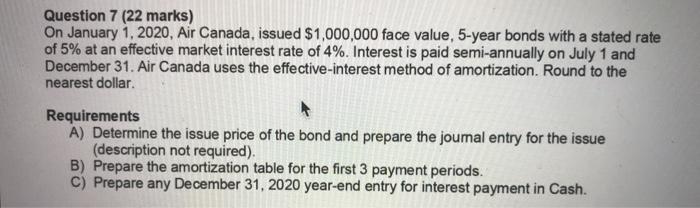

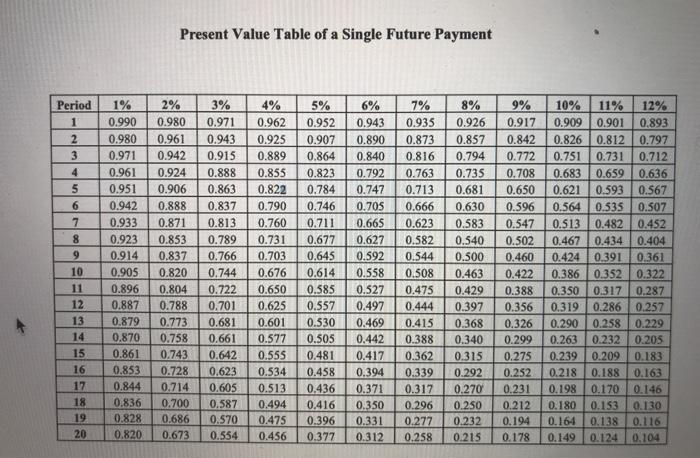

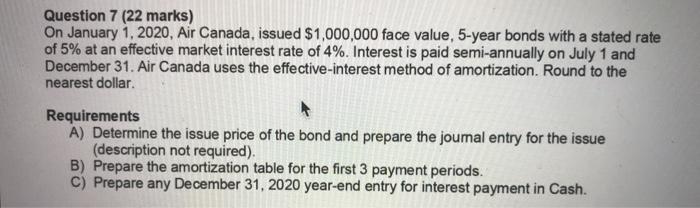

Please check the presebt value table of a single future payment

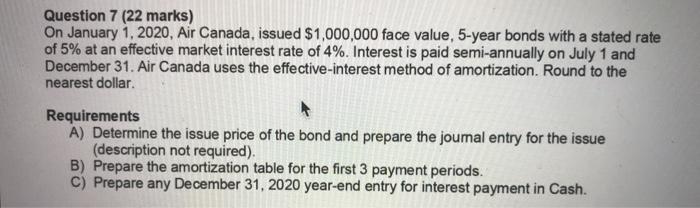

Question 7 (22 marks) On January 1, 2020, Air Canada, issued $1,000,000 face value, 5-year bonds with a stated rate of 5% at an effective market interest rate of 4%. Interest is paid semi-annually on July 1 and December 31. Air Canada uses the effective-interest method of amortization. Round to the nearest dollar Requirements A) Determine the issue price of the bond and prepare the journal entry for the issue (description not required) B) Prepare the amortization table for the first 3 payment periods. C) Prepare any December 31, 2020 year-end entry for interest payment in Cash. Present Value Table of a Single Future Payment % 6% Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 10% 11% 12% 0.909 0.901 0.893 0.826 0.812 0.797 0.751 0.731 0.712 0.683 0.659 0.636 0.621 0.593 0.567 0.564 0.535 0.507 0.513 0.482 0.452 0.467 0.434 0.404 0.424 0.391 0.361 0.386 0.352 0.322 0.350 0.317 0.287 0.319 0.286 0.257 0.290 0.258 0.229 0.263 0.232 0.205 0.239 0.209 0.183 0.218 0.188 0.163 0.198 0.170 0.146 0.180 0.153 0.130 0.164 0.138 0.116 0.149 0.124 0.104