Post the adjusting entries and the closing entries to the general ledger accounts. Hint: Be sure to enter beginning balances.

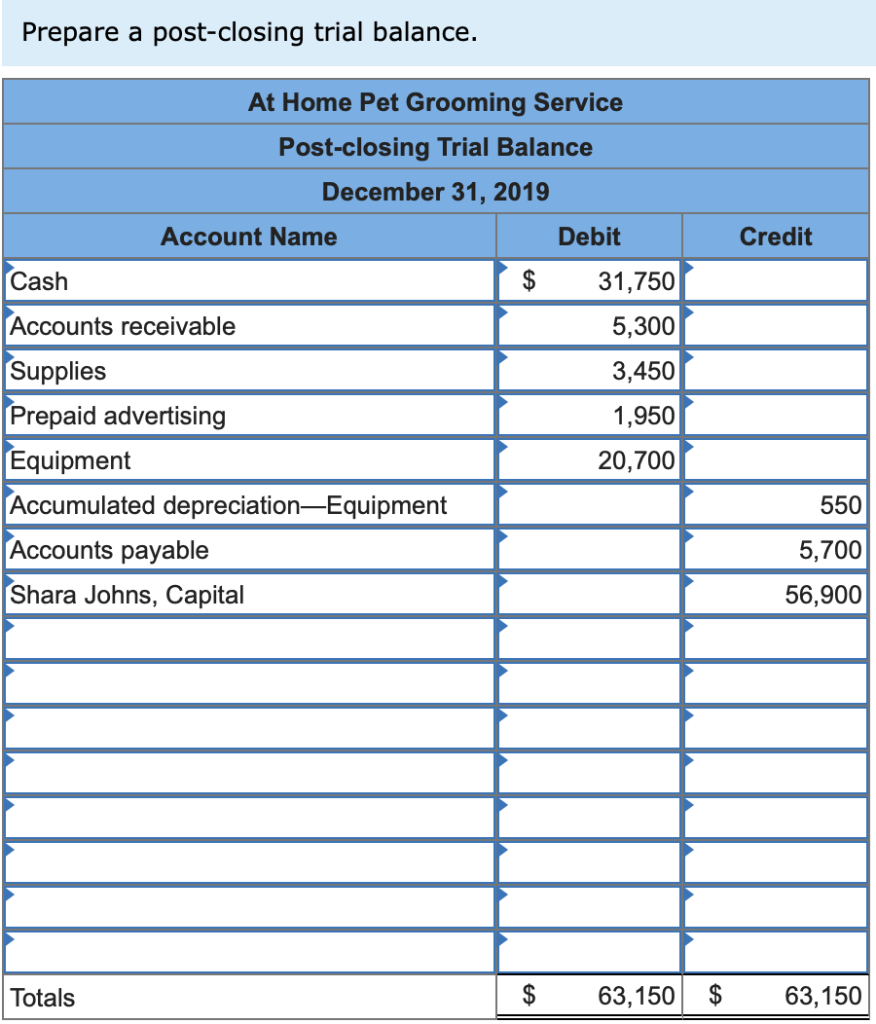

- Prepare a post-closing trial balance.

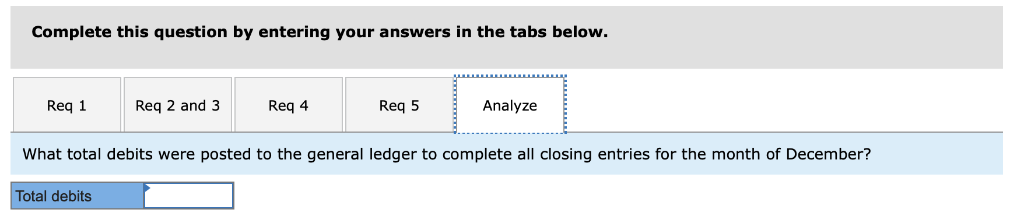

Analyze: What total debits were posted to the general ledger to complete all closing entries for the month of December?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started