Question

please choose from the following accounts: Accounts Payable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Leasehold Improvements Accumulated Depreciation - Machinery

please choose from the following accounts:

Accounts Payable

Accumulated Depreciation - Buildings

Accumulated Depreciation - Equipment

Accumulated Depreciation - Leasehold Improvements

Accumulated Depreciation - Machinery

Accumulated Depreciation - Vehicle Overhaul

Accumulated Depreciation - Vehicles

Advertising Expense

Asset Retirement Obligation

Buildings

Cash

Common Shares

Contributed Surplus - Donated Capital

Cost of Goods Sold

Deferred Revenue - Government Grants

Depreciation Expense

Donation Revenue

Equipment

Finance Expense

Gain on Disposal of Buildings

Gain on Disposal of Equipment

Gain on Disposal of Machinery

Gain on Disposal of Vehicles

Gain on Vehicle Overhaul

Gain or Loss in Value of Investment Property

GST Receivable

Interest Expense

Interest Payable

Inventory

Investment Property

Land

Land Improvements

Legal Expense

Loss on Disposal of Buildings

Loss on Disposal of Equipment

Loss on Disposal of Machinery

Loss on Disposal of Vehicles

Loss on Vehicle Overhaul

Machinery

Mineral Resources

Mortgage Payable

No Entry

Notes Payable

Office Expense

Prepaid Expenses

Prepaid Insurance

Purchase Discounts

Repairs and Maintenance Expense

Revaluation Gain or Loss

Revaluation Surplus (AOCI)

Revaluation Surplus (OCI)

Revenue - Government Grants

Salaries and Wages Expense

Sales Revenue

Service Revenue

Supplies

Tenant Deposits Liability

Vehicle Overhaul

Vehicles

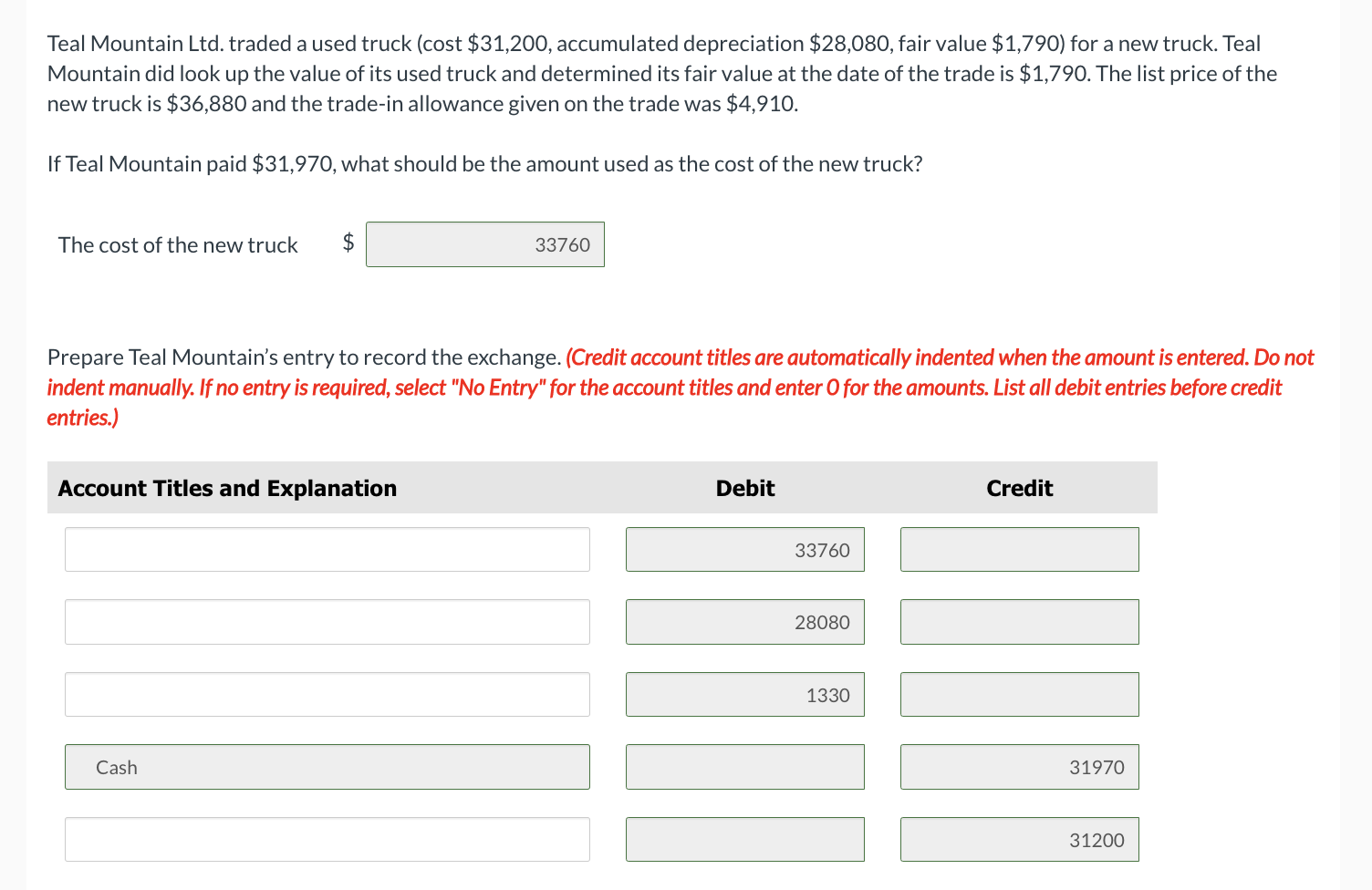

Teal Mountain Ltd. traded a used truck (cost $31,200, accumulated depreciation $28,080, fair value $1,790 ) for a new truck. Teal Mountain did look up the value of its used truck and determined its fair value at the date of the trade is $1,790. The list price of the new truck is $36,880 and the trade-in allowance given on the trade was $4,910. If Teal Mountain paid $31,970, what should be the amount used as the cost of the new truck? The cost of the new truck $ Prepare Teal Mountain's entry to record the exchange. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started