please choose only the correct choice withought any explaination only give me correct answer

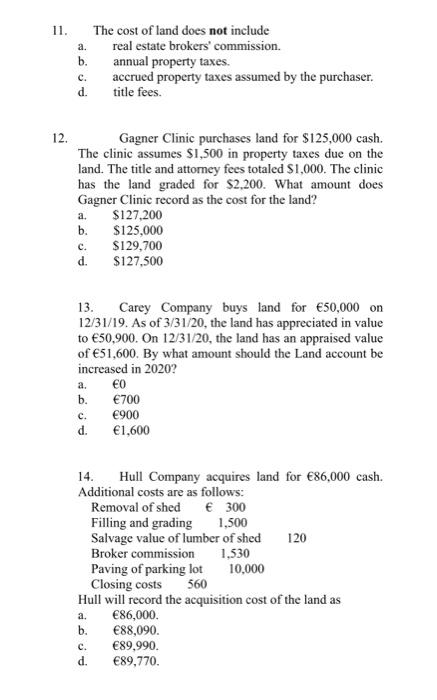

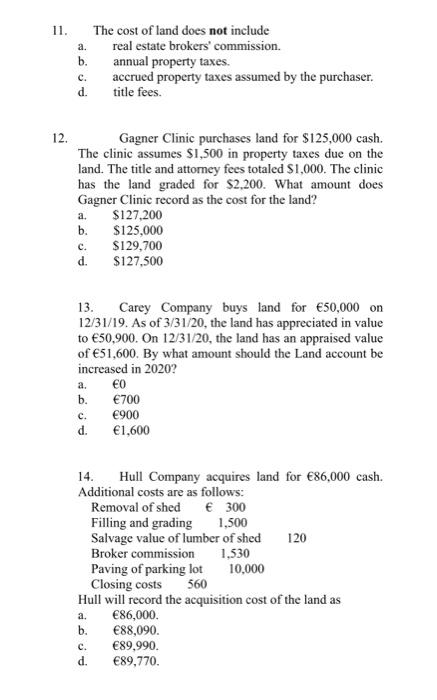

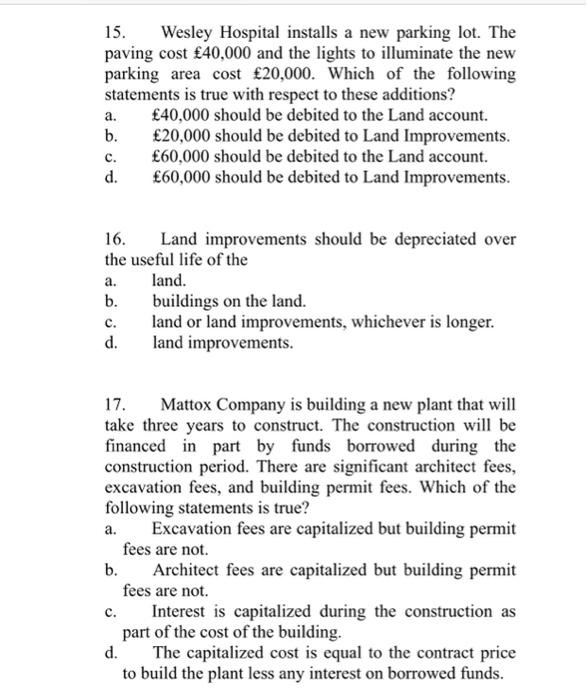

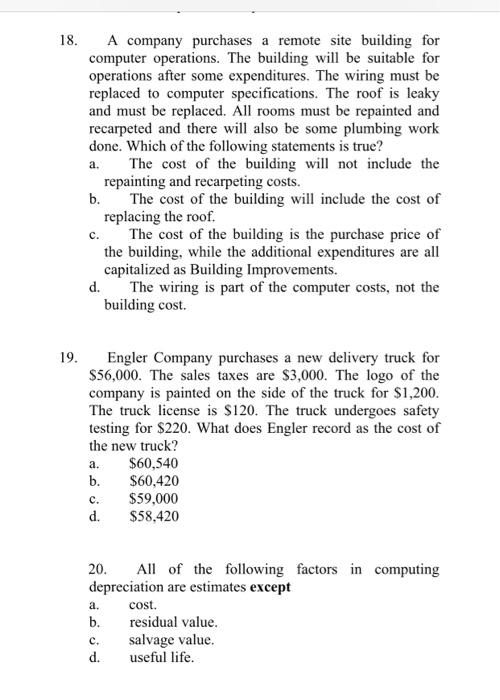

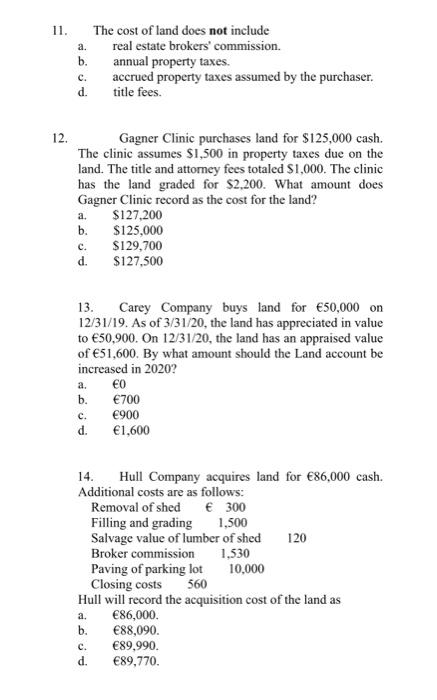

11. a. b. The cost of land does not include real estate brokers' commission. annual property taxes. accrued property taxes assumed by the purchaser. title fees. c. d. 12. Gagner Clinic purchases land for $125,000 cash. The clinic assumes S1,500 in property taxes due on the land. The title and attorney fees totaled S1,000. The clinic has the land graded for $2,200. What amount does Gagner Clinic record as the cost for the land? $127,200 $125,000 $129,700 $127,500 a. b. c. d. 13. Carey Company buys land for 50,000 on 12/31/19. As of 3/31/20, the land has appreciated in value to 50,900. On 12/31/20, the land has an appraised value of 51,600. By what amount should the Land account be increased in 2020? 0 b. 700 900 d. 1,600 a. c. 14. Hull Company acquires land for 86,000 cash. Additional costs are as follows: Removal of shed 300 Filling and grading 1,500 Salvage value of lumber of shed 120 Broker commission 1,530 Paving of parking lot 10,000 Closing costs 560 Hull will record the acquisition cost of the land as a. 86,000. b. 88,090. 89,990. d. 89,770. C. 15. Wesley Hospital installs a new parking lot. The paving cost 40,000 and the lights to illuminate the new parking area cost 20,000. Which of the following statements is true with respect to these additions? a. 40,000 should be debited to the Land account. b. 20,000 should be debited to Land Improvements. 60,000 should be debited to the Land account. d. 60,000 should be debited to Land Improvements. c. 16. Land improvements should be depreciated over the useful life of the a. land. b. buildings on the land. land or land improvements, whichever is longer. d. land improvements. 17. Mattox Company is building a new plant that will take three years to construct. The construction will be financed in part by funds borrowed during the construction period. There are significant architect fees, excavation fees, and building permit fees. Which of the following statements is true? a. Excavation fees are capitalized but building permit fees are not b. Architect fees are capitalized but building permit fees are not. Interest is capitalized during the construction as part of the cost of the building. d. The capitalized cost is equal to the contract price to build the plant less any interest on borrowed funds. c. 18. a. A company purchases a remote site building for computer operations. The building will be suitable for operations after some expenditures. The wiring must be replaced to computer specifications. The roof is leaky and must be replaced. All rooms must be repainted and recarpeted and there will also be some plumbing work done. Which of the following statements is true? The cost of the building will not include the repainting and recarpeting costs. b. The cost of the building will include the cost of replacing the roof. c. The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements. d. The wiring is part of the computer costs, not the building cost. 19. Engler Company purchases a new delivery truck for $56,000. The sales taxes are $3,000. The logo of the company is painted on the side of the truck for $1,200. The truck license is $120. The truck undergoes safety testing for $220. What does Engler record as the cost of the new truck? a. $60,540 b. $60,420 $59,000 d. $58,420 c. a. 20. All of the following factors in computing depreciation are estimates except cost. b. residual value. salvage value. d. useful life. C