please check my work

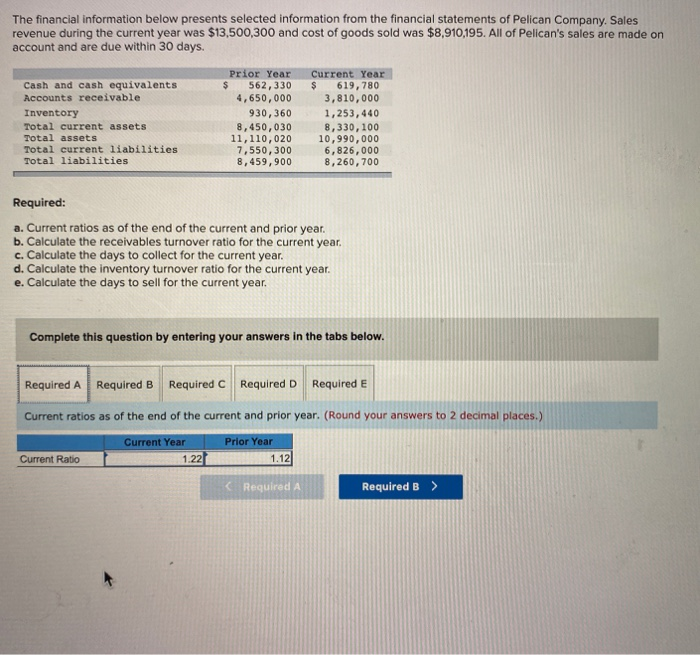

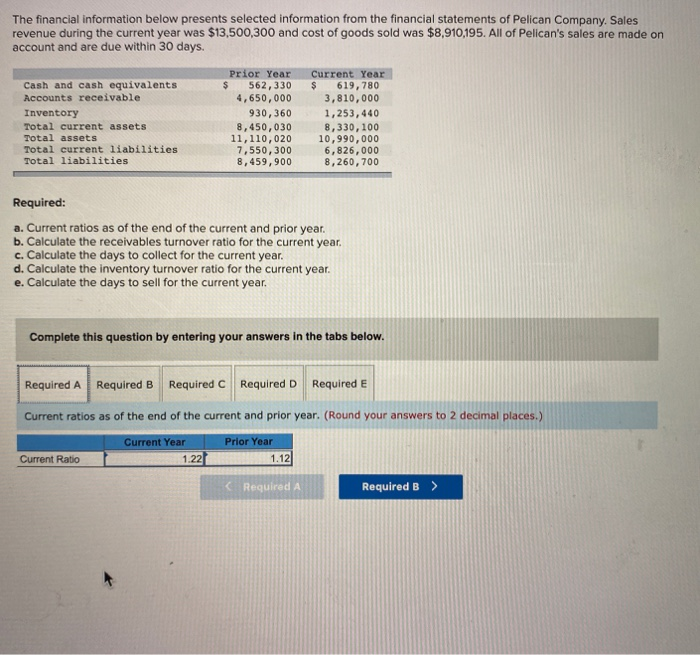

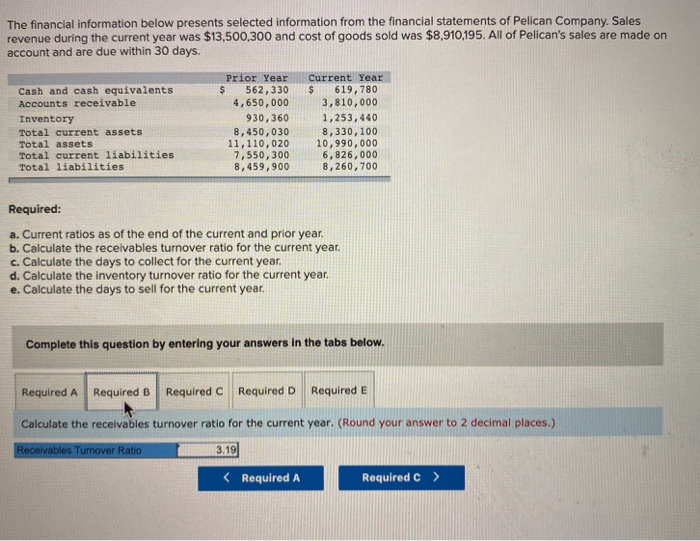

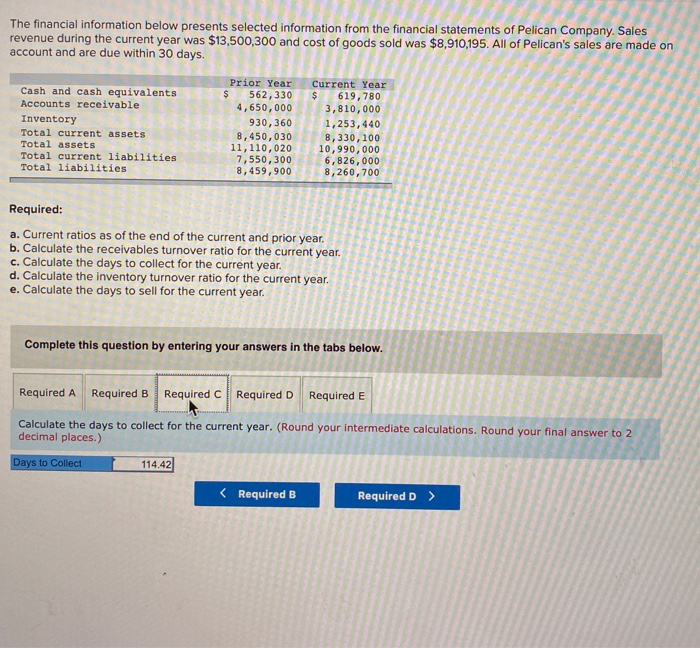

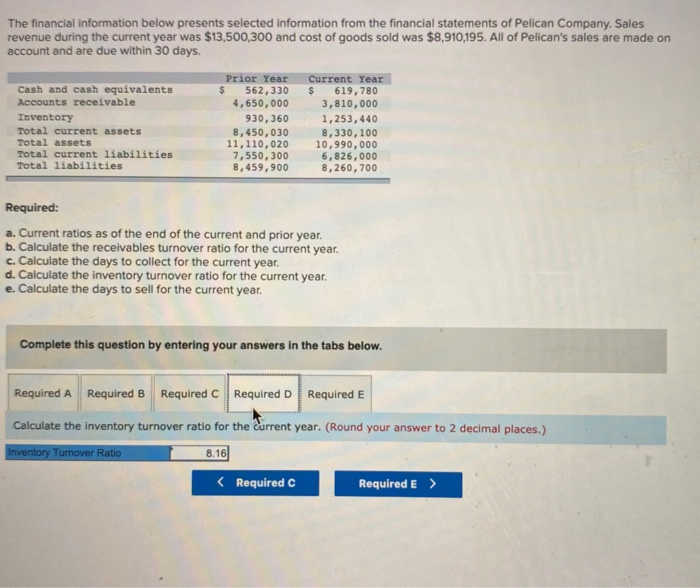

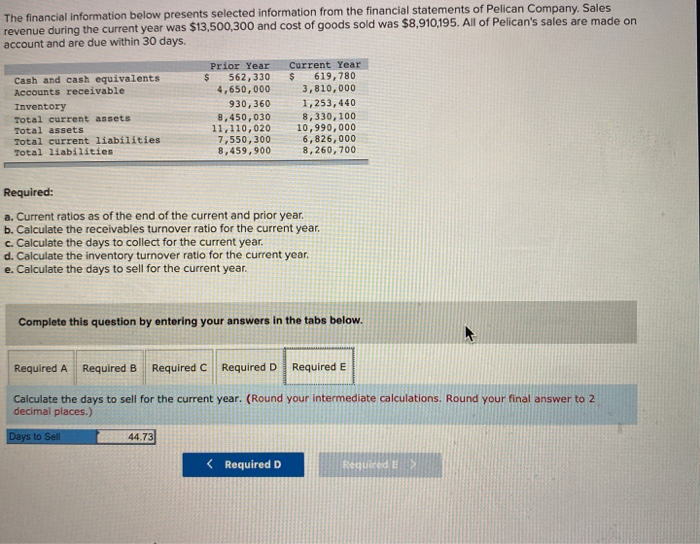

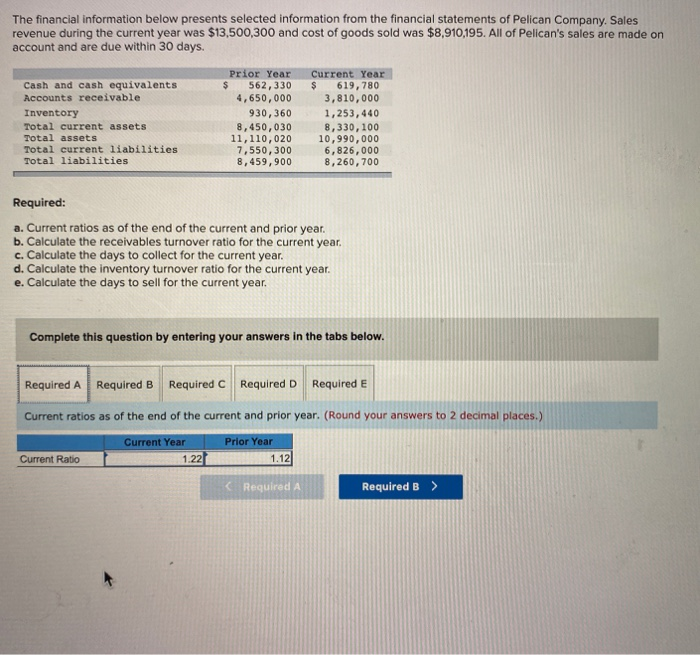

The financial information below presents selected information from the financial statements of Pelican Company. Sales revenue during the current year was $13,500,300 and cost of goods sold was $8,910,195. All of Pelican's sales are made on account and are due within 30 days. Prior Year 562,330 4,650,000 Current Year 619,780 3,810,000 Cash and cash equivalents Accounts receivable Inventory Total current assets Total assets Total current liabilities Total liabilities 930,360 1,253,440 8,330,100 10,990,000 6,826,000 8,260,700 8,450,030 11,110,020 300 ,550, 8,459,900 Required: a. Current ratios as of the end of the current and prior year. b. Calculate the receivables turnover ratio for the current year. c. Calculate the days to collect for the current year. d. Calculate the inventory turnover ratio for the current year. e. Calculate the days to sell for the current year. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Current ratios as of the end of the current and prior year. (Round your answers to 2 decimal places.) Prior Year Current Year 1.22 1.12 Current Ratio K Required A Required B > The financial information below presents selected information from the financial statements of Pelican Company. Sales revenue during the current year was $13,500,300 and cost of goods sold was $8,910,195. All of Pelican's sales are made on account and are due within 30 days. Current Year 619,780 3,810,000 Prior Year 562,330 4,650,000 Cash and cash equivalents Accounts receivable 930,360 8,450,030 11,110,020 7,550, 300 , 459,900 1,253,440 Inventory 8,330,100 10,990,000 6,826,000 8,260,700 Total current assets Total assets Total current liabilities Total liabilities Required: a. Current ratios as of the end of the current and prior year. b. Calculate the receivables turnover ratio for the current year. c. Calculate the days to collect for the current year. d. Calculate the inventory turnover ratio for the current year. e. Calculate the days to sell for the current year. Complete this question by entering your answers in the tabs below. Required A Required B Required E Required C Required D Calculate the receivables turnover ratio for the current year. (Round your answer to 2 decimal places.) 3.19 Receivables Turnover Ratio The financial information below presents selected information from the financial statements of Pelican Company. Sales revenue during the current year was $13,500,300 and cost of goods sold was $8,910,195. All of Pelican's sales are made on account and are due within 30 days. Prior Year 562,330 4,650,000 Current Year 619,780 3,810,000 Cash and cash equivalents Accounts receivable Inventory Total current assets Total assets Total current liabilities Total liabilities 930,360 8,450,030 11,110,020 7,550,300 8,459,900 1,253,440 8,330,100 10,990,000 6,826,000 8,260, 00 Required: a. Current ratios as of the end of the current and prior year. b. Calculate the receivables turnover ratio for the current year. c. Calculate the days to collect for the current year. d. Calculate the inventory turnover ratio for the current year. e. Calculate the days to sell for the current year. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Calculate the days to collect for the current year. (Round your intermediate calculations. Round your final answer to 2 decimal places.) Days to Collect 114.42 The financial information below presents selected information from the financial statements of Pelican Company. Sales revenue during the current year was $13,500,300 and cost of goods sold was $8,910,195. All of Pelican's sales are made on account and are due within 30 days. Prior Year Current Year 619,780 3,810,000 Cash and cash equivalents Accounts receivable 2$ 562,330 4,650,000 Inventory 930,360 1,253,440 Total current assetS Total assets Total current liabilities Total liabilities 8,450,030 11,110,020 7,550,300 8,459,900 8,330,100 10,990,000 6,826,000 8,260,700 Required: a. Current ratios as of the end of the current and prior year. b. Calculate the receivables turnover ratio for the current year. c. Calculate the days to collect for the current year. d. Calculate the inventory turnover ratio for the current year. e. Calculate the days to sell for the current year. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Calculate the inventory turnover ratio for the current year. (Round your answer to 2 decimal places.) 8.16 Inventory Turnover Ratio The financial information below presents selected information from the financial statements of Pelican Company. Sales revenue during the current year was $13,500,300 and cost of goods sold was $8,910,195. All of Pelican's sales are made on account and are due within 30 days. Prior Year 562,330 2$ 4,650,000 Current Year Cash and cash equivalents Accounts receivable 619,780 3,810,000 1,253,440 8,330,100 10,990,000 6,826,000 8,260,700 930,360 8,450,030 11,110,020 7,550,300 8,459,900 Inventory Total current assets Total assets Total current liabilities Total liabilities Required: a. Current ratios as of the end of the current and prior year. b. Calculate the receivables turnover ratio for the current year. c. Calculate the days to collect for the current year. d. Calculate the inventory turnover ratio for the current year. e. Calculate the days to sell for the current year. Complete this question by entering your answers in the tabs below. Required E Required D Required A Required B Required C Calculate the days to sell for the current year. (Round your intermediate calculations. Round your final answer to 2 decimal places.) Days to Sell 44.73