Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please choose two company ,and make this Repoert in text format word,don't use pen and paper , make excell sheet for the calculations. thanks,iam waiting

please choose two company ,and make this Repoert in text format word,don't use pen and paper , make excell sheet for the calculations. thanks,iam waiting for the Report about this. thanks.

chosse these two company 1. Company 1 Ticker Symbol: CVNA Name of the Company: Carvana Co. CIA

2. Company 2 Ticker Symbol: DBD Name of the Company: Diebold Nixdorf Inc

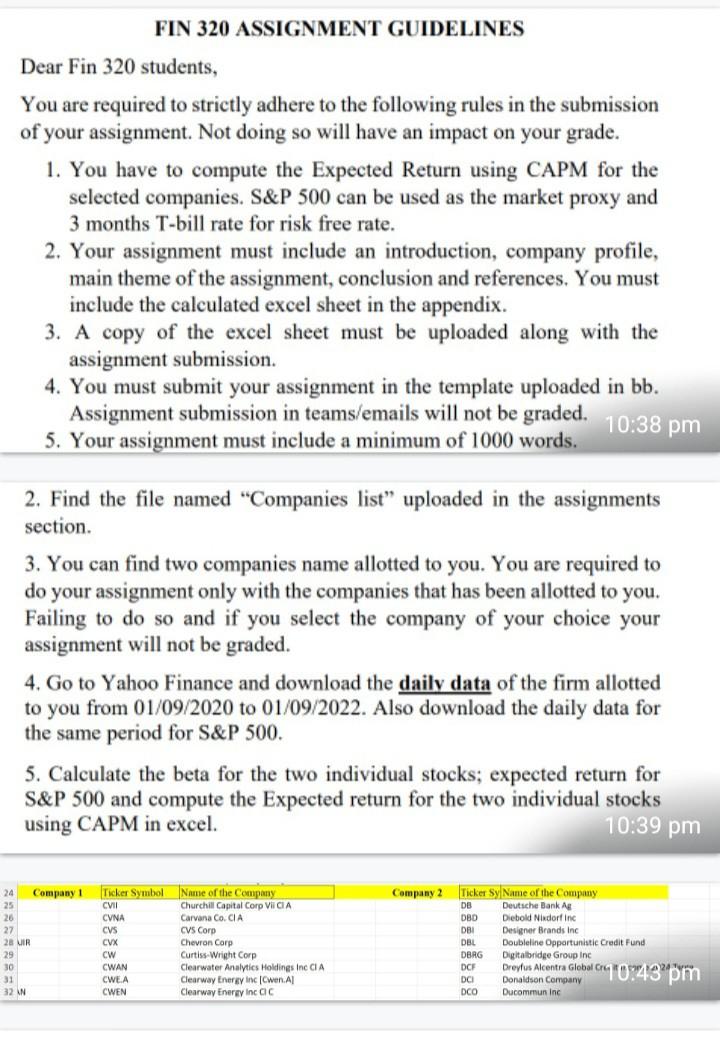

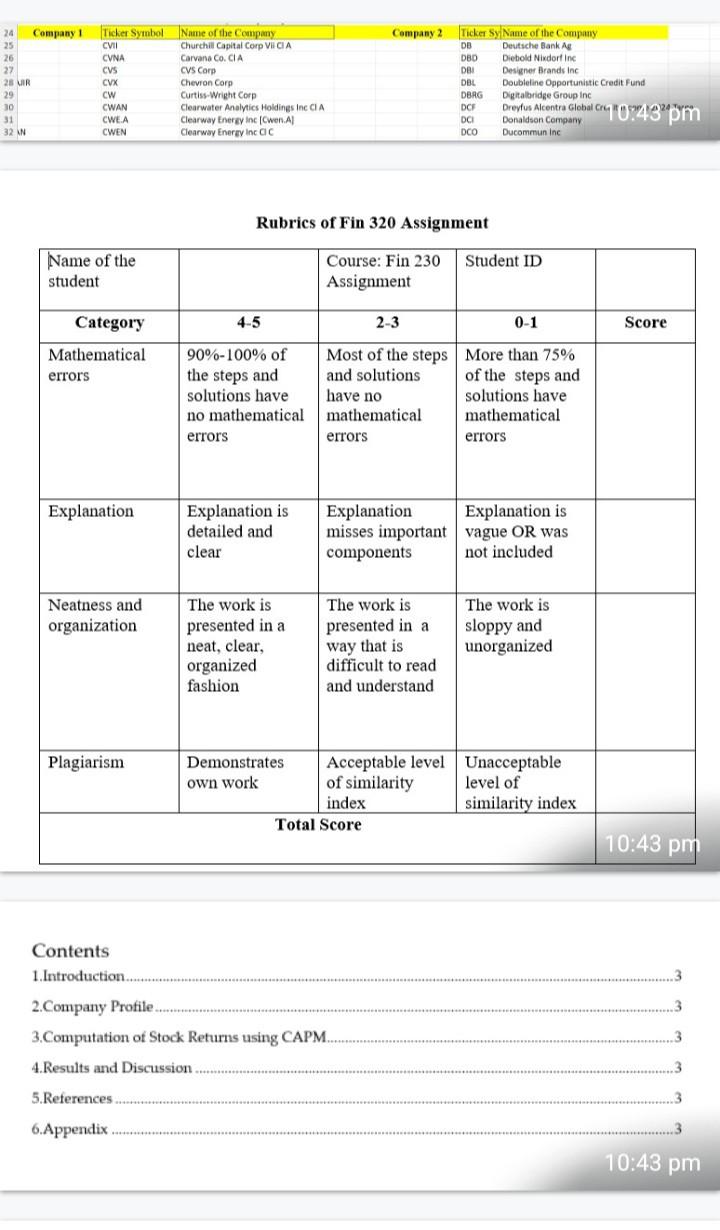

FIN 320 ASSIGNMENT GUIDELINES Dear Fin 320 students, You are required to strictly adhere to the following rules in the submission of your assignment. Not doing so will have an impact on your grade. 1. You have to compute the Expected Return using CAPM for the selected companies. S\&P 500 can be used as the market proxy and 3 months T-bill rate for risk free rate. 2. Your assignment must include an introduction, company profile, main theme of the assignment, conclusion and references. You must include the calculated excel sheet in the appendix. 3. A copy of the excel sheet must be uploaded along with the assignment submission. 4. You must submit your assignment in the template uploaded in bb. Assignment submission in teams/emails will not be graded. 5. Your assignment must include a minimum of 1000 words. 2. Find the file named "Companies list" uploaded in the assignments section. 3. You can find two companies name allotted to you. You are required to do your assignment only with the companies that has been allotted to you. Failing to do so and if you select the company of your choice your assignment will not be graded. 4. Go to Yahoo Finance and download the daily data of the firm allotted to you from 01/09/2020 to 01/09/2022. Also download the daily data for the same period for S\&P 500 . 5. Calculate the beta for the two individual stocks; expected return for S\&P 500 and compute the Expected return for the two individual stocks using CAPM in excel. Rubrics of Fin 320 Assignment 1.Introduction 2.Company Profile 3. Computation of Stock Returns using CAPM 4.Results and Discussion 5.References 6.Appendix FIN 320 ASSIGNMENT GUIDELINES Dear Fin 320 students, You are required to strictly adhere to the following rules in the submission of your assignment. Not doing so will have an impact on your grade. 1. You have to compute the Expected Return using CAPM for the selected companies. S\&P 500 can be used as the market proxy and 3 months T-bill rate for risk free rate. 2. Your assignment must include an introduction, company profile, main theme of the assignment, conclusion and references. You must include the calculated excel sheet in the appendix. 3. A copy of the excel sheet must be uploaded along with the assignment submission. 4. You must submit your assignment in the template uploaded in bb. Assignment submission in teams/emails will not be graded. 5. Your assignment must include a minimum of 1000 words. 2. Find the file named "Companies list" uploaded in the assignments section. 3. You can find two companies name allotted to you. You are required to do your assignment only with the companies that has been allotted to you. Failing to do so and if you select the company of your choice your assignment will not be graded. 4. Go to Yahoo Finance and download the daily data of the firm allotted to you from 01/09/2020 to 01/09/2022. Also download the daily data for the same period for S\&P 500 . 5. Calculate the beta for the two individual stocks; expected return for S\&P 500 and compute the Expected return for the two individual stocks using CAPM in excel. Rubrics of Fin 320 Assignment 1.Introduction 2.Company Profile 3. Computation of Stock Returns using CAPM 4.Results and Discussion 5.References 6.AppendixStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started