please check whats incorrect and missing

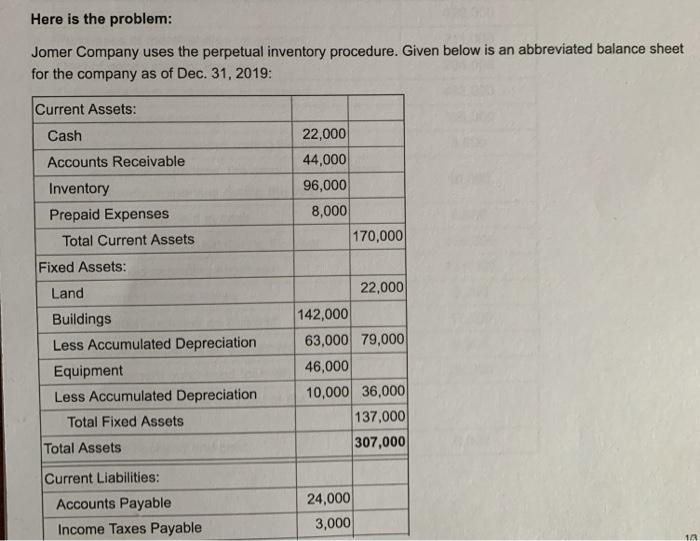

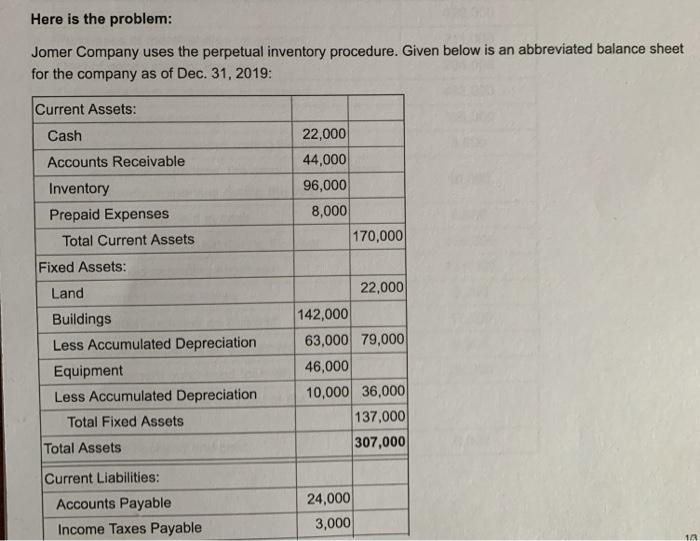

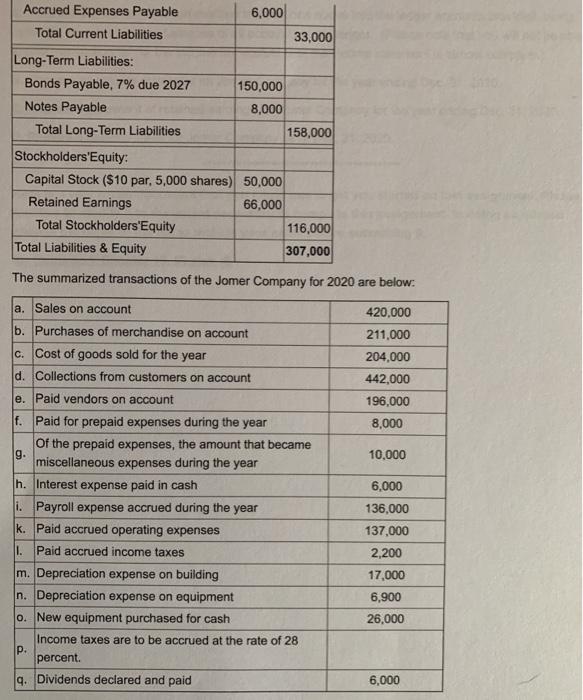

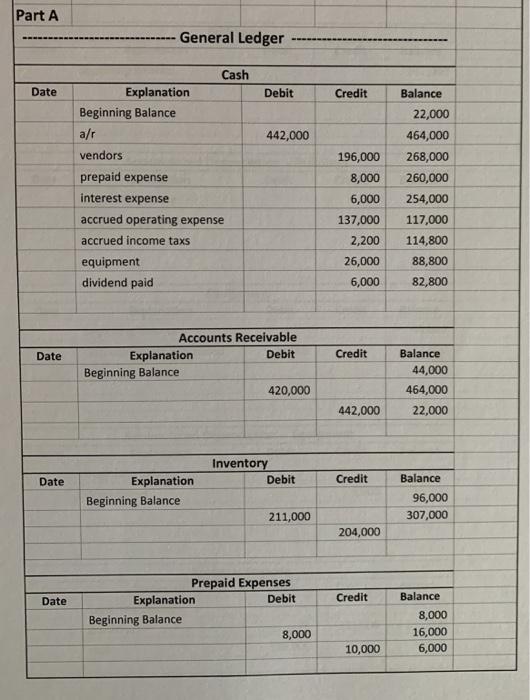

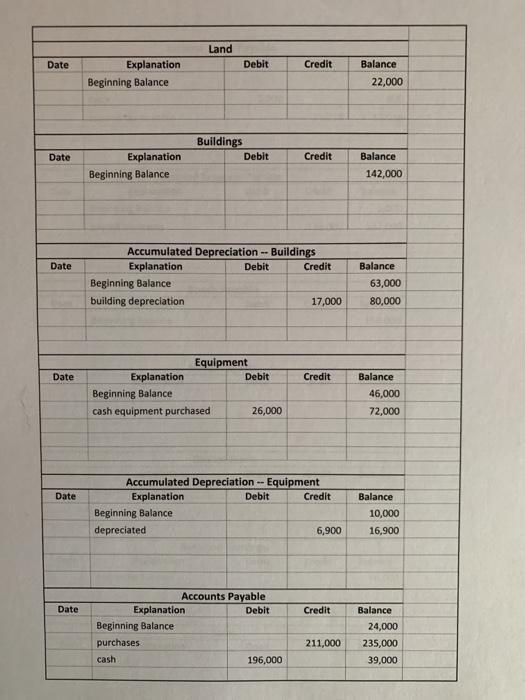

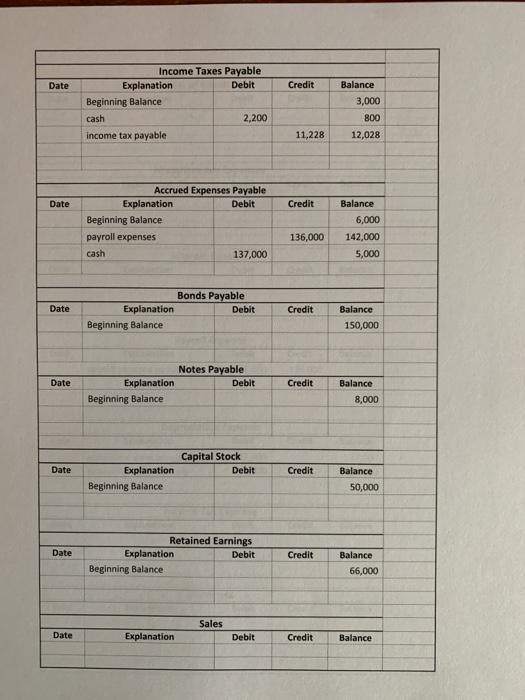

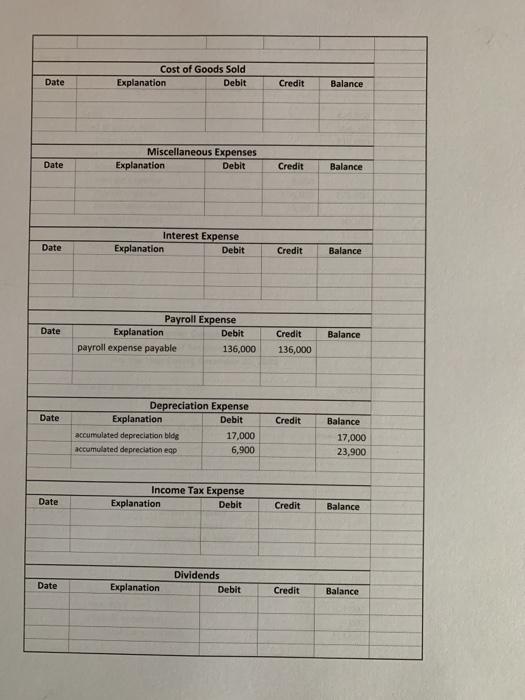

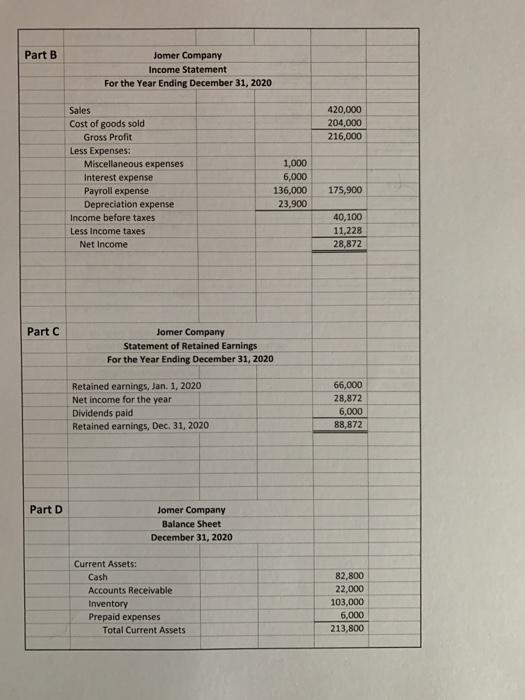

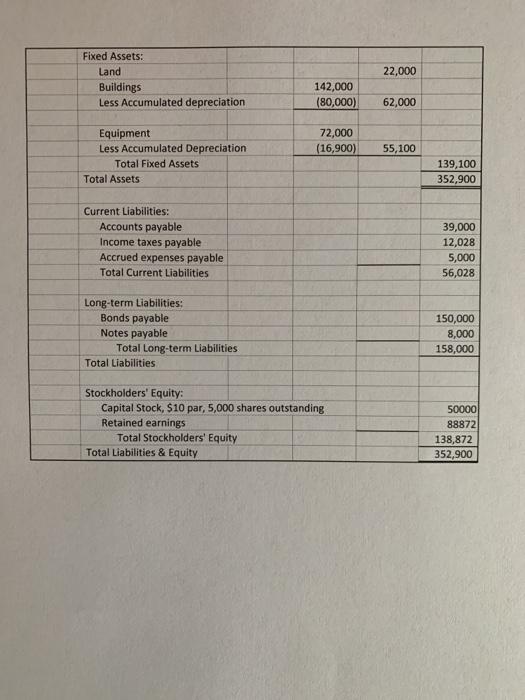

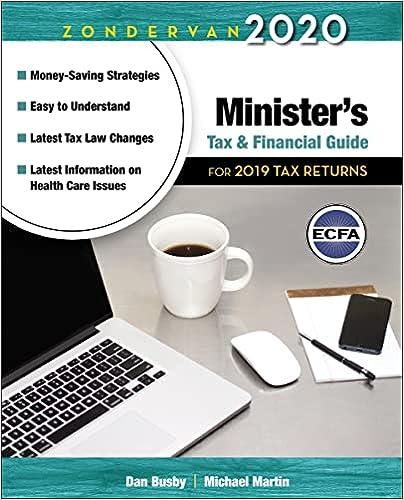

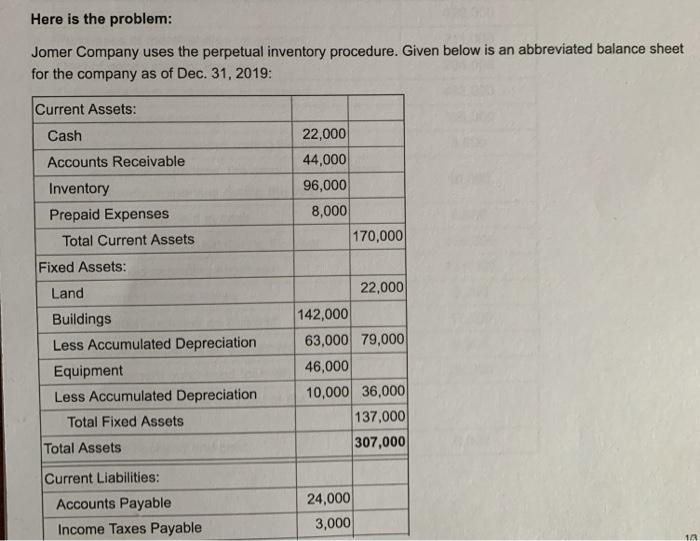

Here is the problem: Jomer Company uses the perpetual inventory procedure. Given below is an abbreviated balance sheet for the company as of Dec. 31, 2019: Current Assets: Cash Accounts Receivable 22,000 44,000 96,000 8,000 170,000 Inventory Prepaid Expenses Total Current Assets Fixed Assets: Land Buildings Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Fixed Assets Total Assets 22,000 142,000 63,000 79,000 46,000 10,000 36,000 137,000 307,000 Current Liabilities: Accounts Payable Income Taxes Payable 24,000 3,000 10 Accrued Expenses Payable 6,000 Total Current Liabilities 33,000 Long-Term Liabilities: Bonds Payable, 7% due 2027 150,000 Notes Payable 8,000 Total Long-Term Liabilities 158,000 Stockholders'Equity: Capital Stock ($10 par, 5,000 shares) 50,000 Retained Earnings 66,000 Total Stockholders'Equity 116,000 Total Liabilities & Equity 307,000 The summarized transactions of the Jomer Company for 2020 are below: 420.000 211.000 204,000 442,000 196,000 8,000 10.000 a. Sales on account b. Purchases of merchandise on account c. Cost of goods sold for the year d. Collections from customers on account e. Paid vendors on account f. Paid for prepaid expenses during the year of the prepaid expenses, the amount that became g. miscellaneous expenses during the year h. Interest expense paid in cash i. Payroll expense accrued during the year k. Paid accrued operating expenses L. Paid accrued income taxes m. Depreciation expense on building n. Depreciation expense on equipment 0. New equipment purchased for cash Income taxes are to be accrued at the rate of 28 P. percent. q. Dividends declared and paid 6,000 136,000 137,000 2,200 17,000 6,900 26,000 6,000 Part A General Ledger Cash Date Debit Credit Balance Explanation Beginning Balance alr 442,000 vendors prepaid expense interest expense accrued operating expense accrued income taxs equipment dividend paid 196,000 8,000 6,000 137,000 2,200 26,000 6,000 22,000 464,000 268,000 260,000 254,000 117,000 114,800 88,800 82,800 Date Credit Accounts Receivable Explanation Debit Beginning Balance 420,000 Balance 44,000 464,000 22,000 442,000 Inventory Debit Date Credit Explanation Beginning Balance Balance 96,000 307,000 211,000 204,000 Date Credit Balance Prepaid Expenses Explanation Debit Beginning Balance 8,000 8,000 16,000 6,000 10,000 Land Date Debit Credit Explanation Beginning Balance Balance 22,000 Buildings Debit Date Credit Explanation Beginning Balance Balance 142,000 Date Accumulated Depreciation -- Buildings Explanation Debit Credit Beginning Balance building depreciation 17,000 Balance 63,000 80,000 Date Credit Equipment Explanation Debit Beginning Balance cash equipment purchased 26,000 Balance 46,000 72,000 Date Accumulated Depreciation -- Equipment Explanation Debit Credit Beginning Balance depreciated 6,900 Balance 10,000 16,900 Date Credit Accounts Payable Explanation Debit Beginning Balance purchases cash 196,000 Balance 24,000 235,000 39,000 211,000 Date Credit Income Taxes Payable Explanation Debit Beginning Balance cash 2,200 income tax payable Balance 3,000 800 12,028 11,228 Date Credit Accrued Expenses Payable Explanation Debit Beginning Balance payroll expenses cash 137,000 Balance 6,000 142,000 5,000 136,000 Date Bonds Payable Explanation Debit Beginning Balance Credit Balance 150,000 Date Notes Payable Explanation Debit Beginning Balance Credit Balance 8,000 Date Capital Stock Explanation Debit Beginning Balance Credit Balance 50,000 Date Retained Earnings Explanation Debit Beginning Balance Credit Balance 66,000 Sales Date Explanation Debit Credit Balance Date Cost of Goods Sold Explanation Debit Credit Balance Miscellaneous Expenses Explanation Debit Date Credit Balance Interest Expense Explanation Debit Date Credit Balance Date Payroll Expense Explanation Debit payroll expense payable 136,000 Balance Credit 136,000 Date Credit Depreciation Expense Explanation Debit accumulated depreciation bldg 17,000 accumulated depreciation eap 6,900 Balance 17,000 23,900 Income Tax Expense Explanation Debit Date Credit Balance Date Explanation Dividends Debit Credit Balance Part B Jomer Company Income Statement For the Year Ending December 31, 2020 420,000 204,000 216,000 Sales Cost of goods sold Gross Profit Less Expenses: Miscellaneous expenses Interest expense Payroll expense Depreciation expense Income before taxes ess Income taxes Net Income 1,000 6,000 136,000 23.900 175,900 40,100 11,228 28,872 Part C Jomer Company Statement of Retained Earnings For the Year Ending December 31, 2020 Retained earnings, Jan 1, 2020 Net income for the year Dividends paid Retained earnings, Dec. 31, 2020 66,000 28,872 6,000 88,872 Part D Jomer Company Balance Sheet December 31, 2020 Current Assets: Cash Accounts Receivable Inventory Prepaid expenses Total Current Assets 82,800 22,000 103,000 6,000 213,800 22,000 Fixed Assets: Land Buildings Less Accumulated depreciation 142,000 (80,000) 62,000 Equipment Less Accumulated Depreciation Total Fixed Assets Total Assets 72,000 (16,900) 55,100 139,100 352,900 Current Liabilities: Accounts payable Income taxes payable Accrued expenses payable Total Current Liabilities 39,000 12,028 5,000 56,028 Long-term Liabilities: Bonds payable Notes payable Total Long-term Liabilities Total Liabilities 150,000 8,000 158,000 Stockholders' Equity: Capital Stock, $10 par, 5,000 shares outstanding Retained earnings Total Stockholders' Equity Total Liabilities & Equity 50000 88872 138,872 352,900 A. Post the entries from the summarized transactions above into the ledger accounts provided, being careful to keep the running balances of all accounts in the ledger. (Please note that you will not be able to post transaction "p" for the income tax accrual until the income statement is almost complete.)