Question

Please circle the correct answer: 1. Which one of the following types of inventory accounts would be used by a wholesaler or retailer? a. Raw

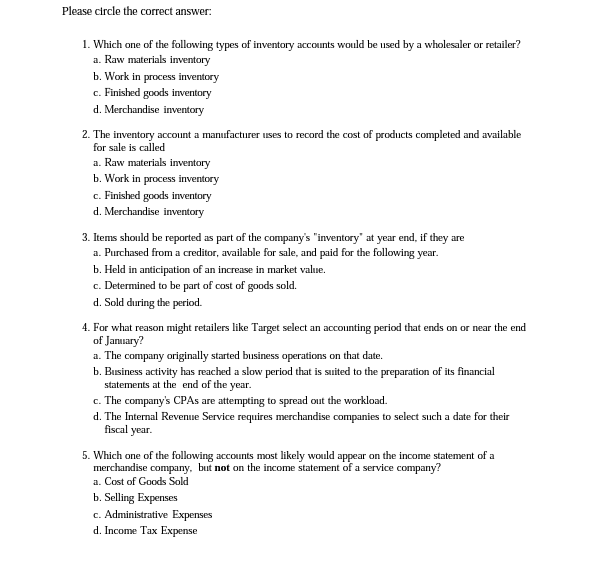

Please circle the correct answer: 1. Which one of the following types of inventory accounts would be used by a wholesaler or retailer? a. Raw materials inventory b. Work in process inventory c. Finished goods inventory d. Merchandise inventory 2. The inventory account a manufacturer uses to record the cost of products completed and available for sale is called a. Raw materials inventory b. Work in process inventory c. Finished goods inventory d. Merchandise inventory 3. Items should be reported as part of the company's "inventory" at year end, if they are a. Purchased from a creditor, available for sale, and paid for the following year. b. Held in anticipation of an increase in market value. c. Determined to be part of cost of goods sold. d. Sold during the period. 4. For what reason might retailers like Target select an accounting period that ends on or near the end of January? a. The company originally started business operations on that date. b. Business activity has reached a slow period that is suited to the preparation of its financial statements at the end of the year. c. The company's CPAs are attempting to spread out the workload. d. The Internal Revenue Service requires merchandise companies to select such a date for their fiscal year. 5. Which one of the following accounts most likely would appear on the income statement of a merchandise company, but not on the income statement of a service company? a. Cost of Goods Sold b. Selling Expenses c. Administrative Expenses d. Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started