Answered step by step

Verified Expert Solution

Question

1 Approved Answer

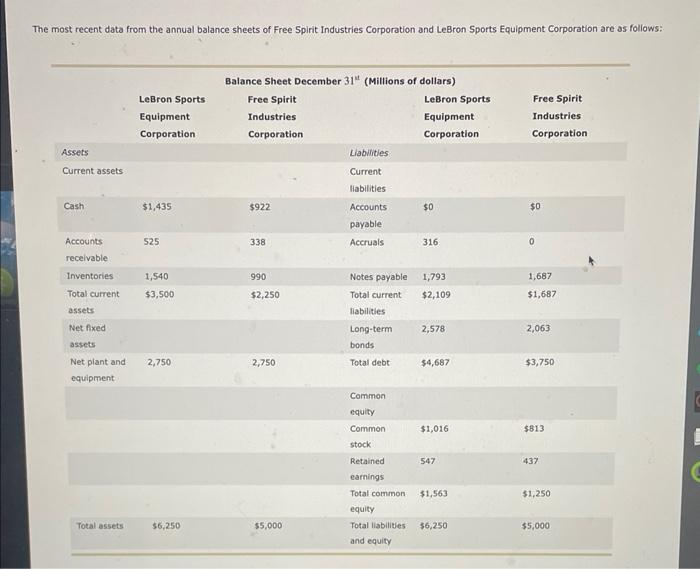

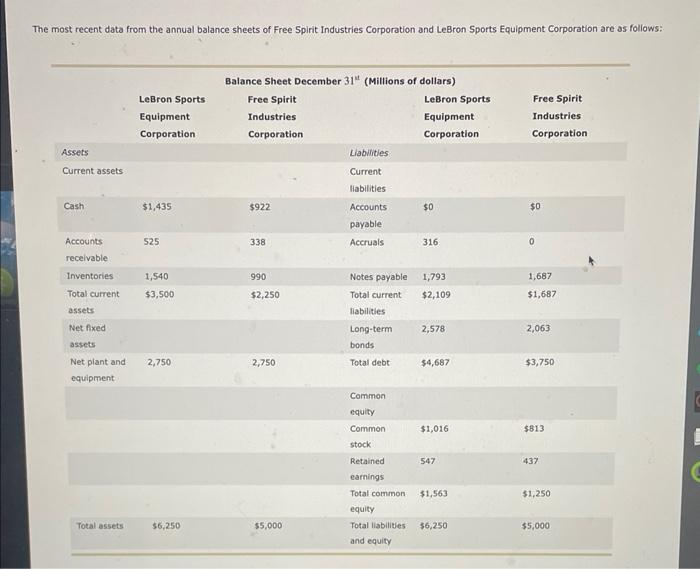

please check the questions ive already answered as well The most recent data from the annual balance sheets of Free Spirit Industries Corporation and LeBron

please check the questions ive already answered as well

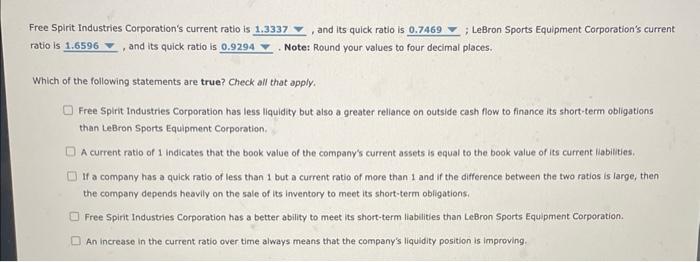

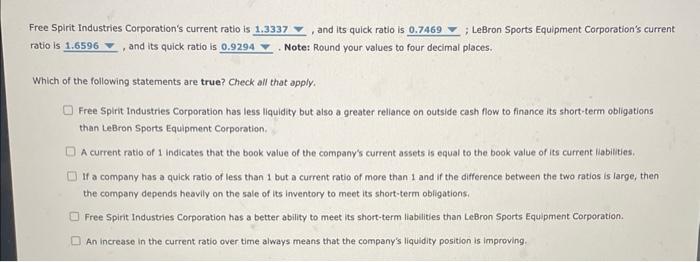

The most recent data from the annual balance sheets of Free Spirit Industries Corporation and LeBron Sports Equipment Corporation are as follows: Free Spirit Industries Corporation's current ratio is , and its quick ratio is ; LeBron Sports Equipment Corporation's current ratio is , and its quick ratio is - Note: Round your values to four decimal places. Which of the following statements are true? Check all that apply. Free Spirit industries Corporation has less liquidity but also a greater reliance on outside cash flow to finance its short-term obligations than LeBron Sports Equipment Corporation. A current ratio of 1 indicates that the book value of the company's current assets is equal to the book value of its current liabilities. If a company has a quick ratio of less than 1 but a current ratio of more than 1 and if the difference between the two ratios is large, then the company depends heavily on the sale of its inventory to meet its short-term obligations. Free Spirit Industries Corporation has a better ability to meet its short-term liabilities than LeBron Sports Equipment Corporation. An increase in the current ratio over time always means that the company's liquidity position is improving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started